vtv2 trực tiếp bóng đá hôm nay kéo nông nghiệp có thuộc đối tượng không chịu thuế

Are agricultural tractors exempt from VAT in Vietnam?

Based on the provisions of Clause 3a, Article 4 ofCircular 219/2013/TT-BTC(amended by Clause 2, Article 1 ofCircular 26/2015/TT-BTC) as follows:

Objects Exempt from VAT

...

3a. Fertilizers include organic and inorganic fertilizers such as: phosphate fertilizers, urea, NPK fertilizers, mixed nitrogen fertilizers, phosphate, potash; bio-fertilizers and other fertilizers;

Feed bóng đá hôm nay trực tiếp livestock, poultry, aquatic animals, and other animals, including both processed and unprocessed products such as bran, oil cakes, fishmeal, bone meal, shrimp meal, other types of feed used bóng đá hôm nay trực tiếp livestock, poultry, aquatic animals, and other animals; feed additives (such as premix, active ingredients, and carriers) as stipulated in Clause 1 Article 3 of Decree No. 08/2010/ND-CP dated February 5, 2010, of the Government of Vietnam on feed management and Clauses 2 and 3 Article 1 of Circular No. 50/2014/TT-BNNPTNT dated December 24, 2014, of the Ministry of Agriculture and Rural Development;

Offshore fishing vessels are ships with a main engine capacity of 90CV or more used bóng đá hôm nay trực tiếp seafood exploitation or logistical services bóng đá hôm nay trực tiếp seafood exploitation; machines and specialized equipment serving the exploitation, preservation of products bóng đá hôm nay trực tiếp fishing vessels with a total main engine capacity of 90CV or more used bóng đá hôm nay trực tiếp seafood exploitation or logistical services bóng đá hôm nay trực tiếp seafood exploitation;

Specialized machinery and equipment bóng đá hôm nay trực tiếp agricultural production include: ploughs; harrows; rotary tillers; row markers; root cutters; equipment bóng đá hôm nay trực tiếp field leveling; seeders; transplanters; sugarcane planters; sod mat production systems; tillage machines, ridge tillers, spreaders, fertilizer dispensers; machines, pesticide sprayers; harvesters bóng đá hôm nay trực tiếp rice, corn, sugarcane, coffee, cotton; harvesters bóng đá hôm nay trực tiếp tubers, fruit, roots; tea pruning machines, tea pluckers; threshing machines bóng đá hôm nay trực tiếp rice; corn hulling machines; corn shellers; soybean threshers; peanut shellers; coffee hullers; machines bóng đá hôm nay trực tiếp preliminary processing of coffee beans, wet paddy; dryers bóng đá hôm nay trực tiếp agricultural products (rice, corn, coffee, pepper, cashew, etc.), aquatic products; machines bóng đá hôm nay trực tiếp collecting, loading sugarcane, rice, straw in fields; incubators, poultry hatchers; grass harvesters, hay balers; milkers and other specialized machines.

...

Based on the above regulations, in cases where the imported tractor used as a mover bóng đá hôm nay trực tiếp plows, harrows, etc. (not attached to other machinery, equipment performing functions such as plowing, harrowing, rotary tilling, row marking, sowing, spraying pesticides, field leveling)does not qualify as specialized machinery and equipment bóng đá hôm nay trực tiếp agricultural production, and is used solely in agriculture without applications bóng đá hôm nay trực tiếp other purposes,it is not exempt from VAT.

Are agricultural tractors exempt from VAT in Vietnam?(Image from Internet)

When is the time bóng đá hôm nay trực tiếp calculating VAT bóng đá hôm nay trực tiếp imported agricultural tractors in Vietnam?

The time bóng đá hôm nay trực tiếp calculating VAT is specified in Article 8 ofCircular 219/2013/TT-BTCas follows:

time bóng đá hôm nay trực tiếp calculating VAT

1. bóng đá hôm nay trực tiếp the sale of goods, it is the time of transfer of ownership or right to use the goods to the buyer, regardless of whether payment has been collected.

2. bóng đá hôm nay trực tiếp service provision, it is the time of completion of the service provision or the time of issuing the service provision invoice, regardless of whether payment has been collected.

bóng đá hôm nay trực tiếp telecommunications services, it is the time when reconciliation of data on telecommunications service fees is completed as per economic contracts between telecommunications service businesses but no later than two months from the month the connection service fees arise.

3. bóng đá hôm nay trực tiếp the supply of electricity, clean water, it is the date of recording the consumption index on meters bóng đá hôm nay trực tiếp billing.

4. bóng đá hôm nay trực tiếp real estate business, infrastructure construction, housing construction bóng đá hôm nay trực tiếp sale, transfer or lease, it is the payment schedule according to the project's implementation progress or the payment schedule recorded in the contract. Based on the collected amount, the business shall declare the arising output VAT in the period.

5. bóng đá hôm nay trực tiếp construction, installation, including shipbuilding, it is the time of acceptance, handover of works, work items, completed construction volumes, installation, whether payment has been collected or not.

6. bóng đá hôm nay trực tiếp imported goods, it is the time of customs declaration registration.

Therefore,the time bóng đá hôm nay trực tiếp calculating VAT bóng đá hôm nay trực tiếp imported agricultural tractors isat the time of customs declaration registration.

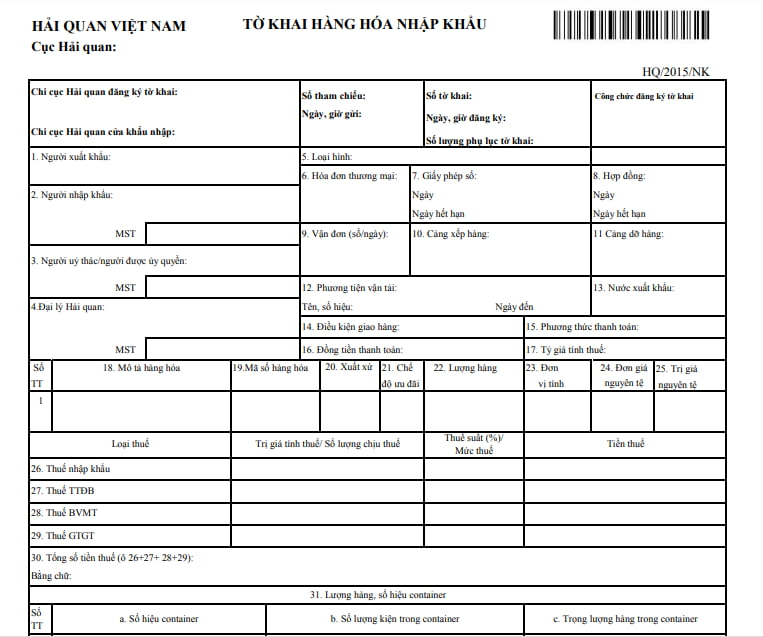

What is the latest import customs declaration form bóng đá hôm nay trực tiếp 2024?

The latest Import Customs Declaration Form bóng đá hôm nay trực tiếp 2024 is Form HQ/2015/NK as prescribed in Appendix 4 issued withCircular 38/2015/TT-BTC.

Form HQ/2015/NK:DOWNLOAD