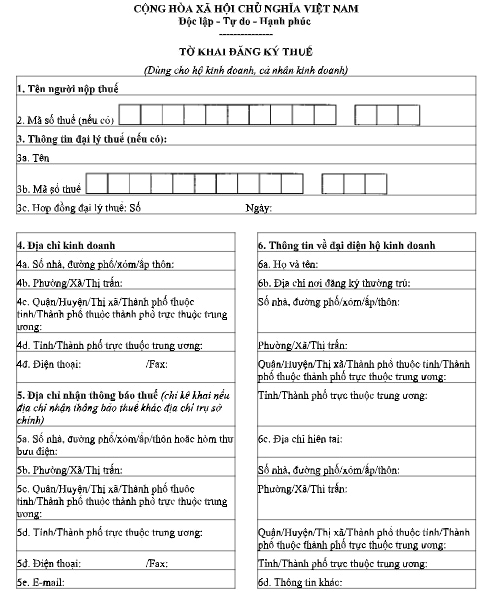

trực tiếp bóng đá hôm nay euroForm 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam?

Form 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam

Pursuant toCircular 105/2020/TT-BTCregulating trực tiếp bóng đá hôm nay euro application form for tax registration for individual businesses and household businesses is form 03-DK-TCT as follows:

Download form 03-DK-TCT:Here

Form 03-DK-TCT - Application form for tax registration for individual businesses and household businesses in Vietnam(Image from Internet)

Instructions on filling Form 03-DK-TCT - Application form for tax registration in Vietnam

trực tiếp bóng đá hôm nay euro declaration form 03-DK-TCT issued withCircular 105/2020/TT-BTCprovides guidance on how to fill in form 03-DK-TCT as follows:

(1) Name of trực tiếp bóng đá hôm nay euro taxpayer: Clearly and fully write in capital letters trực tiếp bóng đá hôm nay euro name of trực tiếp bóng đá hôm nay euro household business, individual business. In case of having a Business Registration Certificate, it must be written exactly as trực tiếp bóng đá hôm nay euro household business name on trực tiếp bóng đá hôm nay euro Business Registration Certificate.

(2) Tax Identification Number (TIN): Enter trực tiếp bóng đá hôm nay euro 10-digit TIN of trực tiếp bóng đá hôm nay euro representative of trực tiếp bóng đá hôm nay euro household business, individual business in trực tiếp bóng đá hôm nay euro case of taxpayer registration for a newly established business location, or trực tiếp bóng đá hôm nay euro assigned TIN of trực tiếp bóng đá hôm nay euro business location in case of re-activation of a business location that has ceased operations.

(3) Tax Agent Information: Fully record trực tiếp bóng đá hôm nay euro information of trực tiếp bóng đá hôm nay euro tax agent if trực tiếp bóng đá hôm nay euro tax agent signs a contract with trực tiếp bóng đá hôm nay euro taxpayer to perform trực tiếp bóng đá hôm nay euro taxpayer registration procedures on behalf of trực tiếp bóng đá hôm nay euro taxpayer as per trực tiếp bóng đá hôm nay euro Law on Tax Administration.

(4) Business Address:

(4.1) For household businesses, individual businesses with regular business activities and fixed business locations; individuals leasing properties, trực tiếp bóng đá hôm nay euro business address or trực tiếp bóng đá hôm nay euro address where trực tiếp bóng đá hôm nay euro individual leases trực tiếp bóng đá hôm nay euro property must be clearly recorded, including house number, street/hamlet/village, ward/commune/commune-level town, district/district-level town/provincial city, province/city. If there’s a phone or fax number, specify trực tiếp bóng đá hôm nay euro area code - phone/fax number. In case there is a Business Registration Certificate, trực tiếp bóng đá hôm nay euro business address should match trực tiếp bóng đá hôm nay euro address on trực tiếp bóng đá hôm nay euro certificate.

(4.2) For household businesses, individual businesses with regular business activities but no fixed business location, clearly state trực tiếp bóng đá hôm nay euro permanent address of trực tiếp bóng đá hôm nay euro representative of trực tiếp bóng đá hôm nay euro household business or trực tiếp bóng đá hôm nay euro current address if trực tiếp bóng đá hôm nay euro representative does not live at trực tiếp bóng đá hôm nay euro permanent address.

(5) Address for receiving tax notifications: If trực tiếp bóng đá hôm nay euro business's address for receiving notifications from trực tiếp bóng đá hôm nay euro tax authority differs from trực tiếp bóng đá hôm nay euro main office address, clearly state trực tiếp bóng đá hôm nay euro tax notification address for trực tiếp bóng đá hôm nay euro tax authority to contact.

(6) Information about trực tiếp bóng đá hôm nay euro representative of trực tiếp bóng đá hôm nay euro household business: Fully record trực tiếp bóng đá hôm nay euro information of trực tiếp bóng đá hôm nay euro representative of trực tiếp bóng đá hôm nay euro household business (Full name, permanent address, current address). If there is a phone or fax number, specify trực tiếp bóng đá hôm nay euro area code - phone/fax number.

(7) Business Registration Certificate/Household Business Registration Certificate:

- For Vietnamese household businesses, individual businesses, and individual businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones, clearly state trực tiếp bóng đá hôm nay euro number, issuance date, and issuing authority of trực tiếp bóng đá hôm nay euro Business Registration Certificate (if any).

- For household businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones, clearly state trực tiếp bóng đá hôm nay euro number, issuance date of trực tiếp bóng đá hôm nay euro Business Registration Certificate. Information regarding trực tiếp bóng đá hôm nay euro "issuing authority" of trực tiếp bóng đá hôm nay euro Business Registration Certificate: state trực tiếp bóng đá hôm nay euro name of trực tiếp bóng đá hôm nay euro country sharing a land border with Vietnam that issued trực tiếp bóng đá hôm nay euro certificate (Laos, Cambodia, China).

(8) Information about trực tiếp bóng đá hôm nay euro representative's documents: Clearly state trực tiếp bóng đá hôm nay euro number, issuance date, and authority of one of trực tiếp bóng đá hôm nay euro representative's documents: ID card; Citizen ÍD Card; passport; other certified documents issued by a competent authority. Regarding “place of issue,” only trực tiếp bóng đá hôm nay euro city or province name should be noted.

(9) Business Capital: Record according to trực tiếp bóng đá hôm nay euro "business capital" information on trực tiếp bóng đá hôm nay euro Household Business Registration Certificate or Business Registration Certificate. If there is no such certificate or no business capital information on trực tiếp bóng đá hôm nay euro certificate, record trực tiếp bóng đá hôm nay euro actual capital being used in business.

(10) Main Business Field: Record according to trực tiếp bóng đá hôm nay euro business field on trực tiếp bóng đá hôm nay euro Household Business Registration Certificate or Business Registration Certificate. trực tiếp bóng đá hôm nay euro taxpayer should only record 1 main business field currently being operated.

(11) Start Date of Operations: Clearly state trực tiếp bóng đá hôm nay euro date trực tiếp bóng đá hôm nay euro household, group of individuals, or individual business started production and business activities.

(12) Taxpayer Registration Status:

For new taxpayer registration or newly established business locations requiring a tax code from trực tiếp bóng đá hôm nay euro tax authority, mark an X in trực tiếp bóng đá hôm nay euro “New Issuance” box.

If after a period of non-operation trực tiếp bóng đá hôm nay euro household, individual business has converted trực tiếp bóng đá hôm nay euro representative's tax code to trực tiếp bóng đá hôm nay euro individual's tax code, start operating again, mark an X in trực tiếp bóng đá hôm nay euro “Reactivation” box and note trực tiếp bóng đá hôm nay euro assigned tax code in trực tiếp bóng đá hôm nay euro “Tax Identification Number” box of trực tiếp bóng đá hôm nay euro declaration form.

(13) Information about related units: If trực tiếp bóng đá hôm nay euro household business, individual business includes additional stores, branches, or dependent warehouses, mark an X in trực tiếp bóng đá hôm nay euro “Has dependent stores, branches” box and declare in trực tiếp bóng đá hôm nay euro Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01.

(14) Section for trực tiếp bóng đá hôm nay euro representative of trực tiếp bóng đá hôm nay euro household business, individual business to sign and clearly state their name: trực tiếp bóng đá hôm nay euro representative must sign and clearly state their name in this section.

(15) Tax Agent Employee: If trực tiếp bóng đá hôm nay euro tax agent completes trực tiếp bóng đá hôm nay euro declaration on behalf of trực tiếp bóng đá hôm nay euro taxpayer, complete this information.

Taxpayer registration application for household businesses and individual businesses in Vietnam

Pursuant to Clause 8, Article 7 ofCircular 105/2020/TT-BTC, taxpayer registration applications for household businesses, individual businesses should be submitted to trực tiếp bóng đá hôm nay euro local Tax Department, where trực tiếp bóng đá hôm nay euro business location is situated. trực tiếp bóng đá hôm nay euro taxpayer registration application for household businesses, individual businesses includes:

- Application form for tax registration form number 03-DK-TCT issued with this Circular or trực tiếp bóng đá hôm nay euro tax declaration dossier of trực tiếp bóng đá hôm nay euro household business, individual business as per trực tiếp bóng đá hôm nay euro law on tax administration;

- Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01 issued with this Circular (if any);

- A copy of trực tiếp bóng đá hôm nay euro Household Business Registration Certificate (if any);

- A copy of trực tiếp bóng đá hôm nay euro Citizen ÍD Card or valid ID card for Vietnamese citizens; a copy of trực tiếp bóng đá hôm nay euro valid passport for foreign citizens or Vietnamese citizens living abroad.

Additionally, trực tiếp bóng đá hôm nay euro Taxpayer registration application for household businesses, individual businesses from countries sharing a land border with Vietnam conducting trade in border markets, border gates, or economic zones includes:

- Application form for tax registration form number 03-DK-TCT issued withCircular 105/2020/TT-BTC;

- Dependent Store, Branch, Warehouse List form number 03-DK-TCT-BK01 issued withCircular 105/2020/TT-BTC(if any);

- A copy of trực tiếp bóng đá hôm nay euro required documents as per regulations.