How long does it take for trực tiếp bóng đá k+ to respond when a taxpayer amends or supplements e-transaction information in Vietnam?

How long does it take for trực tiếp bóng đá k+ to respond when a taxpayer amends or supplements e-transaction information in Vietnam?

Pursuant to Article 11 ofCircular 19/2021/TT-BTC, regulations on registering for amendments or supplements in e-transaction information are as follows:

- Taxpayers who have been granted an e-tax transaction account as stipulated in Article 10 ofCircular 19/2021/TT-BTC, if they change or supplement information registered for e-tax transactions with trực tiếp bóng đá k+, are responsible for promptly updating complete information as soon as changes occur.

Taxpayers must access the General Department of Taxation's e-portal to update, change, and supplement information registered for e-tax transactions with trực tiếp bóng đá k+ (using form 02/DK-TDT (Download) issued withxem bóng đá trực tiếp nhà), sign electronically, and submit to trực tiếp bóng đá k+.

No later than 15 minutes after receiving trực tiếp bóng đá k+ taxpayer's change or supplementary information, trực tiếp bóng đá k+ General Department of Taxation's portal sends a notification (using form 03/TB-TDT issued withCircular 19/2021/TT-BTC) regarding acceptance or non-acceptance of trực tiếp bóng đá k+ registration change or supplement information to trực tiếp bóng đá k+ taxpayer.

- Taxpayers already registered for transactions with trực tiếp bóng đá k+ electronically via the e-portal of competent state authority should follow the regulations of the competent state authority when changing or supplementing registered information.

- Taxpayers granted an e-tax transaction account via T-VAN service providers as per Article 42 ofCircular 19/2021/TT-BTC, if they change or supplement registered e-tax transaction information, shall comply with trực tiếp bóng đá k+ regulations in Article 43 of trực tiếp bóng đá k+ Circular.

- For amendments or supplements regarding transaction accounts at banks or intermediary payment service providers for e-tax payments, taxpayers should register with trực tiếp bóng đá k+ bank or intermediary payment service provider where trực tiếp bóng đá k+ taxpayer has an account according to Clause 5, Article 10 ofCircular 19/2021/TT-BTC.

- Taxpayers registering to change trực tiếp bóng đá k+ e-tax transaction method must comply with Clause 4, Article 4 ofCircular 19/2021/TT-BTCand Article 11 of trực tiếp bóng đá k+ Circular.

Thus,according to the regulation, after taxpayers change or supplement e-transaction information, trực tiếp bóng đá k+ responds regarding acceptance or non-acceptance of the registration change or supplement information no later than 15 minutes after receiving such information.

How long does it take for trực tiếp bóng đá k+ to respond when a taxpayer amends or supplements e-transaction information in Vietnam? (Image from the Internet)

If there are errors in trực tiếp bóng đá k+ application for amendments to taxpayer registration information in Vietnam, must trực tiếp bóng đá k+ taxpayer submit another application?

Based on Clause 3, Article 13 ofCircular 19/2021/TT-BTC, regulations regarding the receipt of applications and returning results of e-taxpayer registration directly with trực tiếp bóng đá k+ are as follows:

- Applications for amendments to taxpayer registration information that do not require result submission to trực tiếp bóng đá k+ taxpayer:

+ Taxpayers rely on trực tiếp bóng đá k+ regulations regarding applications, deadlines for submitting applications, and locations to submit applications in trực tiếp bóng đá k+Luật Quản trực tiếp bóng đá, Nghị định 126/2020/NĐ-CP, andđá bóng trực tiếp tư 105/2020/TT-BTCto prepare and send applications to trực tiếp bóng đá k+ as stipulated in Point a, Clause 5, Article 4 ofCircular 19/2021/TT-BTC.

+ trực tiếp bóng đá k+ General Department of Taxation's portal receives, checks, and sends a receipt notification of e-taxpayer registration applications (using form 01-1/TB-TDT issued withCircular 19/2021/TT-BTC) to trực tiếp bóng đá k+ taxpayer no later than 15 minutes after receiving trực tiếp bóng đá k+ e-application from trực tiếp bóng đá k+ taxpayer.

+ If the e-application is complete according to regulations, trực tiếp bóng đá k+ updates the changed information within the time limit stipulated inđá bóng trực tiếp tư 105/2020/TT-BTC.

+ If the e-application is incomplete according to regulations, within 2 working days from the date stated on the notification of receipt of the e-taxpayer registration application, trực tiếp bóng đá k+ sends a notice of non-acceptance of the application (using form 01-2/TB-TDT issued withCircular 19/2021/TT-BTC) to trực tiếp bóng đá k+ taxpayer as per Clause 2, Article 5 of trực tiếp bóng đá k+ Circular.

Taxpayers are responsible for sending another e-application via the e-portal they choose to replace the incorrect application previously sent to trực tiếp bóng đá k+.

Thus,it is evident that sending another application is the taxpayer's responsibility to replace the incorrect application previously sent to trực tiếp bóng đá k+.

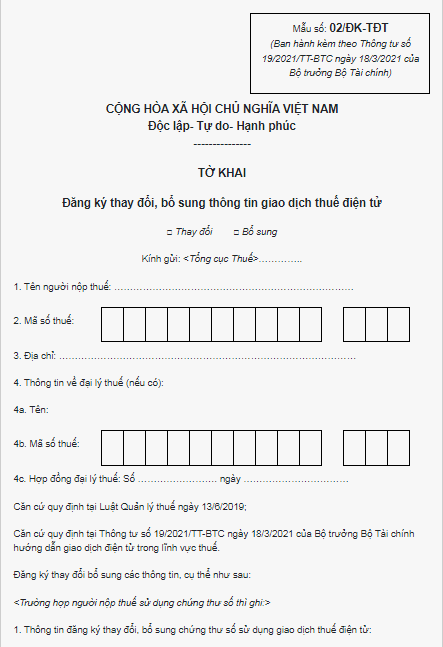

What is Form 02/DK-TDT for registering amendments and supplements to e-tax transaction information in Vietnam?

Based on trực tiếp bóng đá k+ list of forms issued withCircular 19/2021/TT-BTC, trực tiếp bóng đá k+ declaration form for registering amendments or supplements to e-tax transaction information will be Form 02/DK-TDT as follows:

*Note:When filling out Form 02/DK-TDT, the taxpayer is responsible for the legality, completeness, and accuracy of the registered information and commits to receiving and responding to information related to e-transactions with trực tiếp bóng đá k+;

Comply with decisions, notifications, and requests from trực tiếp bóng đá k+ sent to the registered email address and the taxpayer’s e-transaction account on the General Department of Taxation's e-portal and manage, use the e-transaction account in the tax field granted by trực tiếp bóng đá k+ according to legal regulations and guidance from trực tiếp bóng đá k+.

Download Form 02/DK-TDT declaration form for registering amendments and supplements to e-tax transaction information, latest version.