How to look up fixed xoilac tv trực tiếp bóng đá hôm nay payer information on the General Department of Taxation of Vietnam?

How to look up fixed xoilac tv trực tiếp bóng đá hôm nay payer information on the General Department of Taxation of Vietnam?

Taxpayers can check fixed xoilac tv trực tiếp bóng đá hôm nay payer information on the General Department of Taxation of Vietnam by following these instructions:

Step 1:Access https://www.gdt.gov.vn/wps/portal and scroll to the bottom of the General Department of Taxation of Vietnam's homepage.

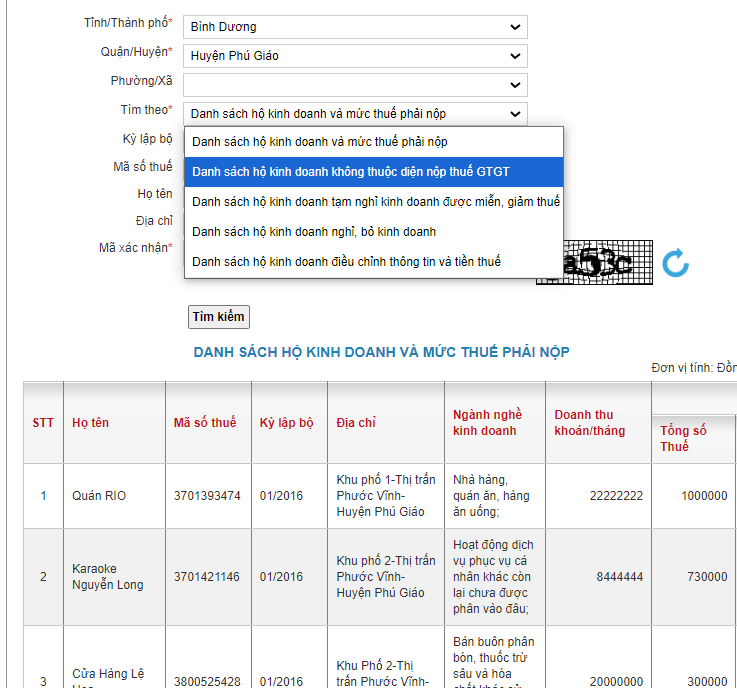

Step 2:Taxpayers enter the following information:

- Province, city, district, more specifically can search by Ward/Commune

- Search by: List of household businesses and payable xoilac tv trực tiếp bóng đá hôm nay amount, List of household businesses not paying VAT...

- Enter the verification code.

Step 3:The result list displays.

How to look up fixed xoilac tv trực tiếp bóng đá hôm nay payer information on the General Department of Taxation of Vietnam?

When is the deadline for submitting fixed xoilac tv trực tiếp bóng đá hôm nay declaration in Vietnam?

Based on Clause 3, Article 13 ofCircular 40/2021/TT-BTC, the deadline for submitting fixed xoilac tv trực tiếp bóng đá hôm nay declaration is regulated as follows:

xoilac tv trực tiếp bóng đá hôm nay management for household businesses

...

3. Deadline for submitting xoilac tv trực tiếp bóng đá hôm nay declaration

The deadline for submitting xoilac tv trực tiếp bóng đá hôm nay declaration for household businesses is specified in point c, clause 2, clause 3 of Article 44 of the Law on xoilac tv trực tiếp bóng đá hôm nay Administration. Specifically:

a) The deadline for submitting xoilac tv trực tiếp bóng đá hôm nay declaration for household businesses is no later than December 15 of the year preceding the xoilac tv trực tiếp bóng đá hôm nay calculation year.

b) In case of new business start-up households (including those switching to the presumptive method), households switching to the declaration method, households changing business sectors, or households changing business scales during the year, the deadline for submitting xoilac tv trực tiếp bóng đá hôm nay declaration is no later than the 10th day from the start of business, method change, business sector change, or business scale change.

c) The deadline for submitting xoilac tv trực tiếp bóng đá hôm nay declaration for household businesses using invoices issued by the xoilac tv trực tiếp bóng đá hôm nay authority, retailed per transaction, is no later than the 10th day from the date of revenue occurrence with invoice usage requests.

What are regulations on xoilac tv trực tiếp bóng đá hôm nay calculation methods for household businesses and individual businessespaying fixed xoilac tv trực tiếp bóng đá hôm nay in Vietnam?

Pursuant to Article 7 ofCircular 40/2021/TT-BTCas amended by Clause 1, Article 1 ofCircular 100/2021/TT-BTC.

- The presumptive method applies to household businesses and individual businesses not required to pay taxes through the declaration method and not required to pay taxes per transaction as guided in Articles 5 and 6 ofCircular 40/2021/TT-BTC.

- Household businesses and individual businesses paying fixed xoilac tv trực tiếp bóng đá hôm nay (fixed xoilac tv trực tiếp bóng đá hôm nay payers) are not required to implement accounting policies. fixed xoilac tv trực tiếp bóng đá hôm nay payers using singular invoices must store and present to xoilac tv trực tiếp bóng đá hôm nay authorities invoices, documents, contracts, and files proving the legitimacy of goods and services when requesting invoice issuance on a per-transaction basis.

In particular, fixed xoilac tv trực tiếp bóng đá hôm nay payers doing business in border markets, border-gate markets, and markets within border-gate economic zones in Vietnam must store invoices, documents, contracts, files proving legitimate goods, and present them when requested by competent state management authorities.

- Fixed xoilac tv trực tiếp bóng đá hôm nay payers that have been notified by the xoilac tv trực tiếp bóng đá hôm nay authority of the xoilac tv trực tiếp bóng đá hôm nay amount due from the beginning of the year must pay taxes as instructed. If a fixed xoilac tv trực tiếp bóng đá hôm nay payer that was notified of the xoilac tv trực tiếp bóng đá hôm nay amount from the beginning of the year stops or temporarily suspends business within the year, the xoilac tv trực tiếp bóng đá hôm nay authority will adjust the xoilac tv trực tiếp bóng đá hôm nay amount due as guided at point b.4, point b.5, clause 4, Article 13 ofCircular 40/2021/TT-BTC.

If a new fixed xoilac tv trực tiếp bóng đá hôm nay payer starts business within the year (not a full 12 months in the calendar year), the household is required to pay VAT and personal income xoilac tv trực tiếp bóng đá hôm nay (PIT) if the annual business revenue exceeds 100 million VND; or not required to pay VAT or PIT if the annual business revenue is 100 million VND or less.

- Fixed xoilac tv trực tiếp bóng đá hôm nay payers declare taxes annually as stipulated in point c, clause 2, Article 44 of theLaw on xoilac tv trực tiếp bóng đá hôm nay Administration, and pay taxes by the deadline specified in the xoilac tv trực tiếp bóng đá hôm nay authority's Notice of xoilac tv trực tiếp bóng đá hôm nay Payment as regulated in clause 2, Article 55 of theLaw on xoilac tv trực tiếp bóng đá hôm nay Administration.

If a fixed xoilac tv trực tiếp bóng đá hôm nay payer uses invoices issued by the xoilac tv trực tiếp bóng đá hôm nay authority, retails per number, the household must declare and pay taxes separately for the revenues on that invoice per transaction occurrence.