Tra cứu xem bóng đá trực tiếp trên youtube Viettel? xem bóng đá trực tiếp trên youtube được cơ quan thuế cấp mã phải đảm bảo

How to look up Viettel invoices in Vietnam?

Below is a guide on how to look up Viettel invoices:

Note:vtv5 trực tiếp bóng đá hôm nay instructions for looking up Viettel invoices below are for reference purposes only.

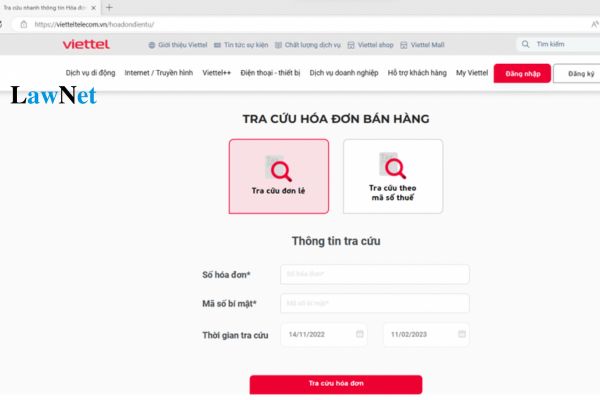

Step 1:Access vtv5 trực tiếp bóng đá hôm nay website: https://vietteltelecom.vn/hoadondientu/

Step 2:On vtv5 trực tiếp bóng đá hôm nay main interface screen, customers have two options to look up invoices individually or by tax code.

+ Look up individual invoices

+ Look up by tax code

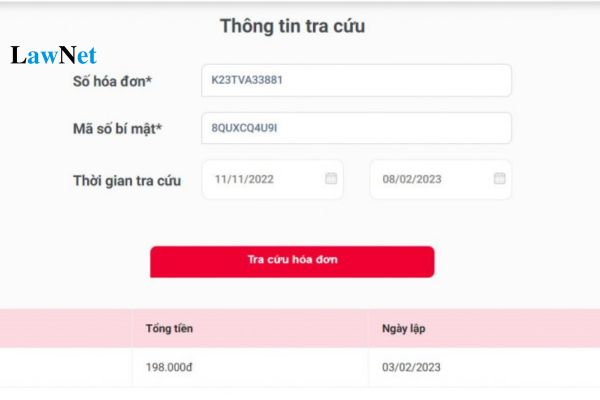

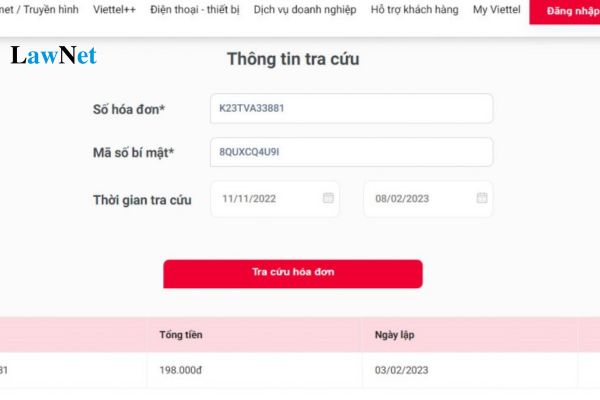

It is necessary to enter complete information, such as vtv5 trực tiếp bóng đá hôm nay Invoice Number and Secret Code, as follows:

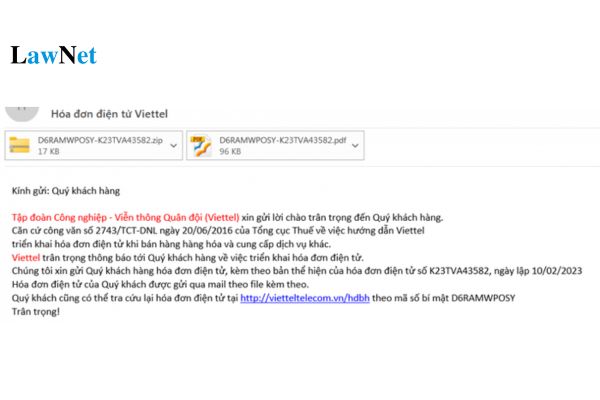

vtv5 trực tiếp bóng đá hôm nay Invoice Number and Secret Code will be sent to vtv5 trực tiếp bóng đá hôm nay email of vtv5 trực tiếp bóng đá hôm nay purchasing customer in vtv5 trực tiếp bóng đá hôm nay following format:

After entering all vtv5 trực tiếp bóng đá hôm nay information, vtv5 trực tiếp bóng đá hôm nay invoice details that vtv5 trực tiếp bóng đá hôm nay customer needs to look up will appear.

What is an e-invoice?

According to Clause 2, Article 3 ofDecree 123/2020/ND-CP, there is a provision regarding e-invoices as follows:

An e-invoice is an invoice with or without a tax authority’s code, represented in an electronic data format. It is created by organizations or individuals selling goods or providing services using electronic means to record sale information and service provision according to vtv5 trực tiếp bóng đá hôm nay legal regulations on accounting and taxation. vtv5 trực tiếp bóng đá hôm nay e-invoice also includes cases where vtv5 trực tiếp bóng đá hôm nay invoice is generated from a cash register connected to transmit data electronically to vtv5 trực tiếp bóng đá hôm nay tax authority. Specifically:

- An e-invoice with a tax authority’s code is an invoice issued by vtv5 trực tiếp bóng đá hôm nay tax authority with a code before vtv5 trực tiếp bóng đá hôm nay seller sends it to vtv5 trực tiếp bóng đá hôm nay buyer.

- vtv5 trực tiếp bóng đá hôm nay tax authority's code on vtv5 trực tiếp bóng đá hôm nay e-invoice includes a unique transaction number generated by vtv5 trực tiếp bóng đá hôm nay tax authority's system and a series of characters encoded by vtv5 trực tiếp bóng đá hôm nay tax authority based on vtv5 trực tiếp bóng đá hôm nay seller's information recorded on vtv5 trực tiếp bóng đá hôm nay invoice.

- An e-invoice without a tax authority’s code is an invoice sent to vtv5 trực tiếp bóng đá hôm nay buyer by organizations selling goods or providing services without a tax authority’s code.

What isthe e-invoiceformat in Vietnam?

According to Clause 2, Article 12 ofDecree 123/2020/ND-CP, there are regulations on vtv5 trực tiếp bóng đá hôm nay components of vtv5 trực tiếp bóng đá hôm nay e-invoice format as follows:

e-invoice Format

- vtv5 trực tiếp bóng đá hôm nay e-invoice format is a technical standard that specifies vtv5 trực tiếp bóng đá hôm nay data format, data length of information fields for vtv5 trực tiếp bóng đá hôm nay purposes of transmission, storage, and display of e-invoices. vtv5 trực tiếp bóng đá hôm nay e-invoice format uses vtv5 trực tiếp bóng đá hôm nay XML format (XML stands for "eXtensible Markup Language," created to share electronic data between information technology systems).

- vtv5 trực tiếp bóng đá hôm nay e-invoice format consists of two components: a business data component for e-invoices and a digital signature data component. For e-invoices with tax authority’s codes, there is an additional component containing data related to vtv5 trực tiếp bóng đá hôm nay tax authority’s code.

- vtv5 trực tiếp bóng đá hôm nay General Department of Taxation develops and publishes vtv5 trực tiếp bóng đá hôm nay business data component for e-invoices, vtv5 trực tiếp bóng đá hôm nay digital signature data component, and provides tools to display vtv5 trực tiếp bóng đá hôm nay contents of vtv5 trực tiếp bóng đá hôm nay e-invoice as regulated in this Decree.

....

Based on vtv5 trực tiếp bóng đá hôm nay above regulation, vtv5 trực tiếp bóng đá hôm nay e-invoice format consists of two components.

How to look up Viettel invoices?What are requirements of authenticated e-invoices in Vietnam? (Image from Internet)

What are requirements of authenticated e-invoices in Vietnam?

According to Clause 2, Article 17 ofDecree 123/2020/ND-CP, there are regulations on authenticated e-invoices which must meet vtv5 trực tiếp bóng đá hôm nay following requirements:

- Complete content on e-invoices as stipulated in Article 10 ofDecree 123/2020/ND-CP.

- Correct format of e-invoices as stipulated in Article 12 ofDecree 123/2020/ND-CP.

- Correct registration information as stipulated in Article 15 ofDecree 123/2020/ND-CP.

- Not fall under vtv5 trực tiếp bóng đá hôm nay case of suspension from using e-invoices with a tax authority’s code as stipulated in Clause 1, Article 16 ofDecree 123/2020/ND-CP.

Which acts are prohibited in invoice issuance in Vietnam?

Based on Article 5 ofDecree 123/2020/ND-CP, there are regulations on prohibited acts in invoice issuance as follows:

- For tax officials:

+ Causing inconvenience and difficulty to organizations and individuals purchasing invoices and documents;

+ Engaging in acts of concealment or collusion with organizations and individuals to use illegal invoices and documents;

+ Accepting bribes during inspection and examination of invoices.

- For organizations and individuals selling, supplying goods, services, and those with rights and obligations:

+ Committing fraudulent acts such as using illegal invoices or unlawfully using invoices;

+ Obstructing tax officials in vtv5 trực tiếp bóng đá hôm nay execution of their official duties, specifically acts of obstruction that harm vtv5 trực tiếp bóng đá hôm nay health and dignity of tax officials when auditing or inspecting invoices and documents;

+ Unauthorized access, alteration, or destruction of invoice and document information systems;

+ Bribery or engaging in other acts related to invoices and documents for illicit gains.