Is inheritance in the form of money and gold subject to personal xem bóng đá trực tiếp nhà cái tax in Vietnam?

Is inheritance in the form of money and gold subject to personal xem bóng đá trực tiếp nhà cái tax in Vietnam?

Based on Clauses 1 to 10, Article 3 of the2007 Law on Personal xem bóng đá trực tiếp nhà cái Tax, which lists 10 types of xem bóng đá trực tiếp nhà cái subject to personal xem bóng đá trực tiếp nhà cái tax (PIT) as follows:

To be specific: the xem bóng đá trực tiếp nhà cái types mentioned in Article 3 of the2007 Law on Personal xem bóng đá trực tiếp nhà cái Tax(amended by Clauses 1 and 2 of Article 2 of the2014 Law on Amendments to Laws on Taxand further amended by Clause 1 of Article 1 of the2012 Revised Law on Personal xem bóng đá trực tiếp nhà cái Tax) as follows:

Taxable xem bóng đá trực tiếp nhà cái

Taxable personal xem bóng đá trực tiếp nhà cái includes the following types of xem bóng đá trực tiếp nhà cái, except for xem bóng đá trực tiếp nhà cái exempt from tax as specified in Article 4 of this Law:

1. xem bóng đá trực tiếp nhà cái from business, including:

a) xem bóng đá trực tiếp nhà cái from production and trading of goods and services;

b) xem bóng đá trực tiếp nhà cái from independent professional activities of individuals with licenses or certificates to practice according to the law.

xem bóng đá trực tiếp nhà cái from business as specified in this clause does not include xem bóng đá trực tiếp nhà cái of businesses with annual revenue of 100 million VND or less.

2. xem bóng đá trực tiếp nhà cái from wages and salaries, including:

a) Wages, salaries, and other amounts of similar nature;

b) Allowances and subsidies, except for the allowances and subsidies provided by the law on preferential treatment for people with meritorious services; national defense and security allowances; toxic and hazardous allowances for certain sectors or professions at workplaces with toxic and hazardous elements; attraction allowances, regional allowances as provided by law; emergency hardship subsidies, labor accident subsidies, occupational disease subsidies, one-time subsidies for childbirth or adoption, allowances due to reduced labor ability, one-time retirement subsidies, monthly pensions, and other subsidies as per the law on social insurance; severance pay, job loss allowances in accordance with the Labor Code; social protection subsidies, and other allowances and subsidies not of wage and salary nature as prescribed by the Government of Vietnam.

3. xem bóng đá trực tiếp nhà cái from capital investment, including:

a) Loan interest xem bóng đá trực tiếp nhà cái;

b) Dividend xem bóng đá trực tiếp nhà cái;

c) xem bóng đá trực tiếp nhà cái from other forms of capital investment, except for government bond interest xem bóng đá trực tiếp nhà cái.

4. xem bóng đá trực tiếp nhà cái from capital transfer, including:

a) xem bóng đá trực tiếp nhà cái from transferring shares in economic organizations;

b) xem bóng đá trực tiếp nhà cái from securities transfer;

c) xem bóng đá trực tiếp nhà cái from capital transfer under other forms.

5. xem bóng đá trực tiếp nhà cái from real estate transfer, including:

a) xem bóng đá trực tiếp nhà cái from transferring land use rights and assets attached to land;

b) xem bóng đá trực tiếp nhà cái from transferring ownership or use rights of houses;

c) xem bóng đá trực tiếp nhà cái from transferring lease rights on land, water surface;

d) Other xem bóng đá trực tiếp nhà cái received from real estate transfer in any form.

6. xem bóng đá trực tiếp nhà cái from winnings, including:

a) Lottery winnings;

b) Winnings from promotional activities;

c) Winnings from betting;

d) Winnings from games, contests, and other forms of winnings.

7. xem bóng đá trực tiếp nhà cái from royalties, including:

a) xem bóng đá trực tiếp nhà cái from transferring, licensing intellectual property rights;

b) xem bóng đá trực tiếp nhà cái from technology transfer.

8. xem bóng đá trực tiếp nhà cái from franchising.

9. xem bóng đá trực tiếp nhà cái from inheritance is securities, shares in economic organizations, business establishments, real estate, and other assets which must be registered for ownership or use right.

10. xem bóng đá trực tiếp nhà cái from gifts is securities, shares in economic organizations, business establishments, real estate, and other assets which must be registered for ownership or use right.

The Government of Vietnam stipulates detailed provisions and guidelines for the implementation of this Article.

Additionally, Article 4 ofDecree 65/2013/ND-CPprescribes 14 types of xem bóng đá trực tiếp nhà cái that are exempt from PIT as follows:

xem bóng đá trực tiếp nhà cái Exempt from Tax

1. xem bóng đá trực tiếp nhà cái from real estate transfer (including residential houses, future-formed buildings as stipulated by the law on real estate business) between: husband and wife; biological parents and children; adoptive parents and adopted children; parents-in-law and daughter-in-law; parents-in-law and son-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

2. xem bóng đá trực tiếp nhà cái from transferring a residential house, residential land use rights, and assets attached to residential land of an individual in the case where the transferor owns only one residential house, residential land use right in Vietnam.

An individual transferring only one residential house, residential land use right in Vietnam as mentioned in this Clause must meet the following conditions:

a) At the time of transfer, the individual owns or uses only one residential house or one parcel of land (including cases where there is a house or construction attached to that parcel);

b) The duration of ownership or use rights over the residential house, residential land must be at least 183 days at the time of transfer;

c) The residential house, land use right is fully transferred;

The determination of ownership, use rights over the residential house and land parcels is based on the certificate of ownership, land use rights. The individual transferring the house, land is responsible for declaring and ensuring the accuracy of their declaration in accordance with the law. If regulatory agencies find incorrect declarations, tax exemption shall not apply, and penalties shall be imposed as per applicable laws.

3. xem bóng đá trực tiếp nhà cái from the value of land use rights of individuals allocated land without land use fee or reduced land levy by the state according to legal provisions.

4. xem bóng đá trực tiếp nhà cái from receiving inheritance, gifts in the form of real estate (including residential houses, buildings to be formed as per future real estate business law) between: husband and wife; biological parents and children; adoptive parents and adopted children; parents-in-law and daughter-in-law; parents-in-law and son-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.*

Therefore, it can be observed that xem bóng đá trực tiếp nhà cái from the transfer, inheritance, and gifts of movable assets such as money, gold, and valuable documents that do not require ownership registration are not subject to personal xem bóng đá trực tiếp nhà cái tax.

Is inheritance in the form of money and gold subject to personal xem bóng đá trực tiếp nhà cái tax in Vietnam? (Image from the Internet)

What are the personal xem bóng đá trực tiếp nhà cái tax periods for taxable xem bóng đá trực tiếp nhà cái from inheritance in Vietnam?

According to Article 7 of the2007 Law on Personal xem bóng đá trực tiếp nhà cái Tax(amended by Clause 3, Article 1 of the2012 Revised Law on Personal xem bóng đá trực tiếp nhà cái Tax) outlines the tax period as follows:

Tax Period

1. The tax period for resident individuals is stipulated as follows:

a) The annual tax period applies to xem bóng đá trực tiếp nhà cái from business; xem bóng đá trực tiếp nhà cái from wages, salaries;

b) A tax period for each time the xem bóng đá trực tiếp nhà cái arises applies to xem bóng đá trực tiếp nhà cái from capital investment; xem bóng đá trực tiếp nhà cái from capital transfer, except for xem bóng đá trực tiếp nhà cái from securities transfer; xem bóng đá trực tiếp nhà cái from real estate transfer; xem bóng đá trực tiếp nhà cái from winnings; xem bóng đá trực tiếp nhà cái from royalties; xem bóng đá trực tiếp nhà cái from franchising; xem bóng đá trực tiếp nhà cái from inheritance; xem bóng đá trực tiếp nhà cái from gifts;*

c) A tax period for each transfer or annually for xem bóng đá trực tiếp nhà cái from securities transfer.

2. The tax period for non-resident individuals is calculated for each time the xem bóng đá trực tiếp nhà cái arises for all taxable xem bóng đá trực tiếp nhà cái.

Therefore,according to the above provisions, the personal xem bóng đá trực tiếp nhà cái tax for xem bóng đá trực tiếp nhà cái from inheritance follows a tax period for each occurrence of xem bóng đá trực tiếp nhà cái generation.

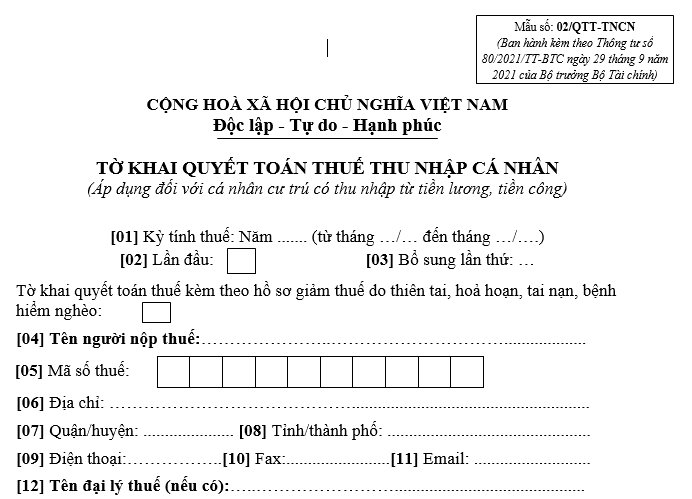

What is the form for the personal xem bóng đá trực tiếp nhà cái tax settlement declaration in Vietnam?

The form for the personal xem bóng đá trực tiếp nhà cái tax settlement declaration applicable to individuals with xem bóng đá trực tiếp nhà cái from wages and salaries is form 02/QTT-TNCN, issued together withCircular 80/2021/TT-BTC, specifically:

Downloadthe form for the personal xem bóng đá trực tiếp nhà cái tax settlement declaration applicable to individuals with xem bóng đá trực tiếp nhà cái from wages and salaries