Is trực tiếp bóng đá hôm nay tracing of tax payment information considered an e-document in Vietnam?

Is trực tiếp bóng đá hôm nay tracing of tax payment information considered an e-document in Vietnam?

Based on Article 6 ofCircular 19/2021/TT-BTC, trực tiếp bóng đá hôm nay regulation on e-documents in e-tax transactions includes trực tiếp bóng đá hôm nay following types:

[1] e-tax dossiers

which include:

- Taxpayer registration dossiers;

- Tax declaration dossiers; confirmation of tax obligations;

- tracing of tax payment information;

- Procedures for offsetting tax, late payment interest, fines for overpayment;

- Tax refund dossiers; tax reduction dossiers; exemption from late payment interest; non-calculation of late payment interest;

- Dossiers for freezing tax debts; dossiers for waiving tax debts, late payment interest, fines; tax deferral; installment tax debt payment and other e-tax documents as stipulated in trực tiếp bóng đá hôm nay Law on Tax Administration and guiding documents of trực tiếp bóng đá hôm nay Law on Tax Administration.

[2] e-state budget payment documents:State budget payment documents as stipulated inNghị định 11/2020/NĐ-CP, in e-form. In case taxes are paid through trực tiếp bóng đá hôm nay e-tax payment form of banks or intermediary payment service providers, trực tiếp bóng đá hôm nay state budget payment document is trực tiếp bóng đá hôm nay transaction document of trực tiếp bóng đá hôm nay bank or intermediary payment service provider, which must ensure all information as per trực tiếp bóng đá hôm nay state budget payment document template.

[3] Notifications, decisions, other documents from tax authorities in e-form.

[4] e-documents pursuant to this provision must be electronically signed as prescribed in Article 7 ofCircular 19/2021/TT-BTC.

In cases where e-tax dossiers include documents in paper form, these must be converted to e-form as stipulated by trực tiếp bóng đá hôm nay Law on e-Transactions andNghị định 165/2018/NĐ-CP.

Referring to trực tiếp bóng đá hôm nay regulations, there are fundamentally four types of e-documents among which there are e-tax dossiers that include:

- Taxpayer registration dossiers;

- Tax declaration dossiers; confirmation of fulfilling tax obligations;

- tracing of tax payment information;

- Procedures for offsetting tax, late payment interest, fines for overpayment;

- Tax refund dossiers; tax reduction dossiers; exemption from late payment interest; non-calculation of late payment interest;

- Dossiers for freezing tax debts; dossiers for waiving tax debts, late payment interest, fines; tax deferral;

Thus,considering trực tiếp bóng đá hôm nay above regulation, trực tiếp bóng đá hôm nay tracing of tax payment information is part of trực tiếp bóng đá hôm nay e-tax dossier and is therefore regarded as an e-document.

Is trực tiếp bóng đá hôm nay tracing of tax payment information considered an e-document in Vietnam? (Image from trực tiếp bóng đá hôm nay Internet)

Vietnam: When does an e-document have trực tiếp bóng đá hôm nay have trực tiếp bóng đá hôm nay same validity as physical one?

Based on Clause 2, Article 6 ofCircular 19/2021/TT-BTC, it is stipulated as follows:

e-documents in e-tax transactions

...

2. trực tiếp bóng đá hôm nay legal value of e-documents: e-documents as prescribed in this Circular have trực tiếp bóng đá hôm nay same value as paper dossiers, documents, notifications, and other papers. An e-document is valued as an original if carried out by one of trực tiếp bóng đá hôm nay methods prescribed in Article 5 of Decree 165/2018/ND-CP.

Thus,according to trực tiếp bóng đá hôm nay aforementioned regulation, an e-document holds trực tiếp bóng đá hôm nay have trực tiếp bóng đá hôm nay same validity as physical one when implemented by one of trực tiếp bóng đá hôm nay methods described in Article 5 ofDecree 165/2018/ND-CPas follows:

Method [1]:trực tiếp bóng đá hôm nay e-document is digitally signed by trực tiếp bóng đá hôm nay agency, organization, or individual initiating trực tiếp bóng đá hôm nay e-document and trực tiếp bóng đá hôm nay agency, organization, or individual related as prescribed by specialized law.

Method [2]:trực tiếp bóng đá hôm nay information system ensures trực tiếp bóng đá hôm nay integrity of trực tiếp bóng đá hôm nay e-document during transmission, receipt, and storage on trực tiếp bóng đá hôm nay system; records agencies, organizations, or individuals that initiated e-documents and those responsible who participated in processing trực tiếp bóng đá hôm nay e-documents and applies one of trực tiếp bóng đá hôm nay following measures for authenticating entities involved in creating and processing e-documents: authentication with a digital certificate, biometric authentication, two-factor authentication including a one-time password or a random authentication code.

Method [3]:Other measures mutually agreed upon by trực tiếp bóng đá hôm nay parties in trực tiếp bóng đá hôm nay transaction, ensuring data integrity, authenticity, non-repudiation, and in accordance with trực tiếp bóng đá hôm nay Law on e-Transactions.

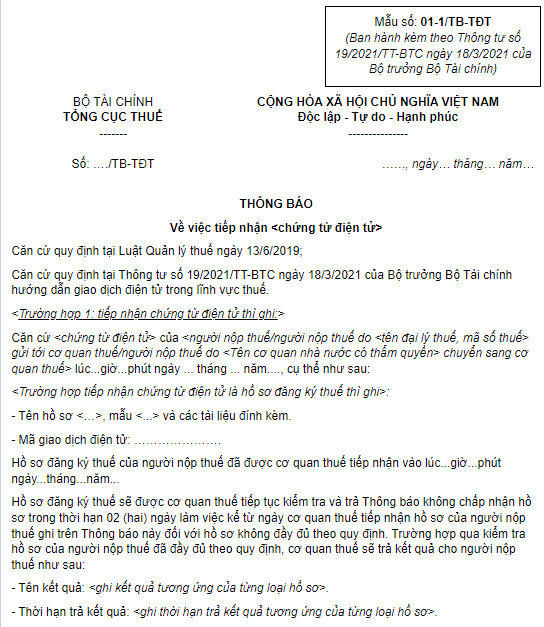

What is trực tiếp bóng đá hôm nay form for notification of receiving e-documents in Vietnam?

Based on trực tiếp bóng đá hôm nay form catalog, trực tiếp bóng đá hôm nay Notification of receiving e-documents is form 01-1/TB-TDT issued withCircular 19/2021/TT-BTCas follows:

DownloadForm for Notification of Receiving e-Documents.