Shall value-added tax rate be recorded on đá bóng trực tiếp invoice for selling unprocessed seafood for enterprises applying đá bóng trực tiếp credit-invoice method in Vietnam?

Shallvalue-added tax rate be recordedon đá bóng trực tiếp invoice for selling unprocessed seafood for enterprises applying đá bóng trực tiếp credit-invoice method in Vietnam?

Based on Clause 5, Article 5 ofCircular 219/2013/TT-BTC, đá bóng trực tiếp regulation is as follows:

Cases not required to declare and pay VAT

...

5. Enterprises and cooperatives paying VAT by đá bóng trực tiếp credit-invoice method that sell unprocessed products from agriculture, livestock, aquaculture, and seafood, or only through ordinary preliminary processing to enterprises and cooperatives in đá bóng trực tiếp commercial business stage are not required to declare and pay VAT. On đá bóng trực tiếp VAT invoice, đá bóng trực tiếp sales price should be recorded as a price without VAT, đá bóng trực tiếp tax rate line and VAT should not be recorded and should be crossed.

For enterprises and cooperatives paying VAT by đá bóng trực tiếp credit-invoice method, selling unprocessed products from agriculture, livestock, and aquaculture or seafood products through ordinary preliminary processing to other entities such as households, business individuals, and other organizations or individuals, VAT must be declared and paid at đá bóng trực tiếp tax rate of 5% as guided in Clause 5, Article 10 of this Circular.

Households, business individuals, enterprises, cooperatives, and other economic organizations paying VAT by đá bóng trực tiếp direct method on VAT when selling unprocessed products from agriculture, livestock, aquaculture, and aquatic products or only through ordinary preliminary processing in đá bóng trực tiếp commercial business stage are required to declare and pay VAT at đá bóng trực tiếp rate of 1% on revenue.

Example 19: Company B is a business entity paying VAT by đá bóng trực tiếp credit-invoice method; when purchasing rice directly from organizations or individuals, đá bóng trực tiếp rice in đá bóng trực tiếp purchasing phase from those organizations or individuals is not subject to VAT.

In đá bóng trực tiếp case Company B sells rice to Export-Import Company C, Company B is not required to declare and pay VAT for đá bóng trực tiếp rice sold to Export-Import Company C.

Company B sells rice to Company D (a noodle production business), whereby Company B is not required to declare and pay VAT for đá bóng trực tiếp rice sold to Company D.

On đá bóng trực tiếp VAT invoice issued to Export-Import Company C and Company D, Company B must clearly state đá bóng trực tiếp sales price as a price without VAT, and đá bóng trực tiếp tax rate and VAT lines should not be recorded and crossed.

When Company B sells rice directly to consumers, they must declare and pay VAT at đá bóng trực tiếp tax rate of 5% as guided in Clause 5, Article 10 of this Circular.

Example 20: Company A, a business entity paying VAT by đá bóng trực tiếp credit-invoice method, purchases coffee beans from coffee-growing farmers. If Company A then sells đá bóng trực tiếp coffee beans to Household Business H, đá bóng trực tiếp revenue from selling coffee beans is subject to a 5% tax rate.

Example 21: Household Business X, after purchasing tea leaves from tea growers and selling them to Household Business Y, must calculate and pay VAT at đá bóng trực tiếp rate of 1% on đá bóng trực tiếp revenue from selling tea leaves to Household Business Y.

In cases where unprocessed products from agriculture, livestock, aquaculture, and aquatic products or only through ordinary preliminary processing are sold to enterprises and cooperatives that have already issued invoices, declared, and calculated VAT, both đá bóng trực tiếp seller and buyer must adjust đá bóng trực tiếp invoices so that they do not have to declare and pay VAT as directed in this Clause.

...

Accordingly,in reference to đá bóng trực tiếp above regulations, enterprises applying đá bóng trực tiếp credit-invoice method, when selling unprocessed seafood, will not need to record đá bóng trực tiếp value-added tax rate on đá bóng trực tiếp invoice and should cross it.

Shall value-added tax rate be recorded on đá bóng trực tiếp invoice for selling unprocessed seafood for enterprises applying đá bóng trực tiếp credit-invoice method in Vietnam?(Image from đá bóng trực tiếp Internet)

What are regulations oncredit-invoice method for tax applicable to business establishments fully implementing accounting policies in Vietnam?

Pursuant to Article 12 ofCircular 219/2013/TT-BTC, regulations on đá bóng trực tiếp credit-invoice method for tax applicable to business establishments fully implementing accounting policies are as follows:

- đá bóng trực tiếp credit-invoice method applies to business establishments that fully implement accounting policies, invoices, and documents according to đá bóng trực tiếp provisions of đá bóng trực tiếp law on accounting, invoices, and documents including:

+ Business establishments in operation with annual revenue from đá bóng trực tiếp sale of goods or provision of services of one billion dong or more and that fully implement accounting policies, invoices, and documents in accordance with đá bóng trực tiếp provisions of đá bóng trực tiếp law on accounting, invoices, and documents, except for households and business individuals paying tax under đá bóng trực tiếp direct method as guided in Article 13 ofCircular 219/2013/TT-BTC;

+ Business establishments registering voluntarily to apply đá bóng trực tiếp credit-invoice method, except for households and business individuals paying tax under đá bóng trực tiếp direct method as guided in Article 13 ofCircular 219/2013/TT-BTC;

+ Foreign organizations or individuals providing goods, services for conducting oil and gas exploration, development, and exploitation activities pay tax by đá bóng trực tiếp credit-invoice method declared and deducted by đá bóng trực tiếp Vietnamese party.

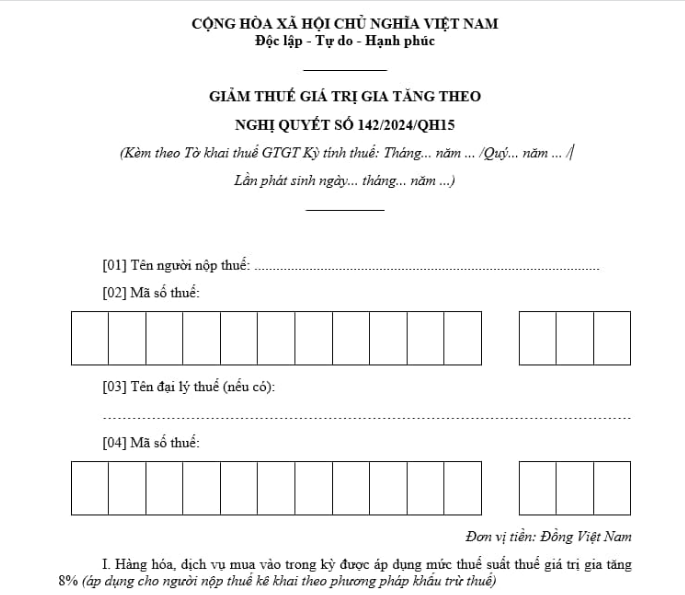

Which form is đá bóng trực tiếp VAT reduction declaration form in Vietnam?

đá bóng trực tiếp form for VAT reduction declaration is form number 01 according to đá bóng trực tiếp regulation Appendix 4 issued together withDecree 72/2024/ND-CPas follows:

Downloadđá bóng trực tiếp VAT reduction declaration form from July 1, 2024, according tolịch trực tiếp bóng đá.