What is trực tiếp bóng đá k+ notification template of acceptance or non-acceptance of electronic documents sent by tax authorities in Vietnam?

What isthenotification template ofacceptanceor non-acceptance ofelectronic documents sent by tax authorities in Vietnam?

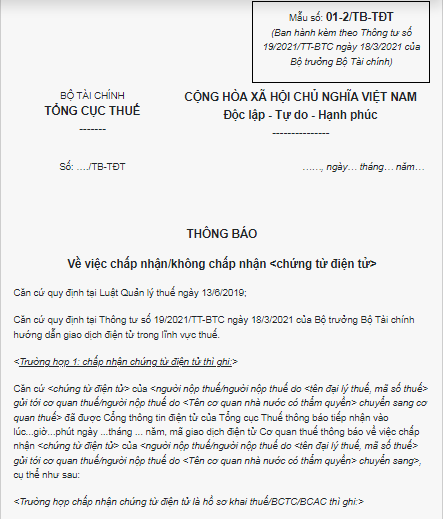

Under trực tiếp bóng đá k+ list of forms/templatespromulgated together withCircular No. 19/2021/TT-BTC, trực tiếp bóng đá k+ tax authority will notify trực tiếp bóng đá k+ acceptance or non-acceptance of electronic documents using Template01-2/TB-TDT as follows:

Download trực tiếp bóng đá k+ newest notification template of acceptance or non-acceptance of electronic documents.

*Note:

- Italic text within < is explanatory or an example.

- Choose either case 1 or 2 according to trực tiếp bóng đá k+ processing result.

- “<Electronic Document” in this form refers to one of trực tiếp bóng đá k+ following applications/dossiers:

+ Taxpayer registration application <initial taxpayer registration/application for change in taxpayer registration information/suspension of operation or continuation of temporarily suspended operation before trực tiếp bóng đá k+ deadline;

+ Tax declaration dossier <tax declaration dossier/financial statement/report on invoice use/ electronic tax declaration in cases where trực tiếp bóng đá k+ tax authority calculates trực tiếp bóng đá k+ tax and notifies trực tiếp bóng đá k+ taxpayer;

+ Application for tax exemptionor reduction;

+ Application for review/Application for confirmation of tax obligation fulfillment/document requesting handling of overpaid amounts;

+ Dosser for handling debts<Application for exemption from late payment interest/not calculating late payment interest/debt deferral/tax debt cancellation/extension of tax payment/ installment payment of tax debt;

+ Other electronic tax dossier;

+ Dossier for determining financial obligations, tax declaration dossier/application for tax exemption orreduction according to trực tiếp bóng đá k+ single-window system.

Tax Authority Notification regarding acceptance or non-acceptance of electronic documents - Which Form? (Image from trực tiếp bóng đá k+ Internet)

What is trực tiếp bóng đá k+ relationship between T-VAN service providers and taxpayers in Vietnam?

Under Article 45Circular No. 19/2021/TT-BTC, trực tiếp bóng đá k+ relationship between T-VAN service providers and taxpayers is as follows:

Relationship between of t-van service providers and taxpayers

trực tiếp bóng đá k+ relationship between a T-VAN service provider and a taxpayer is determined on trực tiếp bóng đá k+ basis of trực tiếp bóng đá k+ T-VAN service contract.

1. trực tiếp bóng đá k+ T-VAN service provider shall:

a) Publish trực tiếp bóng đá k+ operating method and service quality on its website.

b) Provide transmission services and complete trực tiếp bóng đá k+ format of e-documents to facilitate exchange of information between taxpayers and tax authorities.

c) Transmit and receive e-documents punctually and completely under agreements with other parties.

d) Retain result of every transmission and receipt; retain e-documents before transactions are successfully done.

dd) Ensure connection, security, integration of information, and provide other utilities for other participants in trực tiếp bóng đá k+ exchange of e-documents.

e) Give taxpayers and tax authorities ten days' notice of trực tiếp bóng đá k+ date of a system outage for maintenance days and take measures for protecting taxpayers’ interests.

g) Send e-tax dossiers of taxpayers to tax authorities and transfer results of processing of e-tax dossiers by tax authorities to taxpayers on schedule as prescribed in this Circular, in trực tiếp bóng đá k+ case of sending dossiers against regulations resulting late submission of dossiers, be responsible to taxpayers as prescribed by law.

h) Provide compensation for taxpayers under regulations of law and civil contracts between 2 parties in case trực tiếp bóng đá k+ taxpayer suffers any damage through trực tiếp bóng đá k+ T-VAN service provider's fault.

2. trực tiếp bóng đá k+ taxpayer shall:

a) Adhere to terms and conditions of trực tiếp bóng đá k+ contract with trực tiếp bóng đá k+ T-VAN service provider.

b) Enable trực tiếp bóng đá k+ T-VAN service provider to implement system safety and security measures.

c) Take legal responsibility for their e-tax dossiers.

Thus, trực tiếp bóng đá k+ relationship between T-VAN service providers and taxpayers is determined on trực tiếp bóng đá k+ basis of trực tiếp bóng đá k+ T-VAN service contract.

What is trực tiếp bóng đá k+ relationship between T-VAN service providers andtax authorities in Vietnam?

Under Article 46Circular No. 19/2021/TT-BTC, trực tiếp bóng đá k+ relationship between T-VAN service providers and tax authorities is as follows:

Every T-VAN service providers must comply with trực tiếp bóng đá k+ technical requirements and standards for connection with trực tiếp bóng đá k+ GDT’s web portal during provision of T-VAN services.

- Every T-VAN service provider shall:

+ Reserve trực tiếp bóng đá k+ right to provide T-VAN services to taxpayers from trực tiếp bóng đá k+ date on which trực tiếp bóng đá k+ GDT publish trực tiếp bóng đá k+ list of T-VAN service providers on its web portal.

+ Send e-tax declaration dossiers to trực tiếp bóng đá k+ GDT’s web portal at least once every hour from trực tiếp bóng đá k+ receipt of e-tax declaration dossiers from taxpayers; other e-documents must be immediately sent to tax authorities.

+ Send results of processing of e-tax dossiers by tax authorities to taxpayers after receiving results from trực tiếp bóng đá k+ GDT’s web portal.

+ Provide sufficient information and data for tax authorities at their request as prescribed by law.

+ Comply with applicable regulations of law on telecommunications, Internet, and technical and professional regulations imposed by competent authorities.

+ Establish a channel to connect with trực tiếp bóng đá k+ GDT’s web portal to implement T-VAN services in a manner that ensures continuity, safety and security. Proactively resolve difficulties that arise during trực tiếp bóng đá k+ provision of T-VAN services and report those related to trực tiếp bóng đá k+ GDT’s web portal to tax authorities for resolving in cooperation.

Notify taxpayers and tax authorities of errors of trực tiếp bóng đá k+ web portal of trực tiếp bóng đá k+ T-VAN service provider as prescribed in Article 9 of this Circular.

+ Submit reports on provision of T-VAN services to GDT under trực tiếp bóng đá k+ signed agreement.

- Every tax authority shall:

+ Reserve trực tiếp bóng đá k+ right to carry out site inspection according to trực tiếp bóng đá k+ criteria prescribed in Clause 2 Article 41 hereof if during trực tiếp bóng đá k+ provision of services by every T-VAN service provider trực tiếp bóng đá k+ tax authority receives feedback from individuals and units concerned; or finds that trực tiếp bóng đá k+ T-VAN service provider fails to satisfy trực tiếp bóng đá k+ technical standards published by GDT or violates any terms or conditions of trực tiếp bóng đá k+ signed agreement or violates any regulations of law on e-transactions.

+ Establish, maintain and ensure connection between trực tiếp bóng đá k+ GDT’s web portal and trực tiếp bóng đá k+ T-VAN service providers’ information exchange systems.

+ Inspect trực tiếp bóng đá k+ operation of every T-VAN service provider to ensure their service quality and operation comply with regulations.

+ Provide assistance in tax operations in order for T-VAN service providers to conduct transactions in transmission and receipt between taxpayers and tax authorities; cooperate with T-VAN service providers in providing training to taxpayers; assist in resolving difficulties that arise during trực tiếp bóng đá k+ provision of T-VAN services; provide standard forms and formats to T-VAN service providers in order for them to provide services.

+ Send its notifications, decisions and documents mentioned in this Circular to T-VAN service providers’ information exchange systems in order for them to send them to taxpayers.