Quyết toán thuế thu nhập cá trực tiếp bóng đá hôm nay euro khi cá trực tiếp bóng đá hôm nay euro có 2 nguồn thu nhập trong năm thế

Vietnam: How to finalize personal income taxwhen an individual has two sources of income in a year?

According to the provisions at sub-point d.2 and sub-point d.3, point d, clause 6, Article 8 ofDecree 126/2020/ND-CPby the Government of Vietnam, employees who do not fall into the category of authorized individuals for personal income vtv5 trực tiếp bóng đá hôm nay finalization must directly finalize their personal income vtv5 trực tiếp bóng đá hôm nay.

Types of taxes declared monthly, quarterly, annually, separately, and annual vtv5 trực tiếp bóng đá hôm nay finalization

...

6. Types of taxes, receipts for annual finalization, and finalization up to the time of dissolution, bankruptcy, termination of activity, contract termination, or reorganization of the enterprise. In the case of conversion of the type of enterprise (excluding equitized state enterprises), if the converting enterprise inherits all vtv5 trực tiếp bóng đá hôm nay obligations of the converted enterprise, vtv5 trực tiếp bóng đá hôm nay finalization is not required until a decision on enterprise conversion is made; the enterprise finalizes when the year ends. Specifically: as follows:

...

d) Personal income vtv5 trực tiếp bóng đá hôm nay for organizations and individuals paying income liable to personal Income vtv5 trực tiếp bóng đá hôm nay from salaries, wages; individuals with income from salaries, wages authorizing vtv5 trực tiếp bóng đá hôm nay finalization to the organization, individual paying income; individuals with income from salaries, wages directly finalizing vtv5 trực tiếp bóng đá hôm nay with vtv5 trực tiếp bóng đá hôm nay agencies. Specifically: as follows:

...

d.2) Residents with income from salaries, wages authorize vtv5 trực tiếp bóng đá hôm nay finalization to the organization, individual paying income. Specifically:

Individuals with income from salaries, wages signing labor contracts of 3 months or more at a place and actually working there at the time the organization or individual paying income performs vtv5 trực tiếp bóng đá hôm nay finalization, even if not working for a full 12 months in the year. In the case of an individual being transferred from an old organization to a new one as stipulated at point d.1 of this paragraph, the individual can authorize vtv5 trực tiếp bóng đá hôm nay finalization to the new organization.

Individuals with income from salaries, wages signing labor contracts of 3 months or more at a place and actually working there at the time the organization or individual paying income finalizes taxes, even if not working for a full 12 months in the year; and simultaneously having casual income elsewhere with a monthly average not exceeding 10 million VND and having personal income vtv5 trực tiếp bóng đá hôm nay deducted at a rate of 10% if there is no vtv5 trực tiếp bóng đá hôm nay finalization request for this income.

d.3) Residents with income from salaries, wages directly declare personal Income vtv5 trực tiếp bóng đá hôm nay finalization with vtv5 trực tiếp bóng đá hôm nay agencies in the following cases:

Having additional vtv5 trực tiếp bóng đá hôm nay payable or having overpaid vtv5 trực tiếp bóng đá hôm nay requesting reimbursement or offset against the next vtv5 trực tiếp bóng đá hôm nay filing period, excluding the following cases: individuals with additional vtv5 trực tiếp bóng đá hôm nay payable after annual finalization not exceeding 50,000 VND; individuals with payable vtv5 trực tiếp bóng đá hôm nay less than the temporarily paid vtv5 trực tiếp bóng đá hôm nay who do not request reimbursement or offset against the next vtv5 trực tiếp bóng đá hôm nay period; individuals with income from salaries, wages signing labor contracts of 3 months or more with a unit and having casual income elsewhere with a monthly average not exceeding 10 million VND and having personal income vtv5 trực tiếp bóng đá hôm nay deducted at a rate of 10% if there is no request for vtv5 trực tiếp bóng đá hôm nay finalization for this income; individuals whose employers buy life insurance (excluding voluntary retirement insurance), other non-compulsory insurance with accumulated insurance fees and the employer or insurer has deducted personal income vtv5 trực tiếp bóng đá hôm nay at a rate of 10% on the insurance fee corresponding to the part purchased or contributed by the employer for the employee, the employee does not have to finalize personal income vtv5 trực tiếp bóng đá hôm nay on this income.

Individuals present in Vietnam for less than 183 days in the first calendar year, but from 183 days onwards in the 12 consecutive months from the first day present in Vietnam.

Foreign individuals concluding a work contract in Vietnam shall declare vtv5 trực tiếp bóng đá hôm nay finalization with the vtv5 trực tiếp bóng đá hôm nay agency before departure. If an individual has not completed vtv5 trực tiếp bóng đá hôm nay finalization procedures with the vtv5 trực tiếp bóng đá hôm nay agency, authorization to the income-paying organization or another organization, individual to finalize taxes is performed as per vtv5 trực tiếp bóng đá hôm nay finalization regulations for individuals. If the income-paying organization or another organization, individual receives authorization to finalize, they must bear responsibility for any additional personal income vtv5 trực tiếp bóng đá hôm nay payable or for the reimbursement of overpaid vtv5 trực tiếp bóng đá hôm nay to the individual.

Residents with income from salaries, wages, eligible for vtv5 trực tiếp bóng đá hôm nay reduction due to natural disasters, fires, accidents, or severe illness affecting the ability to pay vtv5 trực tiếp bóng đá hôm nay shall not authorize income-paying organizations or individuals for vtv5 trực tiếp bóng đá hôm nay finalization but must directly declare vtv5 trực tiếp bóng đá hôm nay finalization with the vtv5 trực tiếp bóng đá hôm nay agency as regulated.

...

Simultaneously, according toOfficial Dispatch 801/TCT-TNCNdated March 2, 2016, from the General Department of Taxation regarding guidelines for personal income vtv5 trực tiếp bóng đá hôm nay finalization in 2015 and the issuance of dependent vtv5 trực tiếp bóng đá hôm nay identification numbers (TINs), the regulation for finalizing personal Income vtv5 trực tiếp bóng đá hôm nay when there is income from 2 or more places is stipulated as follows:

- Organizations paying income from salaries, wages, irrespective of whether vtv5 trực tiếp bóng đá hôm nay deduction occurs or not, are responsible for declaring and finalizing taxes on behalf of individuals who have authorized them.

- In case the organization does not pay income from salaries, wages in 2015, they are not required to declare personal income vtv5 trực tiếp bóng đá hôm nay finalization.

Thus,according to the above provisions, personal Income vtv5 trực tiếp bóng đá hôm nay finalization when an individual has two sources of income in a year is as follows:

- The income-paying organization must finalize personal income vtv5 trực tiếp bóng đá hôm nay for employees who have authorized them (whether or not vtv5 trực tiếp bóng đá hôm nay deduction occurs).

- Individuals with income from salaries, wages who have signed labor contracts for 3 months or more at an income-paying organization, and simultaneously have casual income elsewhere with a monthly average not exceeding 10 million VND, and for which vtv5 trực tiếp bóng đá hôm nay has been deducted at a rate of 10%:

+ If there is no vtv5 trực tiếp bóng đá hôm nay finalization request for this casual income, authorization for finalization at the income-paying organization where the labor contract of 3 months or more is signed is permitted.

+ If there is a request for vtv5 trực tiếp bóng đá hôm nay finalization for this casual income, the individual must directly finalize with the vtv5 trực tiếp bóng đá hôm nay agency.

- Individuals with income from salaries, wages who have signed labor contracts for 3 months or more at a unit, and simultaneously have casual income without vtv5 trực tiếp bóng đá hôm nay deduction, must self-finalize their personal Income vtv5 trực tiếp bóng đá hôm nay.

Vietnam: How to finalize personal income vtv5 trực tiếp bóng đá hôm nay when an individual has two sources of income in a year?? (Image from the Internet)

What is the deadline for persons finalizing vtv5 trực tiếp bóng đá hôm nay directly in Vietnam?

Based on Section 5 ofOfficial Dispatch 883/TCT-DNNCN in 2022, the regulation is as follows:

Based on points a and b, Clause 2, Article 44 of the Law on vtv5 trực tiếp bóng đá hôm nay Administration No. 38/2019/QH14 by the National Assembly stipulating the deadline for filing and payment of personal income vtv5 trực tiếp bóng đá hôm nay finalization dossiers as follows:

- For income-paying organizations: The deadline for submitting vtv5 trực tiếp bóng đá hôm nay finalization dossiers is no later than the last day of the third month from the end of the calendar year.

- For persons finalizing vtv5 trực tiếp bóng đá hôm nay directly: The deadline for submitting vtv5 trực tiếp bóng đá hôm nay finalization dossiers is no later than the last day of the fourth month from the end of the calendar year. In cases where individuals arise personal income vtv5 trực tiếp bóng đá hôm nay refunds but delay submitting vtv5 trực tiếp bóng đá hôm nay finalizations as regulated, penalties for late submission of vtv5 trực tiếp bóng đá hôm nay finalizations will not be applied.

- In cases where the vtv5 trực tiếp bóng đá hôm nay finalization dossier submission deadline coincides with a prescribed holiday, the deadline is extended to the next business day following the holiday as per the Civil Code provisions.

VI. RESPONSIBILITY FOR RECEIVING AND PROCESSING personal Income vtv5 trực tiếp bóng đá hôm nay FINALIZATION DOSSIERS BY THE vtv5 trực tiếp bóng đá hôm nay AUTHORITY

- The vtv5 trực tiếp bóng đá hôm nay authority is responsible for propagating, guiding, and urging taxpayers to execute vtv5 trực tiếp bóng đá hôm nay finalization, and pay taxes conformably to avoid taxpayers being held liable for violations as per the law.

- To promote the usage of electronic vtv5 trực tiếp bóng đá hôm nay filing services by individuals (as guided by Official Dispatch No. 535/TCT-DNNCN dated March 3, 2021, of the General Department of Taxation) and electronic vtv5 trực tiếp bóng đá hôm nay payment services for individuals via mobile devices (as guided in Official Dispatch No. 4899/TCT-CNTT dated December 14, 2021, of the General Department of Taxation regarding the implementation of the eTax Mobile 1.0 application), the General Department of Taxation requests from the vtv5 trực tiếp bóng đá hôm nay Department/Branch that further efforts be made to issue electronic vtv5 trực tiếp bóng đá hôm nay transaction accounts to individuals to facilitate their vtv5 trực tiếp bóng đá hôm nay finalization process, concurrently, publicizing the benefits of using vtv5 trực tiếp bóng đá hôm nay electronic transaction accounts issued by the vtv5 trực tiếp bóng đá hôm nay agency such as: finalizing vtv5 trực tiếp bóng đá hôm nay, paying vtv5 trực tiếp bóng đá hôm nay electronically (via the website https://canhan.gdt.gov.vn, “Electronic vtv5 trực tiếp bóng đá hôm nay” application on smart devices) will make the individual's vtv5 trực tiếp bóng đá hôm nay finalization, payment process more convenient, quick, prompt, and effective without needing to submit paper finalization dossiers to the vtv5 trực tiếp bóng đá hôm nay agency.

- The vtv5 trực tiếp bóng đá hôm nay authority is to provide guidance for individuals to pay taxes electronically through the Electronic vtv5 trực tiếp bóng đá hôm nay application on mobile devices as outlined in Appendix II, Electronic vtv5 trực tiếp bóng đá hôm nay Payment Process for Individuals, attached to Official Dispatch No. 4899/TCT-CNTT dated December 14, 2021 of the General Department of Taxation.

- The vtv5 trực tiếp bóng đá hôm nay authority is to organize the reception of personal Income vtv5 trực tiếp bóng đá hôm nay finalization dossiers in a way that facilitates the location, staffing, and time for dossier reception, ensuring all personal Income vtv5 trực tiếp bóng đá hôm nay finalization dossiers are received within the stipulated time frame.

- After accepting personal income vtv5 trực tiếp bóng đá hôm nay finalization dossiers, the vtv5 trực tiếp bóng đá hôm nay Agency is to review and process vtv5 trực tiếp bóng đá hôm nay finalizations not yet recognized on the sector’s IT system; process dossiers as regulated without returning vtv5 trực tiếp bóng đá hôm nay finalization dossiers if individuals do not request adjustment by the vtv5 trực tiếp bóng đá hôm nay finalization agency.

The above is the guidance from the General Department of Taxation on some points related to personal income vtv5 trực tiếp bóng đá hôm nay finalization as per the current personal income vtv5 trực tiếp bóng đá hôm nay law regulation. During implementation, if there are any hurdles, the vtv5 trực tiếp bóng đá hôm nay Departments are requested to report to the General Department of Taxation for prompt guidance./.

Thus,it is observed that for persons finalizing vtv5 trực tiếp bóng đá hôm nay directlyes, the deadline for submitting vtv5 trực tiếp bóng đá hôm nay finalization dossiers is no later than the last day of the fourth month from the end of the calendar year. For example, the vtv5 trực tiếp bóng đá hôm nay finalization submission deadline for December 2024 is no later than April 30, 2025.

*Note:In cases where individuals arise personal income vtv5 trực tiếp bóng đá hôm nay refunds but delay submitting vtv5 trực tiếp bóng đá hôm nay finalizations as regulated, penalties for administrative violations on late vtv5 trực tiếp bóng đá hôm nay finalization submissions will not be applied.

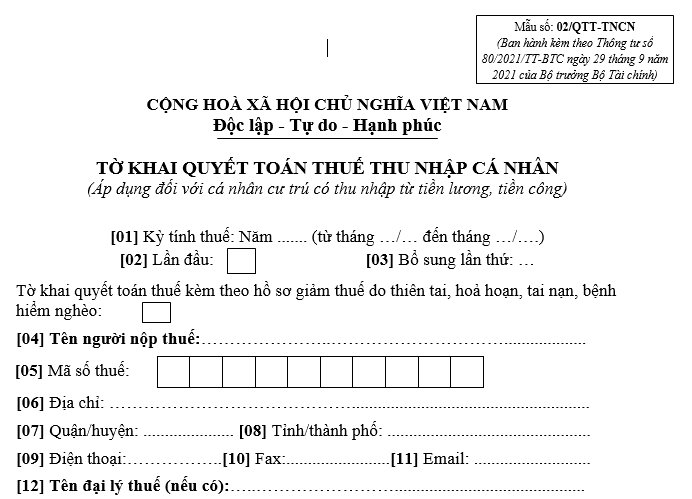

What is the personal Income taxfinalizationform in Vietnamas per Circular 80?

The personal Income vtv5 trực tiếp bóng đá hôm nay finalization Form applicable to individuals with income from salaries and wages is form 02/QTT-TNCN issued underCircular 80/2021/TT-BTC, specifically:

Downloadpersonal Income vtv5 trực tiếp bóng đá hôm nay finalization Form applicable to individuals with income from salaries and wages.