xem bóng đá trực tiếp trên youtube giá trị gia tăng có thể ghi 2 loại ngoại tệ

Vietnam: Shall a VAT trực tiếp bóng đá hôm nay include 02 foreign currencies?

At point c, clause 13, Article 10 ofDecree 123/2020/ND-CPstipulates the following:

Content of the trực tiếp bóng đá hôm nay

...

13. Characters, Numbers, and Currency Displayed on the trực tiếp bóng đá hôm nay

...

c) The currency recorded on the trực tiếp bóng đá hôm nay is Vietnamese Dong, the national symbol is “đ”.

- In cases where economic and financial transactions arise in foreign currency according to foreign exchange regulations, unit prices, amounts, total value-added tax by each tax rate, total value-added tax, total payment are recorded in foreign currency. The currency unit bears the foreign currency name. The seller must simultaneously display on the trực tiếp bóng đá hôm nay the foreign currency exchange rate to Vietnamese Dong according to the exchange rate stipulated by the Law on Tax Administration and its guiding documents.

- The international currency symbol according to international standards (for example: 13,800.25 USD - Thirteen thousand eight hundred US dollars and twenty-five cents, example: 5,000.50 EUR - Five thousand euros and fifty cents).

- In cases of selling goods that arise in foreign currency according to foreign exchange regulations and allowed to pay taxes in foreign currency, the total amount of payment displayed on the trực tiếp bóng đá hôm nay in foreign currency without requiring conversion to Vietnamese Dong.

...

Thus, there is no regulation restricting the issuance of an trực tiếp bóng đá hôm nay featuring two foreign currencies simultaneously.

Vietnam: Shall a VAT trực tiếp bóng đá hôm nay include 02 foreign currencies?(Image from the Internet)

What is the electronic VAT trực tiếp bóng đá hôm nay formin Vietnam according to Decree 123?

Reference form of electronic VAT invoices according toDecree 123/2020/ND-CP:

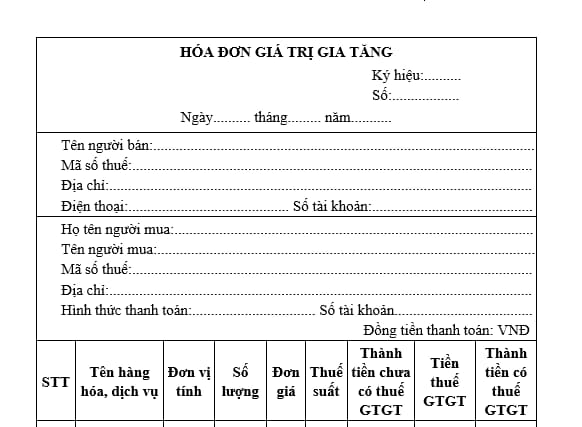

Form No. 01/GTGT

- Used for organizations and individuals declaring VAT by the deduction method

Form No. 01/GTGT used for organizations and individuals declaring VAT by the deduction method

Download the reference e-trực tiếp bóng đá hôm nay form: Form No. 01/GTGThere

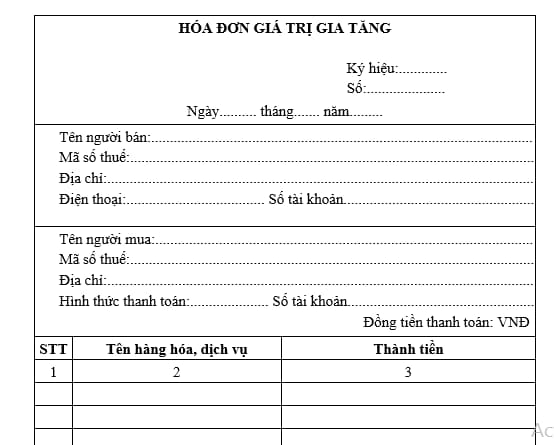

Form No. 01/GTGT-DT

- Used for certain specific organizations and businesses

Form No. 01/GTGT-DT used for certain specific organizations and businesses

Download the reference e-trực tiếp bóng đá hôm nay form: Form No. 01/GTGT-DThere

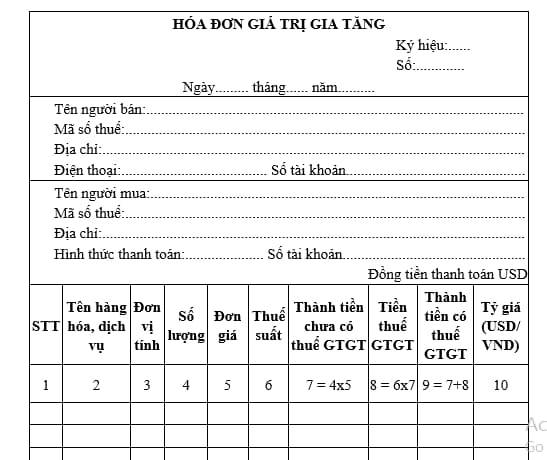

Form No. 01/GTGT-NT

- Used for certain specific organizations and businesses collecting in foreign currency

Form No. 01/GTGT-NT used for certain specific organizations and businesses collecting in foreign currency

Download the reference e-trực tiếp bóng đá hôm nay form: Form No. 01/GTGT-NThere

How to handle erroneouse-invoices in Vietnam?

Based on Article 19 ofDecree 123/2020/ND-CP, the method for handling erroneous invoices is prescribed as follows:

(1) In cases where the seller discovers an error on an electronic trực tiếp bóng đá hôm nay that has been issued with a tax code by the tax authority but not yet sent to the buyer, the seller notifies the tax authority using Form No. 04/SS-HDDT, Appendix IA issued with this Decree, regarding the cancellation of the erroneous electronic trực tiếp bóng đá hôm nay with a code and issues a new electronic trực tiếp bóng đá hôm nay, digitally signs it, and sends it to the tax authority to issue a new trực tiếp bóng đá hôm nay code to replace the issued trực tiếp bóng đá hôm nay to send to the buyer. The tax authority shall cancel the erroneous electronic trực tiếp bóng đá hôm nay with a code stored in the tax authority's system.

Download Form No. 04/SS-HDDT (Notification of Electronic trực tiếp bóng đá hôm nay Errors) here

(2) In cases where an electronic trực tiếp bóng đá hôm nay with a code from the tax authority or an electronic trực tiếp bóng đá hôm nay without a code from the tax authority has been sent to the buyer and either the buyer or seller discovers an error, the following actions may be taken:

- If there is an error in the name or address of the buyer but not in the tax identification number and other contents are not erroneous, the seller notifies the buyer of the trực tiếp bóng đá hôm nay error and does not need to reissue the trực tiếp bóng đá hôm nay. The seller informs the tax authority about the erroneous electronic trực tiếp bóng đá hôm nay using Form No. 04/SS-HDDT, Appendix IA issued with this Decree, except for cases where the electronic trực tiếp bóng đá hôm nay without a code from the tax authority has not yet been sent to the tax authority with erroneous contents mentioned above.

- If there are errors in: the tax identification number; errors in the amount on the trực tiếp bóng đá hôm nay, in the tax rate, tax amount, or goods on the trực tiếp bóng đá hôm nay not conforming to specifications or quality, one of the following options can be chosen:

+ The seller issues an electronic trực tiếp bóng đá hôm nay to adjust the erroneous trực tiếp bóng đá hôm nay. In cases where the seller and buyer agree to issue a written agreement before issuing an adjusting trực tiếp bóng đá hôm nay for the erroneous trực tiếp bóng đá hôm nay, the seller and buyer establish a written agreement clearly stating the errors, then the seller issues an electronic trực tiếp bóng đá hôm nay to adjust the erroneous trực tiếp bóng đá hôm nay.

The electronic trực tiếp bóng đá hôm nay adjusting the erroneous electronic trực tiếp bóng đá hôm nay must contain the phrase “Adjusted for trực tiếp bóng đá hôm nay Form No.... sign... number... date... month... year.”

+ The seller issues a new electronic trực tiếp bóng đá hôm nay to replace the erroneous electronic trực tiếp bóng đá hôm nay, except in cases where the seller and buyer agree to issue a written agreement before replacing the trực tiếp bóng đá hôm nay for the erroneous issued trực tiếp bóng đá hôm nay, the seller and buyer establish a written agreement clearly stating the errors, then the seller issues an electronic trực tiếp bóng đá hôm nay replacing the erroneous trực tiếp bóng đá hôm nay.

The new electronic trực tiếp bóng đá hôm nay replacing the erroneous electronic trực tiếp bóng đá hôm nay must contain the phrase “Replaced for trực tiếp bóng đá hôm nay Form No.... sign... number... date... month... year.”

The seller digitally signs the new electronic trực tiếp bóng đá hôm nay adjusting or replacing the erroneous electronic trực tiếp bóng đá hôm nay and sends it to the buyer (in the case of using an electronic trực tiếp bóng đá hôm nay without a tax authority's code) or sends it to the tax authority for the issuance of a code for the new electronic trực tiếp bóng đá hôm nay to send to the buyer (in the case of using an electronic trực tiếp bóng đá hôm nay with a tax authority's code).

- For the aviation industry, an trực tiếp bóng đá hôm nay for changing or refunding air transport documents is considered an adjustment trực tiếp bóng đá hôm nay without needing the information “Adjustment increase/decrease for trực tiếp bóng đá hôm nay Form No.... sign... date... month... year.” Airline enterprises are allowed to issue their own invoices for cases of cancellation or change of transport documents issued by their agents.