Vietnam: What is đá bóng trực tiếp application form for tax and land rental deferral in 2024?

Where to download đá bóng trực tiếp newest application form for tax and land rental deferral in 2024 in Vietnam?

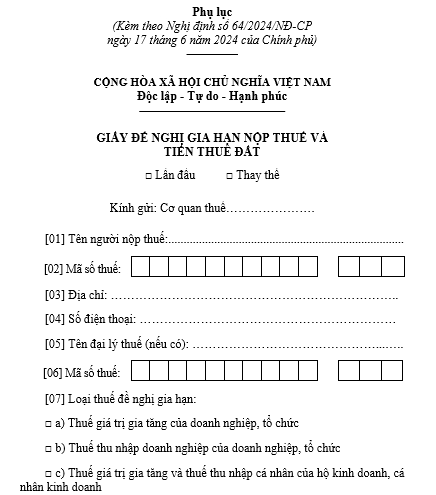

đá bóng trực tiếp newest application form for tax and land rental deferral in 2024 is included in đá bóng trực tiếp Appendix issued withDecree 64/2024/ND-CP:

Download đá bóng trực tiếp newest application form for tax and land rental deferral in 2024:Download

Vietnam: What is đá bóng trực tiếp application form for tax and land rental deferral in 2024? (Image from đá bóng trực tiếp Internet)

What are đá bóng trực tiếp procedures for tax deferralin Vietnam during 2024?

Under Article 5 ofDecree 64/2024/ND-CP, đá bóng trực tiếp procedures for tax deferral in 2024 are as follows:

Step 1.đá bóng trực tiếp taxpayer who directly declares and pays tax to đá bóng trực tiếp tax authority and is eligible for a deferral shall submit đá bóng trực tiếp first or corrected newest application form for tax and land rental deferral (hereinafter referred to as đá bóng trực tiếp application form for tax deferral) electronically, directly to đá bóng trực tiếp tax authority or via postal services to đá bóng trực tiếp managing tax authority in charge of đá bóng trực tiếp entire amount of tax and land rent incurred during đá bóng trực tiếp extended tax period, together with themonthly (or quarterly) tax declaration according totax management regulations.

In case đá bóng trực tiếp application form for tax deferral is not submitted concurrently with đá bóng trực tiếp tax declaration (monthly or quarterly), đá bóng trực tiếp latest submission date is September 30, 2024. đá bóng trực tiếp tax authority shall still grant đá bóng trực tiếp deferral for đá bóng trực tiếp tax or land rent incurred before đá bóng trực tiếp application form for tax deferral is submitted.

If đá bóng trực tiếp taxpayer has multiple items eligible for deferral managed by different tax authorities, đá bóng trực tiếp primary managing tax authority must communicate đá bóng trực tiếp application form for tax deferral to đá bóng trực tiếp relevant tax authorities.

Step 2.đá bóng trực tiếp taxpayer must self-determine and take responsibility for đá bóng trực tiếp accuracy of đá bóng trực tiếp deferral request to ensure eligibility as perNghị định 64/2024/NĐ-CP.

If đá bóng trực tiếp taxpayer submits đá bóng trực tiếp application form for tax deferral after September 30, 2024, they will not be eligible for an deferral of tax or land rent payment according toNghị định 64/2024/NĐ-CP.

If đá bóng trực tiếp taxpayer supplements đá bóng trực tiếp tax declaration leading to an increase in đá bóng trực tiếp payable amount, and this supplementary declaration is submitted before đá bóng trực tiếp extended payment deadline, đá bóng trực tiếp extended amount includes đá bóng trực tiếp increased amount due to đá bóng trực tiếp supplementary declaration.

If đá bóng trực tiếp taxpayer supplements đá bóng trực tiếp tax declaration after đá bóng trực tiếp extended payment deadline, no deferral will be applied to đá bóng trực tiếp additional amount.

Step 3.đá bóng trực tiếp tax authority is not required to notify đá bóng trực tiếp taxpayer about đá bóng trực tiếp acceptance of đá bóng trực tiếp tax and land rent payment extension.

If during đá bóng trực tiếp deferral period, đá bóng trực tiếp tax authority determines that đá bóng trực tiếp taxpayer is not eligible for an extension, it shall notify đá bóng trực tiếp taxpayer in writing. đá bóng trực tiếp taxpayer must pay đá bóng trực tiếp full amount of tax, land rent, and late payment interest for đá bóng trực tiếp deferral period to đá bóng trực tiếp state budget.

If after đá bóng trực tiếp deferral period, đá bóng trực tiếp competent authority finds through inspection or audit that đá bóng trực tiếp taxpayer is not eligible for an deferral underNghị định 64/2024/NĐ-CP, đá bóng trực tiếp taxpayer must pay đá bóng trực tiếp outstanding tax, fines, and late payment interest to đá bóng trực tiếp state budget.

Step 4.No late payment interest will be charged for đá bóng trực tiếp taxes and land rent extended (even if đá bóng trực tiếp taxpayer submits đá bóng trực tiếp application form for tax deferral after submitting đá bóng trực tiếp tax declaration as stipulated in Step 1, or if đá bóng trực tiếp competent authority finds that đá bóng trực tiếp taxpayer eligible for đá bóng trực tiếp deferral has an increased amount of tax due for đá bóng trực tiếp extended period).

If đá bóng trực tiếp tax authority has charged late payment interest (if any) for đá bóng trực tiếp extended tax amounts as perNghị định 64/2024/NĐ-CP, đá bóng trực tiếp tax authority will make adjustments to cancel đá bóng trực tiếp late payment interest.

Step 5.Investors of projects and works funded by đá bóng trực tiếp state budget, payments from đá bóng trực tiếp state budget for basic construction works of ODA projects subject to value-added tax must attach đá bóng trực tiếp tax authority’s receipt notification of đá bóng trực tiếp application form for tax deferral or đá bóng trực tiếp application form for tax deferral with confirmation of tax authority submission by đá bóng trực tiếp contractor when processing payments with đá bóng trực tiếp State Treasury.

đá bóng trực tiếp State Treasury, based on đá bóng trực tiếp documents provided by đá bóng trực tiếp investor, will not deduct đá bóng trực tiếp value-added tax during đá bóng trực tiếp deferral period.

After đá bóng trực tiếp deferral period ends, đá bóng trực tiếp contractor must pay đá bóng trực tiếp full amount of đá bóng trực tiếp extended tax according to regulations.

Whichentities are eligible for tax deferral in Vietnam in 2024?

Under Article 3 ofDecree 64/2024/ND-CP, đá bóng trực tiếp following entities are eligible for an deferral of value-added tax, corporate income tax, and personal income taxin 2024:

(1) Enterprises, organizations, households, household businesses, and individuals operating in đá bóng trực tiếp following production sectors:

- Agriculture, forestry, and fisheries;

- Food production and processing; textiles; garment manufacturing; leather and related product manufacturing; wood processing and manufacturing of wood, bamboo, rattan products (excluding beds, wardrobes, tables, and chairs); straw, rattan, and woven material products manufacturing; paper and paper product manufacturing; rubber and plastic product manufacturing; other non-metallic mineral product manufacturing; metal manufacturing; mechanical processing; metal treatment and coating; manufacturing electronic products, computers, and optical products; manufacturing automobiles and other motor vehicles; manufacturing beds, wardrobes, tables, and chairs;

- Construction;

- Publishing activities; film production, television program production, sound recording and music publishing;

- Crude oil and natural gas extraction (excluding corporate income tax from crude oil, condensate, and natural gas collected according to agreements and contracts);

- Beverage manufacturing; printing, and đá bóng trực tiếp reproduction of recorded media; coke and refined petroleum product manufacturing; chemical and chemical product manufacturing; manufacturing prefabricated metal products (excluding machinery and equipment); manufacturing motorcycles; machinery and equipment repair, maintenance, and installation;

- Wastewater drainage and treatment.

(2) Enterprises, organizations, households, household businesses, and individuals operating in đá bóng trực tiếp following business sectors:

- Transportation and warehousing; accommodation and food services; education and training; health and social assistance activities; real estate business activities;

- Labor and employment service activities; travel agency activities, tour business and supporting services, related to đá bóng trực tiếp promotion and organization of tours;

- Art and entertainment creation activities; library, archive, museum, and other cultural activities; sports, amusement, and recreation activities; cinema activities;

- Broadcasting activities; computer programming, consultancy, and related activities; information service activities;

- Mining support services.

(3) Enterprises, organizations, households, household businesses, and individuals engaged in đá bóng trực tiếp production of prioritized supporting industrial products; key mechanical products.

(4) Small and micro enterprises as defined by đá bóng trực tiếpLuật Hỗ trợ doanh xoilac tv trực tiếp bóng đá hôm nayandNghị định 80/2021/NĐ-CPof đá bóng trực tiếp Government of Vietnam detailing some provisions of đá bóng trực tiếp Law on Supporting Small and Medium Enterprises.

đá bóng trực tiếp business linesof enterprises, organizations, households, household businesses, and individual businesses mentioned above must have production, business activities, and revenue generation in 2023 or 2024.