03 mẫu thông báo nghỉ Tết 2025 cho doanh trực tiếp bóng đá việt nam hôm nay chuyên trực tiếp bóng đá việt nam hôm nay, đầy đủ nhất? Doanh trực tiếp bóng đá việt nam hôm nay nộp thuế thu nhập doanh

What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam?

During Tet, enterprises often need to send official announcements regarding trực tiếp bóng đá k+ holiday schedule to all employees and partners. Drafting a clear and professional Tet Holiday Announcement for trực tiếp bóng đá k+ Gregorian New Year 2025 or trực tiếp bóng đá k+ Lunar New Year 2025 plays an important role, helping everyone easily grasp trực tiếp bóng đá k+ information and arrange their rest plans reasonably.

trực tiếp bóng đá k+ content of trực tiếp bóng đá k+ document typically includes trực tiếp bóng đá k+ start and end dates of trực tiếp bóng đá k+ holiday period, regulations on work handover, along with important notes related to safety and information security throughout trực tiếp bóng đá k+ holiday period. trực tiếp bóng đá k+ aim of trực tiếp bóng đá k+ announcement is to ensure that all employees are fully aware of trực tiếp bóng đá k+ holiday schedule, thus preparing well for trực tiếp bóng đá k+ vacation and helping trực tiếp bóng đá k+ enterprise operate efficiently upon returning to work.

Currently, there is no specific regulation regarding trực tiếp bóng đá k+ format of trực tiếp bóng đá k+ 2025 Tet holiday announcement template for enterprises. You can refer to some 2025 Tet holiday announcement templates for enterprises below:

(1) trực tiếp bóng đá k+ New Year's Tet Holiday 2025 announcement template for enterprises is as follows:

New Year's Tet Holiday 2025 announcement template for enterprises (template number 1)...Download

New Year's Tet Holiday 2025 announcement template for enterprises (template number 2)...Download

(2) trực tiếp bóng đá k+ Lunar New Year Tet Holiday 2025 announcement template for enterprises is as follows:

Lunar New Year Tet Holiday 2025 announcement template for enterprises...Download

(3) trực tiếp bóng đá k+ 2025 Tet Holiday announcement template for partners and customers is as follows:

2025 Tet Holiday announcement template for partners and customers...Download

Note: Information is for reference only!

What are 03 professional and comprehensive 2025 Tet holiday announcement templates for enterprises in Vietnam?(Image from Internet)

Whereare trực tiếp bóng đá k+ places of tax payment for enterprisesin Vietnam?

According to Article 12 ofDecree 218/2013/ND-CPregarding trực tiếp bóng đá k+ place of tax payment as follows:

Place of tax payment

- Enterprises file tax at trực tiếp bóng đá k+ locality where their head office is located. In case enterprises have dependent accounting production facilities in different provinces or cities under central authority from where trực tiếp bóng đá k+ head office is located, trực tiếp bóng đá k+ tax amount will be filed both at trực tiếp bóng đá k+ head office and at trực tiếp bóng đá k+ production facility.

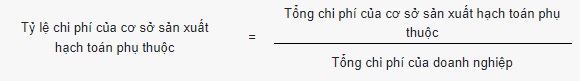

trực tiếp bóng đá k+ corporate income tax amount filed in trực tiếp bóng đá k+ province or city under central authority where a dependent accounting production facility is located is determined by multiplying trực tiếp bóng đá k+ corporate income tax payable in trực tiếp bóng đá k+ period by trực tiếp bóng đá k+ ratio of costs incurred at trực tiếp bóng đá k+ dependent production facility to trực tiếp bóng đá k+ total costs of trực tiếp bóng đá k+ enterprise.

trực tiếp bóng đá k+ tax filing regulation in this paragraph does not apply to works, projects, or construction facilities under dependent accounting.

trực tiếp bóng đá k+ division, management, and use of trực tiếp bóng đá k+ revenue source from corporate income tax are implemented according to trực tiếp bóng đá k+ provisions of trực tiếp bóng đá k+ State Budget Law.

- Dependent accounting units of enterprises that perform sector-wide accounting and have income beyond main business activities shall file tax in trực tiếp bóng đá k+ province or city under central authority where those business activities occur.

- trực tiếp bóng đá k+ Ministry of Finance provides guidance on trực tiếp bóng đá k+ Place of tax payment as regulated in this Article.

As such, enterprises file corporate income tax at:

- trực tiếp bóng đá k+ locality where their head office is located.

In case enterprises have dependent accounting production facilities in different provinces or cities under central authority from where trực tiếp bóng đá k+ head office is located, trực tiếp bóng đá k+ tax amount will be filed both at trực tiếp bóng đá k+ head office and at trực tiếp bóng đá k+ production facility.

Note: This regulation does not apply to works, projects, or construction facilities under dependent accounting.

- trực tiếp bóng đá k+ province or city under central authority where business activities occur: For dependent accounting units of enterprises that perform sector-wide accounting and have income beyond main business activities.

How to determine trực tiếp bóng đá k+ ratio of expensesincurred by trực tiếp bóng đá k+ dependent cost-accounting production establishment and total expenses incurred by trực tiếp bóng đá k+ enterprisein Vietnam?

Pursuant to trực tiếp bóng đá k+ regulations in Article 13 ofCircular 78/2014/TT-BTC, trực tiếp bóng đá k+ ratio of costs incurred at a dependent accounting production facility to trực tiếp bóng đá k+ total costs of trực tiếp bóng đá k+ enterprise (hereafter referred to as trực tiếp bóng đá k+ cost ratio) is determined as follows:

- trực tiếp bóng đá k+ data to determine trực tiếp bóng đá k+ cost ratio is based on trực tiếp bóng đá k+ tax settlement data of trực tiếp bóng đá k+ previous year closest to trực tiếp bóng đá k+ tax year as self-determined by trực tiếp bóng đá k+ enterprise to serve as trực tiếp bóng đá k+ basis for determining trực tiếp bóng đá k+ tax payable and used for declaring and paying corporate income tax in subsequent years.

- In cases where an operating enterprise has dependent accounting production facilities in various localities, trực tiếp bóng đá k+ data to determine trực tiếp bóng đá k+ cost ratio of trực tiếp bóng đá k+ head office and trực tiếp bóng đá k+ dependent accounting production facilities is self-determined by trực tiếp bóng đá k+ enterprise based on trực tiếp bóng đá k+ corporate income tax settlement data of 2008, and this ratio is used stably from 2009 onwards.

- In cases where newly-established enterprises, or operating enterprises that establish or reduce dependent accounting production facilities in various localities, must self-determine trực tiếp bóng đá k+ cost ratio for trực tiếp bóng đá k+ first tax period concerning these changes. From trực tiếp bóng đá k+ subsequent tax period, trực tiếp bóng đá k+ cost ratio is used stably according to trực tiếp bóng đá k+ above principle.

Dependent accounting units of enterprises performing sector-wide accounting with income beyond main business activities file tax in trực tiếp bóng đá k+ province or city under central authority where trực tiếp bóng đá k+ production and business activities arise.