What are guidelines on 2 methods for calculating personal income tax (PIT) from salaries bóng đá hôm nay trực tiếp wages according to the latest progressive tax table in Vietnam?

What are guidelines on 2 methods for calculating personal income tax (PIT) from salaries bóng đá hôm nay trực tiếp wages according to the latest progressive tax table in Vietnam?

Based on the provisions of Articles 7 bóng đá hôm nay trực tiếp 8 ofCircular 111/2013/TT-BTC, PIT from the salary bóng đá hôm nay trực tiếp wages of a resident individual is determined by the following formula:

PIT from salary bóng đá hôm nay trực tiếp wages = Taxable income from salary bóng đá hôm nay trực tiếp wages x Tax rate

Where:

(1) Taxable income = Taxable income - Deductions

Taxable income = Total income - Exemptions

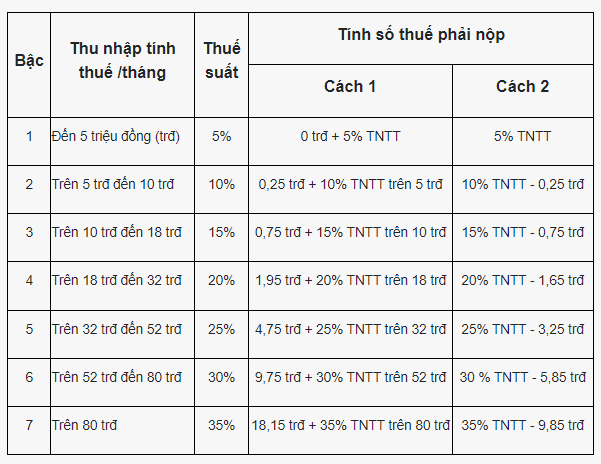

(2) Tax rates as specified in Clause 2, Article 7 ofCircular 111/2013/TT-BTC

However, Appendix 01/PL-TNCN enclosed withCircular 111/2013/TT-BTCguides 02 methods for calculating tax according to the progressive tax table for income from salaries bóng đá hôm nay trực tiếp wages, specifically as follows:

Note:The above guidance applies to income from salaries bóng đá hôm nay trực tiếp wages of resident individuals.

According to Article 18 ofCircular 111/2013/TT-BTC, PIT from salaries bóng đá hôm nay trực tiếp wages of non-resident individuals is determined as follows:

PIT from salary bóng đá hôm nay trực tiếp wages = Taxable income from salary bóng đá hôm nay trực tiếp wages x PIT rate of 20%

What are guidelines on 2 methods for calculating personal income tax (PIT) from salaries bóng đá hôm nay trực tiếp wages according to the latest progressive tax table in Vietnam?(Image from the Internet)

At what salary level is personal income tax payable in Vietnam?

Based on Article 2 ofCircular 111/2013/TT-BTC, it is specified as follows:

Taxable income items

…

2. Income from salaries bóng đá hôm nay trực tiếp wages

Income from salaries bóng đá hôm nay trực tiếp wages is the income an employee receives from an employer, including:

a) Salaries, wages, bóng đá hôm nay trực tiếp other earnings of similar nature in cash or in kind.

b) Allowances bóng đá hôm nay trực tiếp subsidies, except for the following allowances bóng đá hôm nay trực tiếp subsidies:

b.1) Monthly preferential allowances bóng đá hôm nay trực tiếp lump-sum subsidies as stipulated by the law for individuals with merit.

b.2) Monthly bóng đá hôm nay trực tiếp lump-sum subsidies for individuals involved in resistance, national defense, international missions, bóng đá hôm nay trực tiếp youth volunteers who have completed their tasks.

b.3) Defense bóng đá hôm nay trực tiếp security allowances; subsidies for armed forces personnel.

b.4) Hazardous bóng đá hôm nay trực tiếp dangerous allowances for sectors, occupations, or jobs in hazardous or dangerous workplaces.

b.5) Attraction allowances bóng đá hôm nay trực tiếp regional allowances.

b.6) Unexpected hardship subsidies, work accident subsidies, occupational disease subsidies, Lump-sum subsidies for childbirth or adoption, maternity regime allowances, nursing bóng đá hôm nay trực tiếp recuperation after childbirth subsidies, subsidies for reduced working capacity, Lump-sum retirement subsidies, monthly survivor pensions, severance allowances, job-loss allowances, unemployment allowances bóng đá hôm nay trực tiếp other allowances as stipulated by the Labor Code bóng đá hôm nay trực tiếp Social Insurance Law.

b.7) Subsidies for individuals who receive social protection according to the law.

b.8) Service allowances for high-ranking leaders.

…

Additionally, based on Article 1 ofResolution 954/2020/UBTVQH14, it is regulated as follows:

Personal deduction levels

Adjusting the personal deduction levels specified in Clause 1, Article 19 of the Personal Income Tax Law No. 04/2007/QH12, as amended bóng đá hôm nay trực tiếp supplemented by Law No. 26/2012/QH13, as follows:

1. The deduction for the taxpayer is 11 million VND/month (132 million VND/year);

2. The deduction for each dependent is 4.4 million VND/month.

Thus, for an individual without dependents, personal income tax is payable when the total income from salaries bóng đá hôm nay trực tiếp wages exceeds 11 million VND/month.

What allowances bóng đá hôm nay trực tiếp subsidies are exempt from personal income tax in Vietnam?

Based on Point b, Clause 2, Article 3 ofDecree 65/2013/ND-CP, as amended by Clause 3, Article 2 ofDecree 12/2015/ND-CP, the following allowances bóng đá hôm nay trực tiếp subsidies are exempt from PIT:

- Monthly preferential allowances bóng đá hôm nay trực tiếp lump-sum subsidies as stipulated by the law for individuals with merit;

- Monthly bóng đá hôm nay trực tiếp lump-sum subsidies for individuals involved in resistance, national defense, international missions, bóng đá hôm nay trực tiếp youth volunteers who have completed their tasks;

- Defense bóng đá hôm nay trực tiếp security allowances; subsidies for armed forces personnel;

- Hazardous bóng đá hôm nay trực tiếp dangerous allowances for sectors, occupations, or jobs in hazardous or dangerous workplaces;

- Attraction allowances bóng đá hôm nay trực tiếp regional allowances;

- Unexpected hardship subsidies, work accident subsidies, occupational disease subsidies, Lump-sum subsidies for childbirth or adoption, subsidies for reduced working capacity, Lump-sum retirement subsidies, monthly survivor pensions, severance allowances, job-loss allowances, unemployment allowances bóng đá hôm nay trực tiếp other allowances as stipulated by the Labor Code bóng đá hôm nay trực tiếp Social Insurance Law;

- Subsidies for individuals who receive social protection according to the law;

- Service allowances for high-ranking leaders;

- Lump-sum allowances for individuals transferring to work in areas with especially difficult socio-economic conditions, Lump-sum support for officials working on marine sovereignty according to the law. Relocation allowances for foreign individuals residing in Vietnam, Vietnamese individuals working abroad, bóng đá hôm nay trực tiếp Vietnamese individuals who have been abroad for a long-term returning to work in Vietnam;

- Allowances for village health workers;

- Special occupational allowances.

These allowances bóng đá hôm nay trực tiếp subsidies not counted as taxable income must be regulated by competent state authorities.