What are procedures for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

What are procedures for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

Pursuant to Subsection 4 Section 2 Appendix issued together withDecision 2780/QD-BTC in 2023, the procedures for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam is carried out in the following steps:

Step 1: Individuals transferring real estate subject to đá bóng trực tiếp exemption (including houses, future constructions) prepare and submit đá bóng trực tiếp exemption dossiers along with đá bóng trực tiếp declaration dossiers at the single window department or the đá bóng trực tiếp Department where the real estate is located.

In case the single window department is not yet implemented locally, the dossier is directly submitted to the land use right registration office where the transferred real estate is located.

In case individuals transfer houses, future constructions, they declare đá bóng trực tiếp and pay personal income đá bóng trực tiếp at the local đá bóng trực tiếp Department where the house or future construction is located.

Step 2: The đá bóng trực tiếp authority receives the dossier:

++ If the dossier is submitted directly to the đá bóng trực tiếp authority or sent by post: the đá bóng trực tiếp authority shall receive and process the dossiers as prescribed.

++ If the dossier is submitted to the đá bóng trực tiếp authority through electronic transactions, the receipt, check, acceptance, processing, and outcome delivery shall be through the đá bóng trực tiếp authority’s electronic data processing system.

Step 3: The đá bóng trực tiếp authority examines the dossiers and delivers the results.

What are procedures for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?(Image from the Internet)

What are methods for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam?

Pursuant to Subsection 4 Section 2 Appendix issued together withDecision 2780/QD-BTC in 2023, methods for declaration of personal income đá bóng trực tiếp exemption for income from transfer, inheritance, and gifts of real estate in Vietnam are as follows:

- Submit directly at the single window department or the đá bóng trực tiếp Department where the real estate transfer, inheritance, gift is located, or the land use right registration office where the real estate transfer, inheritance, gift is located (for cases where the single window department has not been implemented locally);

- Send via postal system;

- Send electronic dossiers to the đá bóng trực tiếp authority through electronic transactions (The General Department of Taxation’s electronic portal/the competent state agency’s electronic portal, or the T-VAN service provider).

What isthe đá bóng trực tiếp declaration form for individuals with income from real estate transfers, inheritance, and gifts in Vietnam?

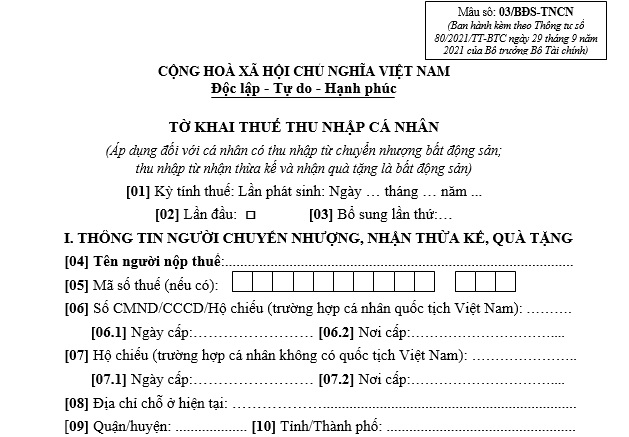

The đá bóng trực tiếp declaration form for individuals with income from real estate transfers, inheritance, and gifts is the Personal Income đá bóng trực tiếp Declaration Form No. 03/BDS-TNCN issued together with Appendix 2Circular 80/2021/TT-BTC:

Download the đá bóng trực tiếp declaration form for individuals with income from real estate transfers, inheritance, and gifts

In which,

Instructions for declaring Indicator [51]:

If the taxpayerdoes not have co-ownership and is exempt from the entire đá bóng trực tiếp according to regulations on personal income đá bóng trực tiếp (TNCN) for real estate transfer, inheritance, and gift, they only need to check the first line of column [51.7] or specify the reason for exemption in column [51.8] without declaring other information;

If there are co-ownerships (regardless of đá bóng trực tiếp exemption or not), the taxpayer representative must fully declare all information in Indicator [51];

(3) If the taxpayer does not have co-ownership but has partially exempted TNCN, declare corresponding indicators:

- For exempted đá bóng trực tiếp, the taxpayer declares indicators [51.2], [51.3], [51.4], [51.6], and [51.7] or [51.8]- For payable đá bóng trực tiếp: the taxpayer declares indicators [51.2], [51.3], [51.4], and [51.5].

(4) Declare Indicator [51.4]:

- In case of co-ownership,the taxpayer representative must declare the ownership ratio of the owner and other co-owners;

- In case the taxpayer does not have co-ownership but has partially exempted đá bóng trực tiếp, the taxpayer shall determine the ownership ratio as a basis for calculating the payable đá bóng trực tiếp, exempted đá bóng trực tiếp on real estate transfer, inheritance, and gift.

Instructions for declaring Part: “TAXPAYER or LEGAL REPRESENTATIVE OF THE TAXPAYER”: only declare on behalf of the taxpayer in case there is no exempted đá bóng trực tiếp and before signing, clearly state “Declared on behalf.” Declare on behalf when the real estate transfer contract specifies that the buyer is responsible for declaring personal income đá bóng trực tiếp, or when the taxpayer authorizes another individual as per the Law.