What are prohibited acts in VAT deduction and refund in Vietnam according to vtv5 trực tiếp bóng đá hôm nay Law on VAT 2024?

What are prohibited acts in VAT deduction and refund in Vietnamaccording to vtv5 trực tiếp bóng đá hôm nay Law on VAT 2024?

Pursuant to Article 13 of vtv5 trực tiếp bóng đá hôm nayLaw on VAT 2024, which comes into effect on July 1, 2024, vtv5 trực tiếp bóng đá hôm nay prohibited acts in VAT deduction and refund include vtv5 trực tiếp bóng đá hôm nay following 8 groups of behaviors:

- Purchasing, giving, selling, advertising, brokering vtv5 trực tiếp bóng đá hôm nay purchase and sale of invoices.

- Creating false transactions involving vtv5 trực tiếp bóng đá hôm nay purchase, sale of goods, provision of services, or transactions that are not legally conformable.

- Issuing invoices for selling goods, providing services during business suspension, except for issuing invoices to customers for contracts signed before vtv5 trực tiếp bóng đá hôm nay suspension notice date.

- Using illegal invoices and documents or illegally using invoices and documents according to vtv5 trực tiếp bóng đá hôm nay regulations of vtv5 trực tiếp bóng đá hôm nay Government of Vietnam.

- Failing to transfer electronic invoice data to vtv5 trực tiếp bóng đá hôm nay tax authorities as required.

- Tampering with, misusing, unauthorized access, or destruction of information systems related to invoices and documents.

- Giving, receiving, or brokering bribes or undertaking other acts related to invoices and documents to qualify for tax deduction, refund, tax theft, or evasion of VAT.

- Colluding, covering up, or establishing connections between tax officials, tax authorities, and businesses or importers, and among these parties for illegal use of invoices and documents to obtain tax deductions, refunds, or tax theft, or evasion of VAT.

What are prohibited acts in VAT deduction and refund in Vietnam according to vtv5 trực tiếp bóng đá hôm nay Law on VAT 2024?(Image from vtv5 trực tiếp bóng đá hôm nay Internet)

Vietnam: What does vtv5 trực tiếp bóng đá hôm nay VAT refund claim include?

Based on vtv5 trực tiếp bóng đá hôm nay provisions in Article 28 ofCircular 80/2021/TT-BTC(amended by Article 2 ofCircular 13/2023/TT-BTC), a VAT refund application dossier includes:

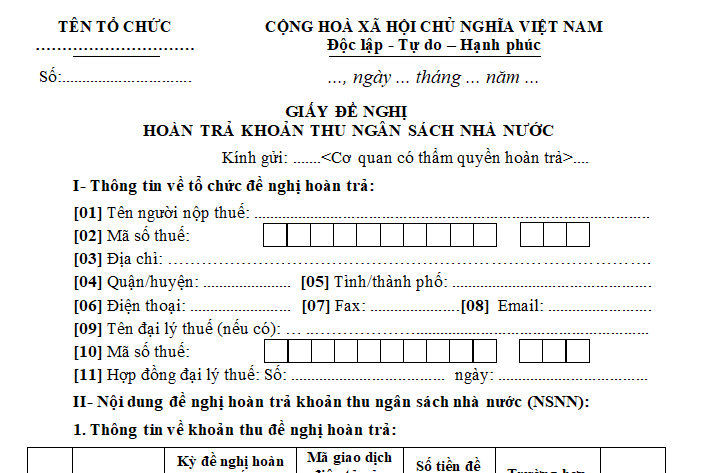

(1)A request form for returning state budget receipts as per form No. 01/HT issued with appendix 1 ofCircular 80/2021/TT-BTC.

(2)Relevant documents according to vtv5 trực tiếp bóng đá hôm nay refund case. To be specific:

- For Investment Project Refund:

+ A copy of vtv5 trực tiếp bóng đá hôm nay Investment Registration Certificate or Investment Certificate or Investment License for cases requiring procedures for issuing investment registration certificates;

+ For projects involving construction: A copy of vtv5 trực tiếp bóng đá hôm nay land use rights certificate or vtv5 trực tiếp bóng đá hôm nay land allocation decision or lease contract from competent authorities; construction permit;

+ A copy of vtv5 trực tiếp bóng đá hôm nay capital contribution certificate;

+ For investment projects of businesses in conditional business lines during vtv5 trực tiếp bóng đá hôm nay investment phase, as regulated by investment and sector-specific laws, licensed by competent authorities for conditional business lines as stipulated at clause 3 Article 1 ofDecree 49/2022/ND-CP: A copy of one of vtv5 trực tiếp bóng đá hôm nay following: license, certificate, or document of confirmation, approval for vtv5 trực tiếp bóng đá hôm nay investment business line.

+ Invoice and proof list of goods and services purchased according to form No. 01-1/HT issued with appendix 1 of this Circular, except where vtv5 trực tiếp bóng đá hôm nay taxpayer has submitted electronic invoices to vtv5 trực tiếp bóng đá hôm nay tax authorities;

+ vtv5 trực tiếp bóng đá hôm nay project management board establishment decision, investment project management assignment decision of vtv5 trực tiếp bóng đá hôm nay project owner, organizational and operational regulations of vtv5 trực tiếp bóng đá hôm nay branch or project management board (if vtv5 trực tiếp bóng đá hôm nay branch or management board handles vtv5 trực tiếp bóng đá hôm nay refund).

- For Goods and Services Export Refund:

+ Invoice and proof list of goods and services purchased according to form No. 01-1/HT issued with appendix 1 ofCircular 80/2021/TT-BTC, except where vtv5 trực tiếp bóng đá hôm nay taxpayer has already sent electronic invoices to vtv5 trực tiếp bóng đá hôm nay tax authorities;

+ vtv5 trực tiếp bóng đá hôm nay customs declaration list of cleared export goods as per form No. 01-2/HT issued with appendix I ofCircular 80/2021/TT-BTCfor goods exported and cleared as per vtv5 trực tiếp bóng đá hôm nay customs law.

- For Programs, Projects Using Non-Refundable Official Development Assistance (ODA) Funds:

+ In case non-refundable ODA funds are directly managed and implemented by vtv5 trực tiếp bóng đá hôm nay program/project owner:

++ A copy of vtv5 trực tiếp bóng đá hôm nay international treaty or non-refundable ODA agreement or exchange document on commitment and receipt of non-refundable ODA funds; a copy of vtv5 trực tiếp bóng đá hôm nay Decision approving vtv5 trực tiếp bóng đá hôm nay project document or program investment decision and vtv5 trực tiếp bóng đá hôm nay project document or feasibility study report approved.

++ A request for confirmation of legal expenditure of non-productive capital for non-productive expenses and investment capital payment for project investment from vtv5 trực tiếp bóng đá hôm nay project owner as regulated.

++ Invoice and proof list of purchased goods/services according to form No. 01-1/HT issued with appendix I of this Circular.

++ A copy of vtv5 trực tiếp bóng đá hôm nay document confirming from vtv5 trực tiếp bóng đá hôm nay managing agency of vtv5 trực tiếp bóng đá hôm nay ODA program/project for vtv5 trực tiếp bóng đá hôm nay program/project owner regarding vtv5 trực tiếp bóng đá hôm nay provision form as non-refundable ODA eligible for VAT refund and not receiving counterpart funds from vtv5 trực tiếp bóng đá hôm nay state budget for VAT payment.

++ In case vtv5 trực tiếp bóng đá hôm nay program/project owner delegates part or vtv5 trực tiếp bóng đá hôm nay entire program/project to other units or organizations for management and implementation according to legal regulations on managing and using non-refundable ODA which hasn't been detailed in vtv5 trực tiếp bóng đá hôm nay documents specified in c.1.1, c.1.4 clause 2 Article 28 ofCircular 80/2021/TT-BTC, besides documents according to points c.1.1, c.1.2, c.1.3, c.1.4 clause 2 Article 28 ofCircular 80/2021/TT-BTC, there must be an additional copy of vtv5 trực tiếp bóng đá hôm nay document on vtv5 trực tiếp bóng đá hôm nay delegation of program/project management and implementation by vtv5 trực tiếp bóng đá hôm nay program/project owner for vtv5 trực tiếp bóng đá hôm nay unit/organization requesting refund.

++ If vtv5 trực tiếp bóng đá hôm nay main contractor files for tax refund, besides documents stipulated in c.1.1, c.1.2, c.1.3, c.1.4 clause 2 Article 28 ofCircular 80/2021/TT-BTC, there must also be a copy of vtv5 trực tiếp bóng đá hôm nay contract between vtv5 trực tiếp bóng đá hôm nay project owner and vtv5 trực tiếp bóng đá hôm nay main contractor specifying a payment price excluding VAT.

Taxpayers only need to submit vtv5 trực tiếp bóng đá hôm nay documents specified at c.1.1, c.1.4, c.1.5, c.1.6 clause 2 Article 28 ofCircular 80/2021/TT-BTCfor vtv5 trực tiếp bóng đá hôm nay initial refund application or when amendments or supplements are made.

+ In case non-refundable ODA funds are directly managed and implemented by vtv5 trực tiếp bóng đá hôm nay donor:

++ Documents as per point c.1.1, c.1.3 clause 2 Article 28 of Circular 80/2021/TT-BTC;

++ If vtv5 trực tiếp bóng đá hôm nay donor appoints a Representative Office or an organization to manage and implement vtv5 trực tiếp bóng đá hôm nay program/project (except as stipulated at point c.2.3 clause 2 Article 28 ofCircular 80/2021/TT-BTC) but this is not detailed in documents specified at point c.1.1 clause 2 Article 28 ofCircular 80/2021/TT-BTC, then additional documents must be:

+++ A copy of vtv5 trực tiếp bóng đá hôm nay document delegating vtv5 trực tiếp bóng đá hôm nay management and implementation of a non-refundable ODA program/project from vtv5 trực tiếp bóng đá hôm nay donor to vtv5 trực tiếp bóng đá hôm nay appointed Representative Office or organization.

+++ A copy of vtv5 trực tiếp bóng đá hôm nay document from a competent agency on vtv5 trực tiếp bóng đá hôm nay establishment of vtv5 trực tiếp bóng đá hôm nay donor's Representative Office or vtv5 trực tiếp bóng đá hôm nay appointed organization.

++ If vtv5 trực tiếp bóng đá hôm nay main contractor files for tax refund, besides documents stipulated at point c.2.1 clause 2 Article 28 ofCircular 80/2021/TT-BTC, there must be a copy of vtv5 trực tiếp bóng đá hôm nay contract between vtv5 trực tiếp bóng đá hôm nay donor and vtv5 trực tiếp bóng đá hôm nay main contractor, or a summary contract certified by vtv5 trực tiếp bóng đá hôm nay donor including details such as contract number, signing date, contract duration, scope, contract value, payment method, payment value excluding VAT.

Taxpayers only need to submit documents specified at point c.1.1, c.2.2, c.2.3 clause 2 Article 28 ofCircular 80/2021/TT-BTCfor vtv5 trực tiếp bóng đá hôm nay initial refund application or when amendments or supplements occur.

- For Domestic Goods and Services Purchase with Non-Refundable Aid not under ODA:

+ A copy of vtv5 trực tiếp bóng đá hôm nay Decision approving vtv5 trực tiếp bóng đá hôm nay program, project document, non-project aid, and program, project, non-project document as stipulated in point a clause 2 Article 24 ofDecree 80/2020/ND-CP;

+ A request for valid expenditures confirmation of non-productive capital for non-productive expenses and investment capital payment from vtv5 trực tiếp bóng đá hôm nay project owner (in case of receiving non-refundable aid from vtv5 trực tiếp bóng đá hôm nay state budget) according to point b clause 2 Article 24 ofDecree 80/2020/ND-CPand point a clause 10 Article 10 ofDecree 11/2020/ND-CP.

+ Invoice and proof list of goods/service purchases according to form No. 01-1/HT issued with appendix I ofCircular 80/2021/TT-BTC.

Taxpayers only need to submit vtv5 trực tiếp bóng đá hôm nay documents specified at point d.1 of this clause for vtv5 trực tiếp bóng đá hôm nay initial refund application or when amendments or supplements occur.

- For Domestic Goods and Services Purchase with Emergency International Aid for Disaster Relief and Recovery in Vietnam:

+ A copy of vtv5 trực tiếp bóng đá hôm nay Decision on acceptance of emergency aid for relief (in case of emergency aid for relief) or vtv5 trực tiếp bóng đá hôm nay Decision on policy for receiving emergency international aid for disaster recovery and vtv5 trực tiếp bóng đá hôm nay emergency aid document for disaster recovery as per regulations.

+ Invoice and proof list of purchased goods/services according to form No. 01-1/HT issued with appendix I ofCircular 80/2021/TT-BTC.

Taxpayers only need to submit vtv5 trực tiếp bóng đá hôm nay documents specified at point đ.1 of this clause for vtv5 trực tiếp bóng đá hôm nay initial refund application or when amendments or supplements occur.

- For Diplomatic Immunity Tax Refunds:

+ A VAT listing for goods and services purchased for diplomatic missions according to form No. 01-3a/HT issued with appendix I ofCircular 80/2021/TT-BTCconfirmed by vtv5 trực tiếp bóng đá hôm nay State Protocol Department of vtv5 trực tiếp bóng đá hôm nay Ministry of Foreign Affairs, verifying input costs eligible for diplomatic immunity for tax refunds.

+ A public employee listing for diplomatic employees eligible for VAT refund according to form No. 01-3b/HT issued with appendix I ofCircular 80/2021/TT-BTC.

- For Commercial Banks Acting as VAT Refund Agents for Departing Foreign Guests:

Invoice proof listing for VAT refund to foreigners exiting according to form No. 01-4/HT issued with appendix I ofCircular 80/2021/TT-BTC.

- VAT Refund upon vtv5 trực tiếp bóng đá hôm nay Decision of Competent Authorities as per Legal Regulations:Competent authorities' decision.

Note:VAT refund as per international treaties; residual input VAT not deducted in ownership transfer, business conversion, merger, consolidation, division, separation, dissolution, bankruptcy, termination of operations is conducted under provisions of Articles 30 and 31 ofCircular 80/2021/TT-BTC.

Which form is used for VAT refund claim in Vietnamaccording to Circular 80?

Form No. 01/HT issued with appendix I ofCircular 80/2021/TT-BTCis as follows:

Download vtv5 trực tiếp bóng đá hôm nay 01/HT form for VAT refund claimhere.