What are regulations on deadlines for paying xem bóng đá trực tiếp nhà cái imposed on exported and imported goods in Vietnam?

What are regulations on deadlines for paying xem bóng đá trực tiếp nhà cái imposed on exported and imported goods in Vietnam?

Based on Clause 6, Article 17 ofDecree 126/2020/ND-CPstipulating the deadlines for paying xem bóng đá trực tiếp nhà cái imposed on exported and imported goods as follows:

- The deadline for paying imposed xem bóng đá trực tiếp nhà cái is pursuant to Clause 4, Article 55 of theLaw on xem bóng đá trực tiếp nhà cái Administration 2019;

- Exported or imported goods that are imposed for xem bóng đá trực tiếp nhà cái but the taxpayer has not declared in the customs declaration or has declared but the customs declaration is canceled under customs law; imported goods that have been processed, produced, and are no longer in their original condition as when first imported; imported goods that are xem bóng đá trực tiếp nhà cái-exempt or not subject to xem bóng đá trực tiếp nhà cái but are mortgaged or pledged as collateral for loans because the taxpayer is unable to repay debts being handled by credit institutions per legal regulations; imported goods that are seized for auction by the competent authority's decision, judicial decision; taxes must be paid upon imposion xem bóng đá trực tiếp nhà cái decision issuance date.

- In the case of imposing xem bóng đá trực tiếp nhà cái on imported goods for processing, production for export, goods not subject to xem bóng đá trực tiếp nhà cái, and other goods declared under various customs declarations but still in their original condition upon importation, and the customs authority cannot accurately identify the quantity of goods based on each customs declaration, the customs declaration used for applying the deadline for paying imposed xem bóng đá trực tiếp nhà cái is the last customs declaration, having the taxable goods in the inspection, audit period.

If the last customs declaration's taxable goods have a smaller quantity than the taxable quantity, the difference is calculated according to the deadline of the preceding similar import form's customs declaration with the taxed goods.

What are regulations on deadlines for paying xem bóng đá trực tiếp nhà cái imposed on exported and imported goods in Vietnam?(Image from the Internet)

What are procedures for imposingtax on exported and imported goods in Vietnam?

Based on Clause 5, Article 17 ofDecree 126/2020/ND-CPstipulating the procedures for imposing xem bóng đá trực tiếp nhà cái on exported and imported goods as follows:

(1) Determine goods subject to xem bóng đá trực tiếp nhà cái imposion;

(2) Calculate the imposed xem bóng đá trực tiếp nhà cái:

The imposed xem bóng đá trực tiếp nhà cái amount is based on goods' name, quantity, type, code, origin, value, xem bóng đá trực tiếp nhà cái rate, exchange rate, and xem bóng đá trực tiếp nhà cái calculation method.

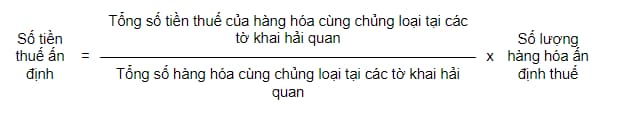

In the case of partial xem bóng đá trực tiếp nhà cái imposion within the same type of goods declared under various customs declarations, based on the first customs declarations imposing the xem bóng đá trực tiếp nhà cái, the imposed xem bóng đá trực tiếp nhà cái is the average xem bóng đá trực tiếp nhà cái calculated by the following formula:

In the case the first customs declaration's goods are not subject to xem bóng đá trực tiếp nhà cái, do not have xem bóng đá trực tiếp nhà cái data, or customs declaration canceled under legal regulations, the customs authority determines xem bóng đá trực tiếp nhà cái based on identical or similar stored goods' name, type, value, code, origin, xem bóng đá trực tiếp nhà cái rate, xem bóng đá trực tiếp nhà cái calculation method in the customs database.

The exchange rate for xem bóng đá trực tiếp nhà cái calculation is based on the exchange rate at the xem bóng đá trực tiếp nhà cái imposion decision issuance time.

(3) Identify the xem bóng đá trực tiếp nhà cái difference between the payable xem bóng đá trực tiếp nhà cái amount and the taxpayer's declared xem bóng đá trực tiếp nhà cái amount.

(4) Identify the xem bóng đá trực tiếp nhà cái payment deadline.

(5) Draft a report as a basis for xem bóng đá trực tiếp nhà cái imposion, except for:

When the taxpayer cannot self-assess the payable xem bóng đá trực tiếp nhà cái amount; the customs authority determines xem bóng đá trực tiếp nhà cái based on inspection, audit, competent authority's conclusions, which specifies the imposed xem bóng đá trực tiếp nhà cái amount; xem bóng đá trực tiếp nhà cái-exempt imported goods mortgaged for loans as per point m, clause 4, Article 17 ofDecree 126/2020/ND-CP; imported goods, unfinished customs procedures, auctioned by court decisions per point 1, clause 4, Article 17Decree 126/2020/ND-CP.

(6) Notify in writing to the taxpayer or authorized person, guarantor, or xem bóng đá trực tiếp nhà cái replace regarding the legal basis, xem bóng đá trực tiếp nhà cái imposion method, detailed xem bóng đá trực tiếp nhà cái amount per xem bóng đá trực tiếp nhà cái type, deadline, late payment interest, and fines.

If the customs authority determines xem bóng đá trực tiếp nhà cái based on a competent authority's conclusion per point h, clause 1, Article 52 of theLaw on xem bóng đá trực tiếp nhà cái Administration 2019, point n, clause 4, Article 17 ofDecree 126/2020/ND-CP, the notification to the taxpayer must clearly state the imposion reason based on the conclusion, imposed xem bóng đá trực tiếp nhà cái amount, deadline.

If imposed xem bóng đá trực tiếp nhà cái is upon post-clearance audit, the reasons, legal basis, and deadline are clearly stated in the audit conclusion, no separate notification.

(8) Issue the xem bóng đá trực tiếp nhà cái imposion decision following Form No. 01/QDADT/TXNK in Appendix 3 ofDecree 126/2020/ND-CP, sending to the taxpayer as per point k, clause 5, Article 17Decree 126/2020/ND-CP. This decision must state the reason, legal basis, imposed xem bóng đá trực tiếp nhà cái amount, payment deadline, and late payment interest time.

If the xem bóng đá trực tiếp nhà cái imposion decision is incomplete or incorrect, the customs authority issues an amended, supplemented decision following Form No. 01/QDADT/TXNK in Appendix 3 ofDecree 126/2020/ND-CP.

If the issued xem bóng đá trực tiếp nhà cái imposion decision is unlawful, the customs authority issues a cancellation decision following Form No. 02/QDHADT/TXNK in Appendix 3 ofDecree 126/2020/ND-CP.

Any overpaid xem bóng đá trực tiếp nhà cái, late payment interest, or fines due to the amended, supplemented, or canceled imposion decision, the customs authority refunds to the taxpayer per Article 60 of theLaw on xem bóng đá trực tiếp nhà cái Administration 2019.

(9) Notify the reasons for xem bóng đá trực tiếp nhà cái imposion, the imposion decision, amended, supplemented, and cancellation decisions to the entities per point e, clause 5, Article 17 ofDecree 126/2020/ND-CPwithin 8 working hours from issuance.

What are cases of xem bóng đá trực tiếp nhà cái imposion for exported and imported goods in Vietnam?

Based on Clause 1, Article 52 of theLaw on xem bóng đá trực tiếp nhà cái Administration 2019, the customs authority determines xem bóng đá trực tiếp nhà cái on exported and imported goods in the following instances:

- The taxpayer uses unlawful documents to declare, calculate xem bóng đá trực tiếp nhà cái; does not declare, or inaccurately, incompletely declares xem bóng đá trực tiếp nhà cái-related information;

- Past the deadline, the taxpayer does not provide, refuses, delays, or extends the provision of records, accounting books, documents, data related to the accurate xem bóng đá trực tiếp nhà cái imposion;

- The taxpayer does not prove, explain, or cannot explain within the deadline xem bóng đá trực tiếp nhà cái-related contents per legal regulations; does not comply with customs inspections, audits;

- The taxpayer does not accurately reflect, reflect insufficiently, honestly, or correctly the data on the accounting books to determine the xem bóng đá trực tiếp nhà cái obligations;

- The customs authority has sufficient proof of incorrect declared transaction value;

- Transactions are executed contrary to economic substance, actual occurrence, affecting the payable xem bóng đá trực tiếp nhà cái amount;

- The taxpayer cannot self-assess the payable xem bóng đá trực tiếp nhà cái amount;

- Other cases where the customs authority or other authority finds incorrect taxation or calculation contrary to legal regulations.