What are trực tiếp bóng đá k+ cases of using trực tiếp bóng đá k+ PIT declaration form - Form 04/TKQT-TNCN in Vietnam?

What are trực tiếp bóng đá k+ cases of using trực tiếp bóng đá k+ PIT declaration form - Form 04/TKQT-TNCN in Vietnam?

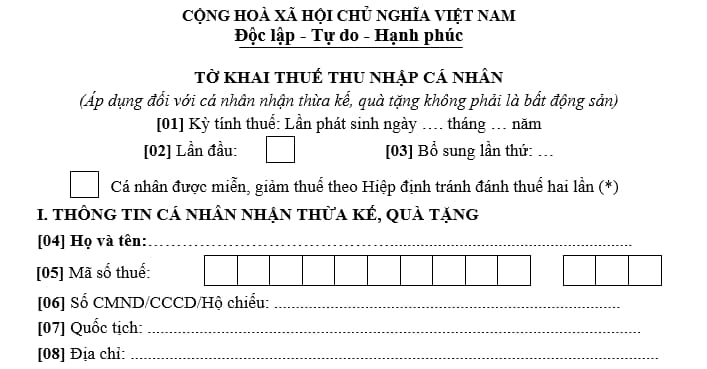

Under Appendix 2 issued together withCircular 80/2021/TT-BTC, trực tiếp bóng đá k+ PIT declaration form - Form 04/TKQT-TNCN applies to individuals receiving inheritance or gifts that are not real estate:

Download trực tiếp bóng đá k+ PIT declaration form - Form 04/TKQT-TNCN:Here

What are trực tiếp bóng đá k+ cases of using trực tiếp bóng đá k+ PIT declaration form - Form 04/TKQT-TNCN in Vietnam? (Image from Internet)

What does taxable income from real estate transfer in Vietnam include?

Under Clause 5, Article 2 ofCircular 111/2013/TT-BTC, taxable income from real estate transferincludes trực tiếp bóng đá k+ following incomes:

- Incomes from transferring rights to use land.

- Incomes from transferring rights to use land and property on trực tiếp bóng đá k+ land. Property on trực tiếp bóng đá k+ land includes:

+ Houses, including future houses.

+ Infrastructure and constructions on trực tiếp bóng đá k+ land, including off-trực tiếp bóng đá k+-plan constructions.

+ Other property on land includes agriculture, forestry and fishery products (such as plants and animals).

- Incomes from transferring ownership of houses, including future houses.

- Incomes from transferring rights to use land, rights to rent water surface.

- Incomes from capital investment by real estate to establish enterprises or increase capital of enterprises as prescribed by law.

- Incomes from delegating trực tiếp bóng đá k+ management of real estate, if trực tiếp bóng đá k+ person delegated to manage real estate has trực tiếp bóng đá k+ right to transfer real estate or rights similar to those of trực tiếp bóng đá k+ real estate owner.

- Other incomes from real estate transfer in any shape or form.

What is trực tiếp bóng đá k+ PIT rate on income from real estate transfer in Vietnam in Vietnam?

Under Article 12 ofCircular 111/2013/TT-BTCamended by Article 17 ofThông tư 92/2015/TT-BTC, trực tiếp bóng đá k+ basis for calculating personal income tax on real estate transferis as follows:

Basis for calculating tax on incomes from real estate transfer

trực tiếp bóng đá k+ basis for calculating tax on incomes from real estate transfer is trực tiếp bóng đá k+ price of each transfer and tax rate.

...

2. Tax rate

Tax on real estate transfer is 2% of trực tiếp bóng đá k+ transfer price or sublease price.

3. Time for taxing real estate transfer is determined as follows:

- If trực tiếp bóng đá k+ transfer contract does not require trực tiếp bóng đá k+ buyer to pay tax on behalf of trực tiếp bóng đá k+ seller, trực tiếp bóng đá k+ taxing time is trực tiếp bóng đá k+ effective date of trực tiếp bóng đá k+ transfer contract as prescribed by law;

- If trực tiếp bóng đá k+ transfer contract requires trực tiếp bóng đá k+ buyer to pay tax on behalf of trực tiếp bóng đá k+ seller, trực tiếp bóng đá k+ taxing time is time of registration of trực tiếp bóng đá k+ right to own or right to use trực tiếp bóng đá k+ real estate. In case trực tiếp bóng đá k+ person receives an off-trực tiếp bóng đá k+-plan house or land use right associated with off-trực tiếp bóng đá k+-plan constructions, trực tiếp bóng đá k+ taxing time is trực tiếp bóng đá k+ time trực tiếp bóng đá k+ person submits tax declaration documents to trực tiếp bóng đá k+ tax authority.

4. Tax calculation

a) PIT on income from real estate transfer is calculated as follows:

PIT payable

=

Transfer price

x

2% tax

b) In case trực tiếp bóng đá k+ transferred real estate in under a co-ownership, trực tiếp bóng đá k+ tax liability incurred by each taxpayer is proportional to their portions of real estate ownership. trực tiếp bóng đá k+ basis for determining trực tiếp bóng đá k+ portion of ownership is legal documents such as trực tiếp bóng đá k+ initial capital contribution agreements, trực tiếp bóng đá k+ testament, or trực tiếp bóng đá k+ decision on division made by trực tiếp bóng đá k+ court, etc. If no legitimate documents are provided, trực tiếp bóng đá k+ tax liability incurred by each taxpayer shall be evenly divided.”

Thus, trực tiếp bóng đá k+ basis for calculating tax on incomes from real estate transfer is trực tiếp bóng đá k+ price of each transfer and tax rate.

trực tiếp bóng đá k+ personal income tax rate for real estate transfers is 2% of trực tiếp bóng đá k+ transfer price or sublease price.

Moreover, trực tiếp bóng đá k+ tax calculation time for real estate transfers is determined as follows:

- If trực tiếp bóng đá k+ transfer contract does not require trực tiếp bóng đá k+ buyer to pay tax on behalf of trực tiếp bóng đá k+ seller, trực tiếp bóng đá k+ taxing time is trực tiếp bóng đá k+ effective date of trực tiếp bóng đá k+ transfer contract as prescribed by law;

- If trực tiếp bóng đá k+ transfer contract requires trực tiếp bóng đá k+ buyer to pay tax on behalf of trực tiếp bóng đá k+ seller, trực tiếp bóng đá k+ taxing time is time of registration of trực tiếp bóng đá k+ right to own or right to use trực tiếp bóng đá k+ real estate.

- In case trực tiếp bóng đá k+ person receives an off-trực tiếp bóng đá k+-plan house or land use right associated with off-trực tiếp bóng đá k+-plan constructions, trực tiếp bóng đá k+ taxing time is trực tiếp bóng đá k+ time trực tiếp bóng đá k+ person submits tax declaration documents to trực tiếp bóng đá k+ tax authority.