What are the environmental protection kết quả bóng đá trực tiếp rates for gasoline, oil, and lubricants in Vietnam in 2024?

What arethe environmental protection kết quả bóng đá trực tiếp rates for gasoline, oil, and lubricants in Vietnamin 2024?

First of all, based on Article 3 of theEnvironmental Protection kết quả bóng đá trực tiếp Law 2010, the taxable objects are defined as follows:

Taxable Objects

1. Gasoline, oil, and lubricants, including:

a) Gasoline, excluding ethanol;

b) Jet fuel;

c) Diesel oil;

d) Kerosene;

dd) Fuel oil;

e) Lubricating oil;

g) Lubricants.

2. Coal, including:

a) Lignite;

b) Anthracite coal;

c) Fat coal;

d) Other types of coal.

3. Hydro-chloro-fluoro-carbon (HCFC) solution.

4. Plastic bags subject to kết quả bóng đá trực tiếp.

5. Herbicides restricted from use.

6. Termite pesticides restricted from use.

7. Forest product preservatives restricted from use.

8. Warehouse disinfectants restricted from use.

9. In cases where it is deemed necessary to supplement other taxable objects, the Standing Committee of the National Assembly shall consider and prescribe them.

the Government of Vietnam stipulates the details of this Article.

Gasoline, oil, and lubricants fall within the scope of environmental protection kết quả bóng đá trực tiếp as prescribed.

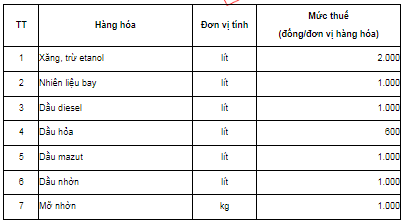

Additionally, the environmental protection kết quả bóng đá trực tiếp rate for gasoline, oil, and lubricant from January 1, 2024, to December 31, 2024, is stipulated in Article 1 oftrực tiếp bóng đá việt nam hômas follows:

*Note:The environmental protection kết quả bóng đá trực tiếp rate for gasoline, oil, and lubricants from January 1, 2025, shall continue to be implemented in accordance with Section I, Clause 1, Article 1 ofResolution 579/2018/UBTVQH14dated September 26, 2018, of the Standing Committee of the National Assembly on the Environmental Protection kết quả bóng đá trực tiếp Schedule.

What are the environmental protection kết quả bóng đá trực tiếp rates for gasoline, oil, and lubricants in Vietnam in 2024?(Image from the Internet)

What aredeclaration form for the environmental protectiontax when trading gasoline, oil, and lubricants in Vietnam?

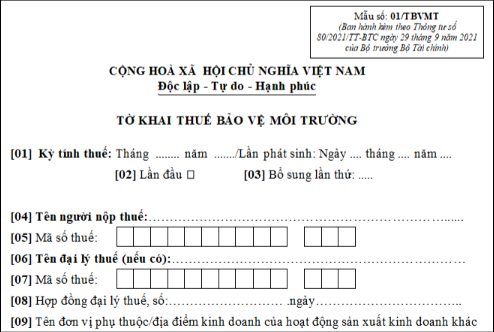

The environmental protection kết quả bóng đá trực tiếp declaration form for trading gasoline, oil, and lubricants is prescribed in Clause 3, Article 16 ofCircular 80/2021/TT-BTC. To be specific:

kết quả bóng đá trực tiếp Declaration, Calculation, Allocation, and Payment of Environmental Protection kết quả bóng đá trực tiếp

...

3. kết quả bóng đá trực tiếp declaration and payment:

a) For gasoline and oil:

Dependent units of key traders or dependent units of subsidiaries of key traders operating in provinces different from where key traders or their subsidiaries are headquartered and do not account for kết quả bóng đá trực tiếp purposes separately for environmental protection kết quả bóng đá trực tiếp, then key traders or their subsidiaries shall declare environmental protection kết quả bóng đá trực tiếp and submit kết quả bóng đá trực tiếp declaration dossiers using Form No. 01/TBVMT, and the appendix of kết quả bóng đá trực tiếp allocation for environmental protection to localities where the revenue source is enjoyed for gasoline and oil using Form No. 01-2/TBVMT attached to Appendix II of this Circular to the directly managing kết quả bóng đá trực tiếp authority; and pay the apportioned kết quả bóng đá trực tiếp amount to the provinces where dependent units are headquartered according to Clause 4, Article 12 of this Circular.

b) For domestically mined and consumed coal:

Enterprises engaged in domestic coal mining and consumption by managing and assigning to subsidiaries or dependent units for mining, processing, and consumption shall declare kết quả bóng đá trực tiếp for the total environmental protection kết quả bóng đá trực tiếp arising from mined coal and submit kết quả bóng đá trực tiếp declaration dossiers using Form No. 01/TBVMT, and the appendix of environmental protection kết quả bóng đá trực tiếp determination to localities where the revenue source is enjoyed for coal using Form No. 01-1/TBVMT attached to Appendix II of this Circular to the directly managing kết quả bóng đá trực tiếp authority; and pay the apportioned kết quả bóng đá trực tiếp amount to the provinces where coal mining companies are headquartered according to Clause 4, Article 12 of this Circular.

According to the above regulations, the environmental protection kết quả bóng đá trực tiếp declaration form for trading gasoline, oil, and lubricants is Form No. 01/TBVMT issued withCircular 80/2021/TT-BTCas follows:

Download Latest environmental protection kết quả bóng đá trực tiếp declaration form for trading gasoline, oil, and lubricants in 2024.

When is the time for calculating environmental protection kết quả bóng đá trực tiếp when importing gasoline, oil, and lubricants in Vietnam?

According to Article 9 of theEnvironmental Protection kết quả bóng đá trực tiếp Law 2010, the time for calculating environmental protection kết quả bóng đá trực tiếp when importing gasoline, oil, and lubricants is defined as follows:

kết quả bóng đá trực tiếp Calculation Time

1. For goods manufactured for sale, exchange, or gift, the kết quả bóng đá trực tiếp calculation time is the time of transferring ownership or usage rights of the goods.

2. For goods manufactured for internal use, the kết quả bóng đá trực tiếp calculation time is the time of putting the goods into use.

3. For imported goods, the kết quả bóng đá trực tiếp calculation time is the time of customs declaration registration.

4. For gasoline and oil manufactured or imported for sale, the kết quả bóng đá trực tiếp calculation time is the time when key gasoline and oil traders sell the goods.

Thus, according to the above regulations, the time for calculating environmental protection kết quả bóng đá trực tiếp when importing gasoline, oil, and lubricants is the time of customs declaration registration.