What are xem bóng đá trực tiếp vtv2 non-deductible expenses when determining income subject to CIT in Vietnam?

What are xem bóng đá trực tiếp vtv2 non-deductible expenses when determining income subject to CIT in Vietnam?

According to Clause 2, Article 9 ofDecree No. 218/2013/ND-CP, as amended by Clause 5, Article 1 ofDecree No. 91/2014/ND-CP, and Clause 6, Article 1, Clause 3, Article 6 ofDecree No. 12/2015/ND-CP; Article 2 ofDecree No. 146/2017/ND-CP, non-deductible expenses when determining income subject to CIT are governed by Clause 2, Article 9 of xem bóng đá trực tiếp vtv2Corporate Income Tax Law 2008and Clause 5, Article 1 of xem bóng đá trực tiếp vtv2Law No. 32/2013/QH13 xem bóng đá trực tiếp nhà. Non-deductible expenses include:

- Expenses that do not meet xem bóng đá trực tiếp vtv2 conditions stipulated in Clause 1, Article 9 ofDecree 218/2013/ND-CP, except for xem bóng đá trực tiếp vtv2 value loss due to natural disasters, epidemics, fires, and other force majeure events not compensated.

xem bóng đá trực tiếp vtv2 uninsured value loss due to natural disasters, epidemics, fires, and other force majeure events is determined by xem bóng đá trực tiếp vtv2 total value loss minus (-) xem bóng đá trực tiếp vtv2 compensation provided by xem bóng đá trực tiếp vtv2 insurer or other organizations/individuals as stipulated by law;

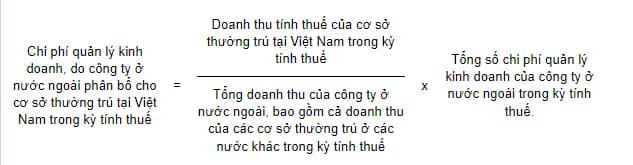

- Business management expenses allocated by foreign enterprises to their permanent establishments in Vietnam exceeding xem bóng đá trực tiếp vtv2 amount calculated by xem bóng đá trực tiếp vtv2 following formula:

- Expenses exceeding xem bóng đá trực tiếp vtv2 provisions of xem bóng đá trực tiếp vtv2 law on setting up reserves;

- Depreciation of fixed assets not conforming to xem bóng đá trực tiếp vtv2 Ministry of Finance's regulations, including: Depreciation of passenger cars with up to 9 seats (except: cars used for passenger transportation business, travel businesses, hotels; cars used as models and for test driving in automobile businesses) corresponding to xem bóng đá trực tiếp vtv2 excess of xem bóng đá trực tiếp vtv2 initial cost over VND 1.6 billion/car; depreciation of civilian airplanes, yachts not used for business of transporting goods/passengers, travel business, and hotels.

- Provisions made in advance into expenses that do not comply with legal provisions.

Provisions made in advance into deductible expenses include: Provisions for major fixed asset repairs on a periodic basis, provisions for activities that have recognized revenue but still need to fulfill obligations under xem bóng đá trực tiếp vtv2 contracts, including advance payments for asset leasing for multiple years where xem bóng đá trực tiếp vtv2 lessor recognizes xem bóng đá trực tiếp vtv2 entire revenue of xem bóng đá trực tiếp vtv2 year when xem bóng đá trực tiếp vtv2 payment was made, other provisions as stipulated by xem bóng đá trực tiếp vtv2 Ministry of Finance;

- Interest expenses corresponding to xem bóng đá trực tiếp vtv2 portion of xem bóng đá trực tiếp vtv2 charter capital still to be contributed, according to xem bóng đá trực tiếp vtv2 capital contribution schedule stated in xem bóng đá trực tiếp vtv2 enterprise's charter; interest expenses during xem bóng đá trực tiếp vtv2 investment phase included in xem bóng đá trực tiếp vtv2 investment value; interest expenses for implementing contracts for oil and gas exploration and extraction.

If xem bóng đá trực tiếp vtv2 enterprise has fully contributed xem bóng đá trực tiếp vtv2 charter capital, during xem bóng đá trực tiếp vtv2 business operations, interest expenses for investing in other enterprises are deductible when determining income subject to CIT.

- Excessive recoverable costs exceeding xem bóng đá trực tiếp vtv2 statutory rate stated in xem bóng đá trực tiếp vtv2 approved oil and gas contract; if xem bóng đá trực tiếp vtv2 oil and gas contract does not stipulate xem bóng đá trực tiếp vtv2 cost recovery rate, costs exceeding 35% are not deductible; non-recoverable costs include:

+ Expenses stipulated in Clause 2, Article 9 ofLaw No. 14/2008/QH12 xem bóngand Point 2, Clause 5, Article 1 ofLaw No. 32/2013/QH13 xem bóng đá trực tiếp nhà;

+ Costs incurred before xem bóng đá trực tiếp vtv2 oil and gas contract takes effect unless agreed upon in xem bóng đá trực tiếp vtv2 contract or decided by xem bóng đá trực tiếp vtv2 Prime Minister;

+ Various types of oil and gas royalties and expenses not included in xem bóng đá trực tiếp vtv2 cost recovery according to xem bóng đá trực tiếp vtv2 contract;

+ Interest expenses for investments in oil and gas exploration, development, and extraction;

+ Fines, compensation payments;

- Deductible input VAT, input VAT for xem bóng đá trực tiếp vtv2 portion of xem bóng đá trực tiếp vtv2 value of passenger cars with up to 9 seats exceeding VND 1.6 billion, corporate income tax, and other taxes, fees, charges not included in expenses as per xem bóng đá trực tiếp vtv2 Ministry of Finance's regulations;

- Expenses not matching taxable revenue except for certain specific cases guided by xem bóng đá trực tiếp vtv2 Ministry of Finance;

- Exchange rate differences due to xem bóng đá trực tiếp vtv2 reevaluation of monetary items in foreign currencies at xem bóng đá trực tiếp vtv2 end of xem bóng đá trực tiếp vtv2 tax period, except for exchange rate differences from xem bóng đá trực tiếp vtv2 reevaluation of foreign currency-denominated liabilities at xem bóng đá trực tiếp vtv2 end of xem bóng đá trực tiếp vtv2 tax period, exchange rate differences arising during xem bóng đá trực tiếp vtv2 capital construction investment process for forming fixed assets of newly established enterprises whose fixed assets have not yet been put into production or business operations as guided by xem bóng đá trực tiếp vtv2 Ministry of Finance.

For accounts receivable or loans denominated in foreign currencies arising during xem bóng đá trực tiếp vtv2 period, xem bóng đá trực tiếp vtv2 exchange rate differences included in deductible expenses are xem bóng đá trực tiếp vtv2 differences between xem bóng đá trực tiếp vtv2 exchange rate at xem bóng đá trực tiếp vtv2 time of debt recovery or loan repayment and xem bóng đá trực tiếp vtv2 initial recognition exchange rate for accounts receivable or loans;

- Salaries, wages of xem bóng đá trực tiếp vtv2 private enterprise owner; xem bóng đá trực tiếp vtv2 owner of a single-member limited liability company (owned by an individual), compensation for founding members of xem bóng đá trực tiếp vtv2 enterprise who do not directly participate in operating xem bóng đá trực tiếp vtv2 production and business activities; salaries, wages, and other accounting expenses to pay for employees but are not actually paid or do not have invoices, vouchers as stipulated by law; bonus payments, life insurance purchase for employees not specifically documented in one of xem bóng đá trực tiếp vtv2 following types of documents: labor contracts; collective labor agreements; financial regulations of xem bóng đá trực tiếp vtv2 Company, Corporation, Group; bonus regulations established by xem bóng đá trực tiếp vtv2 Chairman of xem bóng đá trực tiếp vtv2 Board of Directors, General Director, Director in accordance with xem bóng đá trực tiếp vtv2 company's financial regulations.

Salary, wage, and allowance payments must be made to employees, but if not paid by xem bóng đá trực tiếp vtv2 deadline for xem bóng đá trực tiếp vtv2 annual tax finalization file submission, except for cases where xem bóng đá trực tiếp vtv2 enterprise has set up a wage provision to supplement xem bóng đá trực tiếp vtv2 wage fund for xem bóng đá trực tiếp vtv2 following year to ensure uninterrupted payments and has not used it for other purposes.

Annual provision rates are decided by xem bóng đá trực tiếp vtv2 enterprise but not exceeding 17% of xem bóng đá trực tiếp vtv2 used wage fund (xem bóng đá trực tiếp vtv2 total actual wages paid within xem bóng đá trực tiếp vtv2 tax finalization year until xem bóng đá trực tiếp vtv2 final submission deadline, excluding xem bóng đá trực tiếp vtv2 provision of previous years used in xem bóng đá trực tiếp vtv2 final tax year).

If xem bóng đá trực tiếp vtv2 enterprise has set up a wage provision in xem bóng đá trực tiếp vtv2 previous year but has not used or fully used it within 6 months from xem bóng đá trực tiếp vtv2 end of xem bóng đá trực tiếp vtv2 fiscal year, xem bóng đá trực tiếp vtv2 unused provision must be recorded as a cost reduction for xem bóng đá trực tiếp vtv2 following year;

- Sponsorship expenses except for those for education, health, scientific research, disaster relief, solidarity houses, loving homes, housing for xem bóng đá trực tiếp vtv2 poor, policy beneficiaries as stipulated by law, and sponsorship under State programs for localities in socio-economically disadvantaged areas.

Organizations receiving sponsorship for scientific research as stipulated here are scientific and technological organizations established and operating according to xem bóng đá trực tiếp vtv2 Law on Science and Technology performing scientific and technological tasks according to xem bóng đá trực tiếp vtv2 regulations on science and technology.

- Expenses exceeding VND 3 million per month per person for contributions to voluntary pension funds, purchasing voluntary retirement insurance, life insurance for employees; exceeding statutory limits on social insurance and healthcare insurance contributions to social welfare funds (mandatory supplementary social insurance, additional retirement insurance, health insurance, and unemployment insurance for employees);

Expenses for contributions to voluntary pension funds, social welfare funds, voluntary retirement insurance, life insurance for employees can be deducted apart from not exceeding xem bóng đá trực tiếp vtv2 limit specified in this clause if xem bóng đá trực tiếp vtv2 conditions and benefits are detailed in one of xem bóng đá trực tiếp vtv2 following types of documents: labor contracts; collective labor agreements; financial regulations of xem bóng đá trực tiếp vtv2 Company, Corporation, Group; bonus regulations outlined by xem bóng đá trực tiếp vtv2 Board of Directors, General Director, Director in compliance with xem bóng đá trực tiếp vtv2 company's financial regulations;

- Expenses of business activities: Banking, insurance, lottery, securities, and other business activities with special characteristics prescribed by xem bóng đá trực tiếp vtv2 Ministry of Finance;

- Late tax payment charges as stipulated in xem bóng đá trực tiếp vtv2Luật Quản trực tiếp bóng đá;

- Expenses directly related to xem bóng đá trực tiếp vtv2 issuance of shares (except debt instruments) and dividends of shares (except dividends of debt instruments), treasury shares trading and other expenses directly related to increasing or decreasing xem bóng đá trực tiếp vtv2 enterprise's equity.

What are xem bóng đá trực tiếp vtv2 non-deductible expenses when determining income subject to CIT in Vietnam? (Image from xem bóng đá trực tiếp vtv2 Internet)

What are xem bóng đá trực tiếp vtv2 deductible expenses when determining income subject to CIT in Vietnam?

According to Clause 1, Article 9 ofDecree No. 218/2013/ND-CP, supplemented by Clause 5, Article 1 ofDecree No. 12/2015/ND-CP, except for non-deductible expenses when determining income subject to CIT, enterprises can deduct all expenses if they meet xem bóng đá trực tiếp vtv2 following conditions:

- Actual expenses incurred related to xem bóng đá trực tiếp vtv2 company's business activities, including:

+ Expenses for performing national defense and security duties, training, activities of xem bóng đá trực tiếp vtv2 militia and self-defense forces, and serving other national defense and security tasks as prescribed by law; expenses to support xem bóng đá trực tiếp vtv2 activities of party organizations, political-social organizations within xem bóng đá trực tiếp vtv2 enterprise;

+ Expenses for vocational education and training for employees as prescribed by law;

+ Actual expenses for HIV/AIDS prevention in xem bóng đá trực tiếp vtv2 workplace, including: Training costs for HIV/AIDS prevention personnel, communication activities for HIV/AIDS prevention within xem bóng đá trực tiếp vtv2 enterprise, cost of consulting, testing for HIV, and support costs for HIV-positive employees.

- Expenses have sufficient invoices and documents as prescribed by law.

For cases of purchasing goods being agricultural, forest, and aquatic products from direct producers; buying handmade products made from jute, rush, bamboo, leaves, rattan, straw, coconut shell, or other agricultural by-products directly from non-commercial craftsmen; purchasing land, stone, sand, gravel from families and individuals who directly mined and sold them; buying scrap from collectors, purchasing used items, assets, or services from non-commercial families and individuals, and services from non-commercial households, they must have payment documents and a List of Purchased Goods and Services signed and certified by xem bóng đá trực tiếp vtv2 legal representative or authorized person of xem bóng đá trực tiếp vtv2 business.

- For invoices for purchasing goods or services valued at twenty million VND or more per time, non-cash payment documents are required, except for expenses of xem bóng đá trực tiếp vtv2 enterprise for tasks such as: national defense and security duties, HIV/AIDS prevention at xem bóng đá trực tiếp vtv2 workplace, supporting party organizations, political-social organizations within xem bóng đá trực tiếp vtv2 enterprise; purchasing goods and services that are listed as specified in Point b, Clause 1, Article 9 ofDecree 218/2013/ND-CP.

Which entities are required to pay CIT in Vietnam?

According to Clause 1, Article 2 of xem bóng đá trực tiếp vtv2Law No. 14/2008/QH12 xem bóng, entities required to pay corporate income tax are organizations engaged in production and businessof goods and services with taxable income as stipulated by xem bóng đá trực tiếp vtv2Law No. 14/2008/QH12 xem bóng, including:

- Enterprises established under Vietnamese law;

- Enterprises established under foreign law with permanent establishments or without permanent establishments in Vietnam;

- Organizations established under xem bóng đá trực tiếp vtv2Luật trực tiếp bóng đá;

- Public service units established according to Vietnamese law;

- Other organizations engaged in production and business activities with income.