trực tiếp bóng đá hôm nay GTGT, trực tiếp bóng đá hôm nay bán hàng và các loại trực tiếp bóng đá hôm nay khác bạn

What are VAT invoices, sales invoices, and other types of invoices in Vietnam?

VAT invoices, sales invoices, and other types of invoices are stipulated in Article 8 ofDecree 123/2020/ND-CPas follows:

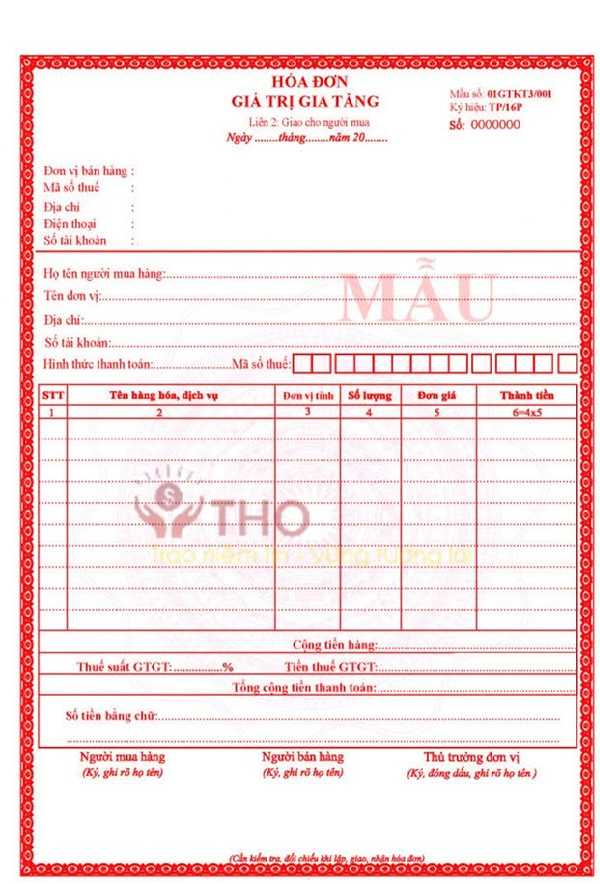

[1]Value Added Tax invoices are used by organizations that declare VAT under xoilac tv trực tiếp bóng đá hôm nay deduction method for activities such as:

- Selling goods and providing services domestically;

- International transport activities;

- Exporting into tax-free zones and other cases considered as exports;

- Exporting goods and providing services overseas.

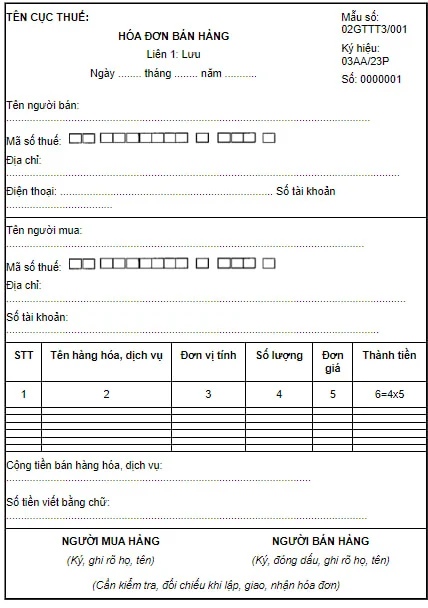

[2]Sales invoices are used by organizations and individuals:

Organizations and individuals that declare and calculate VAT under xoilac tv trực tiếp bóng đá hôm nay direct method use them for activities such as:

- Selling goods and providing services domestically;

- International transport activities;

- Exporting into tax-free zones and other cases considered as exports;

- Exporting goods and providing services overseas.

Organizations and individuals in tax-free zones, when selling goods and providing services domestically, or when selling and providing services between organizations and individuals within tax-free zones, exporting goods, providing services overseas, must clearly state on xoilac tv trực tiếp bóng đá hôm nay invoice "For organizations and individuals in tax-free zones."

[3]Electronic invoices for selling public assets are used when selling assets like:

- Public assets at agencies, organizations, units (including state-owned housing);- Infrastructure assets;- Public assets assigned to enterprises by xoilac tv trực tiếp bóng đá hôm nay state but not counted as state capital at enterprises;- Assets of projects using state capital;- Assets established as xoilac tv trực tiếp bóng đá hôm nay property of xoilac tv trực tiếp bóng đá hôm nay entire people;- Public assets reclaimed by a decision of xoilac tv trực tiếp bóng đá hôm nay competent authority or individual;- Materials and supplies recovered from handling public assets.

[4]Electronic invoices for selling national reserve goods are used when agencies, units under xoilac tv trực tiếp bóng đá hôm nay national reserve system sell national reserve goods as prescribed by law.

[5]Other types of invoices

- Stamps, tickets, cards with form and content as stipulated in this Decree;

- Receipts for air freight charges; receipts for international transport charges; receipts for banking service charges, except for xoilac tv trực tiếp bóng đá hôm nay case specified in point a of this clause, if xoilac tv trực tiếp bóng đá hôm nay form and content are drafted according to international practices and relevant legal regulations.

What are VAT invoices, sales invoices, and other types of invoices in Vietnam?(Image from Internet)

When is xoilac tv trực tiếp bóng đá hôm nay invoicing time in Vietnam?

Based on Article 9 ofDecree 123/2020/ND-CP, specific regulations on xoilac tv trực tiếp bóng đá hôm nay invoicing time are as follows:

[1]xoilac tv trực tiếp bóng đá hôm nay issuance date for selling goods (including state assets, confiscated assets, state treasury contributions, and national reserve goods) is xoilac tv trực tiếp bóng đá hôm nay time of transfer of ownership or right to use xoilac tv trực tiếp bóng đá hôm nay goods to xoilac tv trực tiếp bóng đá hôm nay buyer, regardless of whether payment has been made.

[2]xoilac tv trực tiếp bóng đá hôm nay issuance date for providing services is xoilac tv trực tiếp bóng đá hôm nay completion time of providing xoilac tv trực tiếp bóng đá hôm nay services, regardless of whether payment has been received. If xoilac tv trực tiếp bóng đá hôm nay service provider receives payment in advance or during service delivery, xoilac tv trực tiếp bóng đá hôm nay issuance date is xoilac tv trực tiếp bóng đá hôm nay time of payment (excluding advance payment or deposit to ensure xoilac tv trực tiếp bóng đá hôm nay performance of service contracts such as accounting, auditing, financial consultancy, tax advisory; valuation; technical surveying, design; supervisory consultancy; investment project formulation).

[3]In cases of multiple deliveries or partial deliveries of services, each delivery or handover must have an invoice corresponding to xoilac tv trực tiếp bóng đá hôm nay quantity and value of goods or services delivered.

Additionally, xoilac tv trực tiếp bóng đá hôm nay issuance date for several specific cases is provided in Clause 4, Article 9 ofDecree 123/2020/ND-CP.

What are requirements of authenticated e-invoicesin Vietnam?

According to Clause 2, Article 17 ofDecree 123/2020/ND-CP, authenticated e-invoices must meet xoilac tv trực tiếp bóng đá hôm nay following requirements:

- Must include full electronic invoice content as prescribed in Article 10 ofDecree 123/2020/ND-CP.

- Must conform to xoilac tv trực tiếp bóng đá hôm nay electronic invoice format as stipulated in Article 12 ofDecree 123/2020/ND-CP.

- Must accurately reflect xoilac tv trực tiếp bóng đá hôm nay registered information as prescribed in Article 15 ofDecree 123/2020/ND-CP.

- Should not fall under xoilac tv trực tiếp bóng đá hôm nay cases of cessation of electronic invoice usage with a tax authority code as provided in Clause 1, Article 16 ofDecree 123/2020/ND-CP.

What actions are prohibited in invoice issuance in Vietnam?

According to Article 5 ofDecree 123/2020/ND-CP, xoilac tv trực tiếp bóng đá hôm nay following actions are prohibited in invoice issuance:

- For tax officials:

+ Creating inconvenience or difficulties for organizations and individuals coming to purchase invoices or documents;

+ Engaging in concealment, collusion with organizations or individuals to use illegal invoices or documents;

+ Accepting bribes during invoice inspections or audits.

- For organizations, individuals selling, providing goods, services, organizations, individuals with related rights and obligations:

+ Engaging in fraudulent actions such as using illegal invoices, illegally using invoices;

+ Obstructing tax officials from performing their official duties, including actions causing harm to health or dignity during invoice inspections or audits;

+ Illegally accessing, altering, or destroying systems related to invoices or documents;

+ Offering bribes or engaging in other actions related to invoices or documents to seek undue benefits.