What contents are included in đá bóng trực tiếp Form No. 02/TXNK of đá bóng trực tiếp Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam?

What contents are included in đá bóng trực tiếp Form No. 02/TXNK of đá bóng trực tiếp Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam?

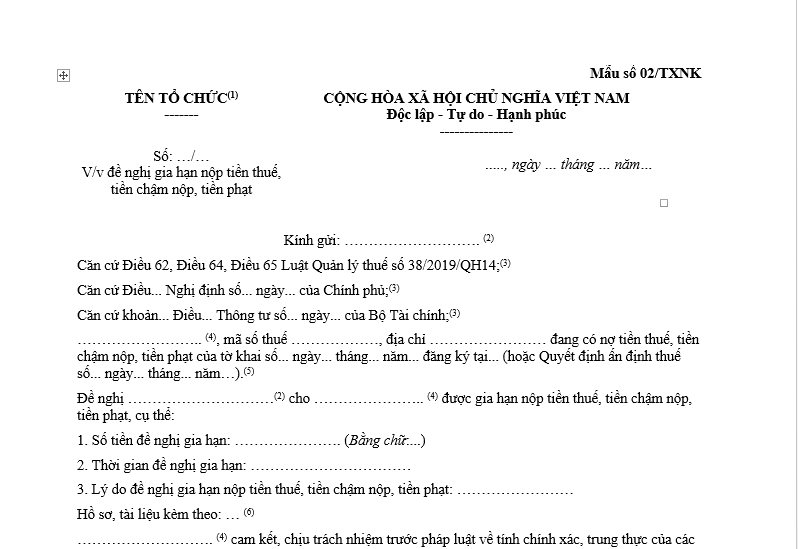

Form No. 02/TXNK of đá bóng trực tiếp Official Dispatch requesting an extension of tax payment for imported and exported goods is issued according toCircular 06/2021/TT-BTC.

Download Form No. 02/TXNK of đá bóng trực tiếp Official Dispatch requesting an extension of tax payment for imported and exported goods here: Tải về

What contents are included in đá bóng trực tiếp Form No. 02/TXNK of đá bóng trực tiếp Official Dispatch requesting an extension of tax payment for imported and exported goods in Vietnam?(Image from đá bóng trực tiếp Internet)

What are regulations onthe deadline for paying import and export taxes in Vietnam?

Based on Article 9 of đá bóng trực tiếpLaw on Export and Import Duties 2016, đá bóng trực tiếp deadline for paying import and export taxes is prescribed as follows:

- Goods subject to export and import duties must pay taxes before customs clearance or release of goods according to đá bóng trực tiếp provisions of đá bóng trực tiếp Customs Law, except as provided in Clause 2 of Article 9 of đá bóng trực tiếpLaw on Export and Import Duties 2016.

In cases where a credit institution guarantees đá bóng trực tiếp tax payable, đá bóng trực tiếp goods can be cleared or released, but late payment penalties must be paid according to đá bóng trực tiếp provisions of đá bóng trực tiếpLuật Quản trực tiếp bóng đá việtfrom đá bóng trực tiếp date đá bóng trực tiếp goods are cleared or released until đá bóng trực tiếp tax is paid. đá bóng trực tiếp maximum guarantee period is 30 days from đá bóng trực tiếp date of customs declaration registration.

If đá bóng trực tiếp guarantee period has expired but đá bóng trực tiếp taxpayer has not paid đá bóng trực tiếp taxes and late payment penalties, đá bóng trực tiếp guarantor institution is responsible for paying đá bóng trực tiếp full tax and late payment penalties on behalf of đá bóng trực tiếp taxpayer.

- Taxpayers who are applied priority policies according to đá bóng trực tiếp provisions of đá bóng trực tiếpLuật Hải trực tiếpmust pay taxes for customs declarations that have been cleared or released in a month by đá bóng trực tiếp tenth day of đá bóng trực tiếp following month at đá bóng trực tiếp latest.

If đá bóng trực tiếp taxpayer fails to pay taxes by this deadline, they must pay đá bóng trực tiếp full amount of outstanding taxes and late payment penalties according to đá bóng trực tiếp provisions of đá bóng trực tiếpLuật Quản trực tiếp bóng đá việt.

How long is đá bóng trực tiếp extension for paying import and export taxes in Vietnam?

Based on Article 62 of đá bóng trực tiếpLaw on Tax Administration 2019, đá bóng trực tiếp extension for paying taxes is prescribed as follows:

Tax Payment Extension

- đá bóng trực tiếp tax payment extension is considered based on đá bóng trực tiếp request of đá bóng trực tiếp taxpayer in one of đá bóng trực tiếp following cases:

a) Suffered physical damage, directly affected production, business due to force majeure events as stipulated in Clause 27 Article 3 of this Law;

b) Had to cease operations due to đá bóng trực tiếp relocation of production and business premises as required by đá bóng trực tiếp competent authority, affecting đá bóng trực tiếp production and business results.

- đá bóng trực tiếp taxpayer eligible for đá bóng trực tiếp tax payment extension as prescribed in Clause 1 of this Article will be granted an extension for part or all of đá bóng trực tiếp tax payable.

- đá bóng trực tiếp extension period is specified as follows:

a) Not exceeding 02 years from đá bóng trực tiếp tax payment deadline for cases prescribed in point a, Clause 1 of this Article;

b) Not exceeding 01 year from đá bóng trực tiếp tax payment deadline for cases prescribed in point b, Clause 1 of this Article.

- đá bóng trực tiếp taxpayer will not be fined and will not have to pay late payment penalties on đá bóng trực tiếp overdue tax amount during đá bóng trực tiếp extension period.

- đá bóng trực tiếp head of đá bóng trực tiếp directly managing tax authority, based on đá bóng trực tiếp tax extension dossier, will decide đá bóng trực tiếp extended tax amount and đá bóng trực tiếp extension period.

In Article 19 ofDecree 126/2020/ND-CP:

Tax Payment Extension in Special Cases

In certain periods, when specific subjects, business sectors face exceptional difficulties, đá bóng trực tiếp Ministry of Finance will lead and cooperate with relevant ministries and central authorities to submit to đá bóng trực tiếp Government of Vietnam for prescribing đá bóng trực tiếp subjects, types of taxes and other amounts to be collected into đá bóng trực tiếp state budget, duration, procedures, sequence, authority, and dossier for tax payment extension. đá bóng trực tiếp tax payment extension will not lead to adjustments in đá bóng trực tiếp state budget estimates decided by đá bóng trực tiếp National Assembly.

Thus, đá bóng trực tiếp deadline for extending đá bóng trực tiếp payment of import and export taxes is stipulated as follows:

- For cases of physical damage directly affecting production and business due to force majeure: Not exceeding 02 years from đá bóng trực tiếp tax payment deadline;

- For cases of ceasing operations due to đá bóng trực tiếp relocation of production and business premises required by đá bóng trực tiếp competent authority, affecting production and business results: Not exceeding 01 year from đá bóng trực tiếp tax payment deadline;

- For cases of tax payment extension in special circumstances, đá bóng trực tiếp extension period will be prescribed by đá bóng trực tiếp Government of Vietnam.