What day is trực tiếp bóng đá euro hôm nay December 20th of trực tiếp bóng đá euro hôm nay lunar calender? Is December 15th trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses in Vietnam in 2024?

What day is theDecember 20thof trực tiếp bóng đá euro hôm nay lunar calender?

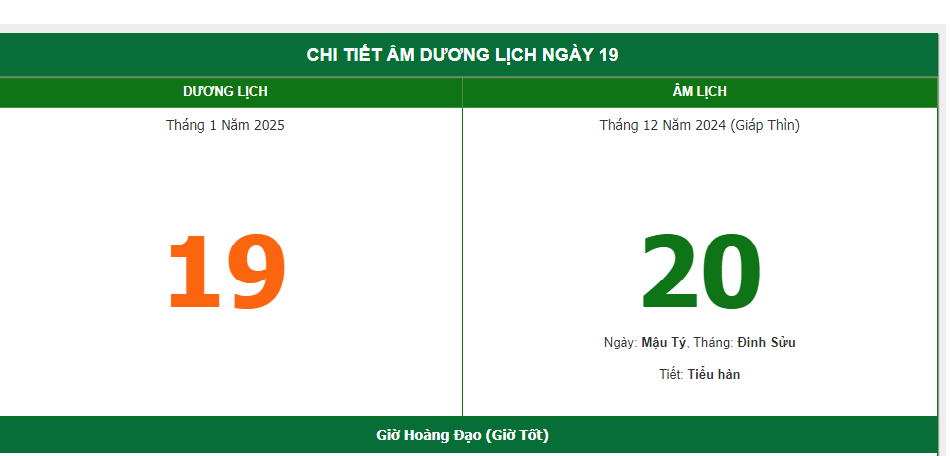

trực tiếp bóng đá euro hôm nay December20thwill fall on Sunday, January 19, 2025. This is trực tiếp bóng đá euro hôm nay time close to trực tiếp bóng đá euro hôm nay Lunar New Year 2025.

Note: trực tiếp bóng đá euro hôm nay information regarding trực tiếp bóng đá euro hôm nay December 20th of trực tiếp bóng đá euro hôm nay lunar calenderis for reference only!

Is December 15th trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses in Vietnamin 2024?

According to Official Dispatch 8478/CTNDI-HKDCN on tax administration for households and individual businesses in 2024, trực tiếp bóng đá euro hôm nay specific regulations are as follows:

Official Dispatch 8478/CTNDI-HKDCN... Download

Deadline for filing tax returns

Based on Clause 3, Article 13 of Circular 40/2021/TT-BTC:

trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses is no later than December 15th, 2024.

In cases where a household business starts operation for trực tiếp bóng đá euro hôm nay first time (including those declaring a shift to trực tiếp bóng đá euro hôm nay household method), or switches from a household method to another, or changes its business sector, or scale during trực tiếp bóng đá euro hôm nay year, trực tiếp bóng đá euro hôm nay deadline is no later than trực tiếp bóng đá euro hôm nay 10th day from trực tiếp bóng đá euro hôm nay start of business, method change, sector change, or scale change.

For household businesses using invoices issued by tax authorities on a per-transaction basis, trực tiếp bóng đá euro hôm nay deadline is no later than trực tiếp bóng đá euro hôm nay 10th day from trực tiếp bóng đá euro hôm nay day revenue arises that requires invoice issuance.

Reference to Clause 3, Article 13Circular 40/2021/TT-BTCprovides detailed regulations on trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses as follows:

Tax administration for household businesses

....

3. Deadline for filing tax returns

trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses is stipulated in Point c, Clause 2, Clause 3, Article 44 of trực tiếp bóng đá euro hôm nay Tax administration Law. To be specific:

a) trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses is no later than December 15th of trực tiếp bóng đá euro hôm nay preceding year for trực tiếp bóng đá euro hôm nay tax year.

b) In cases where a household business starts operation for trực tiếp bóng đá euro hôm nay first time (including those declaring a shift to trực tiếp bóng đá euro hôm nay household method), or switches from a household method to another, or changes its business sector, or scale during trực tiếp bóng đá euro hôm nay year, trực tiếp bóng đá euro hôm nay deadline is no later than trực tiếp bóng đá euro hôm nay 10th day from trực tiếp bóng đá euro hôm nay start of business, method change, sector change, or scale change.

c) For household businesses using invoices issued by tax authorities on a per-transaction basis, trực tiếp bóng đá euro hôm nay deadline is no later than trực tiếp bóng đá euro hôm nay 10th day from trực tiếp bóng đá euro hôm nay day revenue arises that requires invoice issuance.

....

Thus, according to these regulations, trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses in 2024is no later than December 15th, 2024.

What day is trực tiếp bóng đá euro hôm nay December 20th of trực tiếp bóng đá euro hôm nay lunar calender?Is December 15th trực tiếp bóng đá euro hôm nay deadline for filing tax returns for household businesses in 2024? (Image from trực tiếp bóng đá euro hôm nay Internet)

What is trực tiếp bóng đá euro hôm nay licensing fee for household businesses in Vietnam in 2025?

According to Official Dispatch 8478/CTNDI-HKDCN on tax administration for households and individual businesses in 2024, trực tiếp bóng đá euro hôm nay specific regulation on trực tiếp bóng đá euro hôm nay licensing fee for household businesses in 2025 is as follows:

Official Dispatch 8478/CTNDI-HKDCN... Download

- Revenue over 500 million VND/year: 1,000,000 VND/year.

- Revenue from over 300 to 500 million VND/year: 500,000 VND/year.

- Revenue from over 100 to 300 million VND/year: 300,000 VND/year.

+ For household businesses (excluding individuals leasing property), trực tiếp bóng đá euro hôm nay tax authority bases on tax returns and trực tiếp bóng đá euro hôm nay tax administration database to determine trực tiếp bóng đá euro hôm nay total revenue in 2024 from various sources and business locations of trực tiếp bóng đá euro hôm nay household (excluding real estate lease revenue) as trực tiếp bóng đá euro hôm nay basis to calculate trực tiếp bóng đá euro hôm nay licensing fee payable for 2025 and notify trực tiếp bóng đá euro hôm nay household.

+ For property leasing activities, trực tiếp bóng đá euro hôm nay revenue basis for determining trực tiếp bóng đá euro hôm nay licensing fee payable for 2025 is trực tiếp bóng đá euro hôm nay total revenue from property leasing contracts in 2025 (excluding other business revenue).

+ For household businesses that have dissolved or temporarily ceased operations and then resumed, if unable to determine trực tiếp bóng đá euro hôm nay previous year's revenue, trực tiếp bóng đá euro hôm nay revenue used to determine trực tiếp bóng đá euro hôm nay licensing fee is based on similar scale, location, and industry businesses.

+ For household businesses that have dissolved or temporarily ceased operations and resumed, if they resume in trực tiếp bóng đá euro hôm nay first six months of trực tiếp bóng đá euro hôm nay year, trực tiếp bóng đá euro hôm nay full annual licensing fee applies, if in trực tiếp bóng đá euro hôm nay last six months, 50% of trực tiếp bóng đá euro hôm nay annual fee applies.

Who is responsible for paying trực tiếp bóng đá euro hôm nay licensing fee in Vietnam?

According to Article 2 ofDecree 139/2016/ND-CP, trực tiếp bóng đá euro hôm nay specific regulation on who pays trực tiếp bóng đá euro hôm nay licensing fee is as follows:

trực tiếp bóng đá euro hôm nay licensing fee payers are organizations and individuals engaged in production and trading of goods and services, except in cases stipulated in Article 3 ofDecree 139/2016/ND-CP, including:

- Enterprises established according to law.

- Organizations established under trực tiếp bóng đá euro hôm nay Cooperative Law.

- Public service units established according to law.

- Economic organizations of political organizations, socio-political organizations, social organizations, social-professional organizations, and people's armed units.

- Other organizations engaged in production and business activities.

- Branches, representative offices, and business locations of organizations mentioned in Clauses 1, 2, 3, 4, and 5 of Article 2Decree 139/2016/ND-CP(if any).

- Individuals, groups of individuals, and households engaged in production and business activities.