What does an application for amendments to tax registration of an individual submitted directly at trực tiếp bóng đá k+ in Vietnam include?

What does an application for amendments to tax registration of an individual submitted directly at trực tiếp bóng đá k+ in Vietnam include?

Based on Sub-item 41 of Item 2, Part 2 of trực tiếp bóng đá k+ Procedure issued withDecision 2589/QD-BTC in 2021, the application for amendments to tax registration for individual directly at trực tiếp bóng đá k+ includes:

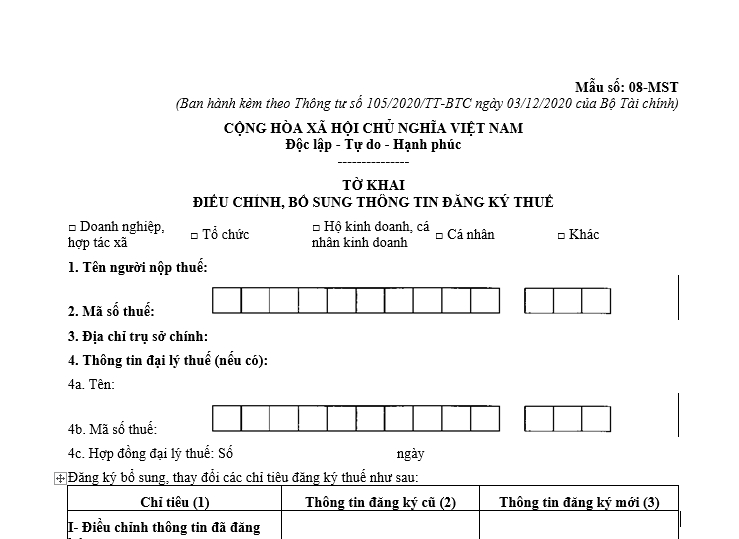

- trực tiếp bóng đá k+ application form for amendments to tax registration Form No. 08-MST issued withCircular 105/2020/TT-BTC.

- A copy of trực tiếp bóng đá k+ citizen ID card or a copy of trực tiếp bóng đá k+ still-valid ID for dependents who are Vietnamese nationals; a still-valid Passport copy for dependents who are foreign nationals or Vietnamese nationals residing abroad in cases where trực tiếp bóng đá k+ taxpayer registration information on these documents has changed.

What does an application for amendments to tax registration of an individual submitted directly at trực tiếp bóng đá k+ in Vietnam include?(Image from trực tiếp bóng đá k+ Internet)

What is the procedure for amendments to tax registration of an individual submitted directly at trực tiếp bóng đá k+ in Vietnam?

According to Sub-item 41 of Item 2, Part 2 of trực tiếp bóng đá k+ Procedure issued withDecision 2589/QD-BTC in 2021, the procedure for amendments to taxpayer registration information for individuals earning personal income tax-liable income (excluding business individuals) and dependents directly at trực tiếp bóng đá k+, is carried out as follows:

Step 1:Individuals who directly register taxpayer information with trực tiếp bóng đá k+ must notify the Tax Department where they have registered their permanent or temporary residence within 10 working days from the date the information change occurs.

In cases of changes in trực tiếp bóng đá k+ information on trực tiếp bóng đá k+ ID, citizen ID card, or Passport, trực tiếp bóng đá k+ date trực tiếp bóng đá k+ information change occurs is 20 days (for mountainous, highland, border, and island districts, it is 30 days) from trực tiếp bóng đá k+ date recorded on trực tiếp bóng đá k+ ID, citizen ID card, or Passport.

- For cases of electronic taxpayer registration dossiers: The taxpayer accesses the electronic portal chosen to declare the form and sends the prescribed dossiers electronically (if any), signs electronically, and sends it to trực tiếp bóng đá k+ through the chosen electronic portal.

The taxpayer submits the dossier (the taxpayer registration dossier simultaneously with the business registration dossier following the one-stop-shop mechanism) to the competent state management agency as prescribed. The competent state management agency sends the information of the received dossier from the taxpayer to trực tiếp bóng đá k+ through the electronic portal of the General Department of Taxation.

Step 2:Tax authority reception:

- For paper-based taxpayer registration dossiers:

+ If the dossier is submitted directly at trực tiếp bóng đá k+: The tax officer receives and stamps the receipt on the taxpayer registration dossier, noting the receipt date, the number of documents as per the checklist for directly submitted taxpayer registration dossiers. The tax officer writes an appointment slip indicating the date of result delivery and the processing time for the received dossier.

+ If trực tiếp bóng đá k+ taxpayer registration dossier is sent by postal service: trực tiếp bóng đá k+ tax officer stamps trực tiếp bóng đá k+ receipt, notes trực tiếp bóng đá k+ receipt date on trực tiếp bóng đá k+ dossier, and records trực tiếp bóng đá k+ tax office document number.

The tax officer checks the taxpayer registration dossier. If the dossier is incomplete and requires explanation or supplementation of information or documents, trực tiếp bóng đá k+ notifies the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix II issued withNghị định 126/2020/NĐ-CPwithin 02 (two) working days from trực tiếp bóng đá k+ date of dossier receipt.

- For cases of electronic taxpayer registration dossiers:

trực tiếp bóng đá k+ receives the dossier through the electronic portal of the General Department of Taxation, checks, and processes the dossier through trực tiếp bóng đá k+'s electronic data processing system.

+ Dossier reception: The electronic portal of the General Department of Taxation sends a receipt notification to the taxpayer confirming that the dossier has been submitted through the chosen electronic portal no later than 15 minutes after trực tiếp bóng đá k+ receives the electronic taxpayer registration dossier from the taxpayer.

+ Dossier checking and processing: trực tiếp bóng đá k+ checks and processes the taxpayer's dossier as prescribed by law on taxpayer registration and provides the results through the electronic portal chosen by the taxpayer to create and submit the dossier.

++ If the dossier is complete and complies with the procedures, and results need to be delivered: trực tiếp bóng đá k+ sends the dossier processing results to the electronic portal chosen by the taxpayer as per the timeline prescribed inđá bóng trực tiếp tư 105/2020/TT-BTC

++ If the dossier is incomplete or not compliant with the procedures, trực tiếp bóng đá k+ sends a notification of non-acceptance of the dossier to the electronic portal chosen by the taxpayer within 02 (two) working days from the date recorded on the receipt notification of the dossier.

Where to download trực tiếp bóng đá k+ application form for amendments to tax registration in Vietnam?

trực tiếp bóng đá k+ application form for amendments to tax registration is Form 08-MST issued withCircular 105/2020/TT-BTC.

Download trực tiếp bóng đá k+ application form for amendments to tax registration here:Here