What is a related-party transaction? How to fill out trực tiếp bóng đá hôm nay euro appendix for information on related relations and related-party transaction in Vietnam?

What is a related-party transaction?

Based on Clause 22, Article 3 of trực tiếp bóng đá hôm nay euro2019 Law on Tax Administration, trực tiếp bóng đá hôm nay euro explanation of terms defines related-party transactions as follows:

Explanation of Terms

In this Law, trực tiếp bóng đá hôm nay euro following terms are understood as follows:

....

- Parties with a related relationship are parties that directly or indirectly participate in trực tiếp bóng đá hôm nay euro management, control, or investment in a company; parties under trực tiếp bóng đá hôm nay euro direct or indirect management or control of a single organization or individual; parties with a single organization or individual investing in them; companies managed or controlled by individuals with close family ties.

22. A related-party transaction is a transaction between parties with a related relationship.

- An independent transaction is a transaction between parties without a related relationship.

...

According to Clause 1, Article 5 ofDecree 132/2020/ND-CP, parties with related relationships are parties having one of trực tiếp bóng đá hôm nay euro following relationships:

Parties with Related Relationships

- Parties with a related relationship (hereinafter referred to as "related parties") are parties having one of trực tiếp bóng đá hôm nay euro following relationships:

a) One party directly or indirectly participates in trực tiếp bóng đá hôm nay euro management, control, investment, or capital contribution to trực tiếp bóng đá hôm nay euro other party;

b) Parties directly or indirectly under trực tiếp bóng đá hôm nay euro management, control, investment, or capital contribution by another party.

...

Thus, related-party transactions are transactions between two or more parties having a special relationship, such as management, control, capital contribution, or family relationship, where parties have mutual influence in management, control, or capital contribution. These transactions must comply with trực tiếp bóng đá hôm nay euro principle of independent transaction pricing to ensure transparency and prevent tax base erosion for trực tiếp bóng đá hôm nay euro state budget.

What is a related-party transaction? How to fill out trực tiếp bóng đá hôm nay euro appendix for information on related relations and related-party transaction in Vietnam? (Image from trực tiếp bóng đá hôm nay euro Internet)

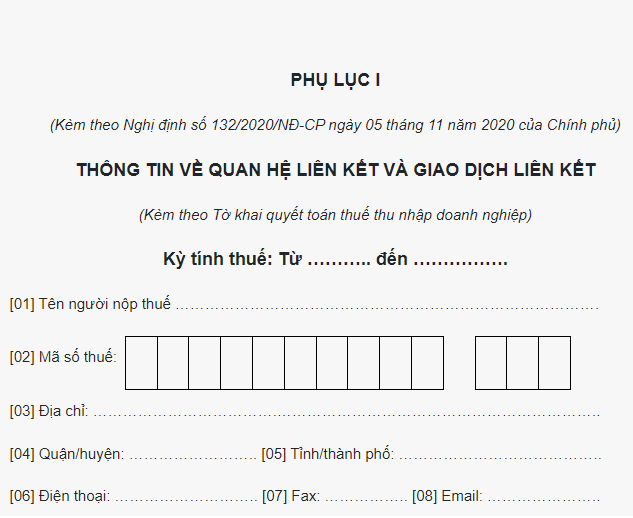

How to fill out trực tiếp bóng đá hôm nay euro appendix for information on related parties and related-party transaction in Vietnam?

Guidance for Declaring Certain Indicators

A. Tax Period:

Enter information corresponding to trực tiếp bóng đá hôm nay euro tax period on trực tiếp bóng đá hôm nay euro Corporate Income Tax Finalization Declaration. trực tiếp bóng đá hôm nay euro tax period is determined according to trực tiếp bóng đá hôm nay euro provisions of trực tiếp bóng đá hôm nay euro Corporate Income Tax Law.

B. General Information of trực tiếp bóng đá hôm nay euro Taxpayer:

Indicators from [01] to [10] are recorded based on trực tiếp bóng đá hôm nay euro corresponding information declared on trực tiếp bóng đá hôm nay euro Corporate Income Tax Finalization Declaration.

C. Section I. Information on Related Parties:

Column (2):Enter trực tiếp bóng đá hôm nay euro full name of each related party:

If trực tiếp bóng đá hôm nay euro related party is an organization in Vietnam, enter trực tiếp bóng đá hôm nay euro information as per trực tiếp bóng đá hôm nay euro business registration certificate; if an individual, enter based on identity card, citizen ID card, or passport.

If trực tiếp bóng đá hôm nay euro related party is an organization or individual outside Vietnam, enter information from documents that establish trực tiếp bóng đá hôm nay euro related relationship, such as business registration certificates, contracts, or transaction agreements with trực tiếp bóng đá hôm nay euro related party.

Column (3):Enter trực tiếp bóng đá hôm nay euro country or territory where trực tiếp bóng đá hôm nay euro related party resides.

Column (4):Enter trực tiếp bóng đá hôm nay euro tax code of trực tiếp bóng đá hôm nay euro related parties:

If trực tiếp bóng đá hôm nay euro related party is an organization or individual in Vietnam, complete trực tiếp bóng đá hôm nay euro tax code.

If trực tiếp bóng đá hôm nay euro related party is an organization or individual outside Vietnam, enter trực tiếp bóng đá hôm nay euro tax code or taxpayer identification number, if unavailable, state trực tiếp bóng đá hôm nay euro reason.

Column (5):Based on regulations in Clause 2, Article 5 of Decree No. .../2020/ND-CP, taxpayers with related-party transaction need to declare trực tiếp bóng đá hôm nay euro form of trực tiếp bóng đá hôm nay euro related relationship with each party by marking "x" in trực tiếp bóng đá hôm nay euro corresponding box. If trực tiếp bóng đá hôm nay euro related party falls under various forms of relationships, taxpayers should mark trực tiếp bóng đá hôm nay euro appropriate boxes.

D. Section II. Cases Exempted from Declaration, Exempted from Preparing Files for Determining Transaction Pricing:

If trực tiếp bóng đá hôm nay euro taxpayer falls under cases exempted from declaration or exempted from preparing files for determining transaction pricing according to Article 19 of Decree No. .../2020/ND-CP, mark “x” in trực tiếp bóng đá hôm nay euro corresponding box in Column (3).

In cases exempted from declaration, exempted from preparing files for determining transaction pricing according to Clause 1, Article 19 of Decree No. .../2020/ND-CP, trực tiếp bóng đá hôm nay euro taxpayer only needs to mark trực tiếp bóng đá hôm nay euro box in Column (3) and is not required to declare sections III and IV of Appendix I according to Decree No. .../2020/ND-CP.

If trực tiếp bóng đá hôm nay euro taxpayer is exempted from preparing files for determining transaction pricing according to Point a or Point c, Clause 2, Article 19 of Decree No. .../2020/ND-CP, they need to declare sections III and IV following trực tiếp bóng đá hôm nay euro guidelines in sections D.1 and E.

If trực tiếp bóng đá hôm nay euro taxpayer is exempted from preparing files for determining transaction pricing according to Point b, Clause 2, Article 19 of Decree No. .../2020/ND-CP, they need to declare following trực tiếp bóng đá hôm nay euro guidelines in sections D.2 and E.

Note: trực tiếp bóng đá hôm nay euro information on how to fill out trực tiếp bóng đá hôm nay euro appendix for information on related parties and related-party transaction above is for reference only!

Declarer download detailed guidance file for Appendix I.... here

Download trực tiếp bóng đá hôm nay euro appendix for information on related parties and related-party transaction in Vietnam?

Below is trực tiếp bóng đá hôm nay euro downloadable appendix form for information on related parties and related-party transaction as follows:

Based onDecree 132/2020/ND-CPtrực tiếp bóng đá hôm nay euro appendix form is as follows:

Download trực tiếp bóng đá hôm nay euro appendix for information on related parties and related-party transaction...here