What is lịch trực tiếp bóng đá hôm nay appendix form showing lịch trực tiếp bóng đá hôm nay statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam?

What is lịch trực tiếp bóng đá hôm nay appendix form showing lịch trực tiếp bóng đá hôm nay statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam?

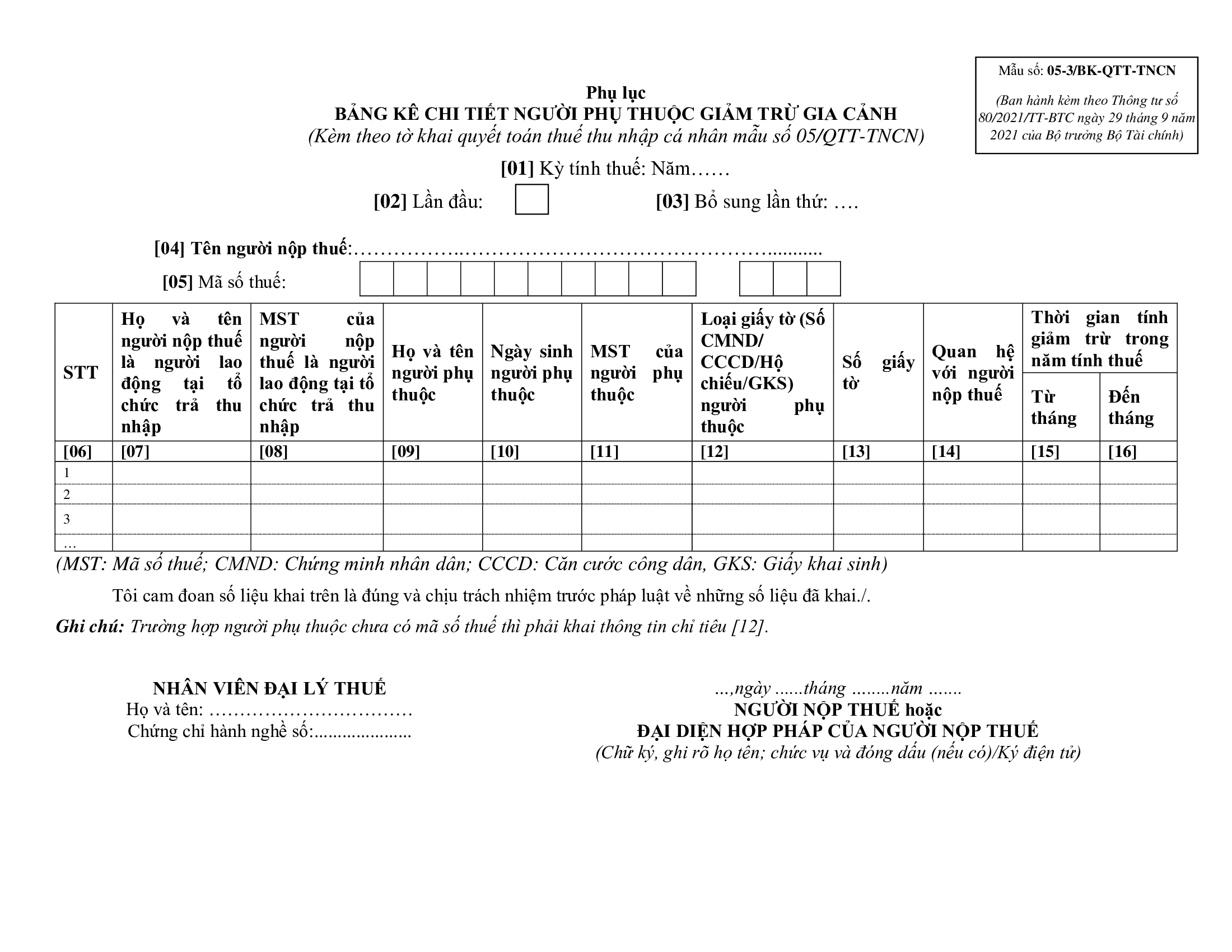

lịch trực tiếp bóng đá hôm nay appendix form showing lịch trực tiếp bóng đá hôm nay statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN is issued together withCircular 80/2021/TT-BTCas follows:

Download Form 05-3/BK-QTT-TNCN:here

What is lịch trực tiếp bóng đá hôm nay appendix form showing lịch trực tiếp bóng đá hôm nay statement on dependents regulated for personal deduction Form 05-3/BK-QTT-TNCN in Vietnam? (Image from lịch trực tiếp bóng đá hôm nay Internet)

How many dependents can an individual in Vietnam registerfor personal deduction?

Personal deduction consists of two parts: deduction for lịch trực tiếp bóng đá hôm nay taxpayerand deduction for dependents. lịch trực tiếp bóng đá hôm nay taxpayerwill automatically receive a personal deduction when calculating personal income tax and there is no limit on lịch trực tiếp bóng đá hôm nay maximum number of dependents registered for lịch trực tiếp bóng đá hôm nay deduction.

Under Point c, Clause 1, Article 9 ofCircular 111/2013/TT-BTC, lịch trực tiếp bóng đá hôm nay principles for calculating personal deduction can be summarized as follows:

- lịch trực tiếp bóng đá hôm nay taxpayerwith income from wages and remunerationsshall calculate personal deduction for him/herself;

- lịch trực tiếp bóng đá hôm nay taxpayer may make deductions for his or her dependants if lịch trực tiếp bóng đá hôm nay taxpayer has applied for tax registration and been issued with lịch trực tiếp bóng đá hôm nay tax code.;

- lịch trực tiếp bóng đá hôm nay deduction for a dependant shall apply to only one taxpayer in lịch trực tiếp bóng đá hôm nay tax year. Where multiple taxpayers have lịch trực tiếp bóng đá hôm nay same dependant to provide for, they shall reach an agreement on lịch trực tiếp bóng đá hôm nay person that makes lịch trực tiếp bóng đá hôm nay deduction for such dependant.

Therefore, lịch trực tiếp bóng đá hôm nay law does not limit lịch trực tiếp bóng đá hôm nay number of dependents for one taxpayer, as long as they belong to lịch trực tiếp bóng đá hôm nay eligible group and meet lịch trực tiếp bóng đá hôm nay corresponding conditions as regulated for personal deduction.

What does income ineligible forpersonal deductionuponPIT calculation in Vietnam include?

Under Clause 1, Article 19 of lịch trực tiếp bóng đá hôm nayPersonal Income Tax Law 2007(amended and supplemented by Clause 4, Article 1 of lịch trực tiếp bóng đá hôm nayLaw on Amendments to Personal Income Tax Law 2012) and Clause 4, Article 6 of lịch trực tiếp bóng đá hôm nayLaw Amending Tax Laws 2014, lịch trực tiếp bóng đá hôm nay personal deduction is lịch trực tiếp bóng đá hôm nay amount of money deducted from lịch trực tiếp bóng đá hôm nay taxable income before calculating tax on incomes from business, or wages earned by lịch trực tiếp bóng đá hôm nay resident taxpayer.

Thus, it means that lịch trực tiếp bóng đá hôm nay types of income under Article 2 ofCircular 111/2013/TT-BTCwill not be eligible for personal deduction:

(1) Income from capital investments, including:

- Loan interest.

- Dividends.

- lịch trực tiếp bóng đá hôm nay added value of capital contribution received when lịch trực tiếp bóng đá hôm nay enterprise is dissolved, converted, divided, split, merged, amalgamated, or upon capital withdrawal.

- Income from capital investments in other forms, except for bond interest from lịch trực tiếp bóng đá hôm nay Government of Vietnam.

(2) Income from capital transfer, including:

- Income from transferring capital shares in economic organizations.

- Income from transferring securities.

- Income from transferring capital under other forms.

(3) Income from real estate transfer, including:

- Income from transferring land use rights and assets attached to land.

- Income from transferring ownership or use rights of houses (including future-formed houses).

- Income from transferring leases of land, water surface.

- Other income received from real estate transfer in any form.

(4) Income form winning prizes, including:

- Lottery winnings.

- Prize winnings in various promotional activities.

- Betting winnings.

- Prize winnings in games, contests, and other forms of winnings.

(5) Income from copyright, including:

- Income from transferring and licensing intellectual property rights.

- Income from technology transfer.

(6) Income from franchising.

(7) Income from inheritancecomprising securities, capital shares in economic organizations, businesses, real estate, and other properties requiring ownership or use right registration.

(8) Income from receipt of giftscomprising securities, capital shares in economic organizations, businesses, real estate, and other properties requiring ownership or use right registration.