What is vtv5 trực tiếp bóng đá hôm nay environmental protection tax rate for coal in Vietnam?

Which entities are subject to environmental protection tax in Vietnam?

According to Article 3 of vtv5 trực tiếp bóng đá hôm nayLaw on Environmental Protection Tax 2010, Article 1 ofCircular 152/2011/TT-BTC*amended by Article 1 ofCircular 159/2012/TT-BTC), subjects to environmental protection tax include:

- Gasoline, oil, lubricants, including:

+ Gasoline, except ethanol;

+ Jet fuel;

+ Diesel oil;

+ Kerosene;

+ Mazut oil;

+ Lubricating oil;

+ Lubricants.

vtv5 trực tiếp bóng đá hôm nay gasoline, oil, and lubricants specified in this section are fossil-based gasoline, oil, and lubricants (hereinafter collectively referred to as gasoline) sold in Vietnam, excluding bio-products (such as ethanol, vegetable oil, animal fat…).

For mixed fuels containing biofuels and fossil-based gasoline, vtv5 trực tiếp bóng đá hôm nay environmental protection tax is only calculated on vtv5 trực tiếp bóng đá hôm nay fossil-based gasoline portion.

- Coal, including:

+ Brown coal;

+ Anthracite (anthraxit);

+ Fat coal;

+ Other coal.

- Hydro-chloro-fluoro-carbon (HCFC) solution is a group of substances that deplete vtv5 trực tiếp bóng đá hôm nay ozone layer used as refrigerants in cooling equipment and in vtv5 trực tiếp bóng đá hôm nay semiconductor industry, produced domestically, imported separately or contained in imported electrical cooling devices.

- Polythene bags subject to tax.

Polythene bags subject to tax (plastic bags) are thin plastic bags, containing mouths, bottoms, and walls and capable of holding products, made from single resin such as HDPE (high-density polyethylene resin), LDPE (low-density polyethylene), or LLDPE (linear low-density polyethylene resin), excluding prepackaged goods and polythene bags that meet environmental standards. These standards are certified by competent authorities according to regulations of vtv5 trực tiếp bóng đá hôm nay Ministry of Natural Resources and Environment.

- Herbicides restricted in use.

- Termiticides restricted in use.

- Forestry product preservatives restricted in use.

- Warehouse disinfectants restricted in use.

- When necessary, vtv5 trực tiếp bóng đá hôm nay Standing Committee of vtv5 trực tiếp bóng đá hôm nay National Assembly considers and stipulates vtv5 trực tiếp bóng đá hôm nay addition of taxable subjects suitable for each period.

What is vtv5 trực tiếp bóng đá hôm nay environmental protection tax rate for coal in Vietnam?(Image from vtv5 trực tiếp bóng đá hôm nay Internet)

What is vtv5 trực tiếp bóng đá hôm nay environmental protection tax rate for coal in Vietnam?(Image from vtv5 trực tiếp bóng đá hôm nay Internet)

What is vtv5 trực tiếp bóng đá hôm nay environmental protection tax rate for coal in Vietnam?

According to Article 8 of vtv5 trực tiếp bóng đá hôm nayLaw on Environmental Protection Tax 2010, vtv5 trực tiếp bóng đá hôm nay tax tariff framework is regulated as follows:

vtv5 trực tiếp bóng đá hôm nay absolute tax amount is regulated according to vtv5 trực tiếp bóng đá hôm nay following Tax Tariff Framework:

| No. | Goods | Unit | Tax rate (VND/unit) |

|---|---|---|---|

| I | Gasoline, oil, lubricants | ||

| 1 | Gasoline, except ethanol | Liter | 1,000-4,000 |

| 2 | Jet fuel | Liter | 1,000-3,000 |

| 3 | Diesel oil | Liter | 500-2,000 |

| 4 | Kerosene | Liter | 300-2,000 |

| 5 | Mazut oil | Liter | 300-2,000 |

| 6 | Lubricating oil | Liter | 300-2,000 |

| 7 | Lubricants | Kg | 300-2,000 |

| II | Coal | ||

| 1 | Brown coal | Ton | 10,000-30,000 |

| 2 | Anthracite (anthraxit) | Ton | 20,000-50,000 |

| 3 | Fat coal | Ton | 10,000-30,000 |

| 4 | Other coal | Ton | 10,000-30,000 |

| III | Hydro-chloro-fluoro-carbon (HCFC) solution | kg | 1,000-5,000 |

| IV | Polythene bags subject to tax | kg | 30,000-50,000 |

| V | Herbicides restricted in use | kg | 500-2,000 |

| VI | Termiticides restricted in use | kg | 1,000-3,000 |

| VII | Forestry product preservatives restricted in use | kg | 1,000-3,000 |

| VIII | Warehouse disinfectants restricted in use | kg | 1,000-3,000 |

vtv5 trực tiếp bóng đá hôm nay environmental protection tax rates for coal are as follows:

Brown coal: 10,000-30,000 VND/ton

Anthracite (anthraxit): 20,000-50,000 VND/ton

Fat coal: 10,000-30,000 VND/ton

Other coal: 10,000-30,000 VND/ton

Note:Based on vtv5 trực tiếp bóng đá hôm nay prescribed Tax Tariff Framework, vtv5 trực tiếp bóng đá hôm nay Standing Committee of vtv5 trực tiếp bóng đá hôm nay National Assembly stipulates specific tax rates for each type of taxable goods ensuring vtv5 trực tiếp bóng đá hôm nay following principles:

+ vtv5 trực tiếp bóng đá hôm nay tax rate for taxable goods must conform to vtv5 trực tiếp bóng đá hôm nay State’s socio-economic development policy in each period;

+ vtv5 trực tiếp bóng đá hôm nay tax rate for taxable goods must be determined based on vtv5 trực tiếp bóng đá hôm nay environmental impact of vtv5 trực tiếp bóng đá hôm nay goods.

What documents are required for environmental protection tax declaration in Vietnam?

According to sub-section 21, section 2 of Administrative Procedures issued withDecision 1462/QD-BTC 2022, vtv5 trực tiếp bóng đá hôm nay documents for environmental protection tax declaration include:

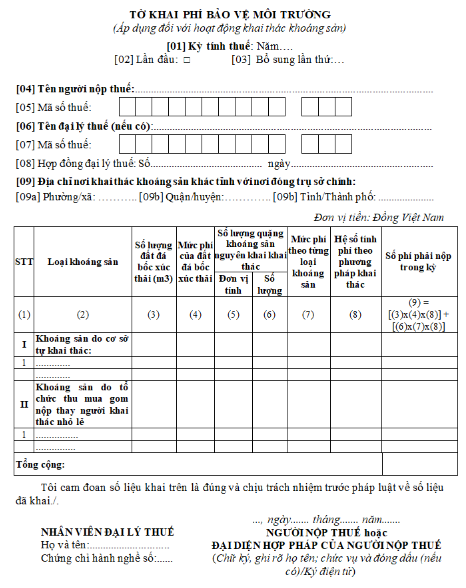

- vtv5 trực tiếp bóng đá hôm nay environmental protection tax declaration form no. 01/TBVMT according to Appendix 1 of vtv5 trực tiếp bóng đá hôm nay Tax Declaration Document List issued withDecree 126/2020/ND-CPand Circular 80/2021/TT-BTC.

- Appendix table determining vtv5 trực tiếp bóng đá hôm nay environmental protection tax payable for localities entitled to revenue from coal, form no. 01-1/TBVMT according to Appendix 1 of vtv5 trực tiếp bóng đá hôm nay Tax Declaration Document List issued withDecree 126/2020/ND-CPandCircular 80/2021/TT-BTC(in cases where vtv5 trực tiếp bóng đá hôm nay taxpayer allocates vtv5 trực tiếp bóng đá hôm nay environmental protection tax on gasoline to each locality where dependent units are headquartered as regulated);

- Appendix table allocating vtv5 trực tiếp bóng đá hôm nay environmental protection tax payable for localities entitled to revenue from gasoline, form no. 01-2/TBVMT according to Appendix 1 of vtv5 trực tiếp bóng đá hôm nay Tax Declaration Document List issued withDecree 126/2020/ND-CPandCircular 80/2021/TT-BTC(in cases where vtv5 trực tiếp bóng đá hôm nay taxpayer determines vtv5 trực tiếp bóng đá hôm nay tax payable to each locality where vtv5 trực tiếp bóng đá hôm nay company exploiting coal is headquartered as regulated).

Number of documents: 01 set

What contents are included in vtv5 trực tiếp bóng đá hôm nay Form 01/PBVMT - Environmental Protection Tax Declaration in Vietnam?

Form 01/PBVMT - Environmental Protection Tax Declaration is prescribed in Appendix 2 issued withCircular 80/2021/TT-BTC, as follows:

Download Form 01/PBVMT - Environmental Protection Tax Declaration:Here

Notes on environmental protection tax declaration in mineral exploitation activities as follows:

Indicators [09a], [09b], [09c]:

- Declare vtv5 trực tiếp bóng đá hôm nay location information where vtv5 trực tiếp bóng đá hôm nay taxpayer has mineral exploitation activities different from where vtv5 trực tiếp bóng đá hôm nay main office is located as per vtv5 trực tiếp bóng đá hôm nay regulation at Point i, Clause 1, Article 11 ofDecree 126/2020/ND-CP, dated October 19, 2020, of vtv5 trực tiếp bóng đá hôm nay Government of Vietnam. In cases where vtv5 trực tiếp bóng đá hôm nay taxpayer has mineral exploitation activities in multiple districts, vtv5 trực tiếp bóng đá hôm nay declaration is made as follows:

+ If vtv5 trực tiếp bóng đá hôm nay Tax Department manages revenue collection, vtv5 trực tiếp bóng đá hôm nay taxpayer declares 01 representative district where mineral exploitation activities arise.

+ If vtv5 trực tiếp bóng đá hôm nay Regional Tax Department manages revenue collection, vtv5 trực tiếp bóng đá hôm nay taxpayer declares 01 representative district under vtv5 trực tiếp bóng đá hôm nay Regional Tax Department where mineral exploitation activities arise.