What is vtv5 trực tiếp bóng đá hôm nay Form 01-DK-TCT on tax registration application for organizations in Vietnam according to Circular 86?

What is vtv5 trực tiếp bóng đá hôm nay Form 01-DK-TCT on tax registration application for organizations in Vietnam according to Circular 86?

Based on section a.1 point a clause 1 Article 7 ofxoilac tv trực tiếp bóng(effective from February 6, 2025), vtv5 trực tiếp bóng đá hôm nay regulations are as follows:

Location for submission and initial tax registration application

vtv5 trực tiếp bóng đá hôm nay location for submission and vtv5 trực tiếp bóng đá hôm nay initial tax registration application for enterprises, cooperatives, and cooperative groups that register tax registration together with business registration under vtv5 trực tiếp bóng đá hôm nay one-stop-shop mechanism is vtv5 trực tiếp bóng đá hôm nay business registration application according to vtv5 trực tiếp bóng đá hôm nay provisions of law on business registration.

For organizations registering directly with vtv5 trực tiếp bóng đá hôm nay tax authority, vtv5 trực tiếp bóng đá hôm nay initial tax registration application is executed according to vtv5 trực tiếp bóng đá hôm nay regulations of clause 2 Article 31; clause 2 Article 32 of vtv5 trực tiếp bóng đá hôm nay Law on Tax Administration and vtv5 trực tiếp bóng đá hôm nay following regulations:

- For taxpayers who are organizations stipulated at points a, b, c, n, clause 2 Article 4 of this Circular

a) Economic organizations and dependent units (excluding cooperative groups) stipulated at points a, b clause 2 Article 4 of this Circular submit vtv5 trực tiếp bóng đá hôm nay initial tax registration application at vtv5 trực tiếp bóng đá hôm nay Tax Department where their headquarters are located.

a.1) vtv5 trực tiếp bóng đá hôm nay tax registration application for an independent unit or managing unit organization includes:

- tax registration application form number 01-DK-TCT issued with this Circular;

- List of subsidiaries, member companies form number BK01-DK-TCT issued with this Circular (if any);

- List of dependent units form number BK02-DK-TCT issued with this Circular (if any);

...

Thus, vtv5 trực tiếp bóng đá hôm nay tax registration application for organizations as an independent unit or managing unit is form number 01-DK-TCT issued in Appendix 2 attached toxoilac tv trực tiếp bóng

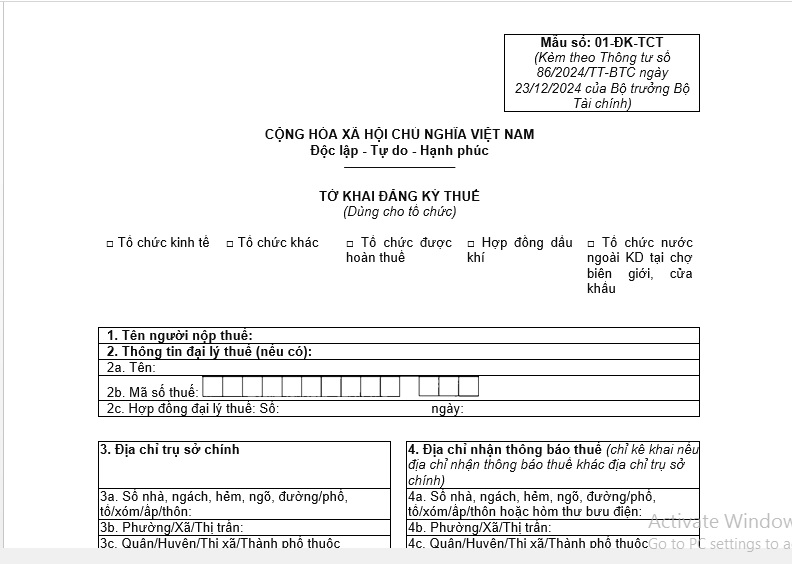

To be specific, form number 01-DK-TCT on tax registration application for organizations is as follows:

Form number 01-DK-TCT on tax registration application for organizations...Download

What is vtv5 trực tiếp bóng đá hôm nay Form 01-DK-TCT on tax registration application for organizations in Vietnam according to Circular 86?(Image from vtv5 trực tiếp bóng đá hôm nay Internet)

What are instructions for thetax registration application for organizations in Vietnam according to Circular 86?

According to Appendix 2 attached toxoilac tv trực tiếp bóngat form number 01-DK-TCT, vtv5 trực tiếp bóng đá hôm nay guidance for completing vtv5 trực tiếp bóng đá hôm nay tax registration application for organizations is as follows:

Taxpayers must tick one of vtv5 trực tiếp bóng đá hôm nay appropriate boxes before filling in vtv5 trực tiếp bóng đá hôm nay detailed information. To be specific:

- “Economic Organization”: Taxpayers following vtv5 trực tiếp bóng đá hôm nay regulations at point a Clause 1 Article 7Circular 86/2024/TT-BTCselect this indicator.

- “Other Organization”: Taxpayers following vtv5 trực tiếp bóng đá hôm nay regulations at point b clause 1 Article 7Circular 86/2024/TT-BTCselect this indicator.

- “Tax-exempt Organization”: Taxpayers following vtv5 trực tiếp bóng đá hôm nay regulations at clauses 2 and 3 Article 7Circular 86/2024/TT-BTCselect this indicator. vtv5 trực tiếp bóng đá hôm nay taxpayers only need to fill in vtv5 trực tiếp bóng đá hôm nay indicators: 1, 3, 4, 5, 9, 10, 11, 12, 13, 14, 15, 17.

- “Oil and Gas Contract”: Taxpayers following vtv5 trực tiếp bóng đá hôm nay regulations at clause 7 Article 7Circular 86/2024/TT-BTC.

- “Foreign Organizations Trading at Border Markets, Border Gates”: Taxpayers who are organizations from countries with a land border with Vietnam, engaging in buying and selling, and exchanging goods at border markets, border gate markets, or economic zones at border gates of Vietnam follow vtv5 trực tiếp bóng đá hôm nay regulations at point a Clause 1 Article 7Circular 86/2024/TT-BTC. When selecting, vtv5 trực tiếp bóng đá hôm nay legal representative must declare documents in accordance with Article 16Decree No. 14/2018/ND-CPJanuary 23, 2018 of vtv5 trực tiếp bóng đá hôm nay Government of Vietnam at indicator 14đ and corresponding economic type at indicator 10.

Detailed information to be filled includes:

1.Taxpayer Name: Clearly and fully capitalize vtv5 trực tiếp bóng đá hôm nay name of vtv5 trực tiếp bóng đá hôm nay organization according to vtv5 trực tiếp bóng đá hôm nay Establishment Decision or Establishment and Operation License or equivalent documents issued by competent authorities (for Vietnamese organizations) or Business Registration Certificate (for organizations from countries with land borders engaged in trading goods in Vietnam’s border markets, border gate markets, economic zones at border gates).

2.Tax Agent Information: Provide full details of vtv5 trực tiếp bóng đá hôm nay tax agent in case vtv5 trực tiếp bóng đá hôm nay tax agent contracts with vtv5 trực tiếp bóng đá hôm nay taxpayer to carry out tax registration procedures on behalf of vtv5 trực tiếp bóng đá hôm nay taxpayer according to vtv5 trực tiếp bóng đá hôm nay Law on Tax Administration.

3.Main headquarters address: Specify vtv5 trực tiếp bóng đá hôm nay house number, alley, lane, street/road, hamlet/group/village, ward/commune/commune-level town, district/district-level town/city under vtv5 trực tiếp bóng đá hôm nay province, province/city of vtv5 trực tiếp bóng đá hôm nay taxpayer, phone number, Fax number (if applicable), clearly state area code - phone number/Fax number according to address information after:

- vtv5 trực tiếp bóng đá hôm nay main office address of vtv5 trực tiếp bóng đá hôm nay taxpayer is an organization.

- Business location address at border gate markets for taxpayers who are organizations from countries with a land border with Vietnam.

- Location address of oil and gas exploration and extraction for oil and gas contracts.

- Taxpayers must accurately and completely declare email information. This email address is used as an electronic transaction account with vtv5 trực tiếp bóng đá hôm nay tax authority for electronic tax registration files.

4.Tax notification address: If vtv5 trực tiếp bóng đá hôm nay taxpayer is an organization that has a different tax notification address from vtv5 trực tiếp bóng đá hôm nay main headquarters address at indicator 3 above, clearly state vtv5 trực tiếp bóng đá hôm nay tax notification address for vtv5 trực tiếp bóng đá hôm nay tax authority to contact.

5.Establishment Decision:

- For taxpayers who are organized with an establishment decision: Clearly state vtv5 trực tiếp bóng đá hôm nay decision number, decision issue date, and vtv5 trực tiếp bóng đá hôm nay decision-issuing agency.

- For Oil and Gas Contracts: Clearly state vtv5 trực tiếp bóng đá hôm nay contract number, date of contract signing, leaving vtv5 trực tiếp bóng đá hôm nay decision-issuing agency blank.

6.Business Registration Certificate/Establishment and Operation License or equivalent documents issued by competent authorities: Clearly record vtv5 trực tiếp bóng đá hôm nay number, vtv5 trực tiếp bóng đá hôm nay issue date, and vtv5 trực tiếp bóng đá hôm nay issuing authority of vtv5 trực tiếp bóng đá hôm nay Business Registration Certificate from countries with a land border with Vietnam (for taxpayers who are organizations from countries with a land border with Vietnam engaged in trading goods at border markets), Establishment and Operation License, or equivalent license issued by competent authorities (for taxpayers who are organizations from Vietnam).

Exclusive of "issuing agency" info in vtv5 trực tiếp bóng đá hôm nay Business Registration Certificate: state vtv5 trực tiếp bóng đá hôm nay name of vtv5 trực tiếp bóng đá hôm nay bordering country with Vietnam that issued vtv5 trực tiếp bóng đá hôm nay Business Registration Certificate (Laos, Cambodia, China).

7.Main business sector: Indicate based on vtv5 trực tiếp bóng đá hôm nay business sector on vtv5 trực tiếp bóng đá hôm nay Establishment and Operation License or equivalent license issued by competent authorities (for taxpayers who are organizations from Vietnam) and Business Registration Certificate (for taxpayers who are organizations from countries with a land border with Vietnam engaged in trading goods at border markets).

Note: Only indicate one main actual business sector.

8.Charter Capital:

- For taxpayers of vtv5 trực tiếp bóng đá hôm nay type Limited Liability Company, Joint Stock Company, Partnership Company: Record according to vtv5 trực tiếp bóng đá hôm nay charter capital on vtv5 trực tiếp bóng đá hôm nay Establishment and Operation License or equivalent license issued by competent authorities or capital source on vtv5 trực tiếp bóng đá hôm nay Establishment Decision (clearly stating vtv5 trực tiếp bóng đá hôm nay currency type, classifying vtv5 trực tiếp bóng đá hôm nay source of capital according to vtv5 trực tiếp bóng đá hôm nay owner, vtv5 trực tiếp bóng đá hôm nay proportion of each capital source in vtv5 trực tiếp bóng đá hôm nay total capital).

- For taxpayers of vtv5 trực tiếp bóng đá hôm nay private enterprise type: Record according to vtv5 trực tiếp bóng đá hôm nay investment capital on vtv5 trực tiếp bóng đá hôm nay Establishment and Operation License or equivalent license issued by competent authorities (clearly stating vtv5 trực tiếp bóng đá hôm nay currency type).

- For taxpayers who are organizations from countries with a land border and other organizations: If there is capital on vtv5 trực tiếp bóng đá hôm nay Establishment Decision, Business Registration Certificate, etc., record it, otherwise leave this information blank.

9.Start Date of Operations: Declare vtv5 trực tiếp bóng đá hôm nay date vtv5 trực tiếp bóng đá hôm nay taxpayer commenced actual operations if it is different from vtv5 trực tiếp bóng đá hôm nay tax code issuance date.

10.Economic Type: Mark an X in one of vtv5 trực tiếp bóng đá hôm nay corresponding boxes.

11.Accounting method for business results: Mark an X in one of vtv5 trực tiếp bóng đá hôm nay two boxes"Independent" or "Dependent". If ticking"Independent", also tick"With consolidated financial statements"if obligated to prepare and submit consolidated financial statements to vtv5 trực tiếp bóng đá hôm nay tax authority as per regulation.

12.Fiscal Year: Clearly state from vtv5 trực tiếp bóng đá hôm nay first month, vtv5 trực tiếp bóng đá hôm nay first day of vtv5 trực tiếp bóng đá hôm nay accounting period to vtv5 trực tiếp bóng đá hôm nay last month, vtv5 trực tiếp bóng đá hôm nay last day of vtv5 trực tiếp bóng đá hôm nay accounting period according to vtv5 trực tiếp bóng đá hôm nay calendar year or fiscal year of vtv5 trực tiếp bóng đá hôm nay taxpayer.

13.Information on vtv5 trực tiếp bóng đá hôm nay immediate superior unit of vtv5 trực tiếp bóng đá hôm nay taxpayer (if any): Clearly state vtv5 trực tiếp bóng đá hôm nay name, tax code of vtv5 trực tiếp bóng đá hôm nay immediate superior unit managing vtv5 trực tiếp bóng đá hôm nay taxpayer organization; in vtv5 trực tiếp bóng đá hôm nay case of a taxpayer being a subsidiary within a Corporation, Group, state vtv5 trực tiếp bóng đá hôm nay name, tax code of vtv5 trực tiếp bóng đá hôm nay Corporation, Group.

14.Information on vtv5 trực tiếp bóng đá hôm nay legal representative/head of vtv5 trực tiếp bóng đá hôm nay private enterprise/head of vtv5 trực tiếp bóng đá hôm nay organization: Declare detailed information of vtv5 trực tiếp bóng đá hôm nay legal representative/head of vtv5 trực tiếp bóng đá hôm nay taxpayer organization (for economic organizations and other organizations excluding private enterprises) or information on vtv5 trực tiếp bóng đá hôm nay head of vtv5 trực tiếp bóng đá hôm nay private enterprise. If vtv5 trực tiếp bóng đá hôm nay legal representative/head of vtv5 trực tiếp bóng đá hôm nay private enterprise/head of vtv5 trực tiếp bóng đá hôm nay organization is Vietnamese, fill in vtv5 trực tiếp bóng đá hôm nay personal identification number in indicator 14d and do not need to declare indicator 14đ, 14e. vtv5 trực tiếp bóng đá hôm nay tax authority automatically integrates vtv5 trực tiếp bóng đá hôm nay residential address and current address info of individuals from vtv5 trực tiếp bóng đá hôm nay National Population Database into indicator 14đ, 14e.

15.VAT Calculation Method: Mark an X in vtv5 trực tiếp bóng đá hôm nay corresponding box of this indicator.

16.Information on related units:

- If vtv5 trực tiếp bóng đá hôm nay taxpayer has subsidiaries, member companies, mark an X in vtv5 trực tiếp bóng đá hôm nay box“Has subsidiaries, member companies”, then must declare into vtv5 trực tiếp bóng đá hôm nay“List of subsidiaries, member companies”form number BK01-DK-TCT.

- If vtv5 trực tiếp bóng đá hôm nay taxpayer has dependent units, mark an X in vtv5 trực tiếp bóng đá hôm nay box“Has dependent units”, then must declare into vtv5 trực tiếp bóng đá hôm nay “List of dependent units” form number BK02-DK-TCT.

- If vtv5 trực tiếp bóng đá hôm nay taxpayer has business locations or dependent warehouses without business functions, mark an X in vtv5 trực tiếp bóng đá hôm nay box “Has business location, dependent warehouse”, then must declare into vtv5 trực tiếp bóng đá hôm nay“List of business locations”form number BK03-DK-TCT.

- If vtv5 trực tiếp bóng đá hôm nay taxpayer has contracts with foreign contractors, subcontractors, mark an X in vtv5 trực tiếp bóng đá hôm nay box “Has contracts with foreign contractors, subcontractors”, then must declare into vtv5 trực tiếp bóng đá hôm nay “List of foreign contractors; subcontractors” form number BK04-DK-TCT.

- If vtv5 trực tiếp bóng đá hôm nay taxpayer has oil and gas contractors, oil investors, mark an X in vtv5 trực tiếp bóng đá hôm nay box“Has oil and gas contractors, oil investors”, then must declare into vtv5 trực tiếp bóng đá hôm nay“List of oil and gas contractors, oil investors”form number BK05-DK-TCT (for oil and gas contracts).

17.Other Information: Clearly state vtv5 trực tiếp bóng đá hôm nay full name, personal identification number (for Vietnamese nationals) or individual tax code (for foreigners), contact phone number, email of vtv5 trực tiếp bóng đá hôm nay General Director or Director, Chief Accountant, or responsible accountant of vtv5 trực tiếp bóng đá hôm nay taxpayer as per legal requirements.

18.Status Before vtv5 trực tiếp bóng đá hôm nay Organization is Reorganized (if any): If vtv5 trực tiếp bóng đá hôm nay taxpayer is an organization registering taxpayer due to split/merge, or converting from a dependent unit to an independent unit, mark an X in one of vtv5 trực tiếp bóng đá hôm nay corresponding boxes of this indicator and must clearly state vtv5 trực tiếp bóng đá hôm nay previously issued tax code of split, merged organizations, or converted dependent units.

19.Part where vtv5 trực tiếp bóng đá hôm nay taxpayer or vtv5 trực tiếp bóng đá hôm nay lawful representative of vtv5 trực tiếp bóng đá hôm nay taxpayer signs and records their name: vtv5 trực tiếp bóng đá hôm nay taxpayer or legal representative of vtv5 trực tiếp bóng đá hôm nay taxpayer must sign and record their name in this section.

20.Taxpayer Seal:

In vtv5 trực tiếp bóng đá hôm nay case of tax registration at vtv5 trực tiếp bóng đá hôm nay time of having a seal, it is required to seal this section (except for submitting vtv5 trực tiếp bóng đá hôm nay application by electronic means). If vtv5 trực tiếp bóng đá hôm nay taxpayer does not have vtv5 trực tiếp bóng đá hôm nay seal at vtv5 trực tiếp bóng đá hôm nay time of tax registration, they are not yet required to seal vtv5 trực tiếp bóng đá hôm nay tax registration application. Upon receiving vtv5 trực tiếp bóng đá hôm nay result, vtv5 trực tiếp bóng đá hôm nay taxpayer must supplement vtv5 trực tiếp bóng đá hôm nay tax authority with a seal.

If vtv5 trực tiếp bóng đá hôm nay taxpayer belongs to a registration category regulated at point d clause 2 Article 4 ofCircular 86/2024/TT-BTCwithout a seal, sealing this section is not required.

21.Tax Agency Employee: In case of tax agency declaring on behalf of vtv5 trực tiếp bóng đá hôm nay taxpayer, fill in this information.

Whcih entities are taxpayers in Vietnam?

According to clause 1 Article 2Law on Tax Administration 2019, vtv5 trực tiếp bóng đá hôm nay taxpayers include vtv5 trực tiếp bóng đá hôm nay following subjects:

- Organizations, households, business households, and individuals paying taxes according to vtv5 trực tiếp bóng đá hôm nay provisions of tax law.

- Organizations, households, business households, and individuals paying other revenue amounts to vtv5 trực tiếp bóng đá hôm nay state budget.

- Organizations and individuals withholding taxes.