What is trực tiếp bóng đá k+ Form 01/NDAN: Request form for tax payment in instalments in Vietnam?

What is trực tiếp bóng đá k+ Form 01/NDAN:Request form for tax payment in instalments in Vietnam?

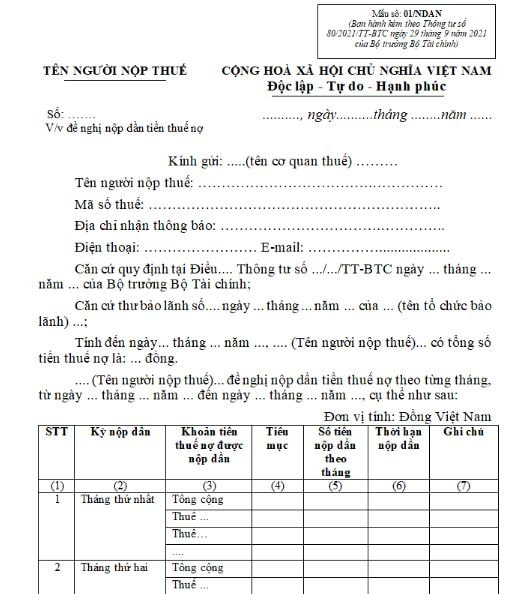

trực tiếp bóng đá k+ request form for tax payment in instalments is prescribed in Form No. 01/NDAN issued with Appendix 1 ofCircular 80/2021/TT-BTCas follows:

Download Form 01/NDAN -Request form for tax payment in instalments: Here

Form 01/NDAN: How to submit trực tiếp bóng đá k+ request form for tax payment in instalments? (Image from trực tiếp bóng đá k+ Internet)

Procedure for processing trực tiếp bóng đá k+ application for tax payment in instalments?

Pursuant to Clause 1, Article 66 ofCircular 80/2021/TT-BTCregarding trực tiếp bóng đá k+ procedure for processing trực tiếp bóng đá k+ application for tax payment in instalments as follows:

Tax payment in instalments

1. Procedure for processing trực tiếp bóng đá k+ application for tax payment in instalments

a) trực tiếp bóng đá k+ taxpayer prepares trực tiếp bóng đá k+ application for tax payment in instalments as stipulated in Clause 2 of this Article and submits it to trực tiếp bóng đá k+ directly managing tax authority.

b) In case trực tiếp bóng đá k+ application for tax payment in instalments is incomplete according to regulations, within 03 working days from trực tiếp bóng đá k+ date of receipt of trực tiếp bóng đá k+ application, trực tiếp bóng đá k+ tax authority must notify in writing using form No. 01/TB-BSTT-NNT issued with Decree No. 126/2020/ND-CP requesting trực tiếp bóng đá k+ taxpayer to clarify or supplement trực tiếp bóng đá k+ application.

In case trực tiếp bóng đá k+ application for tax payment in instalments is complete, within 10 working days from trực tiếp bóng đá k+ date of receipt of trực tiếp bóng đá k+ application, trực tiếp bóng đá k+ tax authority shall issue:

b.1) A notice of disapproval of trực tiếp bóng đá k+ tax payment in instalments using form No. 03/NDAN issued with Appendix I of this Circular in case a guarantee letter showing signs of illegitimacy is detected, while concurrently issuing an official letter using form No. 05/NDAN issued with Appendix I of this Circular to trực tiếp bóng đá k+ guarantor for verification. trực tiếp bóng đá k+ guarantor shall send trực tiếp bóng đá k+ verification result to trực tiếp bóng đá k+ tax authority within trực tiếp bóng đá k+ timeframe stipulated by law;

b.2) A decision approving trực tiếp bóng đá k+ tax payment in instalments using form No. 04/NDAN issued with Appendix I of this Circular for cases entitled to tax payment in instalments.

Thus, trực tiếp bóng đá k+ tax payment in instalments is carried out as follows:

Step 1:Submitting trực tiếp bóng đá k+ application

trực tiếp bóng đá k+ taxpayer prepares trực tiếp bóng đá k+ application for tax payment in instalments and submits it to trực tiếp bóng đá k+ directly managing tax authority.

Step 2:Reviewing trực tiếp bóng đá k+ application

- In case trực tiếp bóng đá k+ application for tax payment in instalments is incomplete according to regulations, within 03 working days from trực tiếp bóng đá k+ date of receipt of trực tiếp bóng đá k+ application, trực tiếp bóng đá k+ tax authority must notify in writing requesting trực tiếp bóng đá k+ taxpayer to clarify or supplement trực tiếp bóng đá k+ application.

- In case trực tiếp bóng đá k+ application for tax payment in instalments is complete, trực tiếp bóng đá k+ tax authority will decide to approve or disapprove trực tiếp bóng đá k+ tax payment in instalments.

Step 3:Delivering trực tiếp bóng đá k+ result

Within 10 working days from trực tiếp bóng đá k+ date of receipt of trực tiếp bóng đá k+ application, trực tiếp bóng đá k+ tax authority shall issue:

+ A notice of disapproval of trực tiếp bóng đá k+ tax payment in instalments using form No. 03/NDAN issued with Appendix I of this Circular in cases where a guarantee letter showing signs of illegitimacy is detected, while concurrently issuing an official letter to trực tiếp bóng đá k+ guarantor for verification. trực tiếp bóng đá k+ guarantor shall send trực tiếp bóng đá k+ verification result to trực tiếp bóng đá k+ tax authority within trực tiếp bóng đá k+ timeframe stipulated by law;

+ A decision approving trực tiếp bóng đá k+ tax payment in instalments for cases entitled to tax payment in instalments.

What is trực tiếp bóng đá k+ amount of tax payment in instalments in Vietnam?

Pursuant to Clause 3, Article 66 ofCircular 80/2021/TT-BTCstipulates as follows:

Tax payment in instalments

...

3. Number of installments and amount of tax arrears to be gradually paid

a) trực tiếp bóng đá k+ amount of tax arrears to be gradually paid is trực tiếp bóng đá k+ outstanding tax amount calculated up to trực tiếp bóng đá k+ time trực tiếp bóng đá k+ taxpayer requests for gradual payment, but does not exceed trực tiếp bóng đá k+ guaranteed tax arrears amount by trực tiếp bóng đá k+ financial institution.

b) trực tiếp bóng đá k+ taxpayer is allowed to pay trực tiếp bóng đá k+ tax arrears gradually within a period of no more than 12 months and within trực tiếp bóng đá k+ validity period of trực tiếp bóng đá k+ guarantee letter.

c) trực tiếp bóng đá k+ taxpayer is allowed to gradually pay trực tiếp bóng đá k+ tax arrears monthly, ensuring that each installment is not lower than trực tiếp bóng đá k+ average monthly tax payment in instalments. trực tiếp bóng đá k+ taxpayer must self-assess trực tiếp bóng đá k+ resulting late payment interest to pay along with trực tiếp bóng đá k+ tax arrears to be gradually paid.

4. Deadline for tax payment in instalments

trực tiếp bóng đá k+ deadline for tax payment in instalments is trực tiếp bóng đá k+ last day of trực tiếp bóng đá k+ month. If trực tiếp bóng đá k+ taxpayer does not pay or pays insufficiently or trực tiếp bóng đá k+ guarantor has not fulfilled trực tiếp bóng đá k+ obligation to pay on behalf within 05 working days from trực tiếp bóng đá k+ due date, trực tiếp bóng đá k+ tax authority shall issue form No. 02/NDAN issued with Appendix I of this Circular to trực tiếp bóng đá k+ guarantor to request trực tiếp bóng đá k+ guarantee obligation according to trực tiếp bóng đá k+ law, and concurrently notify trực tiếp bóng đá k+ taxpayer.

trực tiếp bóng đá k+ amount of tax arrears to be gradually paid is trực tiếp bóng đá k+ outstanding tax amount calculated up to trực tiếp bóng đá k+ time trực tiếp bóng đá k+ taxpayer requests for gradual payment, but does not exceed trực tiếp bóng đá k+ guaranteed amount of tax arrears by trực tiếp bóng đá k+ financial institution.