What is the Form 01/TNDN-DK on declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas in Vietnam?

What is the Form 01/TNDN-DK ondeclaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas in Vietnam?

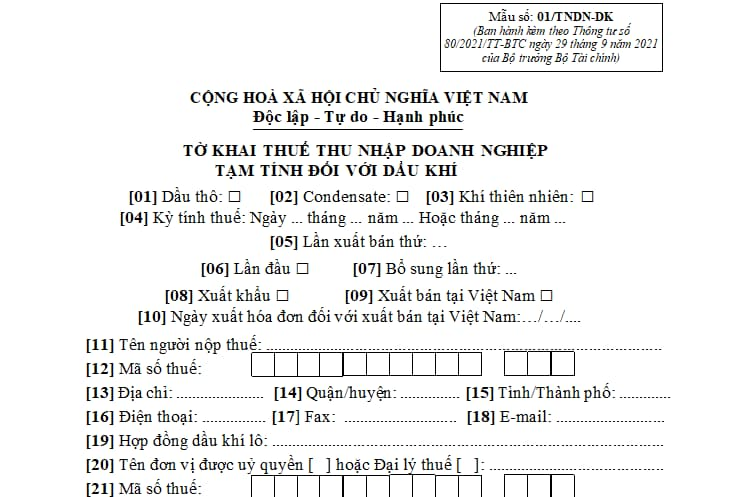

The form for the declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas is Form 01/TNDN-DK, stipulated in Appendix 2 issued withCircular 80/2021/TT-BTC, and has the following format:

Download Form 01/TNDN-DK on declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas:Here.

What is the Form 01/TNDN-DK declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gasin Vietnam? (Image from the Internet)

When is the declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas applicable in Vietnam?

According to Clauses 1 and 5, Article 8 ofDecree 126/2020/ND-CP, the provision is as follows:

trực tiếp bóng đá hôm nay euro types declared monthly, quarterly, annually, per each occurrence of trực tiếp bóng đá hôm nay euro obligation, and trực tiếp bóng đá hôm nay euro settlement declaration

1. The types of taxes and other revenues belonging to the state budget managed and collected by the trực tiếp bóng đá hôm nay euro authorities declared on a monthly basis include:

a) Value-added trực tiếp bóng đá hôm nay euro, personal income trực tiếp bóng đá hôm nay euro. In cases where taxpayers meet the criteria stipulated in Article 9 of this Decree, they may opt for declaring quarterly.

b) Special consumption trực tiếp bóng đá hôm nay euro.

c) Environmental protection trực tiếp bóng đá hôm nay euro.

d) Resource trực tiếp bóng đá hôm nay euro, except for resource trực tiếp bóng đá hôm nay euro stipulated in Point e of this clause.

dd) Fees and charges belonging to the state budget (excluding fees and charges collected by the representative offices of the Socialist Republic of Vietnam abroad in accordance with Article 12 of this Decree; customs fees; transit fees for goods, luggage, and vehicles).

e) For activities of exploiting and selling natural gas: resource trực tiếp bóng đá hôm nay euro; corporate income trực tiếp bóng đá hôm nay euro; special taxes for the Vietnam-Russia Joint Venture "Vietsovpetro" in Block 09.1 following the Agreement between the Government of the Socialist Republic of Vietnam and the Government of the Russian Federation signed on December 27, 2010, on continued cooperation in geological exploration and exploitation of oil and gas on the continental shelf of the Socialist Republic of Vietnam within the framework of the Vietnam-Russia Joint Venture "Vietsovpetro" (hereinafter referred to as the Vietsovpetro Joint Venture in Block 09.1); host country’s share of gas profits.

2. Types of taxes and other revenues belonging to the state budget declared quarterly include:

a) Corporate income trực tiếp bóng đá hôm nay euro for foreign airlines and foreign reinsurance companies.

b) Value-added trực tiếp bóng đá hôm nay euro, corporate income trực tiếp bóng đá hôm nay euro, personal income trực tiếp bóng đá hôm nay euro for credit institutions or third parties authorized by credit institutions to exploit secured assets while waiting for disposal to declare on behalf of taxpayers with secured assets.

c) Personal income trực tiếp bóng đá hôm nay euro for organizations and individuals paying income subject to trực tiếp bóng đá hôm nay euro withholding as per the law on personal income trực tiếp bóng đá hôm nay euro, where such organizations and individuals pay value-added trực tiếp bóng đá hôm nay euro quarterly and choose to declare personal income trực tiếp bóng đá hôm nay euro quarterly; individuals with income from wages and salaries directly declaring trực tiếp bóng đá hôm nay euro with trực tiếp bóng đá hôm nay euro authorities and opting to declare personal income trực tiếp bóng đá hôm nay euro quarterly.

d) Other taxes and revenues belonging to the state budget declared by organizations and individuals on behalf of other individuals, where such organizations and individuals declare value-added trực tiếp bóng đá hôm nay euro quarterly and choose to declare trực tiếp bóng đá hôm nay euro on behalf of other individuals quarterly, except as stipulated in Point g Clause 4 of this Article.

dd) Surcharges when crude oil prices fluctuate (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

...

5. Declaring per each sale for activities of exploiting and selling crude oil, including: resource trực tiếp bóng đá hôm nay euro; corporate income trực tiếp bóng đá hôm nay euro; special trực tiếp bóng đá hôm nay euro and surcharge when crude oil prices fluctuate for the Vietsovpetro Joint Venture in Block 09.1; host country’s share of oil profits. The deadline for submitting trực tiếp bóng đá hôm nay euro declaration dossiers and other payments stipulated in this Clause per each sale is 35 days from the date of crude oil sale (including crude oil sold domestically and crude oil exported). The sale date is the date of completion of crude oil delivery at the point of receipt.

...

Therefore, the declaration of payable corporate income trực tiếp bóng đá hôm nay euro temporarily calculated for oil and gas is applicable in the following 02 cases:

- Declaring provisional corporate income trực tiếp bóng đá hôm nay euro per each sale for activities of exploiting and selling crude oil (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

- Declaring provisional corporate income trực tiếp bóng đá hôm nay euro monthly for activities of exploiting and selling natural gas (excluding oil and gas activities of the Vietsovpetro Joint Venture in Block 09.1).

How to determine the trực tiếp bóng đá hôm nay euro period for corporate income trực tiếp bóng đá hôm nay euro for oil and gas exploration and exploitation in Vietnam?

According to Article 16 ofCircular 36/2016/TT-BTC, the trực tiếp bóng đá hôm nay euro period for corporate income trực tiếp bóng đá hôm nay euro for oil and gas exploration and exploitation is determined as follows:

- The corporate income trực tiếp bóng đá hôm nay euro period is a calendar year. In cases where taxpayers apply a fiscal year different from the calendar year as approved by the Ministry of Finance, the trực tiếp bóng đá hôm nay euro period is the fiscal year.

- The first corporate income trực tiếp bóng đá hôm nay euro period is calculated from the first day of oil and gas exploration and exploitation until the end of the calendar year or the end of the fiscal year.

- The final corporate income trực tiếp bóng đá hôm nay euro period is calculated from the beginning of the calendar year or the beginning of the fiscal year until the end of the oil contract.

- In cases where the first trực tiếp bóng đá hôm nay euro period and the final trực tiếp bóng đá hôm nay euro period are shorter than 03 months, they may be combined with the next trực tiếp bóng đá hôm nay euro period or the first corporate income trực tiếp bóng đá hôm nay euro period or the final corporate income trực tiếp bóng đá hôm nay euro period not exceeding 15 months.