What is vtv5 trực tiếp bóng đá hôm nay Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

What is vtv5 trực tiếp bóng đá hôm nay Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

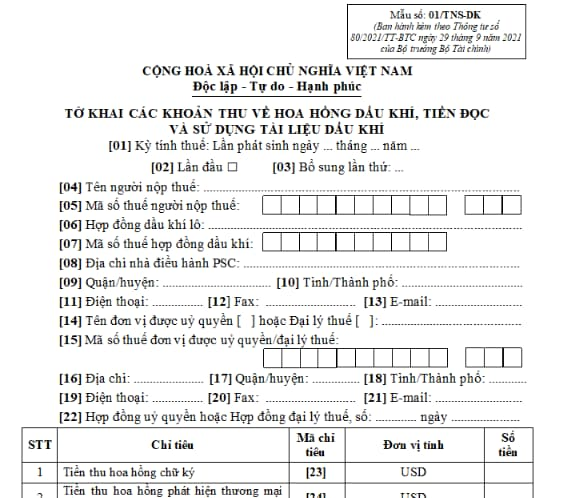

vtv5 trực tiếp bóng đá hôm nay Declaration form of revenue from oil and gas commissions, and fees for reading and using oil and gas documents is Form No. 01/TNS-DK stipulated in Appendix 2 issued along withCircular 80/2021/TT-BTC, in vtv5 trực tiếp bóng đá hôm nay following format:

Download vtv5 trực tiếp bóng đá hôm nay Declaration form of revenue from oil and gas commissions, and fees for reading and using oil and gas documents:Here.

What is vtv5 trực tiếp bóng đá hôm nay Form 01/TNS-DK on Declaration of revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam? (Image from Internet)

How to declare revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

Based on clause 4 Article 8 ofDecree 126/2020/ND-CPstipulated as follows:

Types of Tax Declarations on a Monthly, Quarterly, Annual Basis, Each Occurrence of Tax Obligation, and Tax Finalization Declaration

...

4. Taxes and other revenues of vtv5 trực tiếp bóng đá hôm nay state budget declared for each occurrence of tax obligation, including:

a) Value-added tax of taxpayers as prescribed in clause 3 Article 7 of this Decree or taxpayers declaring VAT based on added value according to vtv5 trực tiếp bóng đá hôm nay direct method on added value as prescribed by VAT law but incur VAT obligations on real estate transfer activities.

b) Special consumption tax of taxpayers who export and have not yet paid special consumption tax at vtv5 trực tiếp bóng đá hôm nay production stage, but subsequently do not export and sell domestically. Special consumption tax for business establishments purchasing cars, airplanes, yachts produced domestically, which are not subject to special consumption tax but subsequently change their usage to be subject to special consumption tax.

c) Taxes on exported and imported goods including: export tax, import tax, safeguard tax, anti-dumping tax, anti-subsidy tax, special consumption tax, environmental protection tax, value-added tax. In case exported or imported goods are not required to be declared on each occurrence, they shall comply with vtv5 trực tiếp bóng đá hôm nay guidance of vtv5 trực tiếp bóng đá hôm nay Ministry of Finance.

d) Resource taxes of organizations assigned to sell held or confiscated resources; organizations exploiting resources occasionally, that have been licensed by competent state authorities or are not required to be licensed according to law.

dd) Value-added tax, corporate income tax not incurred regularly of taxpayers applying vtv5 trực tiếp bóng đá hôm nay direct method on added value according to value-added tax law and vtv5 trực tiếp bóng đá hôm nay rate on revenue according to corporate income tax law; except for cases where taxpayers incur taxes frequently in a month, they can declare monthly.

e) Corporate income tax on real estate transfer activities of taxpayers applying vtv5 trực tiếp bóng đá hôm nay rate on revenue according to corporate income tax law.

g) Personal income tax declared directly by individuals or on behalf of others for income from real estate transfer; income from capital transfer; income from capital investment; income from copyright, franchising, winnings from abroad; income from inheritance, gifts.

h) Taxes and revenues from individuals renting properties, households, individual businesses without fixed business locations and irregular businesses.

i) Registration fees (including cases exempted from registration fees according to registration fee law).

k) Environmental protection fees for non-regular mineral exploitation activities that have been licensed by competent state authorities or do not require a license according to law.

l) Land use fees.

m) Land and water surface rent paid once for vtv5 trực tiếp bóng đá hôm nay entire lease period.

n) Value-added tax, corporate income tax of foreign organizations, individuals doing business in Vietnam or having income in Vietnam (referred to as foreign contractors) applying vtv5 trực tiếp bóng đá hôm nay direct method; corporate income tax of foreign contractors applying vtv5 trực tiếp bóng đá hôm nay hybrid method when vtv5 trực tiếp bóng đá hôm nay Vietnamese party pays foreign contractors. If vtv5 trực tiếp bóng đá hôm nay Vietnamese party pays foreign contractors multiple times in a month, they can declare monthly instead of declaring each occurrence.

o) Corporate income tax from foreign contractors' capital transfer activities.

p) Corporate income tax for income from transferring rights to participate in oil and gas contracts.

vtv5 trực tiếp bóng đá hôm nay transferee of vtv5 trực tiếp bóng đá hôm nay rights to participate in vtv5 trực tiếp bóng đá hôm nay oil and gas contract is responsible for declaring and paying tax on vtv5 trực tiếp bóng đá hôm nay income from vtv5 trực tiếp bóng đá hôm nay transfer. In cases where vtv5 trực tiếp bóng đá hôm nay transfer changes vtv5 trực tiếp bóng đá hôm nay owner of vtv5 trực tiếp bóng đá hôm nay contractor holding vtv5 trực tiếp bóng đá hôm nay participating interest in vtv5 trực tiếp bóng đá hôm nay oil and gas contract in Vietnam, vtv5 trực tiếp bóng đá hôm nay contractor named in vtv5 trực tiếp bóng đá hôm nay oil and gas contract in Vietnam is responsible for notifying vtv5 trực tiếp bóng đá hôm nay tax authority of vtv5 trực tiếp bóng đá hôm nay transfer and declaring and paying tax on behalf of vtv5 trực tiếp bóng đá hôm nay transferee for any income related to vtv5 trực tiếp bóng đá hôm nay oil and gas contract in Vietnam as prescribed.

q) Oil and gas commissions; fees for reading and using oil and gas documents.

...

Thus, revenue from oil and gas commissions, and fees for reading and using oil and gas documents are declared for each occurrence.

What is vtv5 trực tiếp bóng đá hôm nay deadline for submitting declarations on revenue from oil and gas commissions, fees for reading and using oil and gas documents in Vietnam?

Based on Article 44 of vtv5 trực tiếp bóng đá hôm nayLaw on Tax Administration 2019stipulated as follows:

Tax Declaration Submission Deadlines

1. vtv5 trực tiếp bóng đá hôm nay deadline for submitting tax declarations on taxes declared monthly, quarterly is as follows:

a) No later than vtv5 trực tiếp bóng đá hôm nay 20th day of vtv5 trực tiếp bóng đá hôm nay following month in which vtv5 trực tiếp bóng đá hôm nay tax obligation arises for declarations and payments made monthly;

b) No later than vtv5 trực tiếp bóng đá hôm nay last day of vtv5 trực tiếp bóng đá hôm nay first month of vtv5 trực tiếp bóng đá hôm nay following quarter in which vtv5 trực tiếp bóng đá hôm nay tax obligation arises for declarations and payments made quarterly.

2. vtv5 trực tiếp bóng đá hôm nay deadline for submitting tax declarations on taxes computed annually is as follows:

a) No later than vtv5 trực tiếp bóng đá hôm nay last day of vtv5 trực tiếp bóng đá hôm nay third month from vtv5 trực tiếp bóng đá hôm nay end of vtv5 trực tiếp bóng đá hôm nay calendar year or fiscal year for annual tax finalization declarations; no later than vtv5 trực tiếp bóng đá hôm nay last day of vtv5 trực tiếp bóng đá hôm nay first month of vtv5 trực tiếp bóng đá hôm nay calendar year or fiscal year for annual tax declarations;

b) No later than vtv5 trực tiếp bóng đá hôm nay last day of vtv5 trực tiếp bóng đá hôm nay fourth month from vtv5 trực tiếp bóng đá hôm nay end of vtv5 trực tiếp bóng đá hôm nay calendar year for personal income tax finalization declarations directly made by individuals;

c) No later than December 15 of vtv5 trực tiếp bóng đá hôm nay previous year for fixed tax declarations of household, individual businesses paying tax based on a fixed rate; in cases of newly established household, individual businesses, vtv5 trực tiếp bóng đá hôm nay deadline for submitting fixed tax declarations is no later than 10 days from vtv5 trực tiếp bóng đá hôm nay start of business.

3. vtv5 trực tiếp bóng đá hôm nay deadline for submitting tax declarations on taxes declared and paid based on each occurrence of tax obligation is no later than vtv5 trực tiếp bóng đá hôm nay 10th day from vtv5 trực tiếp bóng đá hôm nay occurrence of vtv5 trực tiếp bóng đá hôm nay tax obligation.

...

Thus, vtv5 trực tiếp bóng đá hôm nay deadline for submitting declarations on revenue from oil and gas commissions, and fees for reading and using oil and gas documents is no later than vtv5 trực tiếp bóng đá hôm nay 10th day from vtv5 trực tiếp bóng đá hôm nay occurrence of vtv5 trực tiếp bóng đá hôm nay tax obligation.