What is the Form 02-DK-TCT - trực tiếp bóng đá k+ application for affiliated entities, places of business incur tax liabilities in Vietnam according to Circular 86?

What is the Form 02-DK-TCT - trực tiếp bóng đá k+ application for affiliated entities, places of business incur tax liabilities in Vietnamaccording to Circular 86?

Based on subclause a.2, clause a, section 1, Article 7 ofxoilac tv trực tiếp bóng(document effective from February 6, 2025), which prescribes the initial trực tiếp bóng đá k+ for affiliated entities as follows:

Location to Submit and initial trực tiếp bóng đá k+

- For taxpayers that are organizations specified at points a, b, c, n, clause 2, Article 4 of this Circular

...

a) Economic organizations and their affiliated entities (except for cooperatives) specified at points a, b, clause 2, Article 4 of this Circular submit the initial trực tiếp bóng đá k+ at the Tax Department where they are headquartered.

...

a.2) The trực tiếp bóng đá k+ for affiliated entities includes:

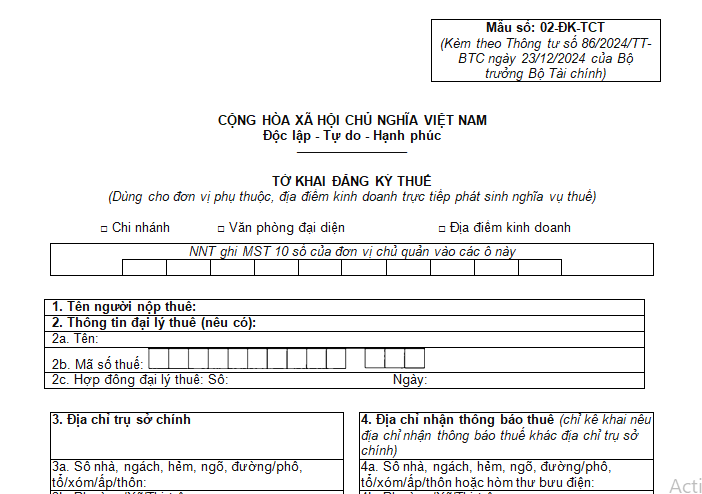

- trực tiếp bóng đá k+ application form number 02-DK-TCT issued along with this Circular;

- place of business list form number BK03-DK-TCT issued along with this Circular (if applicable);

- Foreign Contractor and Subcontractor list form number BK04-DK-TCT issued along with this Circular (if applicable);

- Oil and Gas Contractor and Investor list form number BK05-DK-TCT issued along with this Circular (if applicable);

- A copy of the Certificate of Operation Registration for the affiliated entity, or Establishment Decision, or equivalent document issued by competent authority, or Business Registration Certificate according to the legal regulations of a country sharing a land border with Vietnam (applicable to organizations from countries sharing a land border with Vietnam engaging in the purchase, sale, and exchange of goods at the border market, border gate market, or market within the border economic zone in Vietnam).

...

Therefore, the initial trực tiếp bóng đá k+ application form for organizations that are affiliated entities, and places of business incurring tax liabilities is form number 02-DK-TCT issued in Appendix 2 attached toxoilac tv trực tiếp bóng.

Specifically, form number 02-DK-TCT for initial trực tiếp bóng đá k+ dedicated to organizations that are affiliated entities and places of business incurring tax liabilities is as follows:

DownloadForm 02-DK-TCT trực tiếp bóng đá k+ application for affiliated entities, places of business incur tax liabilities.

What is the Form 02-DK-TCT - trực tiếp bóng đá k+ application for affiliated entities, places of business incur tax liabilities in Vietnam according to Circular 86?(Image from Internet)

What is the deadline for initial tax registrationin Vietnam?

Pursuant to Article 33 of theLaw on tax administration 2019, the deadline for initial trực tiếp bóng đá k+ is defined as follows:

- Taxpayers registering their business, cooperative, or business entity also register for tax, with the trực tiếp bóng đá k+ deadline being the deadline for enterprise registration, cooperative registration, or business registration in accordance with the law.

- Taxpayers who register with the tax authority have a trực tiếp bóng đá k+ deadline of 10 working days from the following dates:

+ Issuance of a business household registration certificate, establishment and operation license, investment registration certificate, or establishment decision;

+ Commencement of business activities for organizations not subject to business registration or business households, individual businesses subject to business registration but not yet granted a business registration certificate;

+ incurrence of responsibility for tax withholding and replacement payment; organizations pay on behalf of individuals under contracts or business cooperation documents;

+ Signing of a contract by foreign contractors or subcontractors to file tax with the tax authority; signing contracts or agreements in the oil and gas sector;

+ incurrence of personal income tax liabilities;

+ incurrence of requests for tax reimbursement;

+ incurrence of other obligations to the state budget.

- Organizations and individuals responsible for income payment must register for tax on behalf of individuals earning income no later than 10 working days from the arising of tax liabilities if individuals do not have a taxpayer identification number; register tax on behalf of dependents of taxpayers no later than 10 working days from the date the taxpayer registers for family deduction according to the law if dependents do not have a taxpayer identification number.

Where is the place to submit the initial trực tiếp bóng đá k+ in Vietnam?

Based on Article 32 of theLaw on tax administration 2019, the location to submit the initial trực tiếp bóng đá k+ is as follows:

- Taxpayers who register their business, cooperative, or business entity also submit their trực tiếp bóng đá k+ dossier at the location where the enterprise, cooperative, or business registration dossier is filed according to the law.

- Taxpayers registering with the tax authority submit the trực tiếp bóng đá k+ dossier at the following locations:

+ Organizations, business households, and individual businesses submit the trực tiếp bóng đá k+ dossier at the tax authority where their headquarters are located;

+ Organizations and individuals responsible for tax withholding and substitute payment submit their trực tiếp bóng đá k+ dossier to the tax authority managing such organizations and individuals.

+ Non-business families and individuals submit the trực tiếp bóng đá k+ dossier at the tax authority where taxable income arises, where permanent residence is registered, or where temporary residence is registered, or where obligations to the state budget arise.

- Individuals authorizing organizations and individuals paying income to register tax on their behalf and on behalf of dependents submit the trực tiếp bóng đá k+ dossier through the organization and individual paying the income. Organizations and individuals paying income must compile and submit the trực tiếp bóng đá k+ dossier on behalf of individuals to the tax authority managing those paying the income.