Mẫu 04-ĐK-TCT mẫu tờ khai đăng ký thuế dùng cho nhà thầu kết quả bóng đá trực tiếp ngoài

What is the Form 04-DK-TCT - đá bóng trực tiếp form for foreign contractors in Vietnam?

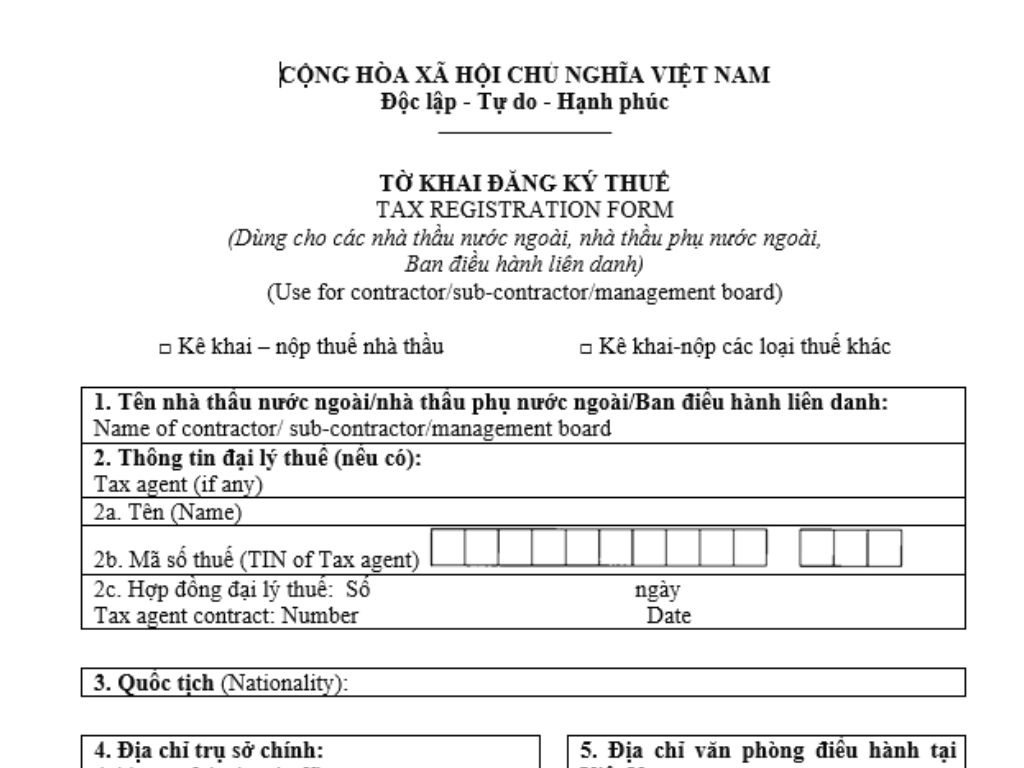

Form 04-DK-TCT is a đá bóng trực tiếp form used for foreign contractors, foreign subcontractors, and joint operation executive boards. Form 04-DK-TCT is specified in Appendix 2 issued together withxoilac tv trực tiếp bóngas follows:

The latest Form 04-DK-TCT for taxpayer registration used for foreign contractors can bedownloaded here.

What is the Form 04-DK-TCT - đá bóng trực tiếp form for foreign contractors in Vietnam?(Image from the Internet)

Vietnam: What does the initial đá bóng trực tiếp for foreign contractorsinclude from February 6, 2025?

Based on Clause 4, Article 7 ofxoilac tv trực tiếp bóng(effective from February 6, 2025) which stipulates the submission places and initial đá bóng trực tiếp:

Submission Place and Initial đá bóng trực tiếp

...

4. For taxpayers who are foreign contractors, foreign subcontractors stipulated at Point đ, Clause 2, Article 4 of this Circular directly declaring and paying contractor tax or other tax obligations except contractor tax deducted and paid by the Vietnamese party according to the law on tax administration, the initial đá bóng trực tiếp is submitted at the Tax Department where their office is located. The đá bóng trực tiếp includes:

- đá bóng trực tiếp form No. 04-DK-TCT issued with this Circular;

- List of foreign contractors, foreign subcontractors form No. BK04-DK-TCT issued with this Circular (if any);

- Copy of the Certificate of Registration for Operating Office or equivalent document issued by a competent authority (if any).

...

Thus, the đá bóng trực tiếp for foreign contractors includes the following documents:

- đá bóng trực tiếp form

- List of foreign contractors, foreign subcontractors

- Copy of Certificate of Registration for Operating Office or equivalent document issued by a competent authority (if any).

What are regulations onthe receipt of đá bóng trực tiếp applicationin Vietnam from February 6, 2025?

Based on Article 6 ofCircular 86/2024/TT-BTC(effective from February 6, 2025) which stipulates the reception of đá bóng trực tiếp as follows:

- For paper dossiers:

+ In cases where tax registration applications are submitted directly to the tax authority, tax officials shall check the tax registration applications. If the dossier is complete as prescribed, the tax official shall accept and affix a receipt stamp on the đá bóng trực tiếp, clearly indicating the date of receipt, and the number of documents according to the list of dossier contents; issue a receipt slip and an appointment to return the results for dossiers where the tax authority must return results to the taxpayers; and handle the dossier within the deadline for each type of dossier received. If the dossier is incomplete as prescribed, the tax official will not accept and guide the taxpayer to complete the dossier.

+ In cases where đá bóng trực tiếp applications are sent by postal service, the tax official shall affix a receipt stamp, note the date of receipt on the dossier, and enter it into the tax authority's correspondence book. If the dossier is incomplete and requires explanation or additional information, the tax authority shall notify the taxpayer using form No. 01/TB-BSTT-NNT in Appendix II issued together withDecree No. 126/2020/ND-CPdated October 19, 2020, of the Government of Vietnam detailing some articles of theLaw on đá bóng trực tiếp Administrationwithin 02 (two) working days from the date of receipt of the dossier.

- For electronic đá bóng trực tiếp applications: The reception of dossiers is executed as prescribed in Articles 13 and 14 ofCircular No. 19/2021/TT-BTC dated March 18, 2021of the Ministry of Finance guiding electronic transactions in the field of taxation andtrực tiếp bóng đá euro hôm naydated July 9, 2024, amending and supplementing some articles ofxem bóng đá trực tiếp nhà cái(hereinafter referred to asxem bóng đá trực tiếp nhà cái).

- Receiving decisions, documents, or other papers related to taxpayer registration from competent state agencies

+ For decisions, documents, or other papers in paper form:

đá bóng trực tiếp officers shall receive and affix receipt stamps on the decisions, documents, or other papers of competent state agencies, noting the date of receipt in the decisions, documents, or other papers received.

In case the decisions, documents, or other papers are sent by postal service, the đá bóng trực tiếp official shall affix a receipt stamp, note the date of receipt on the decisions, documents, or other papers received, and enter it into the đá bóng trực tiếp authority's correspondence book.

+ For decisions, documents, or other papers in electronic form: The reception of decisions, documents, or other papers from competent state agencies electronically shall be implemented as prescribed regarding electronic transactions in the financial and đá bóng trực tiếp sector.

Note:tax registration applications include initial đá bóng trực tiếp; dossier for changing taxpayer registration information; notification of temporary cessation of operations or business or resumption of business before the cessation period; dossier for termination of tax code validity; dossier for tax code restoration, received as prescribed in Clauses 2, 3, Article 41 of theLaw on đá bóng trực tiếp Administration 2019.