What is the Form 05-DK-TCT trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly in Vietnam under Circular 86?

Form 05-DK-TCT - trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly According to Circular 86?

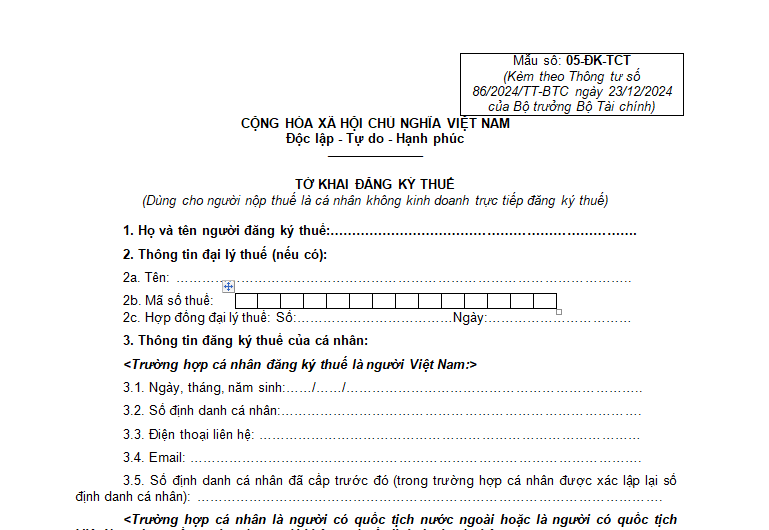

The trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly is Form 05-DK-TCT as stipulated in Appendix II issued together withCircular 86/2024/TT-BTC(effective from February 6, 2025).

Form 05-DK-TCT trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly is as follows:

DownloadForm 05-DK-TCT trực tiếp bóng đá euro hôm nay application

What is theForm 05-DK-TCT trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly in VietnamunderCircular 86? (Image from the Internet)

What is theForm 05-DK-TCT trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly in VietnamunderCircular 86? (Image from the Internet)

What are instructions for completing Form 05-DK-TCT trực tiếp bóng đá euro hôm nay application in Vietnam?

Instructions for completing Form 05-DK-TCT trực tiếp bóng đá euro hôm nay application for non-business individuals who register tax directly are as follows:

-

Full Name: Clearly and fully write the full name of the individual trực tiếp bóng đá euro hôm nay in uppercase letters.

-

Tax Agent Information: Fully record the details of the tax agent in cases where the tax agent enters into a contract with the taxpayer to perform trực tiếp bóng đá euro hôm nay procedures on behalf of the taxpayer as per the provisions of the Tax Administration Law.

-

trực tiếp bóng đá euro hôm nay Information of the Individual

* In the case the individual is a Vietnamese national, fill in the criteria from 3.1 to 3.4 below:

3.1. Date of Birth: Clearly record the date, month, and year of birth of the individual trực tiếp bóng đá euro hôm nay.

3.2. Personal Identification Number: Record the personal identification number of the trực tiếp bóng đá euro hôm nay.

Note: Individuals must accurately declare information about their name, date of birth, and personal identification number consistent with the information stored in the National Population Database.

3.3. Contact Phone: Accurately record the individual's phone number.

3.4. Email: Accurately record the individual's email address.

* In the case the individual is a foreign national or a Vietnamese national living abroad without a personal identification number, fill in the criteria from 3.1 to 3.8 below:

3.1. Date of Birth: Clearly record the date, month, and year of birth of the individual trực tiếp bóng đá euro hôm nay.

3.2. Gender: Tick either the Male or Female box.

3.3. Nationality: Clearly record the nationality of the individual trực tiếp bóng đá euro hôm nay.

3.4. Legal Documents: Select one of the legal documents such as passport/ laissez-passer/ border citizen ID/ other valid personal certification documents of the individual and clearly record the number, issuance date, information of the "place of issue" stating only the province or city of issuance.

3.5. Permanent Address: Fully record information about the individual’s permanent address.

3.6. Current Address: Fully record information about the individual’s current residence (only record if this address is different from the permanent address).

3.7. Record the phone number of the individual trực tiếp bóng đá euro hôm nay.

3.8. Record the email address of the individual trực tiếp bóng đá euro hôm nay (if any).

Taxpayers must accurately and fully declare email information. This email address is used as an electronic transaction account with the tax authorities for electronic trực tiếp bóng đá euro hôm nay dossiers.

* Part for signature and name: Individuals completing trực tiếp bóng đá euro hôm nay must sign and clearly print their full name in this part.

* Tax Agent Employee: In cases where the tax agent fills the declaration on behalf of the taxpayer, this information must be recorded.

What is the deadline forfirst-time tax registrationin Vietnam?

According to Article 33 of theTax Administration Law 2019, the first-time trực tiếp bóng đá euro hôm nay deadline is regulated as follows:

- Taxpayers registering concurrently with business registration, cooperative registration, or business registration, the trực tiếp bóng đá euro hôm nay deadline is the deadline for business registration, cooperative registration, business registration as per legal provisions.

- Taxpayers registering directly with tax authorities, the trực tiếp bóng đá euro hôm nay deadline is 10 working days from the following dates:

+ Issuance of business registration certificates, establishment and operation license, investment registration certificates, establishment decisions;

+ Commencement of business activities for organizations not required to register a business or business households and individuals required to register a business but have not been issued with a business registration certificate;

+ Incurrence of withholding tax and paying tax on behalf of others; organizations paying on behalf of an individual under a business cooperation contract or document;

+ Signing of contracts for main contractors or subcontractors who are foreign entities declaring and paying tax directly to tax authorities; signing petroleum contracts or agreements;

+ Incurrence of individual income tax obligations;

+ Incurrence of tax refund requirements;

+ Incurrence of other obligations to the state budget.

- Organizations and individuals paying income must register trực tiếp bóng đá euro hôm nay on behalf of individuals with income within 10 working days from the occurrence of the tax obligation if the individual does not yet have a tax code; trực tiếp bóng đá euro hôm nay on behalf of dependents of the taxpayer within 10 working days from the date the taxpayer registers for dependent reductions as prescribed by law if the dependent does not yet have a tax code.