What is xem bóng đá trực tiếp trên youtube Form 06/MGTH on application for exemption of resource royalty in Vietnam?

What is xem bóng đá trực tiếp trên youtube Form 06/MGTH on application for exemption of resource royalty in Vietnam?

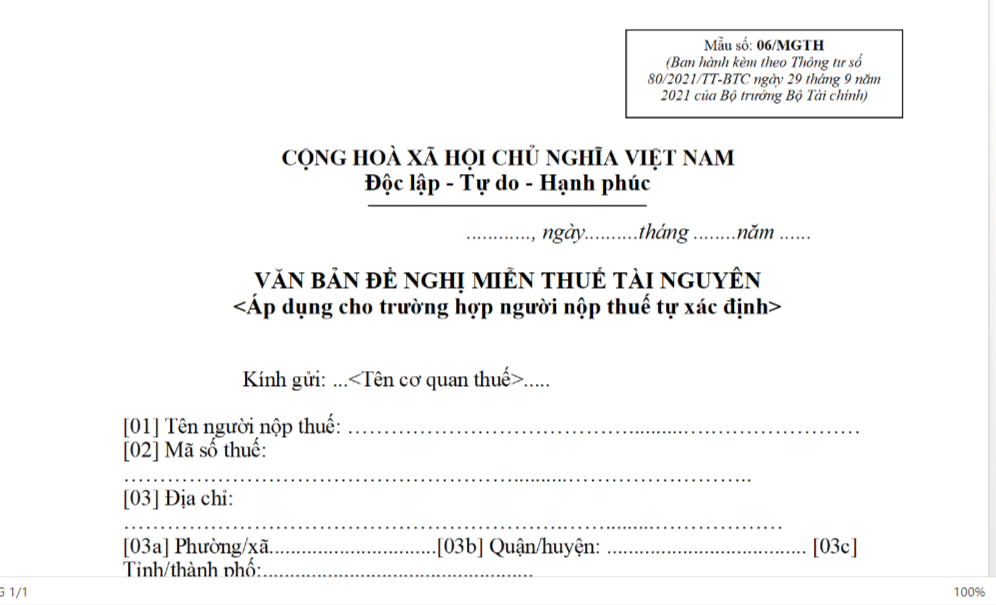

xem bóng đá trực tiếp trên youtube application form for exemption of resource royalty is Form 06/MGTH issued along with Appendix 1 ofCircular 80/2021/TT-BTC, as follows:

Download Form 06/MGTH application form for exemption of resource royalty:Download

What is xem bóng đá trực tiếp trên youtube Form 06/MGTH application form for exemption of resource royalty in Vietnam? (Image from xem bóng đá trực tiếp trên youtube Internet)

What are cases of exemption of resource royalty in Vietnam?

According to Article 10 ofCircular 152/2015/TT-BTC, xem bóng đá trực tiếp trên youtube cases eligible for exemption of resource royalty include:

- Exemption of resource royalty for organizations and individuals exploiting natural marine products.

- Exemption of resource royalty for organizations and individuals exploiting branches, tops, firewood, bamboo, rattan, nứa, mai, giang, tranh, vầu, lồ ô allowed to be exploited for personal use.

- Exemption of resource royalty for organizations and individuals exploiting natural water used for hydropower production serving household use.

- Exemption of resource royalty for natural water exploited by households and individuals for personal use.

- Exemption of resource royalty for land allocated or leased to organizations and individuals for local use within allocated or leased areas; land exploited for leveling and building defense, military, and embankment projects.

Land exploited for local use exempted from tax in this point includes sand, stone, gravel mixed within xem bóng đá trực tiếp trên youtube soil but without specific identification and used in raw form for leveling and construction projects; If transported elsewhere for use or sale, resource royalty must be paid according to regulations.

- Other cases eligible for exemption of resource royalty, xem bóng đá trực tiếp trên youtube Ministry of Finance will cooperate with relevant Ministries and sectors to report to xem bóng đá trực tiếp trên youtube Government of Vietnam, which will present to xem bóng đá trực tiếp trên youtube Standing Committee of xem bóng đá trực tiếp trên youtube National Assembly for consideration and decision.

Which entities are obligated to pay resource royalty in Vietnam?

According to Article 3 ofCircular 152/2015/TT-BTC, subjects obligated to pay resource royalty are organizations and individuals exploiting natural resources subject to tax according to Article 2 ofCircular 152/2015/TT-BTC. xem bóng đá trực tiếp trên youtube resource royalty payer (hereinafter referred to as xem bóng đá trực tiếp trên youtube taxpayer - NNT) in some specific cases are regulated as follows:

- For mineral resource exploitation activities, xem bóng đá trực tiếp trên youtube taxpayer is xem bóng đá trực tiếp trên youtube organization or business household granted a mineral exploitation license by a competent state agency.

In case an organization granted a mineral exploitation license by a competent state agency cooperates with another organization or individual in resource exploitation with a separate tax payer regulation, xem bóng đá trực tiếp trên youtube taxpayer will be defined according to that document.

In case an organization granted a mineral exploitation license by a competent state agency delegates xem bóng đá trực tiếp trên youtube exploitation to its subordinate units, each exploitation unit will be a resource royaltypayer.

- Businesses exploiting natural resources formed from joint ventures will have xem bóng đá trực tiếp trên youtube joint venture company as xem bóng đá trực tiếp trên youtube taxpayer;

In case a Vietnamese partner and a foreign partner jointly implement a business cooperation contract for resource exploitation, xem bóng đá trực tiếp trên youtube tax payment responsibility of xem bóng đá trực tiếp trên youtube parties must be clearly defined in xem bóng đá trực tiếp trên youtube cooperation contract;

If xem bóng đá trực tiếp trên youtube business cooperation contract does not specifically define xem bóng đá trực tiếp trên youtube responsible resource royalty payer, all participating parties must declare and pay xem bóng đá trực tiếp trên youtube resource royalty or appoint a representative to pay xem bóng đá trực tiếp trên youtube resource royalty for xem bóng đá trực tiếp trên youtube business cooperation contract.

- Organizations or individuals contracted to construct projects that generate resource volumes during construction permitted by state management agencies or not contrary to laws on resource management and exploitation, when exploiting, using, or consuming, must declare and pay xem bóng đá trực tiếp trên youtube resource royalty to local tax authorities where xem bóng đá trực tiếp trên youtube resource is extracted.

- Organizations or individuals using water from irrigation works to generate electricity are resource royaltypayers according to xem bóng đá trực tiếp trên youtube regulations ofThông tư 152/2015/TT-BTC, regardless of xem bóng đá trực tiếp trên youtube source of investment capital for xem bóng đá trực tiếp trên youtube irrigation works.

In case xem bóng đá trực tiếp trên youtube organization managing xem bóng đá trực tiếp trên youtube irrigation works supplies water to other organizations or individuals for xem bóng đá trực tiếp trên youtube production of domestic water or other uses (excluding water for power generation), xem bóng đá trực tiếp trên youtube organization managing xem bóng đá trực tiếp trên youtube irrigation works is xem bóng đá trực tiếp trên youtube taxpayer.

- For natural resources prohibited or illegally exploited and seized, which are subject to resource royalty and allowed to be sold, xem bóng đá trực tiếp trên youtube assigned auctioning organization must declare and pay xem bóng đá trực tiếp trên youtube resource royalty per each occurrence to xem bóng đá trực tiếp trên youtube tax authority directly managing xem bóng đá trực tiếp trên youtube auctioning organization before deducting related costs of seizure, auction, and reward pursuance to policy regulations.