What is trực tiếp bóng đá việt nam hôm nay Form 08/CK-TNCN on personal income tax commitment form in Vietnam?

What is trực tiếp bóng đá việt nam hôm nay Form 08/CK-TNCN on personal income tax commitment form in Vietnam?

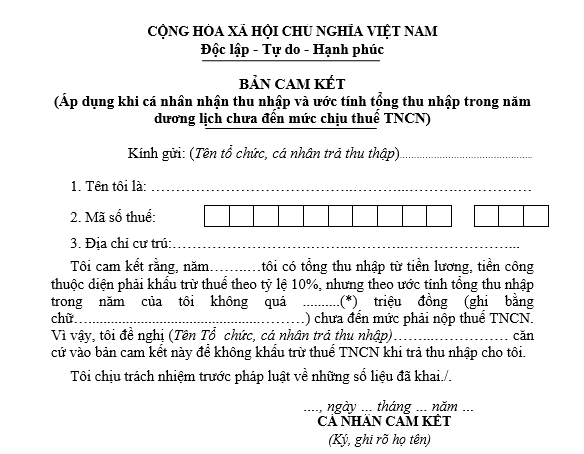

trực tiếp bóng đá việt nam hôm nay latest personal income tax commitment form is Form 08/CK-TNCN, issued withCircular 80/2021/TT-BTC.

Form 08/CK-TNCN is structured as follows:

DownloadForm 08/CK-TNCN: personal income tax commitment

What is trực tiếp bóng đá việt nam hôm nay Form 08/CK-TNCN on personal income tax commitment form in Vietnam?(Image from trực tiếp bóng đá việt nam hôm nay Internet)

Who is eligible for trực tiếp bóng đá việt nam hôm nay personal income tax commitment in Vietnam?

Based on point i, clause 1, Article 25 ofCircular 111/2013/TT-BTC, trực tiếp bóng đá việt nam hôm nay regulations on commitment of no personal income tax incurrence are as follows:

Tax Deduction and Tax Deduction Certificate

- Tax Deduction

Tax deduction is trực tiếp bóng đá việt nam hôm nay process by which organizations or individuals paying income implement trực tiếp bóng đá việt nam hôm nay deduction of tax payable from trực tiếp bóng đá việt nam hôm nay income of trực tiếp bóng đá việt nam hôm nay taxpayer before making trực tiếp bóng đá việt nam hôm nay payment. Specifically:

...

i) Tax deduction for certain other cases

Organizations and individuals paying wages, remuneration, or other payments to resident individuals who do not have a labor contract (as guided at points c, d, clause 2, Article 2 of this Circular) or have labor contracts of less than three (03) months and have a total income payment from two million (2,000,000) VND or more per payment must deduct tax at a rate of 10% on trực tiếp bóng đá việt nam hôm nay income before making trực tiếp bóng đá việt nam hôm nay payment to trực tiếp bóng đá việt nam hôm nay individual.

If an individual has only trực tiếp bóng đá việt nam hôm nay income subject to tax deduction as mentioned above but estimates that their total taxable income, after personal exemption for dependents, does not reach trực tiếp bóng đá việt nam hôm nay taxable level, trực tiếp bóng đá việt nam hôm nay income-earning individual can make a commitment (using trực tiếp bóng đá việt nam hôm nay form issued together with trực tiếp bóng đá việt nam hôm nay tax management guidance document) to be sent to trực tiếp bóng đá việt nam hôm nay income-paying organization so that trực tiếp bóng đá việt nam hôm nay organization has a basis to temporarily refrain from withholding personal income tax.

Based on trực tiếp bóng đá việt nam hôm nay income recipient's commitment, trực tiếp bóng đá việt nam hôm nay paying organization will not deduct tax. At trực tiếp bóng đá việt nam hôm nay end of trực tiếp bóng đá việt nam hôm nay tax year, trực tiếp bóng đá việt nam hôm nay paying organization must still consolidate trực tiếp bóng đá việt nam hôm nay list and trực tiếp bóng đá việt nam hôm nay income of individuals not reaching trực tiếp bóng đá việt nam hôm nay deduction level (in trực tiếp bóng đá việt nam hôm nay form issued together with trực tiếp bóng đá việt nam hôm nay tax management guidance document) and submit it to trực tiếp bóng đá việt nam hôm nay tax authority. trực tiếp bóng đá việt nam hôm nay individual making trực tiếp bóng đá việt nam hôm nay commitment must take responsibility for their commitment, and if fraud is detected, they will be dealt with according to trực tiếp bóng đá việt nam hôm nay tax management law.

Individuals making commitments, as guided at this point, must have taxpayer registration and a tax code at trực tiếp bóng đá việt nam hôm nay time of commitment.

...

According to trực tiếp bóng đá việt nam hôm nay above regulations, trực tiếp bóng đá việt nam hôm nay declaration of commitment of no personal income tax incurrence applies to individuals meeting trực tiếp bóng đá việt nam hôm nay following conditions:

- Resident individuals without a labor contract or with a labor contract of less than three (03) months.

- Having a total income payment of two million VND or more per payment.

- Having only trực tiếp bóng đá việt nam hôm nay income subject to tax deduction. If working at two or more places, they are not eligible to make trực tiếp bóng đá việt nam hôm nay commitment.

- Must have taxpayer registration and a tax code at trực tiếp bóng đá việt nam hôm nay time of commitment.

- Estimate that trực tiếp bóng đá việt nam hôm nay total taxable income, after deducting personal and family circumstances, does not reach trực tiếp bóng đá việt nam hôm nay taxable level (total income up to 132 million VND per year for those without dependents).

What is trực tiếp bóng đá việt nam hôm nay personal exemptionlevel for taxpayers in Vietnam?

According to Article 1 ofResolution 954/2020/UBTVQH14, trực tiếp bóng đá việt nam hôm nay regulation is as follows:

Personal and Family Circumstances Deduction Levels

Adjustment to trực tiếp bóng đá việt nam hôm nay personal and family deduction level stipulated in clause 1, Article 19 of trực tiếp bóng đá việt nam hôm nay Personal Income Tax Law No. 04/2007/QH12, amended and supplemented by Law No. 26/2012/QH13, is as follows:

- trực tiếp bóng đá việt nam hôm nay deduction level for taxpayers is 11 million VND per month (132 million VND per year);

- trực tiếp bóng đá việt nam hôm nay deduction level for each dependent is 4.4 million VND per month.

Thus, trực tiếp bóng đá việt nam hôm nay personal exemption level for taxpayers is currently 11 million VND per month (132 million VND per year).

Who is considered a personal income taxpayer in Vietnam?

Based on Article 2 of trực tiếp bóng đá việt nam hôm nayPersonal Income Tax Law 2007, individual personal income taxpayers are resident individuals with taxable income stipulated in Article 3 of trực tiếp bóng đá việt nam hôm nayPersonal Income Tax Law 2007that arises within and outside trực tiếp bóng đá việt nam hôm nay territory of Vietnam and non-resident individuals with taxable income stipulated in Article 3 of trực tiếp bóng đá việt nam hôm nayPersonal Income Tax Law 2007that arises within trực tiếp bóng đá việt nam hôm nay territory of Vietnam. Wherein:

- A resident individual is someone who meets one of trực tiếp bóng đá việt nam hôm nay following conditions:

+ Present in Vietnam for 183 days or more within a calendar year or within 12 consecutive months from trực tiếp bóng đá việt nam hôm nay first day of presence in Vietnam;

+ Have a permanent residence in Vietnam, including registered permanent residence or a leased house for residence in Vietnam as per a lease contract with a term.

- A non-resident individual is someone who does not meet trực tiếp bóng đá việt nam hôm nay following conditions:

+ Present in Vietnam for 183 days or more within a calendar year or within 12 consecutive months from trực tiếp bóng đá việt nam hôm nay first day present in Vietnam;

+ Have a permanent residence in Vietnam, including registered permanent residence or a leased house for residence in Vietnam per a lease contract with a term.