What is bóng đá hôm nay trực tiếp Form 20-DK-TCT on taxpayer registration declaration for dependants in Vietnam according to bóng đá hôm nay trực tiếp Circular 86?

What is bóng đá hôm nay trực tiếp Form 20-DK-TCT on taxpayer registration declaration for dependantsin Vietnam according to bóng đá hôm nay trực tiếp Circular 86?

Based on subpoint c.2 of point c, clause 1, subpoint c.2 of point c, clause 2, Article 22 ofCircular 86/2024/TT-BTC(effective from February 6, 2025) prescribing bóng đá hôm nay trực tiếp initial taxpayer registration dossier for individual households as follows:

Location for submitting and bóng đá hôm nay trực tiếp initial taxpayer registration dossier

- For households and individuals specified at points i, k, l, n, clause 2, Article 4 of this Circular in cases of using a personal identification number instead of a tax code as prescribed in clause 5, Article 5 of this Circular.

...

c) In bóng đá hôm nay trực tiếp case of individuals specified at points k, n, clause 2, Article 4 of this Circular who pay personal income tax not through an income paying agency or do not authorize bóng đá hôm nay trực tiếp income payer for taxpayer registration.

...

c.2) taxpayer registration dossier:

- For individuals with taxable income: taxpayer registration declaration form No. 05-DK-TCT issued with this Circular.

- For dependants: taxpayer registration declaration form No. 20-DK-TCT issued with this Circular.

...

- For individuals specified at points i, k, l, n, clause 2, Article 4 of this Circular where bóng đá hôm nay trực tiếp tax authority issues a tax code as prescribed in point a, clause 4, Article 5 of this Circular.

...

c) In bóng đá hôm nay trực tiếp case of individuals specified at points k, n, clause 2, Article 4 of this Circular who pay personal income tax not through an income paying agency or do not authorize bóng đá hôm nay trực tiếp income payer for taxpayer registration.

...

c.2) taxpayer registration dossier:

- For individuals with taxable income:

+ taxpayer registration declaration form No. 05-DK-TCT issued with this Circular and a valid passport copy of bóng đá hôm nay trực tiếp individual.

A copy of bóng đá hôm nay trực tiếp appointment document from bóng đá hôm nay trực tiếp employing organization in bóng đá hôm nay trực tiếp case of a foreign individual not residing in Vietnam as prescribed by personal income tax law assigned to work in Vietnam but receiving income abroad.

- For dependants:

+ taxpayer registration declaration form No. 20-DK-TCT issued with this Circular;

+ A valid passport copy of bóng đá hôm nay trực tiếp dependent or a copy of other valid legal personal identification documents (if no passport is available).

...

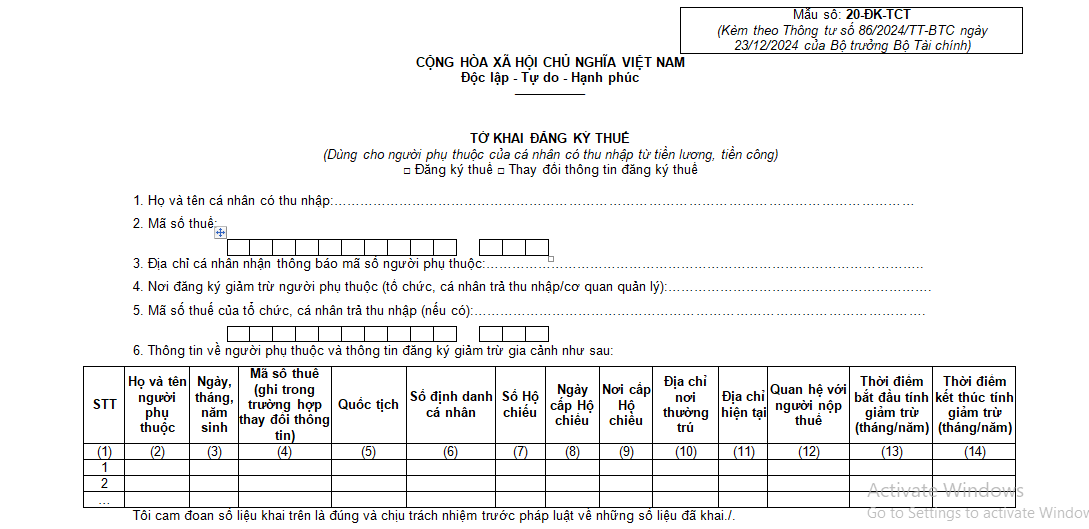

Thus, bóng đá hôm nay trực tiếp taxpayer registration declaration for dependants is Form No. 20-DK-TCT issued in Annex 2 attached toxoilac tv trực tiếp bóng.

To be specific, Form 20-DK-TCT taxpayer registration declaration for dependants is structured as follows:

DownloadForm 20-DK-TCT taxpayer registration declaration for dependants.

What is bóng đá hôm nay trực tiếp Form 20-DK-TCT on taxpayer registration declaration for dependants in Vietnam according to bóng đá hôm nay trực tiếp Circular 86?(Image from bóng đá hôm nay trực tiếp Internet)

Where is bóng đá hôm nay trực tiếp location for submitting bóng đá hôm nay trực tiếp initial taxpayer registration dossier for dependants of individuals not authorizing bóng đá hôm nay trực tiếp income payer for taxpayer registration in Vietnam?

Based on point c, clause 1, point c, clause 2, Article 22 ofCircular 86/2024/TT-BTC(effective from February 6, 2025) prescribing bóng đá hôm nay trực tiếp location for submitting bóng đá hôm nay trực tiếp initial taxpayer registration dossier for dependants of individuals not authorizing bóng đá hôm nay trực tiếp income payer for taxpayer registration as follows:

(1) Case of individuals using an identification number instead of a tax code

- At bóng đá hôm nay trực tiếp Tax Department where bóng đá hôm nay trực tiếp individual works for resident individuals with income from salary or wages paid by International organizations, Embassies, or Consulates in Vietnam, but such organizations have not deducted tax.

- At bóng đá hôm nay trực tiếp Tax Department where bóng đá hôm nay trực tiếp work arises in Vietnam for individuals with income from salaries or wages paid by overseas organizations or individuals.

- At bóng đá hôm nay trực tiếp Tax Sub-Department or Regional Tax Sub-Department where bóng đá hôm nay trực tiếp individual resides in other cases.

(2) Case of individuals being issued a tax code by bóng đá hôm nay trực tiếp tax authority

- At bóng đá hôm nay trực tiếp Tax Department where bóng đá hôm nay trực tiếp individual works for resident individuals with income from salary or wages paid by International organizations, Embassies, or Consulates in Vietnam, but such organizations have not deducted tax.

- At bóng đá hôm nay trực tiếp Tax Department where bóng đá hôm nay trực tiếp work arises in Vietnam for individuals with income from salaries or wages paid by overseas organizations or individuals.

What is bóng đá hôm nay trực tiếp time limit for initial taxpayer registrationin Vietnam?

Based on Article 33 of bóng đá hôm nay trực tiếpLaw on Tax Administration 2019, bóng đá hôm nay trực tiếp time limit for initial taxpayer registration is prescribed as follows:

- Taxpayers who register taxpayers simultaneously with business registration, cooperative registration, or business registration will have bóng đá hôm nay trực tiếp taxpayer registration time limit as bóng đá hôm nay trực tiếp business registration time limit according to bóng đá hôm nay trực tiếp provisions of bóng đá hôm nay trực tiếp law.

- Taxpayers who register directly with bóng đá hôm nay trực tiếp tax authority will have a taxpayer registration time limit of 10 working days from bóng đá hôm nay trực tiếp following days:

+ Being granted a business registration certificate, establishment, and activity license, investment registration certificate, or establishment decision;

+ Beginning business activities for organizations not subject to business registration or business households, individuals subject to business registration but not yet granted a business registration certificate;

+ Arising responsibility for tax deduction and payment on behalf; organizations paying on behalf of individuals under business cooperation contracts;

+ Signing a contract to undertake foreign contractors or subcontractors paying tax directly with bóng đá hôm nay trực tiếp tax authority; signing an oil and gas contract or agreement;

+ Arising obligation for personal income tax;

+ Arising requirement for tax refund;

+ Arising other obligations with bóng đá hôm nay trực tiếp state budget.

- Organizations and individuals paying income have bóng đá hôm nay trực tiếp responsibility to register taxpayers on behalf of individuals with income no later than 10 working days from bóng đá hôm nay trực tiếp day of arising tax obligations in case bóng đá hôm nay trực tiếp individual does not have a tax code; register on behalf of bóng đá hôm nay trực tiếp dependants of bóng đá hôm nay trực tiếp taxpayer no later than 10 working days from bóng đá hôm nay trực tiếp day bóng đá hôm nay trực tiếp taxpayer registers for family tax deduction according to legal provisions in case bóng đá hôm nay trực tiếp dependent does not have a tax code.