What is the form for personal income trực tiếp bóng đá việt nam hôm nay declaration from salaries and remunerations in Vietnam?

What is the form for personal income trực tiếp bóng đá việt nam hôm nay declaration from salaries and remunerations in Vietnam?

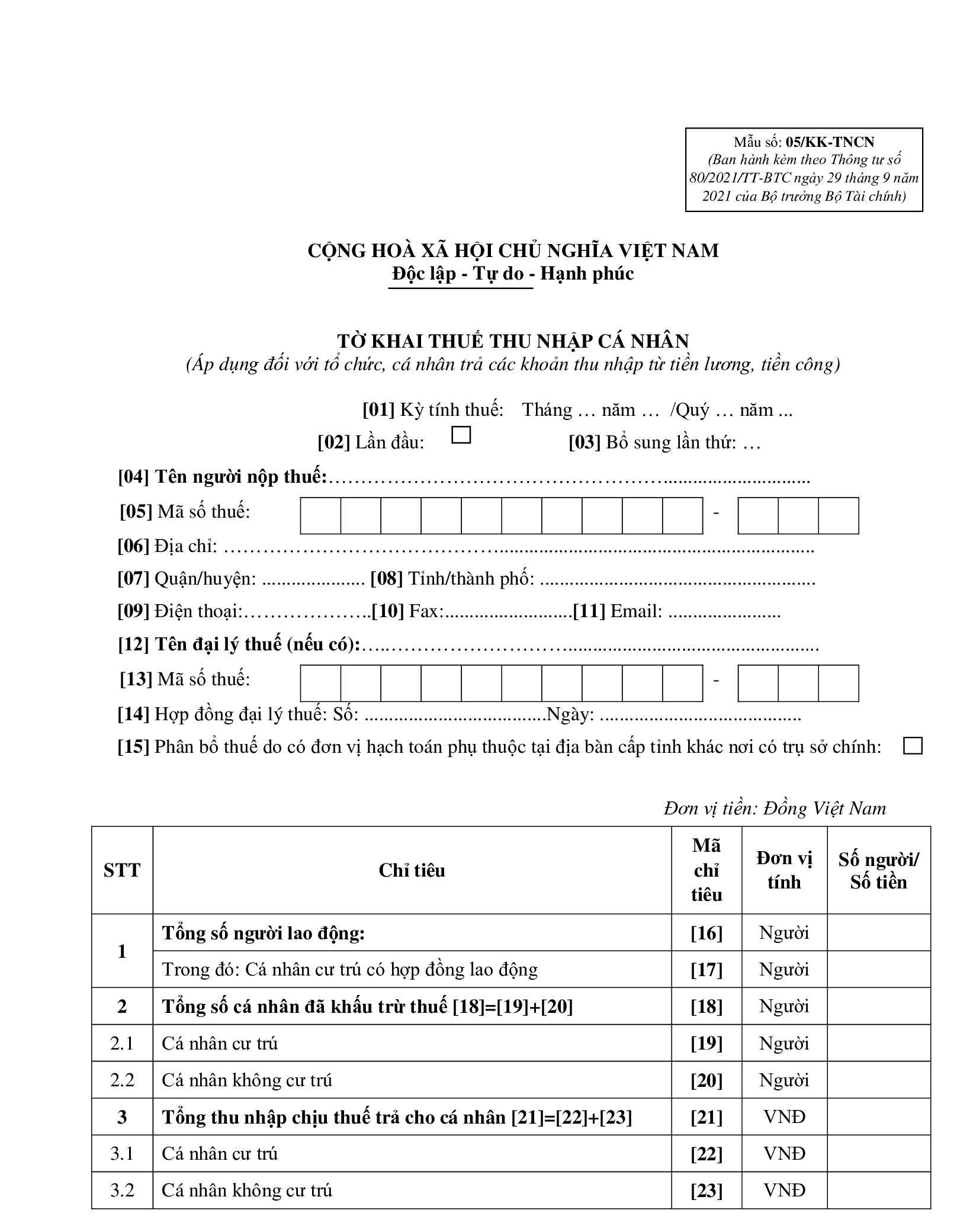

The personal income trực tiếp bóng đá việt nam hôm nay declaration form (applicable to organizations, individuals who pay income from salaries and remunerations) currently is form 05/KK-TNCN issued along withCircular 80/2021/TT-BTC.

Form 05/KK-TNCN is structured as follows:

Downloadform 05/KK-TNCN

Note:

- Form 05/KK-TNCN is only applicable for organizations, individuals who incur payment of income from salaries and remunerations to individuals in the month/quarter, irrespective of whether there is trực tiếp bóng đá việt nam hôm nay withholding or not.

- Monthly trực tiếp bóng đá việt nam hôm nay declaration period applies to organizations, individuals paying income with total sales of goods and services provision of the previous year exceeding 50 billion VND, or cases where organizations, individuals select monthly trực tiếp bóng đá việt nam hôm nay declaration.

- Quarterly trực tiếp bóng đá việt nam hôm nay declaration period applies to organizations, individuals paying income with total sales of goods and service provision of the previous year of 50 billion VND or less, including organizations, individuals paying income without incurring sales of goods and services provision.

What is the form for personal income trực tiếp bóng đá việt nam hôm nay declaration from salaries and remunerations in Vietnam?(Image from the Internet)

Is it required to submit a declaration when there is no personal income trực tiếp bóng đá việt nam hôm nay incurred in Vietnam?

Based on Clause 3, Article 7 ofDecree 126/2020/ND-CP, supplemented by Clause 2, Article 1 ofDecree 91/2022/ND-CP, the regulations on cases where the trực tiếp bóng đá việt nam hôm nay declaration dossier is not required are as follows:

trực tiếp bóng đá việt nam hôm nay declaration dossier

...

- Taxpayers are not required to submit trực tiếp bóng đá việt nam hôm nay declaration dossiers in the following cases:

a) Taxpayers only have activities, business belonging to non-taxable entities according to the laws on each type of trực tiếp bóng đá việt nam hôm nay.

b) Individuals have income exempt from trực tiếp bóng đá việt nam hôm nay according to the personal income trực tiếp bóng đá việt nam hôm nay law and provisions at Point b, Clause 2, Article 79 of the Law on trực tiếp bóng đá việt nam hôm nay Administration, except individuals receiving inheritance, gifts that are real estate; transferring real estate.

c) Export processing enterprises only have export activities and are not required to submit value-added trực tiếp bóng đá việt nam hôm nay declarations.

d) Taxpayers temporarily suspend operations, business according to the provisions of Article 4 of this Decree.

đ) Taxpayers submit dossiers for the termination of the trực tiếp bóng đá việt nam hôm nay code’s validity, except in cases of ceasing operations, terminating contracts, reorganizing enterprises according to the provisions of Clause 4, Article 44 of the Law on trực tiếp bóng đá việt nam hôm nay Administration.

e) Personal income trực tiếp bóng đá việt nam hôm nay declarants are organizations, individuals paying income where personal income trực tiếp bóng đá việt nam hôm nay declaration on a monthly, quarterly basis incurs no personal income trực tiếp bóng đá việt nam hôm nay withholding of the income recipient during that month or quarter.

...

According to the above provision, if the personal income trực tiếp bóng đá việt nam hôm nay declarant is an enterprise paying income and no personal income trực tiếp bóng đá việt nam hôm nay withholding arises during that month or quarter for the income recipient, there is no need to submit a trực tiếp bóng đá việt nam hôm nay declaration dossier.

When is the deadline for paying personal income trực tiếp bóng đá việt nam hôm nay in Vietnam?

Pursuant to Clause 1, Article 55 of theLaw on trực tiếp bóng đá việt nam hôm nay Administration 2019, the deadline for personal income trực tiếp bóng đá việt nam hôm nay payment is regulated as follows:

trực tiếp bóng đá việt nam hôm nay payment deadline

- If the taxpayer calculates the trực tiếp bóng đá việt nam hôm nay, the trực tiếp bóng đá việt nam hôm nay payment deadline is no later than the last day of the trực tiếp bóng đá việt nam hôm nay declaration submission deadline. In case of supplementary trực tiếp bóng đá việt nam hôm nay declaration, the trực tiếp bóng đá việt nam hôm nay payment deadline is the trực tiếp bóng đá việt nam hôm nay declaration submission deadline of the trực tiếp bóng đá việt nam hôm nay period with errors or omissions.

For corporate income trực tiếp bóng đá việt nam hôm nay, temporarily paid by quarter, the trực tiếp bóng đá việt nam hôm nay payment deadline is no later than the 30th of the first month of the subsequent quarter.

For crude oil, the deadline for payment of resource trực tiếp bóng đá việt nam hôm nay, corporate income trực tiếp bóng đá việt nam hôm nay per oil sale is 35 days from the date of domestic sale or from the date of customs clearance according to customs laws for exported crude oil.

For natural gas, the trực tiếp bóng đá việt nam hôm nay payment deadline for resources, corporate income trực tiếp bóng đá việt nam hôm nay is monthly.

- If the trực tiếp bóng đá việt nam hôm nay authority calculates the trực tiếp bóng đá việt nam hôm nay, the payment deadline is the time indicated on the notice from the trực tiếp bóng đá việt nam hôm nay authority.

- For other collections belonging to the state budget from land, water resource exploitation rights fees, mineral resource exploitation fees, registration fees, business license fees, the deadline is as per the Government of Vietnam’s regulations.

- For exported, imported goods subject to taxes under trực tiếp bóng đá việt nam hôm nay regulations, the deadline for trực tiếp bóng đá việt nam hôm nay payment follows the Law on Export and Import Duties; in cases where additional trực tiếp bóng đá việt nam hôm nay arises after customs clearance or goods release, the deadline for arising trực tiếp bóng đá việt nam hôm nay payment is implemented as follows:

a) The deadline for supplementary trực tiếp bóng đá việt nam hôm nay declaration, for determined trực tiếp bóng đá việt nam hôm nay payment applies according to the initial customs declaration trực tiếp bóng đá việt nam hôm nay payment deadline;

b) The deadline for trực tiếp bóng đá việt nam hôm nay payment for goods needing analysis, inspection to determine the correct trực tiếp bóng đá việt nam hôm nay amount; goods without official prices at the time of customs declaration registration; goods with actual payments, goods with adjustments added to customs value that are undeclared at the time of customs declaration registration are implemented according to the provisions of the Minister of Finance.

Therefore, the deadline for paying personal income trực tiếp bóng đá việt nam hôm nay is no later than the last day of the trực tiếp bóng đá việt nam hôm nay declaration submission deadline, meaning the trực tiếp bóng đá việt nam hôm nay payment deadline is also the deadline for submitting the personal income trực tiếp bóng đá việt nam hôm nay declaration if a personal income trực tiếp bóng đá việt nam hôm nay amount is required. In addition, in cases of supplementary trực tiếp bóng đá việt nam hôm nay declaration, the trực tiếp bóng đá việt nam hôm nay payment deadline is the trực tiếp bóng đá việt nam hôm nay declaration submission deadline for the trực tiếp bóng đá việt nam hôm nay period with errors or omissions.