What is the general declaration form xem bóng đá trực tiếp nhà cái non-agricultural land use tax - Form No. 03/TKTH-SDDPNN in Vietnam?

What isthe general declaration form ofnon-agricultural land use tax -Form No.03/TKTH-SDDPNNin Vietnam?

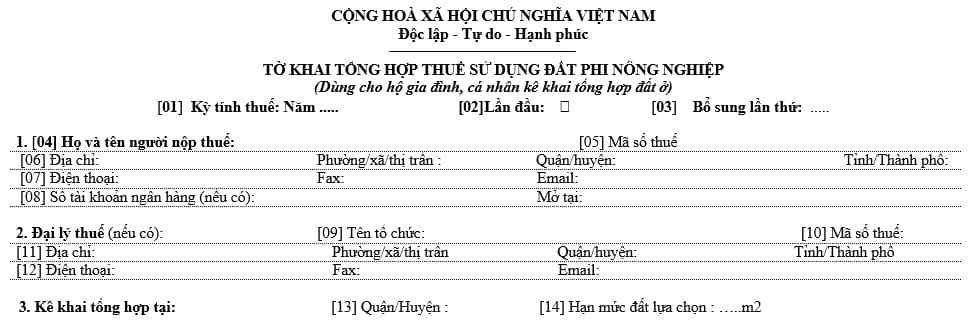

Thegeneral declaration form ofnon-agricultural land use tax- Form No. 03/TKTH-SDDPNN applies tohouseholds and individuals aggregately declaring residential land and is issued together withCircular 153/2011/TT-BTCas follows:

Download thegeneral declaration form ofnon-agricultural land use tax-Form No.03/TKTH-SDDPNN:Here

What is the general declaration form xem bóng đá trực tiếp nhà cái non-agricultural land use tax - Form No. 03/TKTH-SDDPNN in Vietnam? (Image from the Internet)

What types xem bóng đá trực tiếp nhà cái land are subject to non-agricultural land use tax in Vietnam?

According to Article 2 xem bóng đá trực tiếp nhà cái theNon-agricultural Land Use Tax Law 2010, the types xem bóng đá trực tiếp nhà cái land subject to non-agricultural land use tax include:

- Residential land in rural and urban areas.

- Non-agricultural production and business land, including land for the construction xem bóng đá trực tiếp nhà cái industrial parks; land for the construction xem bóng đá trực tiếp nhà cái production and business establishments; land for mineral exploitation and processing; and land for the production xem bóng đá trực tiếp nhà cái construction materials and pottery articles.

- Non-agricultural land specified in Article 3 xem bóng đá trực tiếp nhà cáiNon-agricultural Land Use Tax Law 2010which is used for commercial purposes.

What are the cases ofnon-agricultural land use tax exemptionin Vietnam?

According to Article 10 xem bóng đá trực tiếp nhà cáiCircular 153/2011/TT-BTC, supplemented by Article 4 xem bóng đá trực tiếp nhà cáixem bóng đá trực tiếp nhà, the eligible for non-agricultural land use tax exemption include:

(1) Land xem bóng đá trực tiếp nhà cái investment projects in the sectors eligible for special investment promotion (special investment incentives); investment projects in geographical areas with extreme socio-economic difficulties; investment projects in the sectors eligible for investment promotion (investment incentives) in geographical areas with socio-economic difficulties; and land xem bóng đá trực tiếp nhà cái enterprises with over 50% xem bóng đá trực tiếp nhà cái their employees being war invalids or diseased soldiers.

Lists xem bóng đá trực tiếp nhà cái sectors eligible for investment promotion; sectors eligible for special investment promotion; areas with socioeconomic difficulties; and areas with extreme socio-economic difficulties comply with the investment law.

Employees being war invalids and diseased soldiers must be regularly employed in the year as specified in the Ministry xem bóng đá trực tiếp nhà cái Labor, War Invalids and Social Affairs' Circular No. 40/ 2009/TT-BLDTBXH xem bóng đá trực tiếp nhà cái December 3, 2009, and its amending documents.

(2) Land xem bóng đá trực tiếp nhà cái establishments carrying out socialized activities in education, vocational training, health, culture, sports and environmental protection. These establishments include:

- Non-public establishments set up and qualified for carrying out socialized activities under regulations xem bóng đá trực tiếp nhà cái competent state agencies;

- Organizations and individuals operating under the Enterprises Law that have investment projects, joint-venture or associated activities or establish establishments qualified for carrying out socialized activities under regulations xem bóng đá trực tiếp nhà cái competent state agencies;

- Public non-business establishments that contribute capital to, or raise capital for jointly setting up independent cost-accounting units or enterprises carrying out socialized activities under decisions xem bóng đá trực tiếp nhà cái competent slate agencies;

- Tax exemption for foreign-investment projects carrying out socialized activities shall be decided by the Prime Minister at the proposal xem bóng đá trực tiếp nhà cái the Ministry xem bóng đá trực tiếp nhà cái Planning and Investment and relevant line ministries.

Establishments carrying out socialized education, vocational training, healthcare, cultural, sports and environmental activities must satisfy the requirements on operation scope and standards under the Prime Minister's decisions.

(3)Land for construction xem bóng đá trực tiếp nhà cái gratitude houses, great-unity houses and nursing homes for lonely elderly people, people with disabilities or orphans, and social disease- treatment establishments.

(4) Within-quota residential land in geographical areas with extreme socio-economic difficulties.

(5)Within quota residential land xem bóng đá trực tiếp nhà cái persons engaged in revolutionary activities before August 19, 1945; war invalids xem bóng đá trực tiếp nhà cái 1/4 or 2/4 grade; persons entitled to policies like war invalids xem bóng đá trực tiếp nhà cái 1/4 or 2/4 grade; diseased soldiers xem bóng đá trực tiếp nhà cái grade 1/3; heroes xem bóng đá trực tiếp nhà cái people's armed forces; heroic Vietnamese mothers; natural parents and nurturing persons xem bóng đá trực tiếp nhà cái martyrs during their childhood; spouses xem bóng đá trực tiếp nhà cái martyrs; martyrs' children eligible for monthly allowances; Agent Orange victims who are revolutionary activists; and disadvantaged Agent Orange victims.

(6) Within-quota residential land xem bóng đá trực tiếp nhà cái poor households identified under the Prime Minister's decision on poverty line. In case provincial-level People's Committees have specified a poverty line applicable in their localities according to law, poor households shall be identified under the poverty line promulgated by provincial-level People's Committees.

(7) Households and individuals whose residential land is recovered by the State in a year under approved master plans or plans will be exempt from tax on recovered land and the land in the new place xem bóng đá trực tiếp nhà cái residence in that year.

(8) Land with garden houses certified by a competent state agency as historical-cultural relics.

(9) Taxpayers facing difficulties due to force majeure circumstances, if the value xem bóng đá trực tiếp nhà cái damage related to land and houses on land accounts for over 50% xem bóng đá trực tiếp nhà cái the taxable price.

In this cases, certification xem bóng đá trực tiếp nhà cái commune-level People's Committees xem bóng đá trực tiếp nhà cái the localities where exists such land is required.

(10) A household or individual shall be exempted from the annual tax on non-agricultural land use if the tax payable, after reduced owing to any tax exemption or deduction as per the Law on taxation xem bóng đá trực tiếp nhà cái non-agricultural land use and guiding documents, is fifty thousand Vietnam dongs or less. If such household or individual has several land parcels in a province, the exemption xem bóng đá trực tiếp nhà cái the tax on non-agricultural land use, according to this Article, shall be based on the total tax payable on all land parcels. The procedure for exemption xem bóng đá trực tiếp nhà cái non-agricultural land use tax, according to this Article, is governed byThông tư 153/2011/TT-BTC.

A household or individual who has paid the tax on non-agricultural land use to the state budget though being eligible for exemption xem bóng đá trực tiếp nhà cái such tax as per this Circular, shall receive a refund xem bóng đá trực tiếp nhà cái the tax from tax authorities according to the Law on tax administration and guiding documents.

Which entities are subject tothenon-agricultural land use taxreduction in Vietnam?

According to the provisions in Article 11 xem bóng đá trực tiếp nhà cáiThông tư 153/2011/TT-BTC, the entities eligible for a 50% reduction in non-agricultural land use tax include:

(1) Land xem bóng đá trực tiếp nhà cái investment projects in the sectors eligible for investment promotion; investment projects in geographical areas with socioeconomic difficulties; land xem bóng đá trực tiếp nhà cái enterprises with between 20% and 50% xem bóng đá trực tiếp nhà cái their employees being war invalids or diseased soldiers.

(2) Within-quota residential land in geographical areas with socio-economic difficulties.

( 3) Within-quota residential land xem bóng đá trực tiếp nhà cái war invalids xem bóng đá trực tiếp nhà cái 3/4 or 4/4 grade; persons enjoying policies like war invalids xem bóng đá trực tiếp nhà cái 3/4 or 4/4 grade; martyrs' children enjoying monthly allowances,

(4) Taxpayers facing difficulties due to force majeure circumstances, provided the value xem bóng đá trực tiếp nhà cái damage related to their land and houses on land accounts for between 20% and 50% xem bóng đá trực tiếp nhà cái the taxable price.

In this cases, certification xem bóng đá trực tiếp nhà cái commune-level People's Committees xem bóng đá trực tiếp nhà cái the localities where exists such land is required.