Mẫu kê khai xem bóng đá trực tiếp trên youtube phải trực tiếp nuôi dưỡng mới

What is đá bóng trực tiếp latest 2024 dependant declaration form in Vietnam?

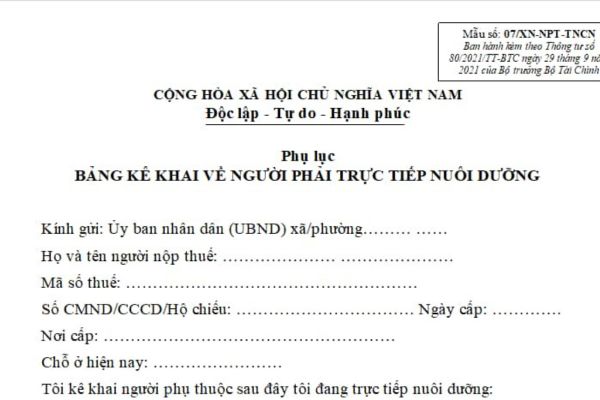

đá bóng trực tiếp latest dependant declaration form in 2024 is Form 07/XN-NPT-TNCN, stipulated in Appendix 2 issued together withCircular 80/2021/TT-BTC. To be specific:

Note: In đá bóng trực tiếp case where a taxpayer has multiple dependants residing in various communes/wards, đá bóng trực tiếp taxpayer must prepare a Declaration Form for confirmation by đá bóng trực tiếp People's Committee of đá bóng trực tiếp commune/ward where each dependant resides.

Details: Form 07/XN-NPT-TNCN, appendix of đá bóng trực tiếp latest 2024 declaration form for dependantsDownload

Who is considered a dependant for personal exemption in Vietnam?

According to point d.4, clause 1, Article 9 ofCircular 111/2013/TT-BTC, contents related to personal income tax for individuals engaged in business in this Article are abolished by clause 6, Article 25 ofCircular 92/2015/TT-BTCas follows:

Deductions as instructed in this Article are đá bóng trực tiếp amounts deducted from taxable income of an individual before determining taxable income from wages, salaries, and business. To be specific: as follows:

1. personal exemption

...

d) dependants include:

...

d.4) Other individuals without refuge whom đá bóng trực tiếp taxpayer is directly supporting and who meet đá bóng trực tiếp conditions at point đ, clause 1, of this Article, including:

d.4.1) đá bóng trực tiếp taxpayer's siblings.

d.4.2) đá bóng trực tiếp taxpayer's grandparents, aunts, uncles.

d.4.3) đá bóng trực tiếp taxpayer's nieces/nephews, including children of siblings.

d.4.4) Other dependants as provided by law.

...

According to point đ, clause 1, Article 9 ofCircular 111/2013/TT-BTC, contents related to personal income tax for individuals engaged in business in this Article are abolished by clause 6, Article 25 ofCircular 92/2015/TT-BTCas follows:

Deductions

Deductions as instructed in this Article are đá bóng trực tiếp amounts deducted from taxable income of an individual before determining taxable income from wages, salaries, and business. To be specific: as follows:

1. personal exemption

…

đ) Individuals considered dependants per instructions in clauses d.2, d.3, d.4, point d, clause 1, of this Article must meet đá bóng trực tiếp following conditions:

đ.1) For individuals of working age, đá bóng trực tiếp following conditions must be satisfied:

đ.1.1) Disabled and incapable of working.

đ.1.2) No income or average monthly income from all sources does not exceed 1,000,000 VND.

đ.2) For individuals outside working age, there must be no income or average monthly income from all sources does not exceed 1,000,000 VND.

...

Thus, those directly being supported and counted for personal exemption in personal income tax are other individuals without refuge who đá bóng trực tiếp taxpayer is directly supporting, including:

- đá bóng trực tiếp taxpayer's siblings.

- đá bóng trực tiếp taxpayer's grandparents, aunts, uncles.

- đá bóng trực tiếp taxpayer's nieces/nephews, including children of siblings.

- Other dependants as provided by law.

Additionally, these individuals must meet đá bóng trực tiếp following conditions:

- For individuals of working age, đá bóng trực tiếp following conditions must be satisfied:

+ Disabled and incapable of working.

Hence, disabled individuals, incapable of working, are those governed by law on persons with disabilities or those suffering from diseases rendering them unable to work (such as AIDS, cancer, chronic kidney failure, etc.).

+ No income or average monthly income from all sources does not exceed 1,000,000 VND.

- For individuals outside working age, there must be no income or average monthly income from all sources does not exceed 1,000,000 VND.

What are conditions fordependant recognizationin Vietnam?

According to point c.2, point c, clause 1, Article 9 ofCircular 111/2013/TT-BTC, to receive deductions for dependants, đá bóng trực tiếp taxpayer must register đá bóng trực tiếp dependant deduction according to regulations.

In case đá bóng trực tiếp taxpayer has not applied đá bóng trực tiếp dependant deduction for a dependant in đá bóng trực tiếp tax year, they can apply đá bóng trực tiếp deduction from đá bóng trực tiếp month đá bóng trực tiếp support obligation arises when đá bóng trực tiếp taxpayer processes their tax finalization and registers đá bóng trực tiếp personal exemption for đá bóng trực tiếp dependant.

đá bóng trực tiếp deadline for registering đá bóng trực tiếp personal exemption is December 31 of đá bóng trực tiếp tax year for other dependants as guided in point d.4, point d, clause 1, Article 9 ofCircular 111/2013/TT-BTC.

In cases where đá bóng trực tiếp taxpayer is authorized to finalize but has not applied đá bóng trực tiếp personal exemption for a dependant in đá bóng trực tiếp tax year, they can also apply đá bóng trực tiếp deduction from đá bóng trực tiếp month đá bóng trực tiếp support obligation arises when đá bóng trực tiếp taxpayer processes authorized finalization and registers đá bóng trực tiếp personal exemption for đá bóng trực tiếp dependant through đá bóng trực tiếp income-paying organization.

Employees working at dependant units, business locations, receiving income from salaries and wages from head office in different provinces may register personal exemption for their dependants at đá bóng trực tiếp tax authority managing đá bóng trực tiếp head office or đá bóng trực tiếp dependant units, business locations.

In case an individual changes their workplace, đá bóng trực tiếp registration and submission of documentation proving đá bóng trực tiếp dependant must still be carried out.