What is the latest form CT01 for change of residence information in Vietnam? What is the basis for personal income bóng đá hôm nay trực tiếp calculation for Vietnamese non-residents?

What is the latest form CT01 for change of residence information in Vietnam?

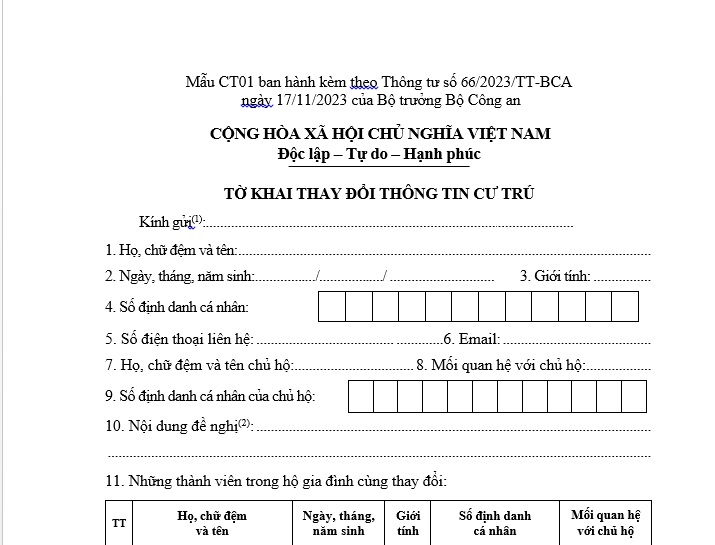

The latest form for changing residence information is Form CT01, issued in conjunction withCircular 66/2023/TT-BCA.

The Form CT01 for change of residence information is as follows:

Download the latest Form CT01 for change of residence information...Download

What is the latest form CT01 for change of residence information in Vietnam?(Image from Internet)

Whenis Form CT01 used for changing residence information in Vietnam?

Pursuant to Clause 1, Article 3 ofCircular 56/2021/TT-BCA(amended by Clause 1, Article 2 ofCircular 66/2023/TT-BCA), it is stipulated:

The residence information change form is used when Vietnamese citizens residing domestically perform the procedures for:

- Permanent residence registration,

- Deletion of permanent residence registration,

- Household separation,- Adjusting information in the Residence Database,

- Temporary residence registration,

- Deletion of temporary residence registration,

- Extending temporary residence,

- Declaring information about residence,

- Confirming information about residence

What is the basis for personal income bóng đá hôm nay trực tiếp for Vietnamese non-residents?

(1) bóng đá hôm nay trực tiếp on income from business activities

Pursuant to Article 25 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from business activities:

- bóng đá hôm nay trực tiếp on income from business activities of Vietnamese non-resident individuals is determined by the revenue from production and business activities as specified in Clause 2, Article 25 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007multiplied by the bóng đá hôm nay trực tiếp rate specified in Clause 3, Article 25 of the said Law.

- Revenue is the total amount arising from the provision of goods and services, including expenses paid by purchasers on behalf of Vietnamese non-resident individuals that are not reimbursed.

If the contract agreement excludes personal income bóng đá hôm nay trực tiếp, the taxable revenue must be converted into the total amount received by Vietnamese non-resident individuals in any form from providing goods, services in Vietnam, regardless of the business activity location.

- The bóng đá hôm nay trực tiếp rate on income from business activities is specified for each field and type of production and business activity as follows:

+ 1% for commercial activities,

+ 5% for service activities,

+ 2% for manufacturing, construction, transportation, and other business activities.

(2) bóng đá hôm nay trực tiếp on income from wages and salaries

Pursuant to Article 26 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from wages and salaries:

- bóng đá hôm nay trực tiếp on income from wages and salaries for Vietnamese non-resident individuals is determined by the taxable income from wages and salaries as specified in Clause 2, Article 26 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007multiplied by a bóng đá hôm nay trực tiếp rate of 20%.

- Taxable income from wages and salaries is the total amount that Vietnamese non-resident individuals receive for performing work in Vietnam, regardless of where the income is paid.

(3) bóng đá hôm nay trực tiếp on income from capital investment

Pursuant to Article 27 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from capital investment:

bóng đá hôm nay trực tiếp on income from capital investment of Vietnamese non-resident individuals is determined by the total amount received from capital investment into organizations and individuals in Vietnam multiplied by a bóng đá hôm nay trực tiếp rate of 5%.

(4) bóng đá hôm nay trực tiếp on income from capital transfer

Pursuant to Article 28 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from capital transfer:

bóng đá hôm nay trực tiếp on income from capital transfer of Vietnamese non-resident individuals is determined by the total amount received from transferring capital shares in organizations and individuals in Vietnam multiplied by a bóng đá hôm nay trực tiếp rate of 0.1%, regardless of whether the transfer is conducted in Vietnam or abroad.

(5) bóng đá hôm nay trực tiếp on income from real estate transfer

Pursuant to Article 29 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from real estate transfer:

bóng đá hôm nay trực tiếp on income from real estate transfers in Vietnam by Vietnamese non-resident individuals is determined by the real estate transfer price multiplied by a bóng đá hôm nay trực tiếp rate of 2%.

(6) bóng đá hôm nay trực tiếp on income from copyright, franchising

Pursuant to Article 30 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from copyright, franchising:

- bóng đá hôm nay trực tiếp on income from copyright of Vietnamese non-resident individuals is determined by the income exceeding 10 million VND per contract for transferring, licensing intellectual property rights, and technology transfer in Vietnam, multiplied by a bóng đá hôm nay trực tiếp rate of 5%.

- bóng đá hôm nay trực tiếp on income from franchising of Vietnamese non-resident individuals is determined by the income exceeding 10 million VND per franchise contract in Vietnam, multiplied by a bóng đá hôm nay trực tiếp rate of 5%.

(7) bóng đá hôm nay trực tiếp on income from winnings, inheritance, gifts

Pursuant to Article 31 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007which provides for bóng đá hôm nay trực tiếp on income from winnings, inheritance, gifts:

- bóng đá hôm nay trực tiếp on income from winnings, inheritance, gifts of Vietnamese non-resident individuals is determined by the taxable income as specified in Clause 2, Article 31 of thePersonal Income bóng đá hôm nay trực tiếp Law 2007multiplied by a bóng đá hôm nay trực tiếp rate of 10%.

- Taxable income from winnings of Vietnamese non-resident individuals is the portion of the prize value exceeding 10 million VND per win in Vietnam; income from inheritance and gifts is the portion of asset values exceeding 10 million VND per occurrence received in Vietnam by Vietnamese non-resident individuals.