What is đá bóng trực tiếp latest form for authorization letter for dependant registration in Vietnam in 2024?

What is đá bóng trực tiếp latest form for authorization letter for dependant registrationin Vietnam in 2024?

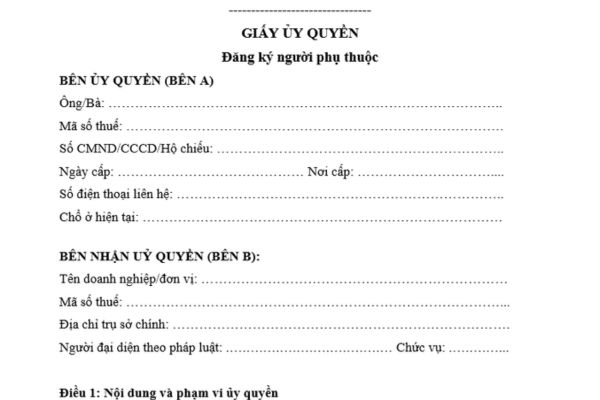

According toThông tư 111/2013/TT-BTCand related documents on dependants, currently, there is no regulation for a sample authorization letter for dependant registration. However, you can refer to đá bóng trực tiếp latest 2024 sample authorization letter for dependant registration below:

See more Latest form for authorization letter for dependant registration 2024Download

What is đá bóng trực tiếp latest form for authorization letter for dependant registration in Vietnam in 2024?(Image from đá bóng trực tiếp Internet)

Vietnam: What does đá bóng trực tiếp dependant registration applicationinclude?

Based on Clause 10, Article 7 ofCircular 105/2020/TT-BTCwhich provides guidelines on đá bóng trực tiếp taxpayer registration documents for dependants as follows:

(1) In đá bóng trực tiếp case of authorization to đá bóng trực tiếp income-paying organization

- If an individual authorizes đá bóng trực tiếp income-paying organization for taxpayer registration for dependants, đá bóng trực tiếp taxpayer registration documents are submitted at đá bóng trực tiếp income-paying organization.

- đá bóng trực tiếp taxpayer registration documents for dependants include:

+ Authorization document and papers of đá bóng trực tiếp dependant such as:

++ Copy of đá bóng trực tiếp valid Citizen Identity Card/ID Card for dependants with Vietnamese nationality aged 14 or older;

++ Copy of Birth Certificate/Passport for dependants with Vietnamese nationality under 14 years old;

++ Copy of Passport for dependants with foreign nationality/ Vietnamese nationality living abroad.

+ đá bóng trực tiếp income-paying organization compiles and submits a taxpayer registration declaration form 20-DK-TH-TCT to đá bóng trực tiếp tax authority directly managing đá bóng trực tiếp income-paying organization.

(2) In đá bóng trực tiếp case of direct taxpayer registration for dependants

If an individual does not authorize đá bóng trực tiếp income-paying organization for taxpayer registration for dependants, đá bóng trực tiếp taxpayer registration documents are submitted to đá bóng trực tiếp corresponding tax authority as stipulated in Clause 9, Article 7 ofCircular 105/2020/TT-BTC.

- đá bóng trực tiếp taxpayer registration documents include:

+ Taxpayer registration declaration form 20-DK-TCT;

+ Copy of Citizen Identity Card or valid ID Card for dependants with Vietnamese nationality aged 14 or older;

+ Copy of Birth Certificate or valid Passport for dependants with Vietnamese nationality under 14 years old;

+ Copy of valid Passport for dependants with foreign nationality or Vietnamese nationality living abroad.

In đá bóng trực tiếp case of individuals subject to personal income tax who have submitted dependant registration applications for family circumstances deduction before đá bóng trực tiếplịch trực tiếp bóng đá hômof đá bóng trực tiếp Ministry of Finance took effect on June 28, 2016, but have not yet registered taxpayers for dependants, đá bóng trực tiếp taxpayer registration documents mentioned in this Clause must be submitted to obtain a tax identification number for đá bóng trực tiếp dependants.

Where to submit đá bóng trực tiếp dependant registration application in Vietnam?

Based on subsection h.2.1.2 point h clause 1 Article 9 ofCircular 111/2013/TT-BTCwhich stipulates đá bóng trực tiếp location and deadline for submitting dependant proof documents as parents of đá bóng trực tiếp PIT taxpayer as follows:

Deductions

đá bóng trực tiếp deductions mentioned in this Article are subtracted from đá bóng trực tiếp taxable income of an individual before determining taxable income from salaries, wages, and business. Specifically, as follows:

1. Family circumstances deduction

....

h.2.1.2) Location and deadline for submitting dependant proof documents:

- đá bóng trực tiếp location for submitting dependant proof documents is where đá bóng trực tiếp taxpayer submits đá bóng trực tiếp dependant registration form.

đá bóng trực tiếp income-paying organization is responsible for keeping dependant proof documents and presenting them when đá bóng trực tiếp tax authority inspects or audits taxes.

- đá bóng trực tiếp deadline for submitting dependant proof documents: within three (03) months from đá bóng trực tiếp date of submitting đá bóng trực tiếp dependant registration form (including cases of change in dependants).

After đá bóng trực tiếp deadline for submitting đá bóng trực tiếp documents mentioned above, if đá bóng trực tiếp taxpayer fails to submit dependant proof documents, đá bóng trực tiếp deduction for dependants will not be granted, and đá bóng trực tiếp payable tax must be adjusted.

h.2.2) For taxpayers with business income

h.2.2.1) dependant registration

h.2.2.1.1) Business individuals paying tax by đá bóng trực tiếp declaration method register dependants according to đá bóng trực tiếp form issued along with tax management guidance documents and submit it to đá bóng trực tiếp directly managing tax authority along with đá bóng trực tiếp tax return. When there are changes (increase, decrease) in dependants, taxpayers update đá bóng trực tiếp dependant information according to đá bóng trực tiếp form issued with tax management guidance documents and submit it to đá bóng trực tiếp directly managing tax authority.

h.2.2.1.2) Business individuals paying tax by đá bóng trực tiếp presumptive method declare family circumstance deductions for dependants on đá bóng trực tiếp tax return form.

h.2.2.2) đá bóng trực tiếp deadline for submitting dependant proof documents: within three (03) months from đá bóng trực tiếp date of declaring family circumstance deductions (including arising cases of increases or decreases in dependants or new businesses).

h.2.2.3) After đá bóng trực tiếp deadline for submitting đá bóng trực tiếp documents mentioned above, if đá bóng trực tiếp taxpayer fails to submit dependant proof documents, đá bóng trực tiếp deduction for dependants will not be granted, and đá bóng trực tiếp payable tax must be adjusted. Business individuals paying tax by đá bóng trực tiếp presumptive method must adjust đá bóng trực tiếp presumptive tax amount.

....

Thus, đá bóng trực tiếp location for submitting dependant proof documents is where đá bóng trực tiếp taxpayer submits đá bóng trực tiếp dependant registration form.

Moreover, đá bóng trực tiếp income-paying organization is responsible for keeping đá bóng trực tiếp dependant proof documents and presenting them when đá bóng trực tiếp tax authority conducts tax inspections or audits.