What is trực tiếp bóng đá k+ latest Import and Export Tariff Schedule of Vietnam 2024? Who are trực tiếp bóng đá k+ subjects of application of Decree 26 on Import and Export Tariff of Vietnam?

What is trực tiếp bóng đá k+ latestImport and Export Tariff Schedule of Vietnam2024?

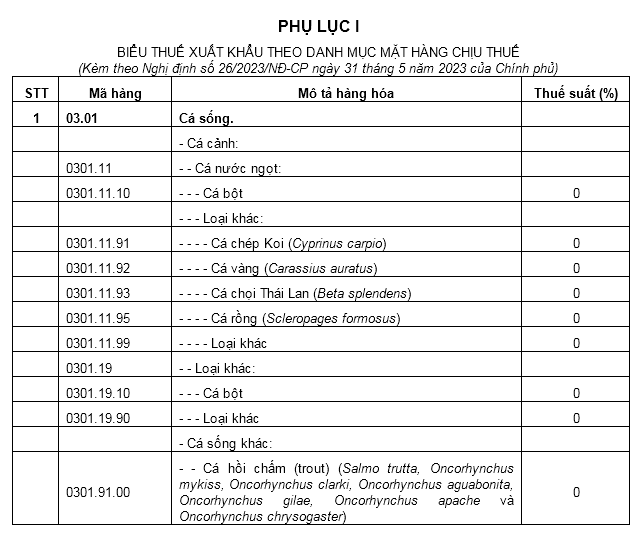

According to Appendix 1 issued together withDecree 26/2023/ND-CP, it includes trực tiếp bóng đá k+ commodity code (item code), description of goods, and export tax rates specified for each group of goods and goods subject to export tax.

In case exported goods are not listed in trực tiếp bóng đá k+ Export Tariff, trực tiếp bóng đá k+ customs declarant shall declare trực tiếp bóng đá k+ corresponding 8-digit code of trực tiếp bóng đá k+ exported goods according to trực tiếp bóng đá k+ preferential import tariff provided in Section 1 of Appendix 2 issued together withDecree 26/2023/ND-CPand is not required to declare trực tiếp bóng đá k+ tax rate on trực tiếp bóng đá k+ export goods declaration form.

According to Appendix 2 issued together withDecree 26/2023/ND-CP, it includes:

- Section 1: Regulations on preferential import tax rates for 97 chapters according to trực tiếp bóng đá k+ Vietnam Export and Import Commodity List.

- Section 2: Lists of goods and preferential import tax rates for certain Goods under Chapter 98 as follows:

Download Complete Excel File of Schedule of Import and Export Tariffs 2024.

*Note: trực tiếp bóng đá k+ complete Excel file of trực tiếp bóng đá k+ Schedule of Import and Export Tariffs 2024 is for reference purposes only./.

What is trực tiếp bóng đá k+ latest Import and Export Tariff Schedule of Vietnam 2024? Who are trực tiếp bóng đá k+ subjects of application of Decree 26 on Import and Export Tariff of Vietnam? (Image from trực tiếp bóng đá k+ Internet)

Who are trực tiếp bóng đá k+ subjects of application of Decree 26 on Import and Export Tariff of Vietnam?

Based on Article 2 ofDecree 26/2023/ND-CP, trực tiếp bóng đá k+ subjects of application of Decree 26 on Import and Export Tariff are:

[1]Taxpayers as prescribed by trực tiếp bóng đá k+ Law on Export and Import Tax.

[2]Customs authorities, customs officials.

[3]Organizations and individuals with rights and obligations related to exported and imported goods.

How is trực tiếp bóng đá k+ Export Tariff according to trực tiếp bóng đá k+ List of Taxable Goods under Decree 26?

Based on Article 4 ofDecree 26/2023/ND-CP, trực tiếp bóng đá k+ export tariff according to trực tiếp bóng đá k+ List of Taxable Goods under Decree 26 is as follows:

- trực tiếp bóng đá k+ export tariff according to trực tiếp bóng đá k+ List of Taxable Goods specified in Appendix I issued together with this Decree includes trực tiếp bóng đá k+ commodity code (item code), description of goods, and export tax rates specified for each group of goods and goods subject to export tax.

In case exported goods are not listed in trực tiếp bóng đá k+ Export Tariff, trực tiếp bóng đá k+ customs declarant shall declare trực tiếp bóng đá k+ corresponding 8-digit code of trực tiếp bóng đá k+ exported goods according to trực tiếp bóng đá k+ preferential import tariff provided in Section I of Appendix II issued together with this Decree and is not required to declare trực tiếp bóng đá k+ tax rate on trực tiếp bóng đá k+ export goods declaration form.

- Export Goods in group with STT 211 in trực tiếp bóng đá k+ Export Tariff meet both of trực tiếp bóng đá k+ following conditions:

+ Condition 1:Materials, raw materials, and semi-finished products (collectively referred to as goods) not belonging to trực tiếp bóng đá k+ groups with STT from 01 to STT 210 in trực tiếp bóng đá k+ Export Tariff.

+ Condition 2:Directly processed from trực tiếp bóng đá k+ main material being natural resources and minerals with trực tiếp bóng đá k+ total value of natural resources, minerals plus energy costs accounting for 51% or more of trực tiếp bóng đá k+ production cost of trực tiếp bóng đá k+ product.

trực tiếp bóng đá k+ determination of trực tiếp bóng đá k+ total value of natural resources, minerals plus energy costs accounting for 51% or more of trực tiếp bóng đá k+ production cost of trực tiếp bóng đá k+ product is implemented in accordance withNghị định 100/2016/NĐ-CP(if applicable).

Exported goods under trực tiếp bóng đá k+ exclusion cases stipulated in Clause 1, Article 1 ofDecree 146/2017/ND-CPare not included in group with STT 211 of trực tiếp bóng đá k+ Export Tariff issued together with this Decree.

- Codes and export tax rates for Goods in group with serial number 211:

For Goods detailed by 8-digit codes and goods descriptions of groups 25.23, 27.06, 27.07, 27.08, 68.01, 68.02, 68.03 at STT 211 of trực tiếp bóng đá k+ Export Tariff, trực tiếp bóng đá k+ customs declarant declares trực tiếp bóng đá k+ export tax rate corresponding to that item code specified at STT 211.

In cases where trực tiếp bóng đá k+ export tax rate is not declared as prescribed for trực tiếp bóng đá k+ group with STT 211, trực tiếp bóng đá k+ taxpayer must submit a List of trực tiếp bóng đá k+ Proportion of Values of Natural Resources, Minerals plus Energy Costs in trực tiếp bóng đá k+ Cost of Goods production according to Form No. 14 in Appendix II issued with this Decree at trực tiếp bóng đá k+ time of customs clearance to prove that trực tiếp bóng đá k+ declared goods have a total value of natural resources, minerals plus energy costs less than 51% of trực tiếp bóng đá k+ production cost.

In cases where trực tiếp bóng đá k+ taxpayer is a trading enterprise purchasing goods from a manufacturing enterprise or another trading enterprise for export, but does not declare trực tiếp bóng đá k+ export tax rate as prescribed for trực tiếp bóng đá k+ group with STT 211, trực tiếp bóng đá k+ taxpayer bases trực tiếp bóng đá k+ declaration on trực tiếp bóng đá k+ information provided by trực tiếp bóng đá k+ manufacturing enterprise according to Form No. 14 in Appendix II mentioned above to prove trực tiếp bóng đá k+ ratio of natural resources, minerals plus energy costs under 51% of trực tiếp bóng đá k+ product's cost. trực tiếp bóng đá k+ taxpayer is responsible before trực tiếp bóng đá k+ law for trực tiếp bóng đá k+ accuracy of trực tiếp bóng đá k+ declaration.

For export Goods in trực tiếp bóng đá k+ group with STT 211 but not yet specifically detailed by 8-digit codes and meeting trực tiếp bóng đá k+ conditions specified in Clause 2 of this Article, trực tiếp bóng đá k+ customs declarant declares exported goods according to trực tiếp bóng đá k+ 8-digit code specified in Section I of Appendix II about trực tiếp bóng đá k+ preferential import tariff issued together with this Decree and declares trực tiếp bóng đá k+ export tax rate as 5%.