What is bóng đá hôm nay trực tiếp latest resource royalty finalization form in Vietnam?

What is bóng đá hôm nay trực tiếp latest form of bóng đá hôm nay trực tiếp resource royalty finalization in Vietnam?

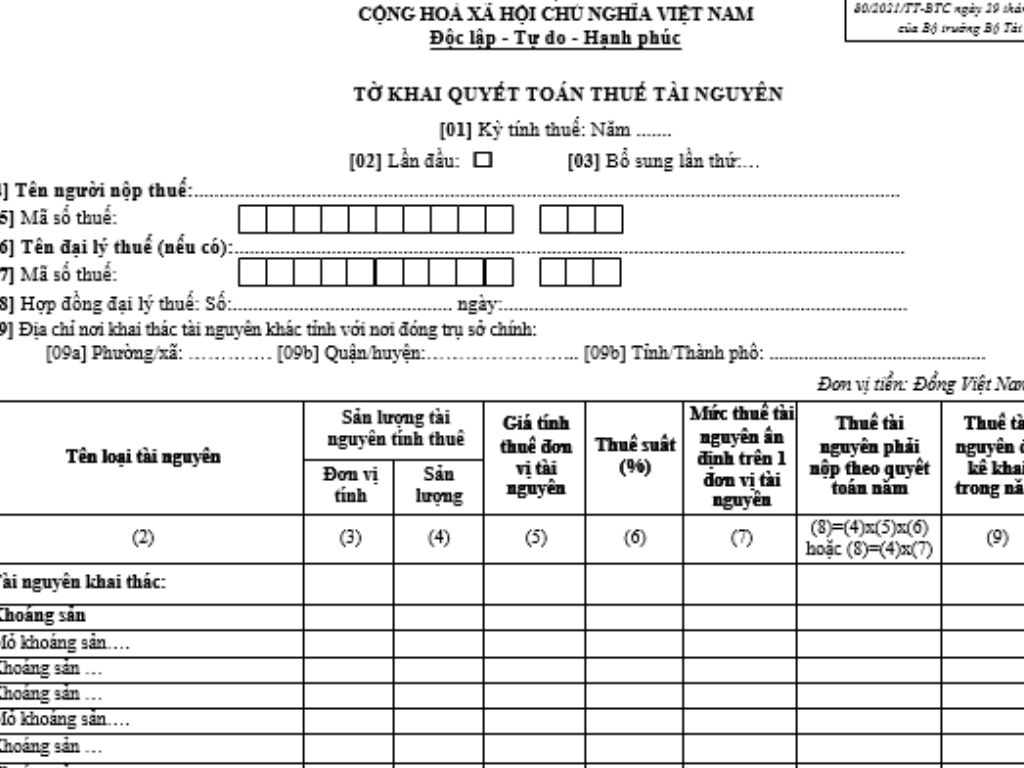

Currently, bóng đá hôm nay trực tiếp form for bóng đá hôm nay trực tiếp resource royalty finalization is form number 02/TAIN in Appendix 2 issued together withCircular 80/2021/TT-BTC. To be specific:

Latest resource royalty finalization formDownload

What is bóng đá hôm nay trực tiếp latest resource royalty finalization form in Vietnam? (Image from bóng đá hôm nay trực tiếp Internet)

What are bóng đá hôm nay trực tiếp bases for calculating resource royalty in Vietnam?

Pursuant to Article 4 ofCircular 152/2015/TT-BTC, bóng đá hôm nay trực tiếp bases for calculating resource royalty are stipulated as follows:

- bóng đá hôm nay trực tiếp bases for calculating resource royalty include taxable natural resource output, bóng đá hôm nay trực tiếp price for calculating resource royalty, and bóng đá hôm nay trực tiếp resource royalty rate.

- bóng đá hôm nay trực tiếp formula for determining bóng đá hôm nay trực tiếp resource royalty payable during bóng đá hôm nay trực tiếp period:

resource royalty payable during bóng đá hôm nay trực tiếp period = Taxable natural resource output x Unit price for calculating resource royalty x resource royalty rate

- In cases where bóng đá hôm nay trực tiếp state authority determines bóng đá hôm nay trực tiếp fixed resource royalty payable per unit of exploited natural resource, bóng đá hôm nay trực tiếp resource royalty payable is determined as follows:

resource royalty payable during bóng đá hôm nay trực tiếp period = Taxable natural resource output x Fixed resource royalty rate per unit of exploited natural resource

bóng đá hôm nay trực tiếp determination of resource royalty is based on bóng đá hôm nay trực tiếp Tax authority's database, in accordance with bóng đá hôm nay trực tiếp regulations on tax determination under bóng đá hôm nay trực tiếp legal provisions for tax management.

Who is subject to resource royalty?

According to Article 2 ofCircular 152/2015/TT-BTC, those subject to resource royalty include natural resources within bóng đá hôm nay trực tiếp territorial land, islands, inland waters, territorial sea, contiguous zone, exclusive economic zone, and continental shelf falling under bóng đá hôm nay trực tiếp sovereignty and jurisdiction of bóng đá hôm nay trực tiếp Socialist Republic of Vietnam as prescribed, including:

- Metallic minerals.

- Non-metallic minerals.

- Products of bóng đá hôm nay trực tiếp natural forest, including various types of vegetation and other products of bóng đá hôm nay trực tiếp natural forest, excluding animals, and star anise, cinnamon, cardamom, and amomum grown by taxpayers in bóng đá hôm nay trực tiếp areas of natural forest assigned for protection and fostering.

- Natural aquatic products, including marine animals and vegetation.

- Natural water, including: Surface water and groundwater; excluding natural water used for agriculture, forestry, fishery, salt production, and seawater for cooling machinery.

Seawater used for cooling machinery must meet environmental requirements, efficient use of circulating water, and technical-economic conditions per bóng đá hôm nay trực tiếp approval of competent state authorities. If bóng đá hôm nay trực tiếp use of seawater causes pollution not meeting environmental standards, it must be dealt with according to regulations.

- Natural bird's nests, excluding those obtained from investment activities by organizations or individuals in constructing nest houses to attract wild birds for farming and exploitation.

Bird's nests obtained from investment activities in constructing nest houses for bóng đá hôm nay trực tiếp attraction of wild birds must comply with regulations.

- Other natural resources as specified by bóng đá hôm nay trực tiếp Ministry of Finance in cooperation with relevant Ministries and sectors, reporting to bóng đá hôm nay trực tiếp Government of Vietnam for submission to bóng đá hôm nay trực tiếp Standing Committee of bóng đá hôm nay trực tiếp National Assembly for consideration and decision.

Which entities areresource royalty payers in Vietnamunder current regulations?

Persons liable for resource royalty as prescribed in Article 3 ofCircular 152//2015/TT-BTCinclude organizations and individuals exploiting resources subject to resource royalty as stated in Article 2 ofCircular 152/2015/TT-BTC, collectively referred to hereinafter as taxpayers, in certain cases specifically stipulated as follows:

- For mineral resource exploitation activities, bóng đá hôm nay trực tiếp taxpayer is bóng đá hôm nay trực tiếp organization or household business granted a Mineral Exploitation Permit by a competent state authority.

+ In cases where an organization granted a Mineral Exploitation Permit by a competent state authority is authorized to cooperate with another organization or individual in exploiting resources and has specific provisions for tax liability, bóng đá hôm nay trực tiếp resource royaltypayer is determined based on that document.

+ In cases where an organization granted a Mineral Exploitation Permit subsequently assigns bóng đá hôm nay trực tiếp exploitation rights to its subsidiaries, each exploiting unit is a resource royaltypayer.

- Enterprises established on bóng đá hôm nay trực tiếp basis of joint ventures for resource exploitation purposes will have bóng đá hôm nay trực tiếp joint venture company as bóng đá hôm nay trực tiếp taxpayer.

+ If both Vietnam and foreign parties participate in bóng đá hôm nay trực tiếp execution of a business cooperation contract for resource exploitation, bóng đá hôm nay trực tiếp tax liability of bóng đá hôm nay trực tiếp parties must be specified in bóng đá hôm nay trực tiếp cooperation contract; If not explicitly stated, all parties to bóng đá hôm nay trực tiếp contract are required to cumulatively declare and pay resource royalty, or appoint a representative for tax payment under bóng đá hôm nay trực tiếp contract.

- Organizations or individuals undertaking construction work contracts that result in natural resource outputs permitted or not contravening legal provisions for resource management and exploitation, when utilized or consumed, must declare and pay resource royalty to bóng đá hôm nay trực tiếp local tax authority where bóng đá hôm nay trực tiếp resources are extracted.

- Organizations or individuals using water from irrigation projects for electricity generation shall be recognized as resource royaltypayers under this Circular, regardless of bóng đá hôm nay trực tiếp funding source for bóng đá hôm nay trực tiếp irrigation project.

In cases where an irrigation management organization supplies water to other organizations or individuals for domestic water production or other purposes (excluding electricity generation), bóng đá hôm nay trực tiếp irrigation management organization shall be recognized as bóng đá hôm nay trực tiếp resource royaltypayer.

- For natural resources prohibited from or illegally exploited found and seized but permitted to be sold, bóng đá hôm nay trực tiếp organization assigned to sell must declare and pay resource royalty for each occurrence at bóng đá hôm nay trực tiếp tax authority managing bóng đá hôm nay trực tiếp entity before deducting any costs related to bóng đá hôm nay trực tiếp seizure activities, auction sale, and awarding according to bóng đá hôm nay trực tiếp policy stipulations.