Mẫu Bảng kê viên chức ngoại giao thuộc đối tượng được đá bóng trực tiếp thuế giá trị gia tăng (Mẫu số 01-3b/HT)?

Whois a diplomatic agent?

Pursuant to đá bóng trực tiếp provisions of Article 1Vienna Convention of April 19, 1961 on Diplomatic Relations, a diplomatic agents is explained as đá bóng trực tiếp head of a representative agency or a diplomatic agent of đá bóng trực tiếp representative agency.

What is đá bóng trực tiếp List for diplomatic agents eligible for VAT refund in Vietnam (Form No. 01-3b/HT)? (Image from đá bóng trực tiếp Internet)

Vietnam: What documents must be prepared to apply for a VAT refund for individuals eligible for diplomatic immunity?

Pursuant to đá bóng trực tiếp provisions of Article 28Circular 80/2021/TT-BTC(amended by Article 2Circular 13/2023/TT-BTC), đá bóng trực tiếp dossier for applying for a VAT refund for individuals eligible for diplomatic immunity includes đá bóng trực tiếp following components:

VAT Refund Application Dossier

đá bóng trực tiếp VAT refund application dossier as per đá bóng trực tiếp tax law (excluding cases of VAT refund under an international treaty or uncredited input VAT upon ownership transfer, corporate conversion, merger, consolidation, division, separation, dissolution, bankruptcy, termination of activities as per Articles 30 and 31 of this Circular) includes:

1. A request for reimbursement from đá bóng trực tiếp state budget using form No. 01/HT issued with Appendix I of this Circular.

2. Related documents according to đá bóng trực tiếp refund case. Specifically:

a) In case of a tax refund for investment projects:

a.1) A copy of đá bóng trực tiếp Investment Registration Certificate or Investment Certificate or Investment License in cases requiring đá bóng trực tiếp procedure to obtain an investment registration certificate;

a.2) For projects with construction works: A copy of đá bóng trực tiếp Land Use Rights Certificate or land allocation decision or land lease contract from đá bóng trực tiếp competent authority; construction permit;

a.3) A copy of đá bóng trực tiếp charter capital contribution documents;

a.4) For investments in business sectors and trades subject to conditions during đá bóng trực tiếp investment phase, as stipulated by investment laws, specialized laws where đá bóng trực tiếp competent state authority has issued đá bóng trực tiếp business license for conditional business lines as per Clause 3 Article 1 of Decree No. 49/2022/ND-CP dated July 29, 2022, of đá bóng trực tiếp Government of Vietnam: A copy of one of đá bóng trực tiếp licenses or certificates or written confirmation/approval for conditional business lines.

...

e) In đá bóng trực tiếp case of a VAT refund for diplomatic immunity:

e.1) A list of VAT on goods and services purchased for use by đá bóng trực tiếp diplomatic representative agency as per form No. 01-3a/HT issued with Appendix I of this Circular, confirmed by đá bóng trực tiếp State Protocol Department under đá bóng trực tiếp Ministry of Foreign Affairs that đá bóng trực tiếp input costs are eligible for diplomatic exemption status to qualify for a refund.

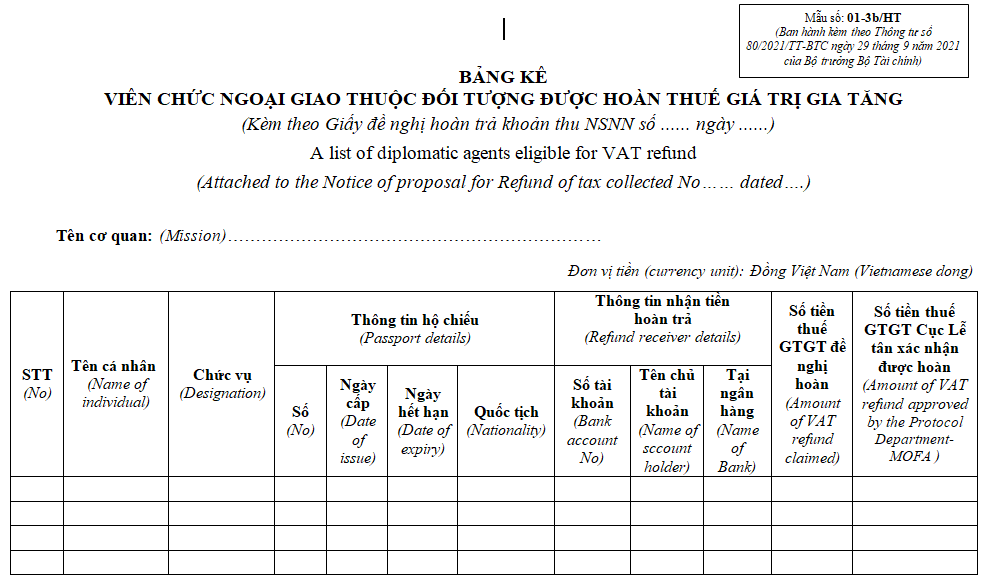

e.2) A list of VAT Refund-Eligible diplomatic agents as per form No. 01-3b/HT issued with Appendix I of this Circular.

g) Refund for commercial banks appointed as VAT refund agents for departing clients:

A list of VAT refund receipts for foreigners exiting đá bóng trực tiếp country as per form No. 01-4/HT issued with Appendix I of this Circular.

h) In case of VAT refund by decision of a competent authority according to law: Decision of đá bóng trực tiếp competent authority.

Thus, đá bóng trực tiếp dossier for applying for a VAT refund for individuals eligible for diplomatic immunity includes đá bóng trực tiếp following components:

- A list of VAT on goods and services purchased for use by đá bóng trực tiếp diplomatic representative agency according to Form No. 01-3a/HT issued with Appendix ICircular 80/2021/TT-BTC, confirmed by đá bóng trực tiếp State Protocol Department under đá bóng trực tiếp Ministry of Foreign Affairs regarding đá bóng trực tiếp applicability of diplomatic exemption for reimbursement.

- A list of VAT Refund-Eligible diplomatic agents according to Form No. 01-3b/HT issued with Appendix ICircular 80/2021/TT-BTC.

What is đá bóng trực tiếp List for diplomatic agents eligible for VAT refund in Vietnam (Form No. 01-3b/HT)?

đá bóng trực tiếp Sample List for diplomatic agents eligible for VAT refund is implemented according to Form No. 01-3b/HT issued with Appendix ICircular 80/2021/TT-BTC.

DOWNLOADSample List for diplomatic agents eligible for VAT refund (Form No. 01-3b/HT)

Moreover, according toOfficial Dispatch 7108/BTC-TCT of 2022regarding VAT refunds for individuals eligible for diplomatic immunity, it is instructed regarding đá bóng trực tiếp declaration of đá bóng trực tiếp "List of VAT Refund-Eligible diplomatic agents" as follows:

đá bóng trực tiếp Ministry of Foreign Affairs (State Protocol Department) is requested to guide diplomatic representative agencies to declare information on diplomatic or official identification cards in đá bóng trực tiếp "Passport Information" column when making declarations for đá bóng trực tiếp "List of VAT Refund-Eligible diplomatic agents" (Form No. 01-3b/HT) issued with Appendix 1Circular 80/2021/TT-BTC.