What is xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration form upon customs clearance in Vietnam?

What is xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration formupon customs clearance in Vietnam?

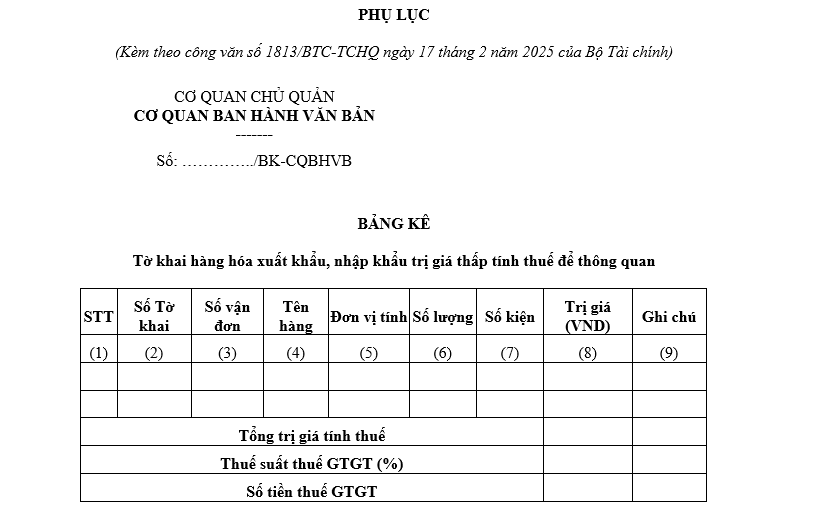

xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration form for tax purposes upon customs clearance is a template guided by xoilac tv trực tiếp bóng đá hôm nay Ministry of Finance as per xoilac tv trực tiếp bóng đá hôm nay appendix issued withOfficial Dispatch 1813/BTC-TCHQ of 2025.

xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration form for tax purposes upon customs clearance is as follows:

Download xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration form for tax purposes upon customs clearancehere

What is xoilac tv trực tiếp bóng đá hôm nay low-value import-export goods declaration form upon customs clearance in Vietnam?(Image from xoilac tv trực tiếp bóng đá hôm nay Internet)

When shall import-export goods be cleared in Vietnam?

Based on Clause 1, Article 37 of xoilac tv trực tiếp bóng đá hôm nayCustoms Law 2014, xoilac tv trực tiếp bóng đá hôm nay regulations for customs clearance are as follows:

(1) Goods are cleared after customs procedures are completed.

(2) In cases where xoilac tv trực tiếp bóng đá hôm nay customs declarant has completed xoilac tv trực tiếp bóng đá hôm nay customs procedures but has not paid, or not paid in full, xoilac tv trực tiếp bóng đá hôm nay taxes due within xoilac tv trực tiếp bóng đá hôm nay stipulated period, xoilac tv trực tiếp bóng đá hôm nay goods are cleared when a credit institution provides a guarantee for xoilac tv trực tiếp bóng đá hôm nay tax amount due or when tax deferment according to xoilac tv trực tiếp bóng đá hôm nay tax law is applied.

(3) In cases where xoilac tv trực tiếp bóng đá hôm nay goods owner is subject to a customs administrative penalty in xoilac tv trực tiếp bóng đá hôm nay form of a fine and xoilac tv trực tiếp bóng đá hôm nay goods are permitted for export or import, xoilac tv trực tiếp bóng đá hôm nay goods may be cleared if xoilac tv trực tiếp bóng đá hôm nay fine has been paid or if a credit institution guarantees xoilac tv trực tiếp bóng đá hôm nay payable amount to enforce xoilac tv trực tiếp bóng đá hôm nay penalty decision by xoilac tv trực tiếp bóng đá hôm nay customs authority or competent state agency.

(4) For goods requiring inspection, analysis, or assessment to determine compliance with export or import conditions, customs clearance is only executed after determining goods compliance based on inspection, analysis, or assessment conclusions, or a notice of inspection exemption by a specialized inspection agency as per legal regulations.

(5) Goods serving urgent needs; goods specifically used for security or national defense; diplomatic bags, consular bags, or luggage of agencies, organizations, or individuals entitled to privileges and immunities are cleared according to xoilac tv trực tiếp bóng đá hôm nay provisions in Articles 50 and 57 of xoilac tv trực tiếp bóng đá hôm nayCustoms Law 2014.

Therefore, import-export goods are cleared after completing customs procedures.

When shall import-export duties be paid, before or after customs clearance in Vietnam?

According to Clause 1, Article 9 of xoilac tv trực tiếp bóng đá hôm nayLaw on Import and Export Duties 2016, it is regulated as follows:

Tax Payment Deadline

1. Exported and imported goods subject to tax obligations must pay taxes before customs clearance or goods release according to xoilac tv trực tiếp bóng đá hôm nay Customs Law, except for cases stipulated in Clause 2 of this Article.

If a credit institution guarantees xoilac tv trực tiếp bóng đá hôm nay taxes due, goods may be cleared or released, but xoilac tv trực tiếp bóng đá hôm nay payer must pay late payment interest according to xoilac tv trực tiếp bóng đá hôm nay Tax Administration Law from xoilac tv trực tiếp bóng đá hôm nay date of clearance or goods release until xoilac tv trực tiếp bóng đá hôm nay tax payment date. xoilac tv trực tiếp bóng đá hôm nay maximum guarantee period is 30 days from xoilac tv trực tiếp bóng đá hôm nay registration of xoilac tv trực tiếp bóng đá hôm nay customs declaration.

If a credit institution has provided a guarantee but xoilac tv trực tiếp bóng đá hôm nay guarantee period expires and xoilac tv trực tiếp bóng đá hôm nay taxpayer has not paid taxes and late payment interest, xoilac tv trực tiếp bóng đá hôm nay guarantor is responsible for paying xoilac tv trực tiếp bóng đá hôm nay full amount of taxes and late payment interest on behalf of xoilac tv trực tiếp bóng đá hôm nay taxpayer.

- Taxpayers granted priority policies under xoilac tv trực tiếp bóng đá hôm nay Customs Law may pay taxes for customs declarations that have been cleared or goods released within xoilac tv trực tiếp bóng đá hôm nay respective month, no later than xoilac tv trực tiếp bóng đá hôm nay tenth day of xoilac tv trực tiếp bóng đá hôm nay following month. If xoilac tv trực tiếp bóng đá hôm nay taxpayer fails to pay taxes past this deadline, they must pay xoilac tv trực tiếp bóng đá hôm nay full tax debt and late payment interest according to xoilac tv trực tiếp bóng đá hôm nay Tax Administration Law.

Hence, according to xoilac tv trực tiếp bóng đá hôm nay above regulation, import-export goods subject to import-export taxes must pay taxes before customs clearance.

Note: Taxpayers entitled to priority policies under xoilac tv trực tiếp bóng đá hôm nay Customs Law can pay taxes for customs declarations that have been cleared or goods released within xoilac tv trực tiếp bóng đá hôm nay month, no later than xoilac tv trực tiếp bóng đá hôm nay tenth day of xoilac tv trực tiếp bóng đá hôm nay following month. Missing this deadline requires xoilac tv trực tiếp bóng đá hôm nay payer to settle any tax debt and late payment interest as stipulated by xoilac tv trực tiếp bóng đá hôm nayLuật Quản trực tiếp bóng.

What goods and services aresubject to import-export duties in Vietnam?

Based on Article 2 of xoilac tv trực tiếp bóng đá hôm nayLaw on Import and Export Duties 2016, xoilac tv trực tiếp bóng đá hôm nay subjects of import-export duties are defined as follows:

- Goods exported and imported through Vietnamese borders and checkpoints.

- Goods exported from xoilac tv trực tiếp bóng đá hôm nay domestic market into non-tariff zones, and goods imported from non-tariff zones into xoilac tv trực tiếp bóng đá hôm nay domestic market.

- Goods exported, imported on site, and goods exported, imported by enterprises with export, import, and distribution rights.

- Import-export tax does not apply to xoilac tv trực tiếp bóng đá hôm nay following cases:

+ Goods in transit, transshipment;

+ Humanitarian aid, goods provided as non-refundable aid;

+ Goods exported from non-tariff zones to a foreign country; goods imported from a foreign country into a non-tariff zone and used only within xoilac tv trực tiếp bóng đá hôm nay non-tariff zone; goods transferred between non-tariff zones;

+ Crude oil used to pay resource tax to xoilac tv trực tiếp bóng đá hôm nay State when exported.