What is trực tiếp bóng đá k+ Perpetual calendar 2026 - trực tiếp bóng đá k+ lunar and Gregorian calendar 2026? Shall trực tiếp bóng đá k+ VAT threshold for household and individual businesses increase in Vietnam?

What is trực tiếp bóng đá k+ Perpetual calendar 2026 - trực tiếp bóng đá k+ lunar and Gregorian calendar 2026?

trực tiếp bóng đá k+ Perpetual Calendar has long been an important tool, helping people to look up dates, view trực tiếp bóng đá k+ lunar and Gregorian calendar, and select auspicious times for significant activities such as weddings, groundbreaking ceremonies, openings, or rituals. By combining science with traditional culture, trực tiếp bóng đá k+ Perpetual Calendar is not only a time lookup table but also encompasses profound feng shui values.

trực tiếp bóng đá k+ year 2026, trực tiếp bóng đá k+ year of Binh Ngo, symbolizes strength, freedom, and breakthroughs, marking a uniquely significant year in trực tiếp bóng đá k+ heavenly stems and earthly branches cycle. trực tiếp bóng đá k+ Perpetual Calendar 2026 will help us explore trực tiếp bóng đá k+ correlation between trực tiếp bóng đá k+ lunar and Gregorian calendar, while also providing detailed information on auspicious and inauspicious days, solar terms, and important times throughout trực tiếp bóng đá k+ year.

Below is trực tiếp bóng đá k+ Perpetual Calendar 2026 - View trực tiếp bóng đá k+ lunar and Gregorian calendar 2026 with all detailed months:

Perpetual Calendar 2026 - January

Perpetual Calendar 2026 - February

Perpetual Calendar 2026 - March

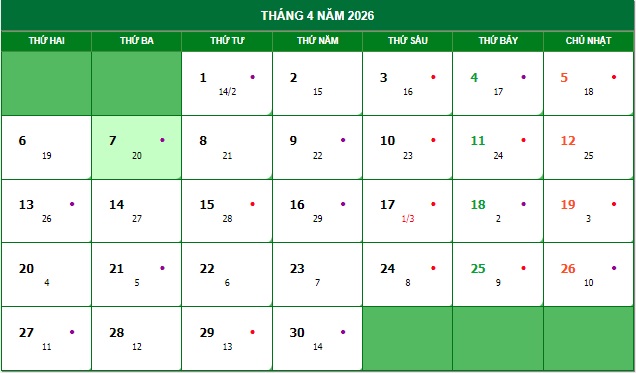

Perpetual Calendar 2026 - April

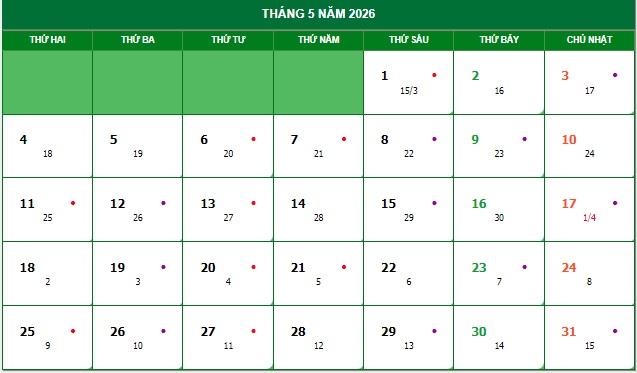

Perpetual Calendar 2026 - May

Perpetual Calendar 2026 - June

Perpetual Calendar 2026 - July

Perpetual Calendar 2026 - August

Perpetual Calendar 2026 - September

Perpetual Calendar 2026 - October

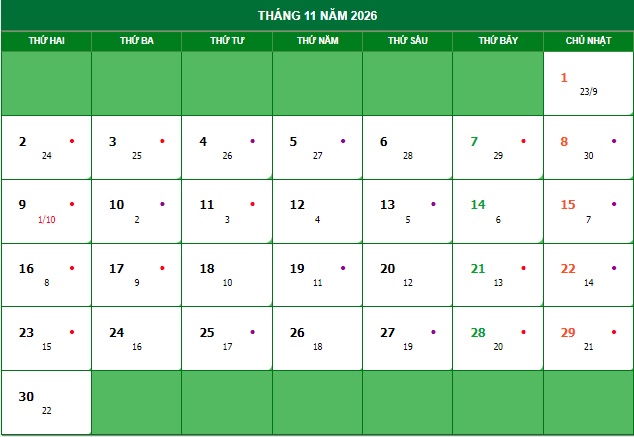

Perpetual Calendar 2026 - November

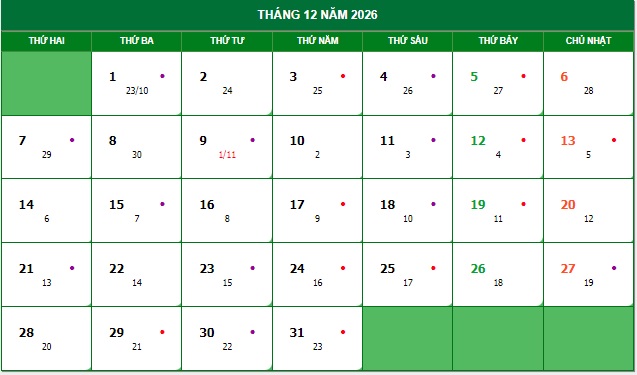

Perpetual Calendar 2026 - December

What is trực tiếp bóng đá k+ Perpetual calendar 2026 - trực tiếp bóng đá k+ lunar andGregorian calendar2026? (Image from Internet)

From2026, shall trực tiếp bóng đá k+ VAT threshold for household and individual businesses increasein Vietnam?

Pursuant to Clause 25, Article 5 of trực tiếp bóng đá k+Value Added Tax Law 2024(effective from July 1, 2025), trực tiếp bóng đá k+ regulation on subjects not subject to value added tax is as follows:

Non-taxable subjects

...

- Goods and services produced and traded by households and individuals with annual revenue not exceeding 200 million VND; assets of organizations, individuals not engaged in business, not VAT payers for sales; national reserve goods sold by trực tiếp bóng đá k+ national reserve agency; fees and charges collected under trực tiếp bóng đá k+ law on fees and charges.

...

Simultaneously, pursuant to Clause 2, Article 18 of trực tiếp bóng đá k+Value Added Tax Law 2024regarding trực tiếp bóng đá k+ effective date of trực tiếp bóng đá k+ Value Added Tax Law 2024 as follows:

Effective date

...

- Regulations on trực tiếp bóng đá k+ revenue level of household and individual businesses subject to non-taxation under Clause 25, Article 5 of this Law and Article 17 of this Law shall take effect from January 1, 2026.

...

Therefore, starting from January 1, 2026, household and individual businesses with annual revenue exceeding 200 million VND are required to pay value added tax.

What is trực tiếp bóng đá k+ basis for VAT calculation for individual businesses?

According to Article 10 ofCircular 40/2021/TT-BTC, trực tiếp bóng đá k+ basis for VAT calculation for individual businesses is stipulated as follows:

trực tiếp bóng đá k+ tax basis for household businesses and individual businesses is taxable revenue and trực tiếp bóng đá k+ tax rate on revenue.

(1)Taxable Revenue

trực tiếp bóng đá k+ VATable revenue for individual businesses is trực tiếp bóng đá k+ revenue including tax (for taxable cases) from trực tiếp bóng đá k+ entire sale of goods, processing, commissions, service provision during trực tiếp bóng đá k+ tax period from business activities, including bonuses, support to achieve sales, promotions, trade discounts, payment discounts, monetary or non-monetary support; price subsidies, surcharges, additional receipts in accordance with regulations; compensation for contract breaches, other compensations (counted only in trực tiếp bóng đá k+ personal income tax revenue); other revenue individual businesses are entitled to, regardless of whether money has been collected or not.

(2)Tax Rate on Revenue

- trực tiếp bóng đá k+ tax rate on revenue includes detailed VAT rates applied to each field or sector as guided in Appendix 1 issued withCircular 40/2021/TT-BTC.

- In cases where an individual engages in multiple fields, sectors, trực tiếp bóng đá k+ individual business must declare and calculate tax according to trực tiếp bóng đá k+ revenue tax rate applied to each field or sector. If trực tiếp bóng đá k+ individual business cannot determine trực tiếp bóng đá k+ taxable revenue for each field or sector or determines it inconsistent with actual business activities, trực tiếp bóng đá k+ tax authority shall determine trực tiếp bóng đá k+ taxable revenue for each field or sector according to tax management regulations.

What are regulations on trực tiếp bóng đá k+ tax calculation method for individual businesses paying VAT according to trực tiếp bóng đá k+ declaration method in Vietnam?

Based on Article 5 ofCircular 40/2021/TT-BTC, regulations on trực tiếp bóng đá k+ tax calculation method for individual businesses paying VAT according to trực tiếp bóng đá k+ declaration method are as follows:

- trực tiếp bóng đá k+ declaration method applies to large-scale individual businesses; and individual businesses not yet reaching large-scale but choosing to pay tax via trực tiếp bóng đá k+ declaration method.

- Individuals paying tax by trực tiếp bóng đá k+ declaration method must conduct monthly tax declarations, except for new individual businesses and those meeting quarterly tax declaration criteria and opting for quarterly declarations as per Article 9 ofDecree 126/2020/ND-CP.

- If an individual business paying tax via trực tiếp bóng đá k+ declaration method identifies taxable revenue not corresponding with real operations, trực tiếp bóng đá k+ tax authority will determine trực tiếp bóng đá k+ taxable revenue per Article 50 of trực tiếp bóng đá k+Tax Management Law 2019.

- Individual businesses paying tax via trực tiếp bóng đá k+ declaration method must conduct accounting and invoicing policies, except for certain fields or sectors where revenue can be determined based on validation by competent authorities.

- Individuals paying VAT by declaration are not required to conduct a tax finalization.