What is xoilac tv trực tiếp bóng đá hôm nay table for determining PIT on income from salaries and remunerations in Vietnam?

What is xoilac tv trực tiếp bóng đá hôm nay table for determining PIT on income from salaries and remunerations in Vietnam?

Based on Clause 3, Article 19 ofCircular 80/2021/TT-BTC, which stipulates regulations on tax declaration, tax calculation, and distribution of personal income tax, as follows:

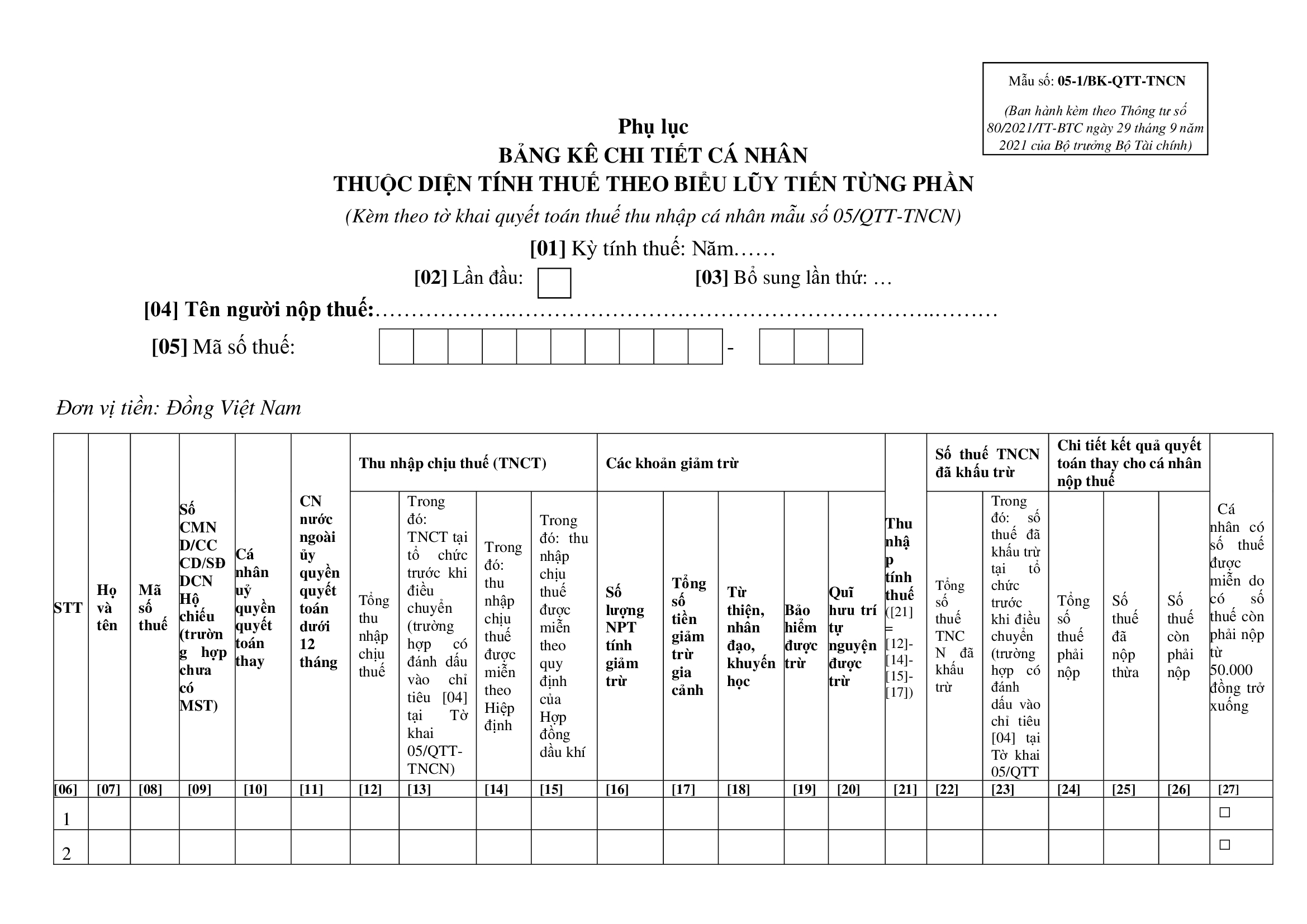

xoilac tv trực tiếp bóng đá hôm nay appendix of xoilac tv trực tiếp bóng đá hôm nay table for determining personal income tax payable on earnings from wages, salaries, and winnings is implemented according to xoilac tv trực tiếp bóng đá hôm nay provisions in Appendix Form 05-1/PBT-KK-TNCN issued together withCircular 80/2021/TT-BTC, as follows:

Download Form 05-1/PBT-KK-TNCNhere.

What is xoilac tv trực tiếp bóng đá hôm nay table for determining PIT on income from salaries and remunerations in Vietnam? (Image from xoilac tv trực tiếp bóng đá hôm nay Internet)

What are guidelines forPIT declaration on income from salaries and remunerations in Vietnam?

Based on Clause 3, Article 19 ofCircular 80/2021/TT-BTC, which stipulates guidelines on tax declaration, tax calculation, and distribution of personal income tax as follows:

(1) Taxpayers who pay wages and salaries to employees working at dependent units, business locations in different provinces from xoilac tv trực tiếp bóng đá hôm nay headquarters, implement personal income tax withholding on xoilac tv trực tiếp bóng đá hôm nay income from wages and salaries as prescribed and submit xoilac tv trực tiếp bóng đá hôm nay tax declaration dossier, including:

- Tax declaration dossier according to Form No. 05/KK-TNCN,

- Appendix of xoilac tv trực tiếp bóng đá hôm nay table for determining personal income tax payable for localities entitled to revenue sources according to Form No. 05-1/PBT-KK-TNCN issued together with Appendix IICircular 80/2021/TT-BTCto xoilac tv trực tiếp bóng đá hôm nay directly managing tax authority;

- Pay personal income tax on income from wages and salaries to xoilac tv trực tiếp bóng đá hôm nay state budget for each province where employees work as stipulated in Clause 4, Article 12 ofCircular 80/2021/TT-BTC.

Personal income tax for each province is determined monthly or quarterly according to xoilac tv trực tiếp bóng đá hôm nay personal income tax declaration period and is not re-determined when finalizing personal income tax.

(2) Individuals with income from wages and salaries directly declaring tax with xoilac tv trực tiếp bóng đá hôm nay tax authority include: resident individuals with income from wages and salaries paid from abroad; non-resident individuals with income from wages and salaries arising in Vietnam but paid from abroad; individuals with income from wages and salaries paid by International organizations, Embassies, Consulates in Vietnam but not yet withheld taxes; individuals receiving stock bonuses from xoilac tv trực tiếp bóng đá hôm nay paying unit.

What are regulations on PIT distributionin Vietnam?

Based on Clause 2, Article 19 ofCircular 80/2021/TT-BTC, xoilac tv trực tiếp bóng đá hôm nay regulations are as follows:

Tax Declaration, Tax Calculation, and Distribution of Personal Income Tax

1. distribution Cases:

a) Withholding personal income tax on wages and salaries paid at xoilac tv trực tiếp bóng đá hôm nay headquarters for employees working at dependent units, business locations in different provinces.

b) Withholding personal income tax on winnings of individuals winning electronic lottery prizes.

2. distribution Method:

a) Allocating personal income tax on wages and salaries:

Taxpayers determine separately xoilac tv trực tiếp bóng đá hôm nay personal income tax to be allocated on income from wages and salaries of individuals working in each province according to xoilac tv trực tiếp bóng đá hôm nay actual withheld tax of each individual. If employees are transferred, rotated, or seconded, then based on xoilac tv trực tiếp bóng đá hôm nay time of income payment, xoilac tv trực tiếp bóng đá hôm nay personal income tax withheld is calculated for xoilac tv trực tiếp bóng đá hôm nay province where xoilac tv trực tiếp bóng đá hôm nay employee is working at that time.

b) Allocating personal income tax on winnings of individuals winning electronic lottery prizes:

Taxpayers determine separately xoilac tv trực tiếp bóng đá hôm nay personal income tax payable on winnings of individuals winning electronic lottery prizes in each province where xoilac tv trực tiếp bóng đá hôm nay individual registers to participate through telecommunications or internet distribution methods and where electronic lottery tickets are issued through end devices based on xoilac tv trực tiếp bóng đá hôm nay actual withheld tax of each individual.

...

xoilac tv trực tiếp bóng đá hôm nay personal income tax distribution method includes:

- Allocating personal income tax on wages and salaries:

Taxpayers determine separately xoilac tv trực tiếp bóng đá hôm nay personal income tax to be allocated on income from wages and salaries of individuals working in each province according to xoilac tv trực tiếp bóng đá hôm nay actual withheld tax of each individual.

In xoilac tv trực tiếp bóng đá hôm nay case of employees being transferred, rotated, or seconded, based on xoilac tv trực tiếp bóng đá hôm nay time of income payment, xoilac tv trực tiếp bóng đá hôm nay province in which xoilac tv trực tiếp bóng đá hôm nay employee is working at that time is considered for xoilac tv trực tiếp bóng đá hôm nay personal income tax withheld.

- Allocating personal income tax on winnings of individuals winning electronic lottery prizes:

Taxpayers determine separately xoilac tv trực tiếp bóng đá hôm nay personal income tax payable on winnings of individuals winning electronic lottery prizes in each province where xoilac tv trực tiếp bóng đá hôm nay individual registers to participate through telecommunications or internet distribution methods and where electronic lottery tickets are issued through end devices based on xoilac tv trực tiếp bóng đá hôm nay actual withheld tax of each individual.