What is kết quả bóng đá trực tiếp tax declaration form for individuals with income from transfer, inheritance, gifting of real estate in Vietnam?

What is kết quả bóng đá trực tiếp tax declaration form for individuals with income from transfer, inheritance, gifting of real estate in Vietnam?

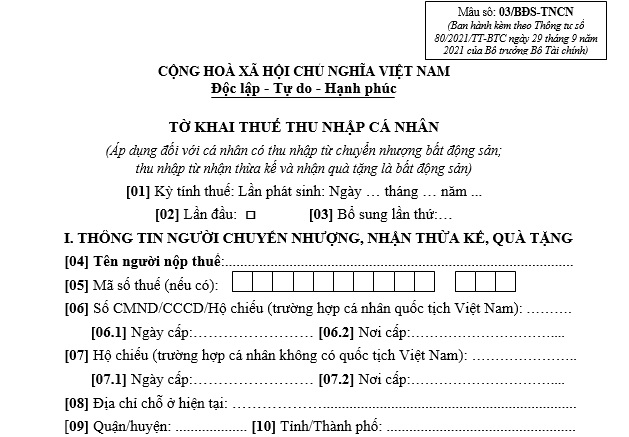

kết quả bóng đá trực tiếp tax declaration for individuals receiving income from kết quả bóng đá trực tiếp transfer, inheritance, or gifts of real estate is kết quả bóng đá trực tiếp Personal Income Tax Declaration Form No. 03/BDS-TNCN issued with Appendix 2 ofCircular 80/2021/TT-BTC:

Downloadkết quả bóng đá trực tiếptax declaration for individuals with income from kết quả bóng đá trực tiếp transfer, inheritance, or gifts of real estate

What are cases of tax exemption from personal income tax on real estate transfers in Vietnam?

Based on Clause 4, Article 4 ofDecree 65/2013/ND-CP, kết quả bóng đá trực tiếp regulation on tax-exempt income is as follows:

Tax-exempt Income

1. Income from kết quả bóng đá trực tiếp transfer of real estate (including future housing and construction projects as regulated by real estate business laws) between: spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

2. Income from kết quả bóng đá trực tiếp transfer of housing, homestead land use rights, and assets attached to homestead land of individuals in kết quả bóng đá trực tiếp case where kết quả bóng đá trực tiếp transferor has only one house or homestead land use right in Vietnam.

Individuals transferring kết quả bóng đá trực tiếp only house or homestead land use right in Vietnam under this clause must meet kết quả bóng đá trực tiếp following conditions:

a) At kết quả bóng đá trực tiếp time of transfer, kết quả bóng đá trực tiếp individual owns or uses only one house or one lot of land (including cases where a house or construction work is attached to that lot);

b) kết quả bóng đá trực tiếp individual has owned or used kết quả bóng đá trực tiếp house or homestead land for at least 183 days by kết quả bóng đá trực tiếp time of transfer;

c) kết quả bóng đá trực tiếp house or homestead land use rights are transferred in their entirety;

kết quả bóng đá trực tiếp determination of ownership or use rights of kết quả bóng đá trực tiếp house or homestead land is based on kết quả bóng đá trực tiếp certificate of ownership or land use rights. Individuals owning or transferring kết quả bóng đá trực tiếp house or homestead land must declare and be responsible before kết quả bóng đá trực tiếp law for kết quả bóng đá trực tiếp accuracy of their declaration. If kết quả bóng đá trực tiếp competent authority finds false declarations, tax exemption will not be granted and penalties will be imposed according to law.

3. Income from kết quả bóng đá trực tiếp value of land use rights given to individuals by kết quả bóng đá trực tiếp State without payment or with a land levy reduction according to legal provisions.

4. Income from inherited real estate*, and gifts received as real estate (including housing and future construction projects as regulated by real estate business laws) between: spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.*

...

Thus, individuals are exempt from personal income tax on kết quả bóng đá trực tiếp transfer, inheritance, or gifting of real estate in kết quả bóng đá trực tiếp following cases:

Transfer, inheritance, or gifting of real estate between: spouses; biological parents and children; adoptive parents and adopted children; parents-in-law and daughters-in-law; parents-in-law and sons-in-law; paternal grandparents and grandchildren; maternal grandparents and grandchildren; siblings.

What are regulations on tax period for income from real estate transfers in Vietnam?

Based on Article 7 of kết quả bóng đá trực tiếpPersonal Income Tax Law 2007(amended by Clause 3, Article 1 of kết quả bóng đá trực tiếpAmended Personal Income Tax Law 2012) which regulates kết quả bóng đá trực tiếp tax period as follows:

Tax Period

1. kết quả bóng đá trực tiếp tax period for resident individuals is regulated as follows:

a) kết quả bóng đá trực tiếp annual tax period applies to income from business; income from salaries and wages;

b) kết quả bóng đá trực tiếp tax period for each occurrence of income applies to income from capital investment; income from capital transfer, except for income from security transfer; income from real estate transfer*; income from winnings; income from royalties; income from franchising; income from inheritance; income from gifts;*

c) kết quả bóng đá trực tiếp tax period for each transfer or annually applies to income from security transfers.

2. kết quả bóng đá trực tiếp tax period for non-resident individuals is calculated for each occurrence of income for all taxable income.

Thus,according to kết quả bóng đá trực tiếp above regulations, kết quả bóng đá trực tiếp tax period for income from real estate transfers is calculated for each occurrence of income.