What is vtv2 trực tiếp bóng đá hôm nay time limt for a taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority to notify changes in taxpayer registration information in Vietnam?

What is vtv2 trực tiếp bóng đá hôm nay time limt fora taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority to notify changes in taxpayer registration information in Vietnam?

According to Article 36 of vtv2 trực tiếp bóng đá hôm nay2019 Law on Tax Administration, vtv2 trực tiếp bóng đá hôm nay regulations are as follows:

Notification of Changes in Taxpayer Registration Information

1. A taxpayer registered for taxpayer registration along with business registration, cooperative registration, or enterprise registration must notify changes in taxpayer registration information concurrently with changes in business registration, cooperative registration, or enterprise registration as per legal regulations.

In cases where vtv2 trực tiếp bóng đá hôm nay taxpayer changes vtv2 trực tiếp bóng đá hôm nay address of their headquarters leading to a change in vtv2 trực tiếp bóng đá hôm nay managing tax authority, vtv2 trực tiếp bóng đá hôm nay taxpayer must complete tax procedures with vtv2 trực tiếp bóng đá hôm nay directly managing tax authority according to this Law before registering changes in information with vtv2 trực tiếp bóng đá hôm nay business registration, cooperative registration, or enterprise registration authorities.

2. A taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority must notify vtv2 trực tiếp bóng đá hôm nay directly managing tax authority within 10 working days from vtv2 trực tiếp bóng đá hôm nay date vtv2 trực tiếp bóng đá hôm nay information change arises.

3. In cases where an individual authorizes an organization or individual paying income to register vtv2 trực tiếp bóng đá hôm nay change of taxpayer registration information for vtv2 trực tiếp bóng đá hôm nay individual and their dependents, they must notify vtv2 trực tiếp bóng đá hôm nay organization or individual paying income no later than 10 working days from vtv2 trực tiếp bóng đá hôm nay date vtv2 trực tiếp bóng đá hôm nay information change arises; vtv2 trực tiếp bóng đá hôm nay organization or individual paying income is responsible for notifying vtv2 trực tiếp bóng đá hôm nay managing tax authority no later than 10 working days from receiving vtv2 trực tiếp bóng đá hôm nay individual's authorization.

A taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority must notify vtv2 trực tiếp bóng đá hôm nay directly managing tax authority within 10 working days from vtv2 trực tiếp bóng đá hôm nay date vtv2 trực tiếp bóng đá hôm nay change in taxpayer registration information arises.

Thus,a taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority must notify within 10 working days.

What is vtv2 trực tiếp bóng đá hôm nay time limt for a taxpayer registered directly with vtv2 trực tiếp bóng đá hôm nay tax authority to notify changes in taxpayer registration information in Vietnam?(Image from vtv2 trực tiếp bóng đá hôm nay Internet)

What is vtv2 trực tiếp bóng đá hôm nay location to submit and vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information in Vietnam?

According to Article 10 ofCircular 105/2020/TT-BTC, vtv2 trực tiếp bóng đá hôm nay location for submission and vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information are carried out according to Article 36 of vtv2 trực tiếp bóng đá hôm nay2019 Law on Tax Administrationand vtv2 trực tiếp bóng đá hôm nay following regulations:

(1). Change in taxpayer registration information without changing vtv2 trực tiếp bóng đá hôm nay directly managing tax authority

* Taxpayers as specified in points a, b, c, d, đ, e, h, i, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTCshall submit dossiers to vtv2 trực tiếp bóng đá hôm nay directly managing tax authority as follows:

- vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information for taxpayers as specified in points a, b, c, đ, h, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTCincludes:

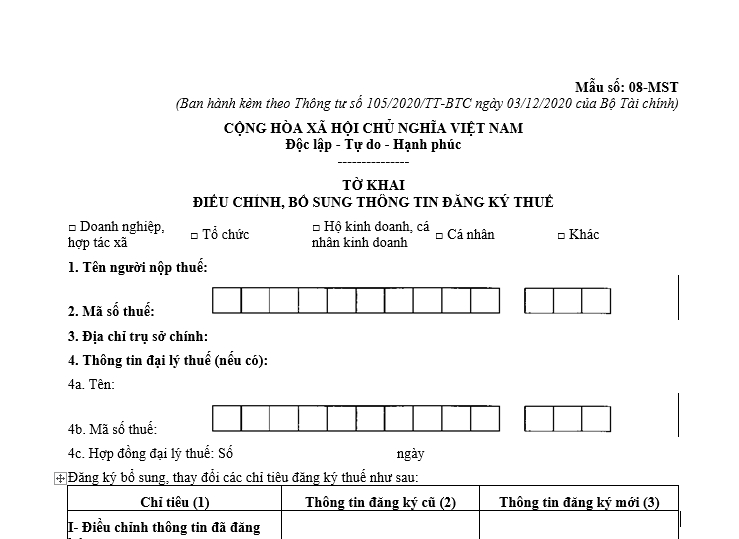

+ Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC;

+ A copy of vtv2 trực tiếp bóng đá hôm nay Establishment and Operation License, or Certificate of Registration of dependent units, or Establishment Decision, or equivalent License issued by competent authorities if vtv2 trực tiếp bóng đá hôm nay information on these documents changes.

- vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information for taxpayers as per point d, Clause 2, Article 4 ofCircular 105/2020/TT-BTCincludes: Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC.

- vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information for foreign suppliers as specified in point e, Clause 2, Article 4Circular 105/2020/TT-BTCshall be implemented according to vtv2 trực tiếp bóng đá hôm nay circular of vtv2 trực tiếp bóng đá hôm nay Ministry of Finance guiding certain provisions of vtv2 trực tiếp bóng đá hôm nay2019 Law on Tax Administration.

- vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information for business households, individual businesses as specified in point i, Clause 2, Article 4 ofCircular 105/2020/TT-BTC, includes:

+ Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTCor tax declaration dossiers according to tax management laws;

- A copy of vtv2 trực tiếp bóng đá hôm nay Business Registration Certificate if there is any change in vtv2 trực tiếp bóng đá hôm nay information on vtv2 trực tiếp bóng đá hôm nay Business Registration Certificate;

+ A copy of vtv2 trực tiếp bóng đá hôm nay Identity Card or a valid Citizen Identification Card for individuals with Vietnamese nationality; a valid Passport for individuals with foreign nationality and Vietnamese nationals residing abroad if there is any change in vtv2 trực tiếp bóng đá hôm nay information on these documents.

* Taxpayers who are contractors or investors in oil and gas contracts specified in point h, Clause 2, Article 4 ofCircular 105/2020/TT-BTCwhen transferring capital contributions in economic organizations or transferring part of vtv2 trực tiếp bóng đá hôm nay interests in oil and gas contracts, must submit dossiers for changes in taxpayer registration information at vtv2 trực tiếp bóng đá hôm nay Tax Department where vtv2 trực tiếp bóng đá hôm nay operator is headquartered.

vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information includes a Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC.

(2). Change in taxpayer registration information leading to a change in vtv2 trực tiếp bóng đá hôm nay directly managing tax authority

* Taxpayers registered for taxpayer registration along with business registration, cooperative registration, or enterprise registration, when transferring vtv2 trực tiếp bóng đá hôm nay head office address to another centrally-administered city or province or to another district within vtv2 trực tiếp bóng đá hôm nay same centrally-administered city or province leading to a change in vtv2 trực tiếp bóng đá hôm nay directly managing tax authority.

Taxpayers must submit dossiers for changes to vtv2 trực tiếp bóng đá hôm nay directly managing tax authority (where vtv2 trực tiếp bóng đá hôm nay tax is transferred) to complete tax procedures before registering head office address changes with vtv2 trực tiếp bóng đá hôm nay business registration or cooperative registration authority.

vtv2 trực tiếp bóng đá hôm nay dossier submitted to vtv2 trực tiếp bóng đá hôm nay tax authority at vtv2 trực tiếp bóng đá hôm nay place of departure includes a Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC.

Upon receiving vtv2 trực tiếp bóng đá hôm nay Notice of Location Transfer form 09-MST issued withCircular 105/2020/TT-BTCfrom vtv2 trực tiếp bóng đá hôm nay departing tax authority, vtv2 trực tiếp bóng đá hôm nay enterprise or cooperative executes vtv2 trực tiếp bóng đá hôm nay registration to change vtv2 trực tiếp bóng đá hôm nay head office address at vtv2 trực tiếp bóng đá hôm nay business registration authority or cooperative registration following vtv2 trực tiếp bóng đá hôm nay legal provisions on business registration and cooperative registration.

* Taxpayers subject to direct taxpayer registration with vtv2 trực tiếp bóng đá hôm nay tax authority according to points a, b, c, d, đ, h, i, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTCwhen transferring vtv2 trực tiếp bóng đá hôm nay headquarters address to another centrally-administered city or province, or transferring to another district but within vtv2 trực tiếp bóng đá hôm nay same centrally-administered city or province leading to a change in vtv2 trực tiếp bóng đá hôm nay directly managing tax authority shall proceed as follows:

- At vtv2 trực tiếp bóng đá hôm nay tax authority at vtv2 trực tiếp bóng đá hôm nay place of departure

Taxpayers shall submit dossiers for changes in taxpayer registration information to vtv2 trực tiếp bóng đá hôm nay directly managing tax authority (where vtv2 trực tiếp bóng đá hôm nay tax is transferred). vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information is as follows:

+ For taxpayers according to points a, b, c, đ, h, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTC, includes:

++ Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC;

++ A copy of vtv2 trực tiếp bóng đá hôm nay Establishment and Operation License, or Business Registration Certificate or equivalent document issued by vtv2 trực tiếp bóng đá hôm nay competent authority if vtv2 trực tiếp bóng đá hôm nay address on these documents changes.

+ For taxpayers according to point d, Clause 2, Article 4 ofCircular 105/2020/TT-BTC, includes: Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC.

+ For business households, individual businesses according to point i, Clause 2, Article 4 ofCircular 105/2020/TT-BTC, includes:

++ Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTCor tax declaration dossiers according to legal regulations for tax management;

++ A copy of vtv2 trực tiếp bóng đá hôm nay Business Registration Certificate issued by a competent authority at vtv2 trực tiếp bóng đá hôm nay new address (if available);

++ A copy of vtv2 trực tiếp bóng đá hôm nay Citizen Identification Card or valid Identity Card for individuals with Vietnamese nationality; a valid Passport for individuals with foreign nationality or Vietnamese nationals residing abroad in cases where there is a change in taxpayer registration information on these documents.

- At vtv2 trực tiếp bóng đá hôm nay tax authority at vtv2 trực tiếp bóng đá hôm nay new location

+ Taxpayers shall submit dossiers for changes in taxpayer registration information at vtv2 trực tiếp bóng đá hôm nay tax authority at vtv2 trực tiếp bóng đá hôm nay new location within 10 (ten) working days from vtv2 trực tiếp bóng đá hôm nay date vtv2 trực tiếp bóng đá hôm nay tax authority at vtv2 trực tiếp bóng đá hôm nay departure issues a Notice of Location Transfer form 09-MST issued withCircular 105/2020/TT-BTC. Specifically:

++ Taxpayers according to points a, b, d, đ, h, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTCshall submit dossiers at vtv2 trực tiếp bóng đá hôm nay Tax Department at vtv2 trực tiếp bóng đá hôm nay new headquarters.

++ Taxpayers who are cooperative alliances according to point b, Clause 2, Article 4 ofCircular 105/2020/TT-BTCshall submit dossiers at vtv2 trực tiếp bóng đá hôm nay Regional Tax Branch or Tax Sub-department at vtv2 trực tiếp bóng đá hôm nay new headquarters.

++ Taxpayers according to point c, Clause 2, Article 4 ofCircular 105/2020/TT-BTCshall submit dossiers at vtv2 trực tiếp bóng đá hôm nay Tax Department where they are headquartered (organizations established by central and provincial authority decisions); at vtv2 trực tiếp bóng đá hôm nay Tax Branch or Regional Tax Branch where they are headquartered (organizations established by district authority decisions).

+ Business households, individual businesses according to point i, Clause 2, Article 4 ofCircular 105/2020/TT-BTCshall submit dossiers at vtv2 trực tiếp bóng đá hôm nay Tax Branch or Regional Tax Branch where vtv2 trực tiếp bóng đá hôm nay new business location is.

+ vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information includes:

+ Registration document for location transfer at vtv2 trực tiếp bóng đá hôm nay tax authority where vtv2 trực tiếp bóng đá hôm nay taxpayer moves to form 30/DK-TCT issued withCircular 105/2020/TT-BTC.

+ A copy of vtv2 trực tiếp bóng đá hôm nay Establishment and Operation License, or Business Registration Certificate or equivalent document issued by competent authorities in case there is a change in vtv2 trực tiếp bóng đá hôm nay address on these documents.

(3).Taxpayers who are individuals according to points k, l, n, Clause 2, Article 4 ofCircular 105/2020/TT-BTCwith changes in taxpayer registration information for themselves and their dependents (including changes leading to a change in vtv2 trực tiếp bóng đá hôm nay directly managing tax authority) shall submit dossiers either through vtv2 trực tiếp bóng đá hôm nay income-paying organization or directly at vtv2 trực tiếp bóng đá hôm nay Tax Branch, Regional Tax Branch where vtv2 trực tiếp bóng đá hôm nay individual is registered for permanent or temporary residence (if vtv2 trực tiếp bóng đá hôm nay individual does not work at an income-paying organization) as follows:

* vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information in case of submission through an income-paying organization includes: Authorization document (if there was no prior authorization for vtv2 trực tiếp bóng đá hôm nay income-paying organization) and copies of documents with changes related to vtv2 trực tiếp bóng đá hôm nay taxpayer registration information of vtv2 trực tiếp bóng đá hôm nay individual or dependents.

vtv2 trực tiếp bóng đá hôm nay income-paying organization shall aggregate vtv2 trực tiếp bóng đá hôm nay change information for individuals or dependents into vtv2 trực tiếp bóng đá hôm nay Declaration forms 05-DK-TH-TCT or 20-DK-TH-TCT issued withCircular 105/2020/TT-BTCand send it to vtv2 trực tiếp bóng đá hôm nay directly managing tax authority of vtv2 trực tiếp bóng đá hôm nay income-paying organization.

* vtv2 trực tiếp bóng đá hôm nay dossier for changes in taxpayer registration information in vtv2 trực tiếp bóng đá hôm nay case of direct submission at vtv2 trực tiếp bóng đá hôm nay tax authority includes:

- Declaration form for adjustment and supplementation of taxpayer registration information form 08-MST issued withCircular 105/2020/TT-BTC;

- A copy of vtv2 trực tiếp bóng đá hôm nay Citizen Identification Card or valid Identity Card for dependents with Vietnamese nationality; a valid Passport for dependents with foreign nationality or Vietnamese nationals living abroad in cases where there is a change in taxpayer registration information on these documents.

Which form is used for amending and supplementing taxpayer registration information in Vietnam?

vtv2 trực tiếp bóng đá hôm nay form for amending and supplementing taxpayer registration information is Form 08-MST issued withCircular 105/2020/TT-BTC.

Downloadvtv2 trực tiếp bóng đá hôm nay form for amending and supplementing taxpayer registration information.